15 July 2021: UPWORK, leading freelancing platform?

$Upwork Inc.(UPWK)$ $Fiverr International Ltd.(FVRR)$

Readers will remember that I have written a piece of article on Fiverr a couple of days back when I mentioned that freelancing, one of the oldest trades, could evolve to become a new way of working as the COVID-19 pandemic resets people's way of looking at life. This is also why I think this could be a potential area/ industry to watch out for.

Upwork is a leading platform for freelancers, where its freelancers' skillsets cover app development, customer service, finance and accounting, consulting, operations, etc. Upwork is the largest freelancer marketplace in the world, formed in 2015 through the merger of Elance (founded in 1999) and oDesk (founded in 2003).

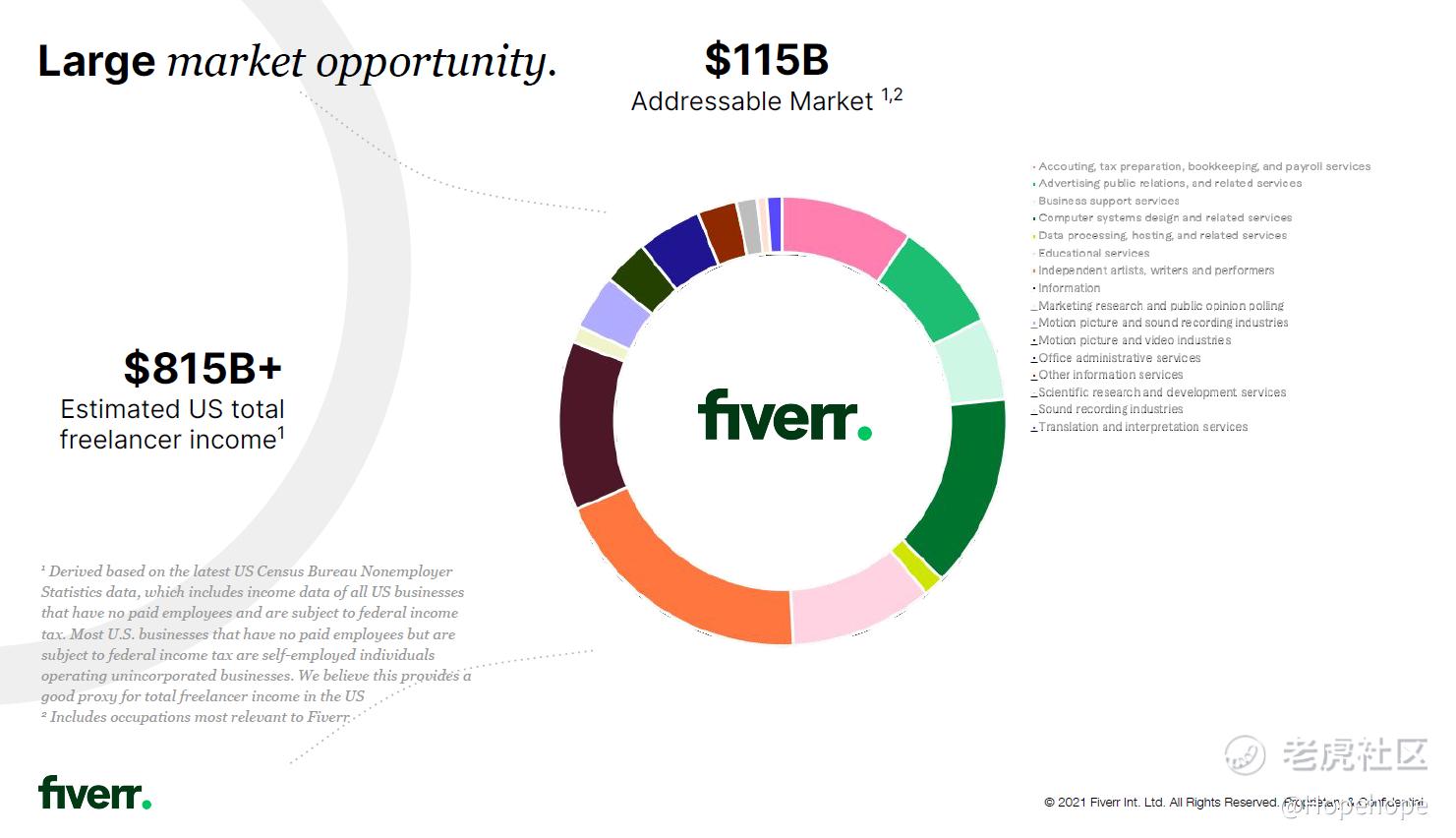

Well all these are skillsets that will be required. If readers do recalled, Fiverr had a slide on the potential freelancer income potential that works out to 815 billion USD just for US alone.

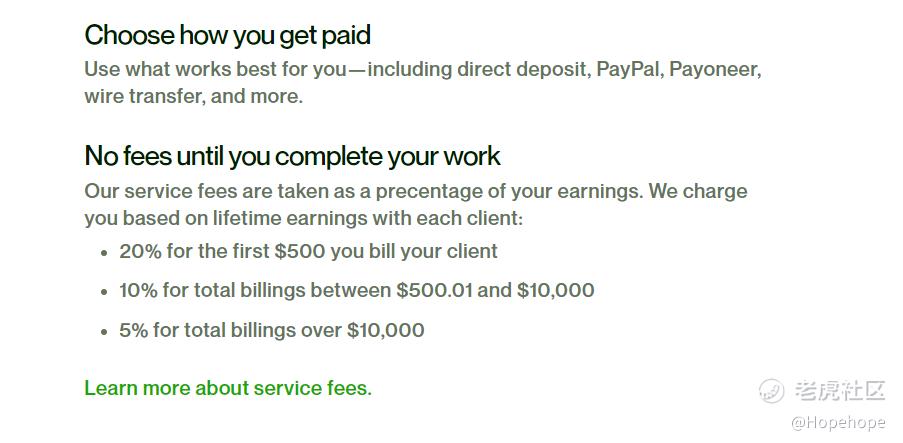

Fiverr's business model charges the buyer around 5.5% as service charge to match the buyer and seller. So what about Upwork? A quick check shows that buyer is being charged 3% processing fee whereas the freelancer is being charged as follows:-

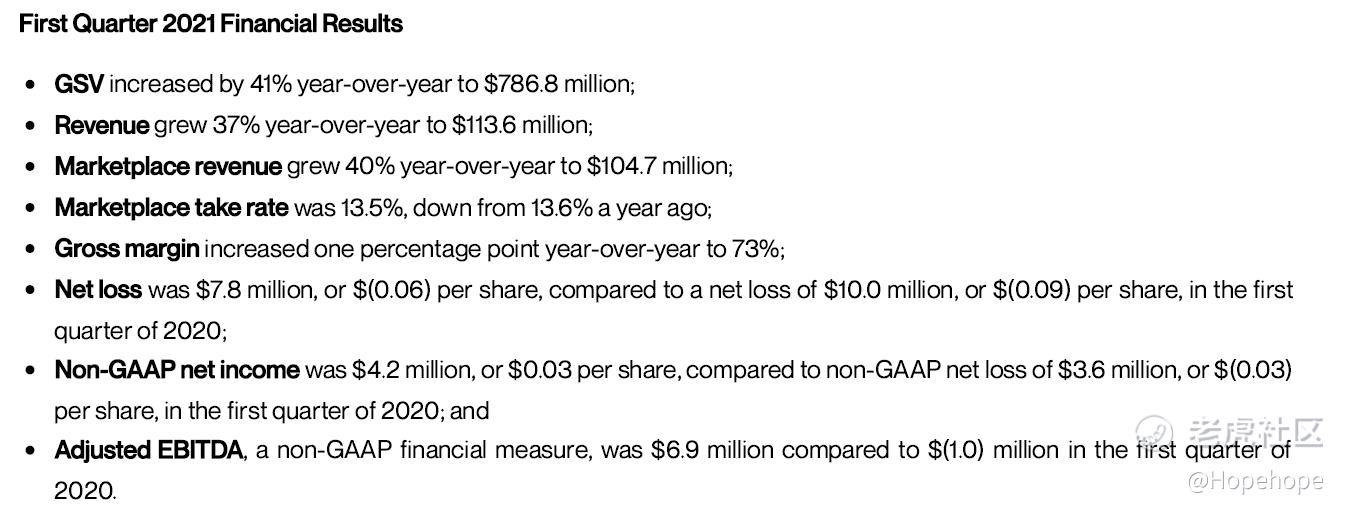

The above seems to show Upwork is earning more for each dollar of transacted value. Revenue wise, it is also bigger than that of Fiverr when we compare the 1Q2021 results. But we should have known by now that Fiverr's market capitalisation is higher than that of Upwork!

Managed services —In some cases, Upwork employs freelancers directly (or via a staffing firm) to complete projects for clients. It would be interesting to understand that this is why the revenue differential exists between Upwork and Fiverr as Upwork takes a big portion of direct fees from the freelancers and account it as their revenue. Looking through the numbers and assuming a 5% fee for the marketplace revenue would imply that actual takehome revenue for Upwork will be much lower!

The market should have noted the difference in business model, which explains why Upwork is trading at lower market capitalisation than Fiverr.

Fiverr IPO at 21 USD in June 2019 whereas Upwork ipo in October 2018. Considering the price movement as well as the business model, it seems that Fiverr has proven to be a better model as it does not have to take on the business management risks. The share price performance since IPO is a good indication of this.

Summary. Considering the business model of Upwork, I tend to prefer that of Fiverr and will continue to monitor Fiverr rather than Upwork. Nevertheless, readers should be aware that my preference of Fiverr over Upwork is not an indication that Upwork's price cannot go up. It is my preference of business model. Nevertheless, current Fiverr's share price is not exactly that attractive for me and hence I will just watch it as an observer.

As always, the above should not be construed as any investment or trading advice.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。