书单加总结,帮你建立全面的技术分析体系(六)--成交量和市场指标

这一期中我们主要聊的是成交量和市场指标,市场行为最基本的表现是成交价格和成交量,成交量是对标的物交易市场较为真实的反应,成交量表明了多空双方对某一时刻成交价格的认同程度。成交量指标可以用来反映市场供需关系,判断市场走势。市场指标则是将现有市场实时发生的情况记录后进行分析,是对市场真实有效的反馈。

01

能量潮指标(OBV)

重要指数:★★★

A.《以交易为生》

若当日收盘价高于前一日的收盘价,那么当日的成交量加到OBV上,若股票当日收盘价低于前一日收盘价,当日成交量从OBV中减去。

交易规则:

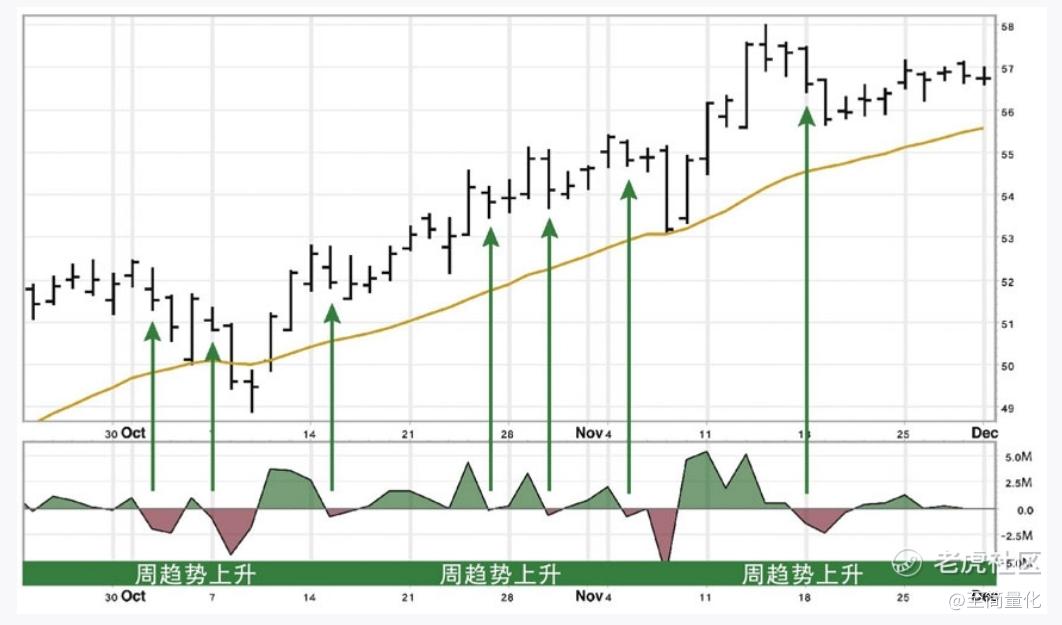

当OBV达到新高时,表明价格很可能持续上涨,给出买入信号。当OBV跌穿上一个底部值时,价格可能会创新低,给出卖出信号。

当OBV与价格相背离时,是强烈的买入或卖出信号。如果价格上涨趋势出现回调,随后反弹创新高,但是OBV没有创新高,是卖出信号。买入信号相反。

当价格在震荡区间,但是OBV却突破新高,便出现买入信号。反之,OBV创新低,便出现卖出信号。

麦当劳(MCD)日线图,22日指数移动均线

图片来源:《以交易为生》

该指标发明者格兰维尔利用OBV,将道琼工业指数成分股的OBV计算出来,并将这些指标划分为上升、下降和持平三类,取值分别为1,-1,0,称为净趋势指标。将净趋势指标相加,得到峰值指标。当股市反弹并且峰值指标达到新高时,便是很强的买入信号。

可以根据指数决定个股的买卖,也可以交易跟随市场整体走势的投资标的,比如标普500股指期货。

02

集散指标(A/D)

重要指数:★

A.《以交易为生》

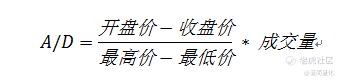

公式:

交易信号出现在A/D值背离价格走向时,如果价格上涨创新高但A/D值没有随之创新高,则出现了卖出信号。价格创新低但A/D值却没有创新低时,表明投资者在下跌过程中不断买入并逐步建仓,反弹即将到来。

03

强力指数指标

重要指数:★★★

A.《以交易为生》

公式:

该指标将价格改变的方向、程度及其在改变过程中所对应的成交量汇集到一起。

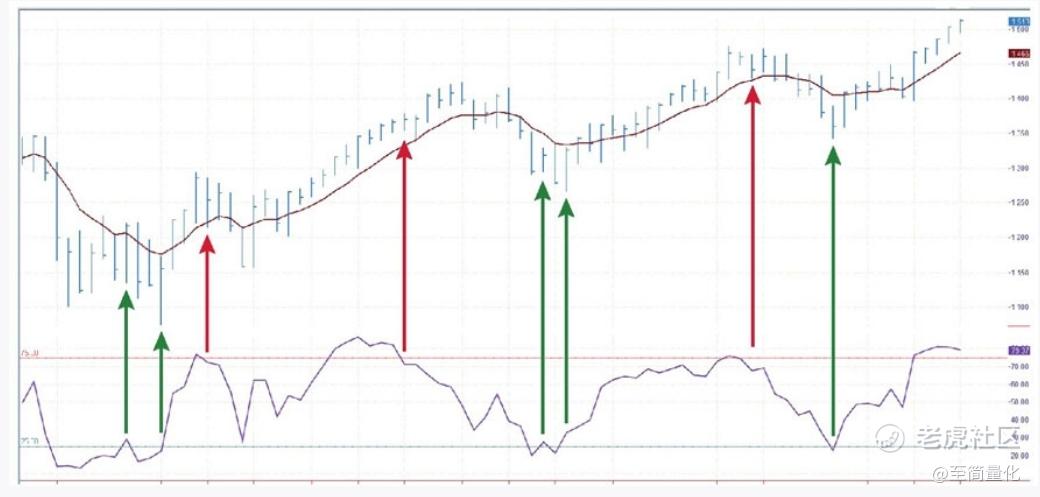

奥多比公司(ADBE)日线图,26日指数移动平均

图片来源:《以交易为生》

交易规则:

2日EMA是短期追踪的高敏感性指标。当趋势跟随指标确认了上升趋势,2日EMA值下降到0以下是买入点。若趋势向下,2日EMA上升到0以上是卖出点。13日EMA追踪是较长周期多空力量的变化。

2日EMA也能帮助我们决定何时清仓。在2日EMA为负值时买入的短线交易者可以在该值为正时卖出。在该指标为正的时候卖出的短线交易者可以在该值为负时买入。

2日EMA与价格走势出现背离现象时(有效的背离必须和0值线有交叉)。不管何时,2日EMA若下跌深度比正常深5倍以上,并从该区域反弹时,可以预期不久将来价格将回升。

在强力指数界面中,加入一个包络线可以检测极端偏离值,该极端偏离值可能是价格趋势反转的信号,这种方法在周线图中很好用,在日线图和分时图中不好用,是一个真正的长期指标工具。

04

新高-新低指数

重要指数:★★★

A.《以交易为生》

通过衡量任意一天中股价创出年内新高的股票数减去创出年内新低的股票数来追踪市场。《以交易为生》作者埃尔德认为该指数是股票市场最佳的市场领先指标。

交易法则:

中线上下的位置、趋势、与价格走向之间的背离。

位置:

中线上方表明多方力量强大,中线下方表明空方力量强大。如果指数为负,并持续了一段时间,在上升到中线以上时,便是涨势启动的信号,可以使用震荡指标寻找买入机会。

趋势:

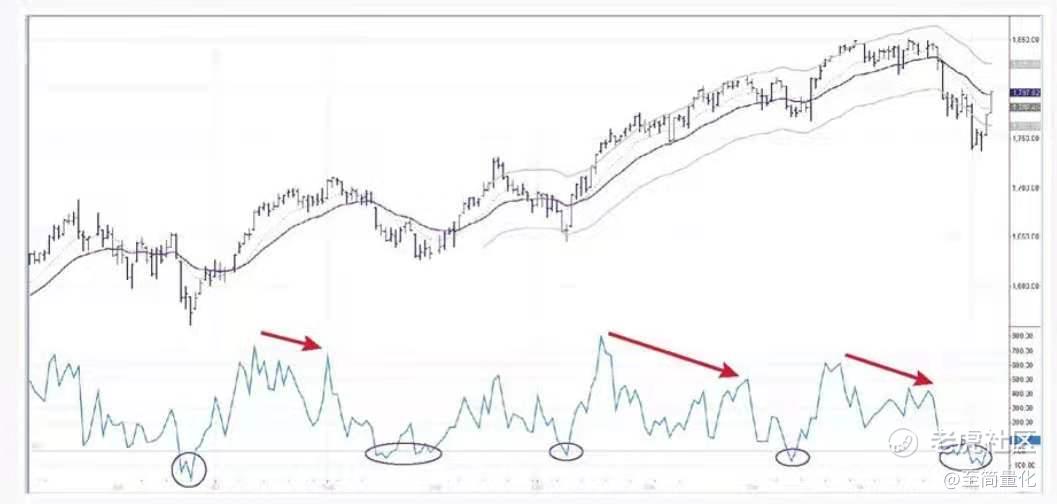

如果市场上升但是指数却在下降,就可以考虑多头头寸利润兑现。市场走平但是指数上升,则显现了牛市的预兆,是买入的信号。市场走平但是指数下降,则是卖出的信号。

指数背离:

如果市场创出新高但是指数只达到了一个次高点,就产生了背离。背离表明上升趋势结束,但是需要关注次高点的高度。如果指数的最近峰值只比0高一些,那么随后可能出现一次重大回调。另一方面,如果最近峰值高于100,则表明向上的力量还很强大,足以阻止市场下跌。

可以根据指数决定个股的买卖,也可以交易跟随市场整体走势的投资标的,比如标普500股指期货。

标准普尔500(S&P 500)日线图,26日和13日指数移动均线

图片来源:《以交易为生》

除了上述日度的新高新低指数,还有两种新的指数,即20日和65日新高新低指数,分别表示过去一个月、一个季度的高低数据,比标准的年度指数更加敏锐。

05

50日均线上的股票数占比

重要指数:★★

A.《以交易为生》

计算交易价格在均线以上的股票数与总股票数的比值,绘制成图形,值域为0-100%。《以交易为生》作者喜欢在周线图上来分析该指标,这样可以捕捉中期反转点。25%和75%水平一般作为边界线。

这一指标不是通过其达到某一特定水平来发出交易信号,而是接近某一水平后发生反转来发出交易信号。该指标通过上升到上参考线之上再下跌到该参考线之下来显示顶部即将完成。

标准普尔500周线图( 26周移动均线)50日均线上股票数占比75%和25%参考线

图片来源:《以交易为生》

06

腾落指数(advance/decline, A/D)

重要指数:★

A.《以交易为生》

该值是将每天收盘价上涨股票数减去收盘价下跌股票数的值。

交易者应该关注新高和新低,而不是绝对值的大小,因为绝对值主要取决于起止日期。如果价格创出新高同时A/D线也创出新高,表明上涨有广泛的基础,上升趋势有望延续。如果A/D线只达到了低于前期高点的一个次高点,表明上涨趋势可能接近尾声。

标准普尔500日线图和腾落指数线

图片来源:《金融市场技术分析》

08

结语

重要指数:★★★★★

对于不同的指标都有其适用范围,这是在文章中反复强调的,这个范围决定了指标的有效程度。文中提到在强力指数界面中,加入一个包络线可以检测极端偏离值,该极端偏离值可能是价格趋势反转的信号。这种方法在周线图中很好用,在日线图和分时图中不好用,是一个真正的长期指标工具。

至简量化是由两位职业金融从业者联合打造的专业财经自媒体。

我们在用心创作,希望通过您的分享,让更多人看到我们。

公众号“至简量化”请同步关注!

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。