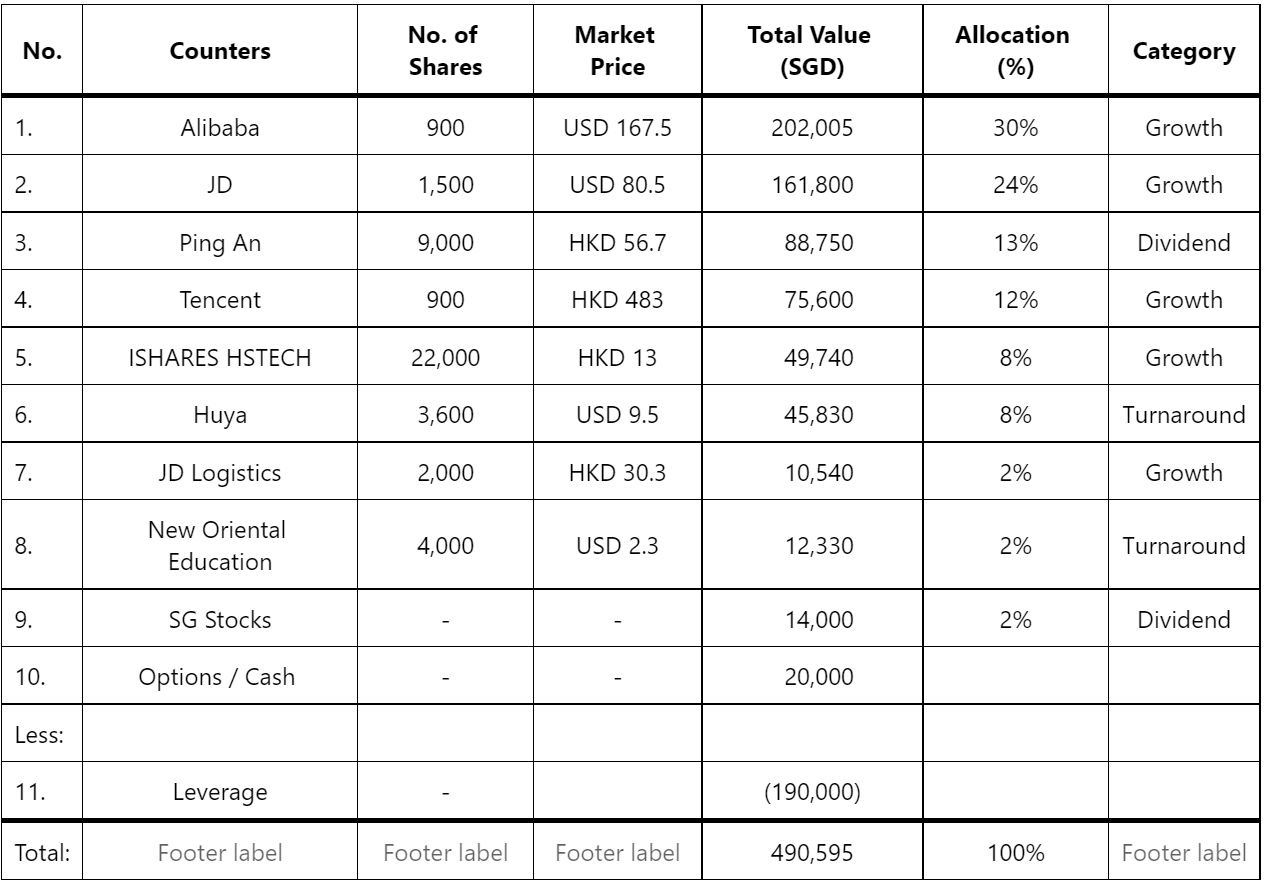

Oct 2021 – Portfolio & Transaction Updates

Another round of quick portfolio updates for the month of October as we head towards the last quarter of the year.

What a transition month it has been for stocks from September to October.

Although it may look like most of these stocks were flat month on month, there were many developments that happened across the month which sent some of the stocks like Baba and Ping An to its new 52 weeks low.

Using this as an opportunity, I added a couple more positions in $Alibaba(BABA)$ , $PING AN(02318)$ and $ISHARESHSTECH(03067)$ to average down on my positions. Ping an had also gone for ex-dividend, so I am expecting the dividend to come in on the 25th October later this month.

If you have seen my previous blogpost article, I mentioned that I had expected Baba to hit $130 which is a strong support line but the news on Charlie Munger have sent the share price rebounding earlier than expected. I am still expecting for the share price to retrace towards back and retest the last low once again since it is still in the long term blue trendline so it’s still too early to expect a meaningful rebound for now.

Still, it is good to see that it managed to close above the EMA50 last night on a daily candle so there are a little positives taken out from here.

On a new position update, I have added a small position of $New Oriental Education & Technology(EDU)$ stock in my portfolio which I’ve previously blogged a few weeks ago. This is a wild card turnaround play so the market will reprice when it’s ready to accept the new situation in the market. Until then, I am just expecting this to trend sideways with not much downside expected.

I have also added a new position for my long-term SG stocks portfolio in $EliteComREIT GBP(MXNU.SI)$ . It is a good stable REIT with long WALE and built in escalations which fits in perfectly for my longer term SG stocks portfolio which predominantly consists of dividend paying companies.

Since it is a small portfolio, I have decided to consolidate them together with all my other scrap odd lots counters which I have been holding for a long time (such as OCBC, Ho Bee Land, First Reit, Fraser Logistics, Oversea Education and now Elite Commercial REIT).

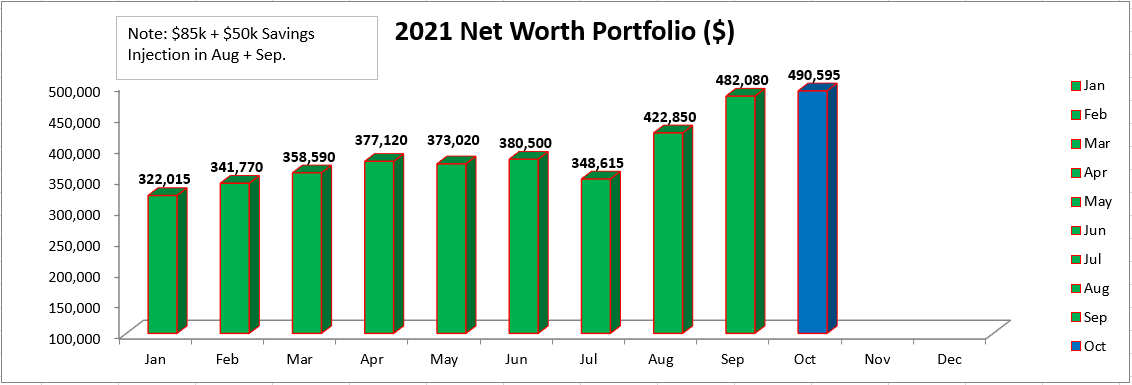

Networth Updates:

Net worth updates didn’t change much month on month despite the addition of some of these stocks.

Do note that there was also a deliberate capital injection from the emergency funds back in Aug and Sep which helps to increase the equity networth from that aspect. Otherwise, the equity portfolio simply just returned back to where it was back in Mar.

Still, I am confident that heading into 2022 this portfolio could well outperform the rest, as it has seemingly been beaten down very badly in this year. We’ll have to see if that realization will come true and boost the portfolio returns in months to come.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 史小锐·2021-10-18阅点赞举报

- 我i168·2021-10-15Nice!2举报

- 我i168·2021-10-15Nice!2举报

- 我i168·2021-10-15Nice!2举报