The opportunity behind coinbase:

In order to understand the value proposition of Coinbase, studying the possible use-cases of cryptocurrencies and technologies is inherently beneficial. First, it is useful to examine some shortcomings with Legacy Financial Institutions. In their S-1, Coinbase boils a complex network of issues into three main points: Access, Efficiency and Cost. In summary, these three factors encompass phenomena that is everpresence when interacting with today’s financial systems. More specifically financial infrastructure is often limited by geography or is not easily relied upon by all, there is often an undeniable presence of middle men and protocols that result in noticeable friction, and there are a variety of costs that must be distributed to different points of the network, all of which make for more unpleasant and inefficient end-user experiences. In order to cement these assertions it is worth discussing real-world happenings and potential use-cases where cryptocurrency may resolve these issues.

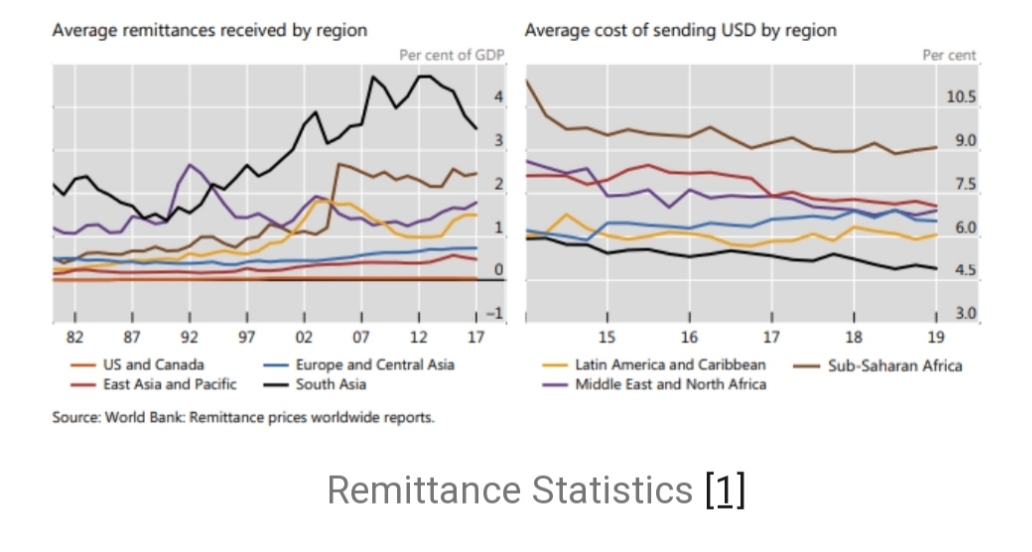

When one compares the West with Certain Emerging Market and Developing Economies, (EMDEs), there is an evident disparity in the uniformity of the adoption of financial accounts, offerings etc. Despite improvements having been made of late, there is a lack of universality in the number of people in these locations that possess bank accounts, either as a result of their lack of usefulness/functionality, the inability to keep up with maintenance costs or not being able to pass the bank’s customer due diligence requirements. These regions also struggle with banking concentration, which in essence describes the fact that financial institutions in many EDMEs do not face ample competition and thus are free to mark-up services however they may please. These occurrences are problematic for those that do possess bank accounts. Many of these regions are heavily reliant on remittances to survive, as outlined by the lefthand side of the image below and with the average cost of sending money in these regions being approximately 7.5%, there is room for improvements.

The high level of adoptions of cryptocurrencies and stablecoins in these areas has evidently been a response to these inefficiencies. With the average fee associated with a transaction of bitcoin having remained relatively stagnant at approximately $2-$3 of late, this technology evidently represents a huge cost benefit to its users in comparison to traditional mechanisms.

With a simple understanding of one of the many ways cryptocurrency can be used to solve legacy institution induced issues, we can now move over to where cryptocurrency fits in within the shifting landscape that is the internet. Many like to tout the emergence of Web 3.0 as one of the driving factors behind crypto adoption, therefore we must understand its predecessors. Web 1.0 can be described as the first iteration of the World Wide Web, existing largely as a content delivery mechanism web pages were static, elements on the page were aligned using simple frames and tables and content was sourced from a server’s file system. The next iteration, Web 2.0 saw a heavier focus on both interaction and collaboration, with the encompassment of the change from static to dynamic pages, web-based applications, user-generated content and the growth of social media contained therein.

Many describe the rise of Web 2.0 to be directly proportional to three layers of innovation that have taken our world by storm, i.e. the rise of mobile, social and cloud. Although these innovations are still coming into fruition, they have resulted in a centralization of data within the hands of big tech companies and as such have spurred what many believe to be the next paradigm shift into action. Coined as Web 3.0, this set of disruptive actions is thought to be a move in the direction of open, trustless and permissionless networks. In essence Web 3.0 should theoretically allow for software to be designed by developers in a way that makes it accessible and transparent to the rest of the world, leveraging blockchain technologies which can essentially be thought of as a distributed database/ledger that allows transactions and interactions to occur between peers without the verification of a third party, all while remaining permissionless, i.e. out of the hands of a central governing body.

In an amazing Not Boring piece that details where Crypto fits in within “The Great Online Game”, Packy refers to crypto as an in-game money for the internet, rewarding participation in the Web 3.0 ecosystem for users, builders, validators, stakers etc. I think this summarizes cryptocurrencies connection to the internet quite well and as more and more of our daily lives become rooted in the virtual, it only makes sense that there exists an asset that is native to the ecosystem. Rather than delving into whether cryptocurrency is actual money itself, i.e. the debate we have all come across of late that discusses whether cryptocurrency is a store of value, unit of account and medium of exchange (the three classic characteristics of money), I believe it will be of the most use to detail additional real-world use cases and adoption statistics to get a sense of just how big this opportunity is at the moment.

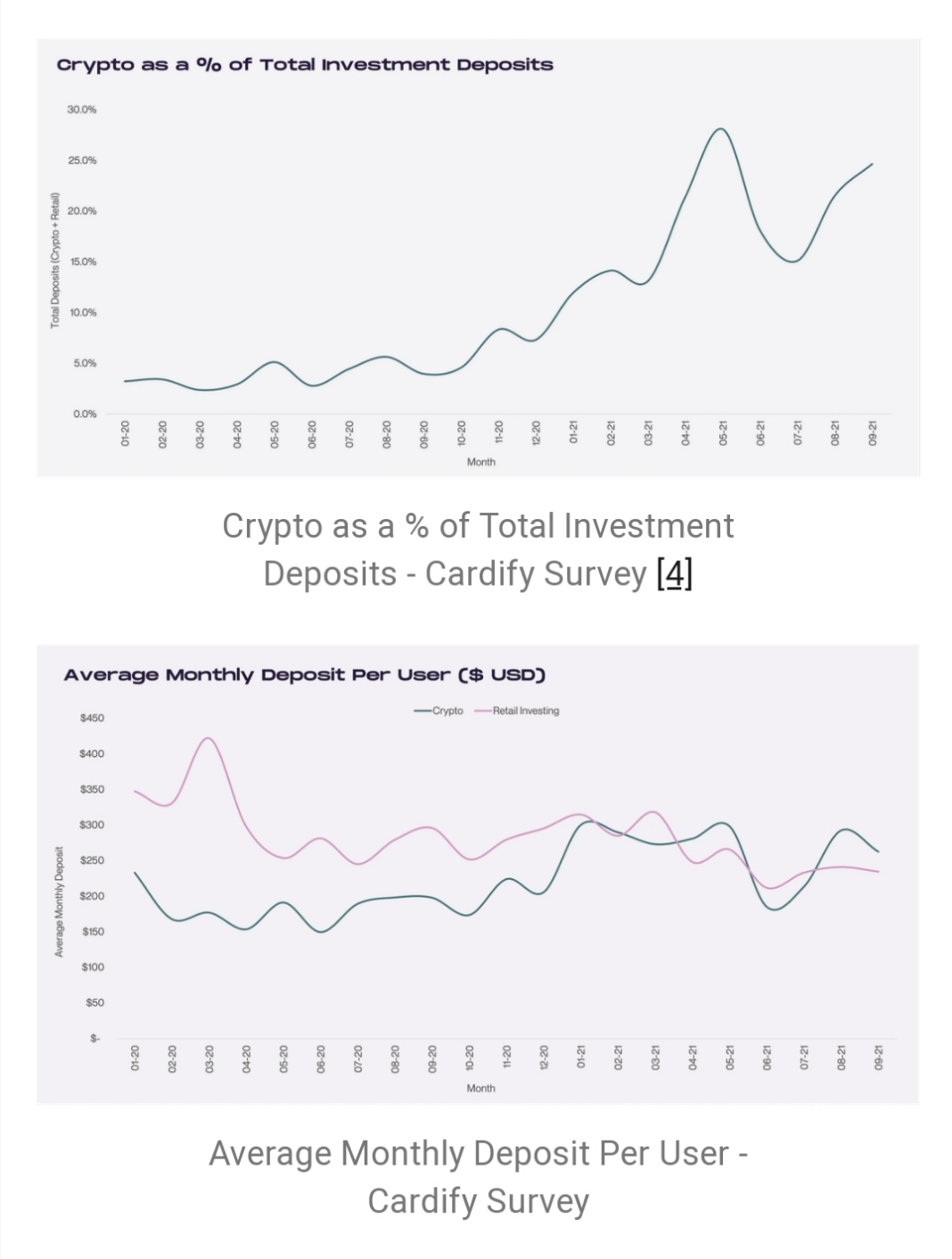

First off, 2020 saw an explosion in crypto-related activity, a phenomenon which has been both carried into and vastly exceeded in 2021.

Another gauge of this heightened activity is the number of Ethereum addresses. Ethereum, one of the most popular cryptocurrencies in the world has seen remarkable adoption over the last 5 years with over 180M unique Ethereum addresses being measured as of December 10th 2021, displaying non-stop growth despite volatile price action.

The total market capitalization of all cryptocurrencies has also shown steady growth over the last few months, growing from approximately $770B in January of this year to approximately $2.2T.

Put into perspective, there aren’t many instances where a ~$1T tech stock (as an example) triples its value in under a year but crypto has seen a pace of acceleration that has been jawdropping to say the least. Whether you think this is a speculative bubble or not, this growth has not been solely attributable to Retail Involvement. Some of the biggest corporations in the world, ranging from Blackrock to Tesla have allocated to cryptocurrency and there has been a steady growth in the Total AUM of crypto-centred hedge funds from 2018 to 2020, as outlined by a recent PWC report, a feat that likely an order of magnitude higher in 2021.

To further illustrate the breadth of the cryptoeconomy, so to speak, it is worth discussing both Non-Fungible Tokens and Security Tokens, since I feel they illustrate a little snippet of what the technology is capable of doing. Starting off with the former, to the dismay of many NFTs have taken the world by storm, adopted by both enthusiastic tech nerds and celebrities alike, we have all seen the hype in this area of late. NFTs are most often built on the ethereum blockchain and represent a digital proof of ownership, i.e. if I own an NFT art piece I am the only individual in the world that can lay this claim. Sparing you the technical specifics (since I am not an expert in this area) the amount of money being thrown around in NFTs is astonishing, with a cryptopunk (popular NFT) selling for almost $530M in late October.

If one thinks about the numerous applications NFTs could have with modern art, music and other facets of the creator economy, i’d be hard pressed to say that these disappear over night, and the continued activity in the amount of unique users executing a transaction on OpenSea, the most popular NFT ecosystem, paints a similar tale.

Moving over to the latter, Security Tokens can essentially be used to obtain fractional ownership in real assets. Companies have already started to complete Security Token Offerings (STOs), i.e. a process that allows individuals to obtain equity in the company on the blockchain, and there are some exciting opportunities for investments that were predominantly illiquid in the past (commercial real estate, private companies) now being made available to traders via STOs. Out of all the crypto applications, I am most hopeful in the ability for security tokens to democratize investing, providing the little guy access to portfolio allocations that were previously only available to institutions.

Conclusion

First the activity in crypto is both stunning and, judging by the level of adoption and intertwinement with social trends and culture, may be hear to stay for the long run. In addition, and as previously asserted, the applications are vast and I have barely scratched the surface with regards to the amount of de-fi technology currently being circulated. Coinbase aims to be the logical first step for all things crypto. With a market-leading brand, a strict adherence to regulatory guidelines and requirements, top-notch security, an ability to act as a trusted custodian for crypto assets, and easy-to-use and functional technology, the company has definitely cemented itself at the forefront of the industry.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- CatherineGunter·2021-12-24This is a great, highly profitable company with a strong balance sheet and cash flow. And there’s lots of room for growth for years to come.点赞举报

- ChristKitto·2021-12-24There are many companies trading at premiums even when they have not even became profitable. $COIN is an extremely profitable exchange with positive earnings per share and with P/E Ratios that are not overpriced.This company will do well in the long run点赞举报

- CrystalRose·2021-12-24Regardless, I'm thinking 2022 will be a breakout banner year for COIN, This could be the last year (2021) to buys share in the $200点赞举报

- mark01bravz·2021-12-26on a side note, I do invest in Bitcoin, etherum, nano, defichain, ftt and a little bit of dogecoin. probably buying decentralized stocks soon at cakedefi.点赞举报

- MyrnaNorth·2021-12-24coinbase makes money whether crypto goes up ir down. volatility should be good for this stock why is it tanking. all fintech tanking. guess average down bc its the future of money点赞举报

- MatthewWalter·2021-12-24Coinbase is my view among the few that should be bought here and now as its business model appears to have only strengthened within the past couple of months. The potential is still huge点赞举报

- ChristKitto·2021-12-24Coinbase provides the average person access to cryptocurrency. They produce cash FLOW, something many growth companies lack. The leadership is strong and is located in a rapidly growing industry.点赞举报

- CyrilDavy·2021-12-24This is a long term hold tech company that is still in it's early days but despite this is making huge profits. I’m holding my position and adding.点赞举报