Top 3 market-beatin' stocks owned by Congress

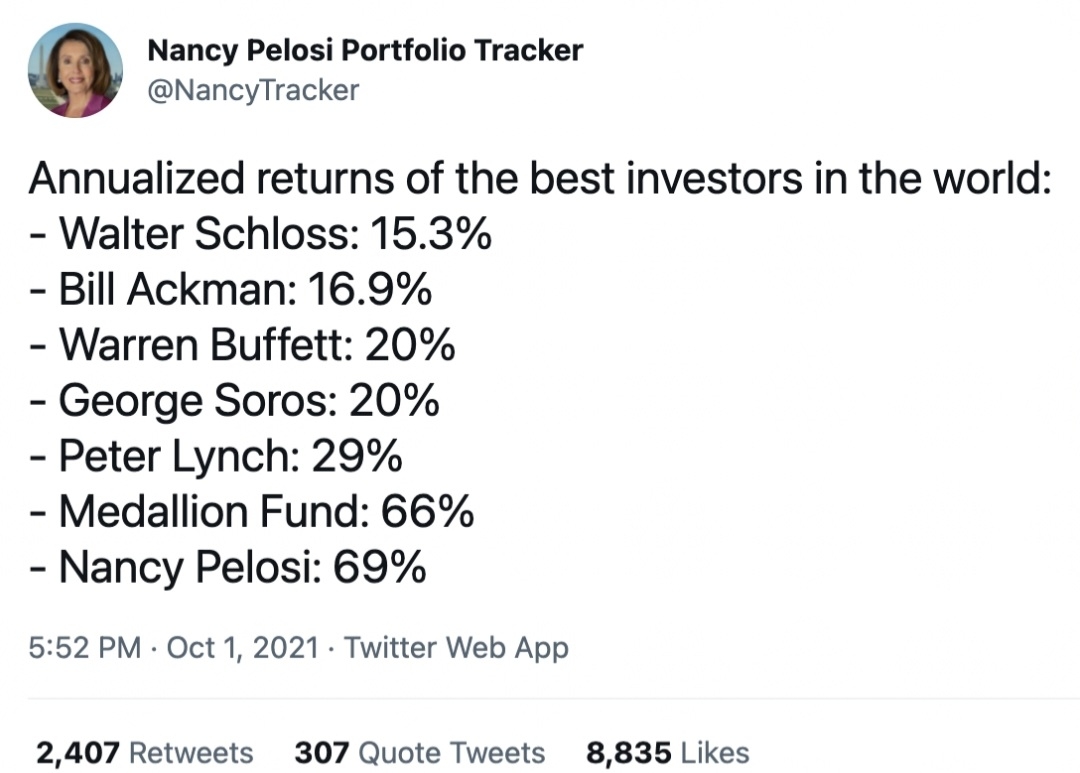

Many of you think Warren Buffet, Bill Ackman or even Gorge Soros is the best investor. But you are wrong! The best investor is actually Nancy Pelosi, speaker of The House, who has beaten the S&P500 constantly. Her portfolio has returned 69% Per Annum for the past decade.

Is it insider Trading or is it actual talent? You be the judge of that. But whatever it is, politicians who trade stocks tend to know more than the commoners, it does not take a fool to know that.

According to a report by BusinessInsider, more than 220 members of Congress own individual stocks in 2020, with tech stocks being the most popular. In this article, lets look at the top stocks traded by members of congress.

Apple is the most held stock with 79 investors from congress. Apple's net income has grown 13.8% annually in the past decade and right now they are the company with the biggest market cap at 2.81 Trillion. The company has been actively buying back shares, spending nearly $90 Billion year to date. Apple being the tech company with biggest moat is truly a giant and a compounding machine, no wonder congress just loves this company!

Microsoft is the 2nd most held stock with 66 investors from Congress. Revenue of this company has grown 16.9% Per annum in the past decade and Microsoft has been a free cash flow machine. The company has the 2nd biggest market cap 2.43 Trillion. The company has spent their massive free cash flow through acquisitions and buybacks. Some of their acquisitions include Linkedin, Nuance Technology and Skype. The company has spent 40 Billion on stock repurchases and their dividend has grown 12.49% annually in the past 10 years. The company has a huge pile of cash waiting to be deployed into more M&A. With 137.8 Billion in Cash, the company will sure to compound even more in the next decade.

BAC, a warren buffet favourite company, is owned by 59 member of congress. BAC is the second largest bank by market cap, first being JP Morgan. With a market cap of 350 Billion and 1.5 Trillion Asset under management, BAC has created a strong moat and operates around 30 countries as of today. Bank of America has grown by acquisitions, by acuqiring 9 financial companies and becoming the top Banking and Asset Management company.

All this 3 companies that have been actively bought into by Congress members have grown greatly and outperform the S&P500. By just mirroring your investment to Congress Trades, you yourself can make a huge significant return. The SEC Form 13F provides u with the information on which stocks congress are trading with. What do you guys think about members of congress trading stocks? Is it unfair and an insider trading? Or is it raw talent on outperforming the market?

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- yansuji·2021-12-21but they won't tell you the next investment strategy, and you don't know how to analyze it. by a super performance computer?2举报

- Tracccy·2021-12-21I think bank of America will be a great investment target. we know the operation of the Fed and the impact.1举报

- BlancheElsie·2021-12-21there must be more companies, such as Tesla? RIVN?🤣1举报

- BartonBecky·2021-12-21but we can see that the performance of technology stocks is not ideal recently, so I don't think it's a good time to buy now点赞举报

- JulianAlerander·2021-12-21Both AAPL and Microsoft are suitable for long-term investment点赞举报

- 刘雪英·2023-02-26👍点赞举报

- 刘雪英·2023-02-25👍点赞举报