US & China meets to address listing concerns

please refer to original sources so that we can better understand the concerns of listing.

"Recently, individual media reports that Chinese regulators will prohibit companies with variable interest entity (VIE) structures from listing abroad and promote the delisting of Chinese companies listed in the US are completely misunderstood and misinterpreted," the statement said.

"We leaned that some domestic companies are actively communicating with domestic and foreign regulatory agencies to promote listing in the United States," according to the statement

In terms of US-China audit and regulatory cooperation, the CSRC has recently had frank and constructive communication with the SEC, the Public Company Accounting Oversight Board (PCAOB) and other regulators on resolving issues in cooperation, and has made positive progress in advancing cooperation on some key matters, the statement said

"We believe that as long as regulators on both sides continue to uphold this principle of mutual respect, rationality, pragmatism and professional mutual trust in conducting dialogue and consultation, we will be able to find a mutually acceptable path of cooperation," according to the statement.

In fact, China and the US have been cooperating in the field of audit and supervision of China concept stocks, and had also explored effective ways of cooperation through pilot inspections, laying a better foundation for cooperation between the two sides.

<above is extract from www.cnevpost.com>

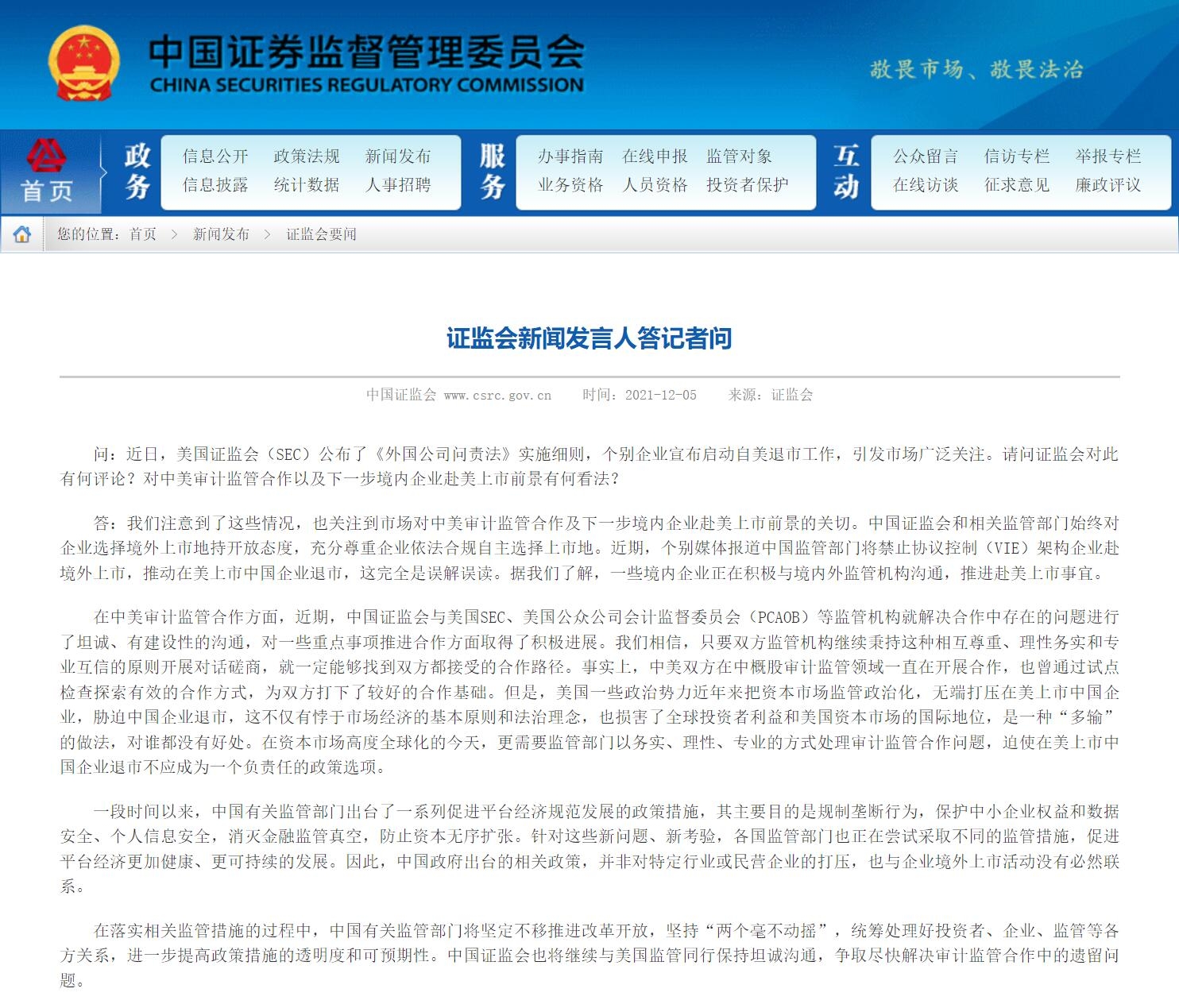

CSRC news announcement from official website:

CSRC Spokesperson Answered Reporter Question Regarding Recent Statement (in English)

05-12-2021

Reporter: Recently, the SEC released its rules for implementing the Holding Foreign Companies Accountable Act and certain Chinese company announced that it started to delist from the U.S.. This has attracted wide attention in the market. What is the CSRC’s comment on this matter and what are your views on prospect of audit oversight cooperation between China and U.S. and that of domestic companies’ listing in the U.S.?

Spokesperson: We have taken notice of this recent development and the market’s concerns over the audit oversight issues and the prospect of domestic companies listing in the U.S. The CSRC and relevant Chinese regulatory authorities have always been open to and fully respect Chinese companies’ independent choices of overseas listing venues in compliance with relevant laws and regulations. Recently, some overseas media reported that Chinese regulators will ban overseas listing of companies with VIE structure and demand Chinese companies to delist from U.S. stock exchanges, which is a completely misunderstanding and misinterpretation. As far as we know, some domestic companies are actively communicating with domestic and foreign regulators to seek listing in the U.S. markets.

In terms of audit oversight cooperation, the CSRC has recently conducted candid and constructive communications with the U.S. SEC and PCAOB to address issues in bilateral cooperation and has made positive progress on several important issues. We believed that as long as regulators on both sides continue to conduct dialogues and negotiations in the spirit of mutual respect and trust, and deal with regulatory issues in a rational, pragmatic and professional way, we will certainly be able to find a mutually acceptable path of cooperation. In fact, both sides have been cooperating on audit oversight of US-listed Chinese companies, and worked together on pilot inspection programmes in order to find a more efficient way of cooperation, which has laid a good foundation for future cooperation. In recent years, however, certain political fractions in the U.S. have turned capital market regulation into part of their politicizing tools, waging unwarranted clampdowns on Chinese companies and coercing them into delisting from U.S. stock exchanges. This lose-lose mentality goes against the fundamental principles and rule of law of the market economy, harms the interests of global investors, undermines the international status of the U.S. capital markets, and benefits nobody. In today’s era when the capital markets are highly globalized, it has become more imperative than ever for regulatory authorities to engage with each other on audit oversight cooperation in a pragmatic, rational and professional manner. Forcing Chinese companies to delist from U.S. stock exchanges is by no means a responsible policy option.

The series of policy measures that relevant Chinese regulatory authorities have introduced in the past months with respect to regulating the development of the platform economy are aimed at limiting monopoly, protecting SMEs, safeguarding data and personal information security, and preventing the disorderly expansion of capital. Regulators in other parts of the world are also taking various regulatory measures against such emerging issues and challenges, with a view to promoting the sound and sustainable development of platform economy. Therefore, relevant policy initiatives of the Chinese government are not targeted at specific industries or private companies, nor are they necessarily connected to overseas listing of Chinese companies.

In the process of implementing the relevant policy measures, the Chinese regulatory authorities will continue to steadfastly promote reform and opening-up, stick to the principle of the “Two Unwaverings”, strive to engage with stakeholders including investors, companies and peer regulators, and further enhance policy transparency and predictability. CSRC will also continue its candid dialogues with its U.S. counterparts, and endeavour to resolve the remaining issues in audit oversight cooperation in the near future.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。