Fraser Logistic & Ind Trust good return?

$FRASERS LOGISTICS & IND TRUST(BUOU.SI)$

I like Reit investment. Today would like to share another of my favourite Reit, Fraser Logistic and Commercial Trust. Short form FLCT.

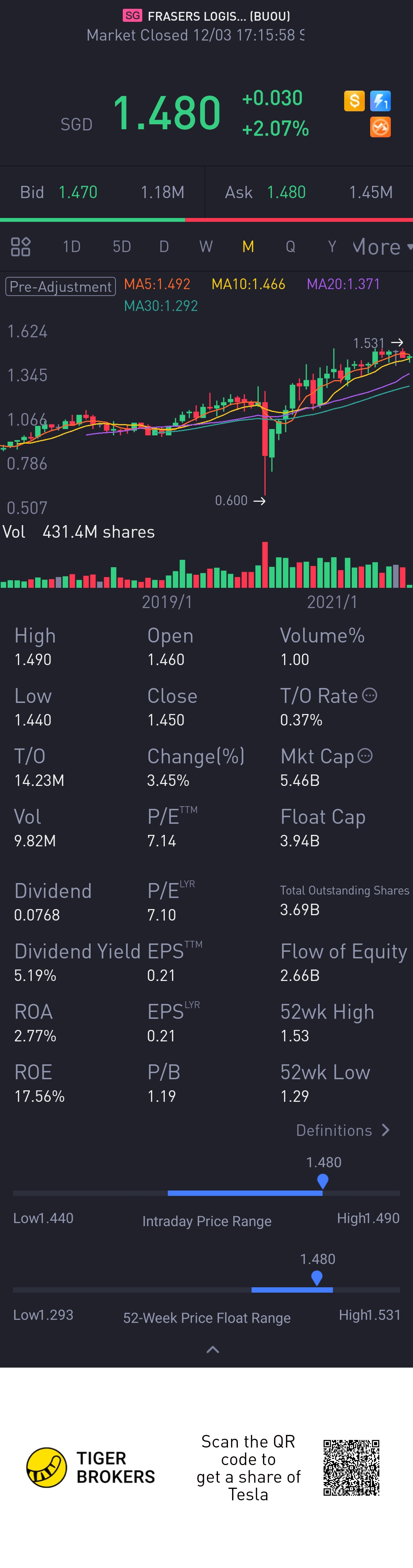

In today's price at $1.48, this reit pay out a decent 5% dividend.

Price of the Trust was not affected by the pandemic. In fact it outperform other reit.

But having said that, will the price drop when pandemic recover fully? Yet to be seen.

Here I provide some background and their FY2021 result.

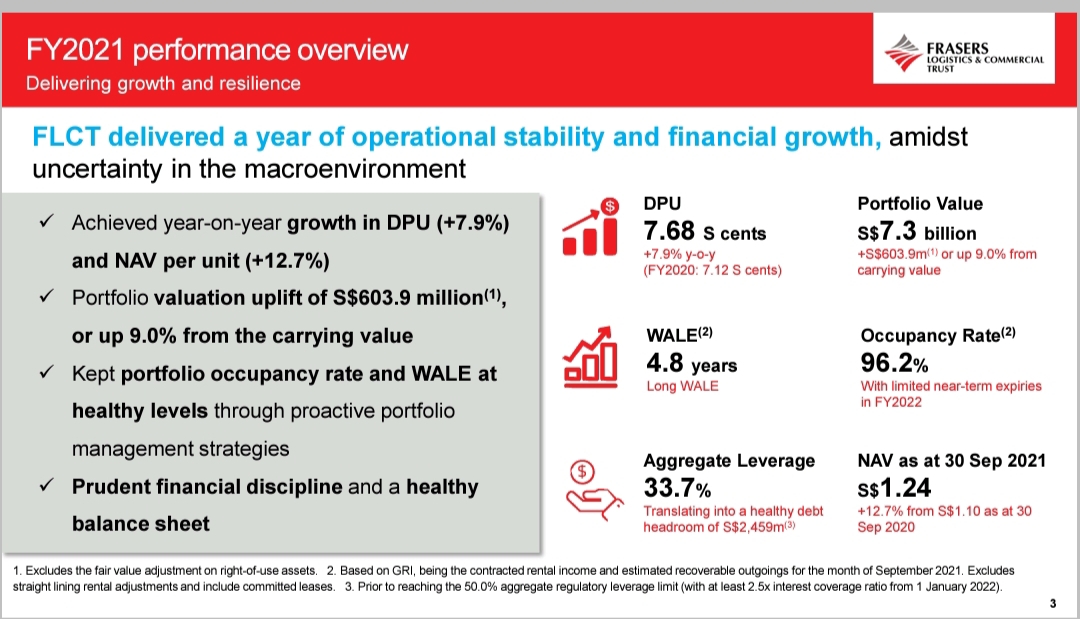

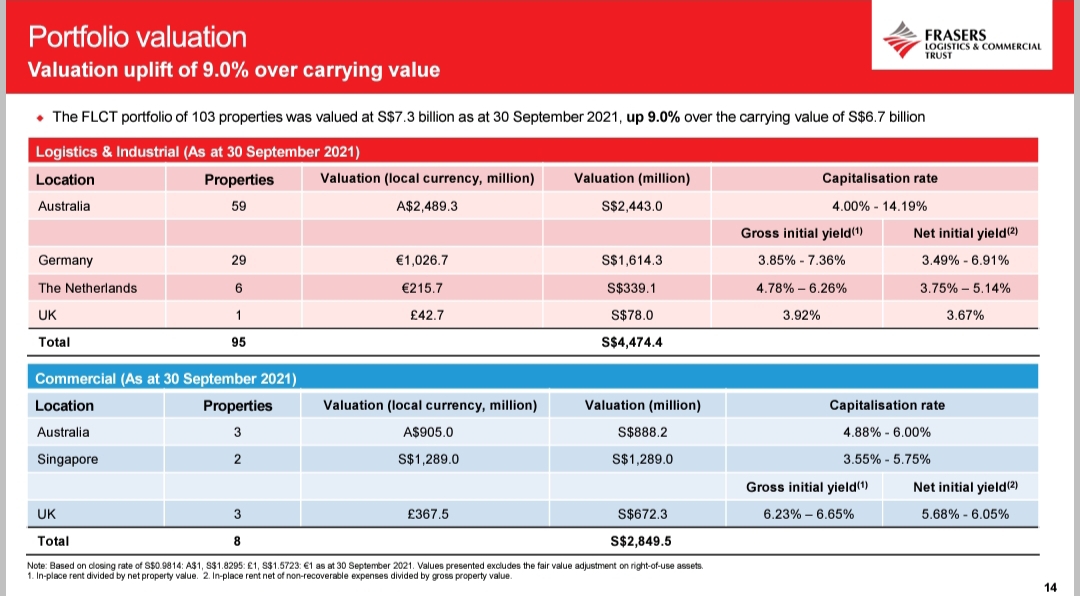

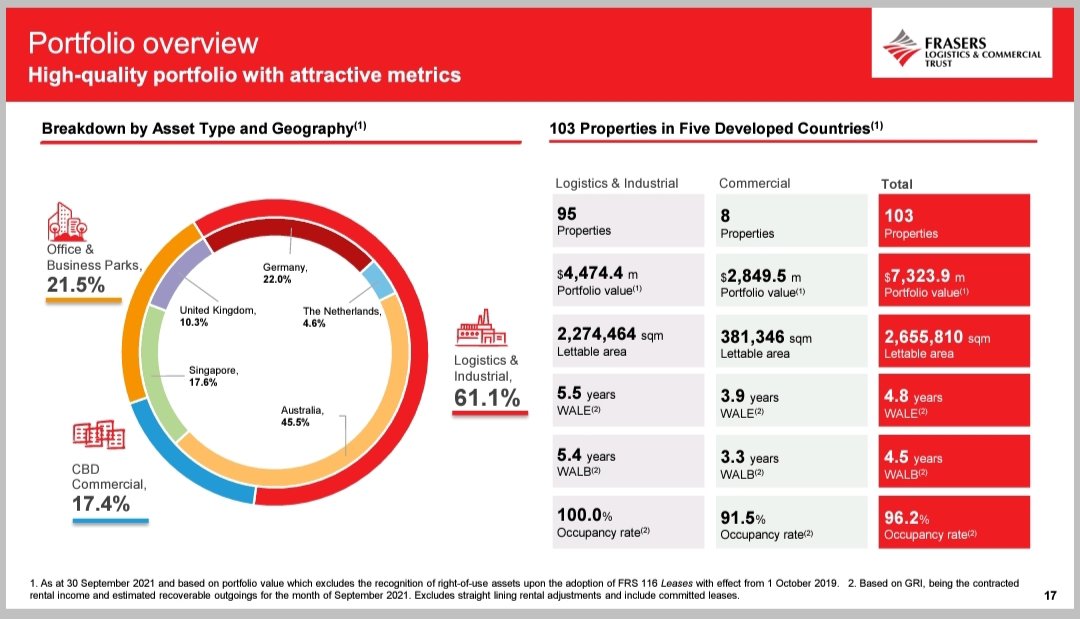

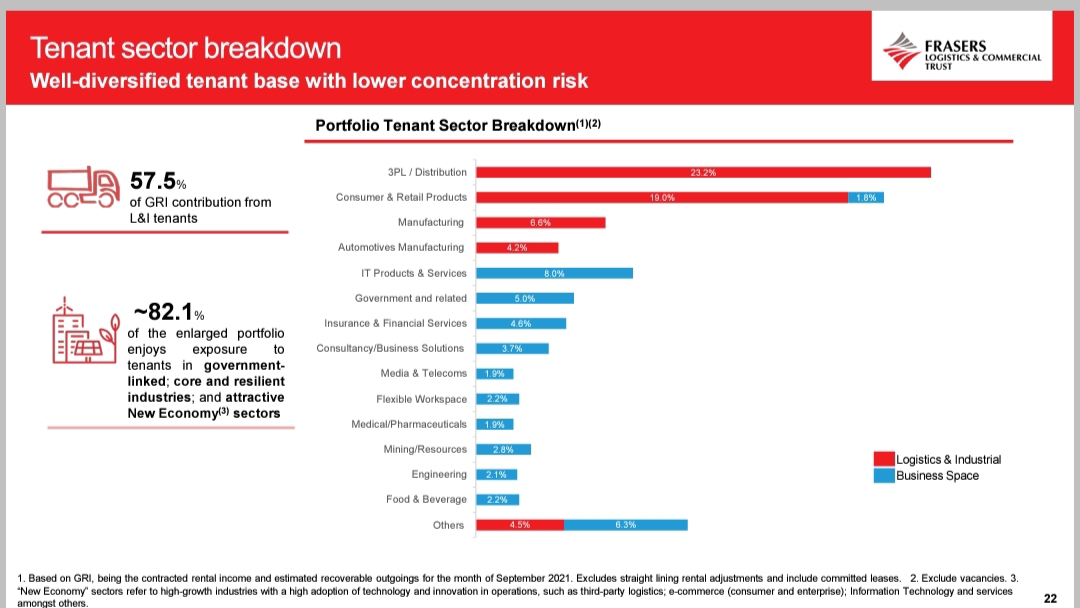

FLCT currently manages more than 100 properties across Australia, Singapore, Germany, the UK, and the Netherlands. The appraised value of FLCT’s portfolio about $7b.

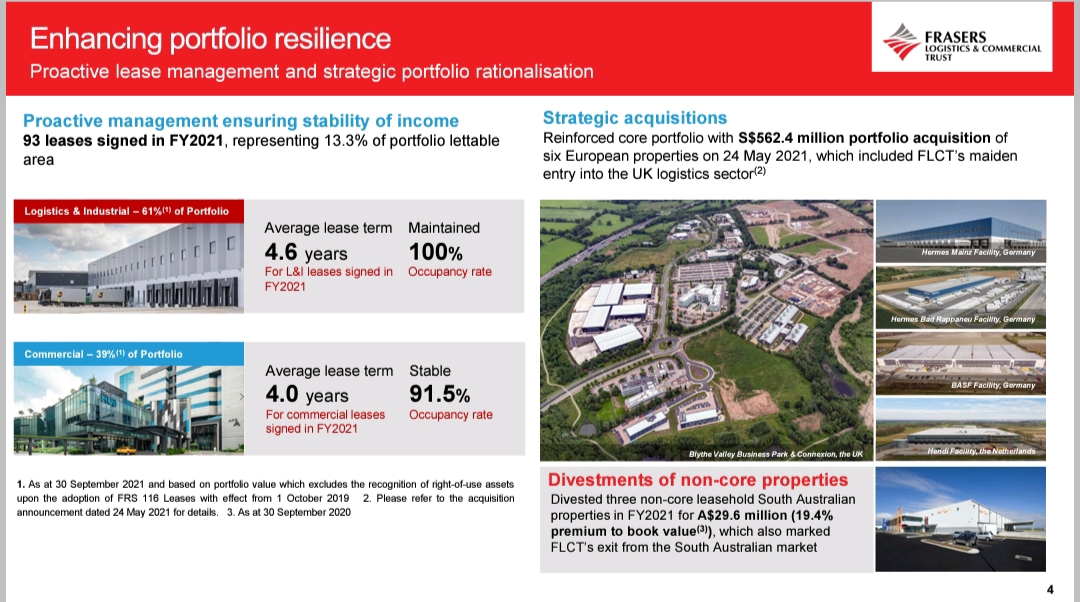

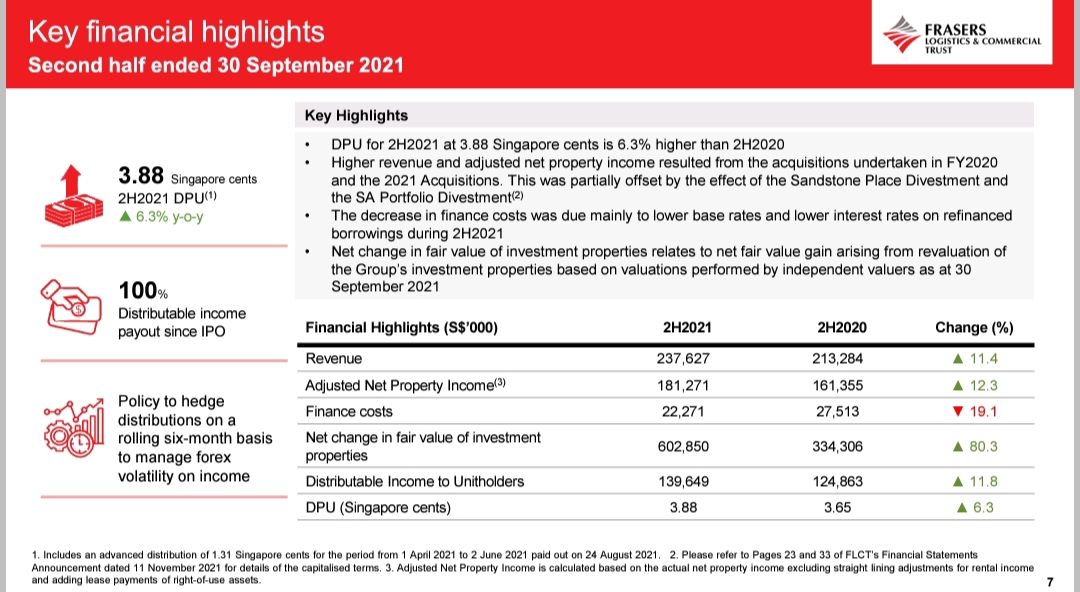

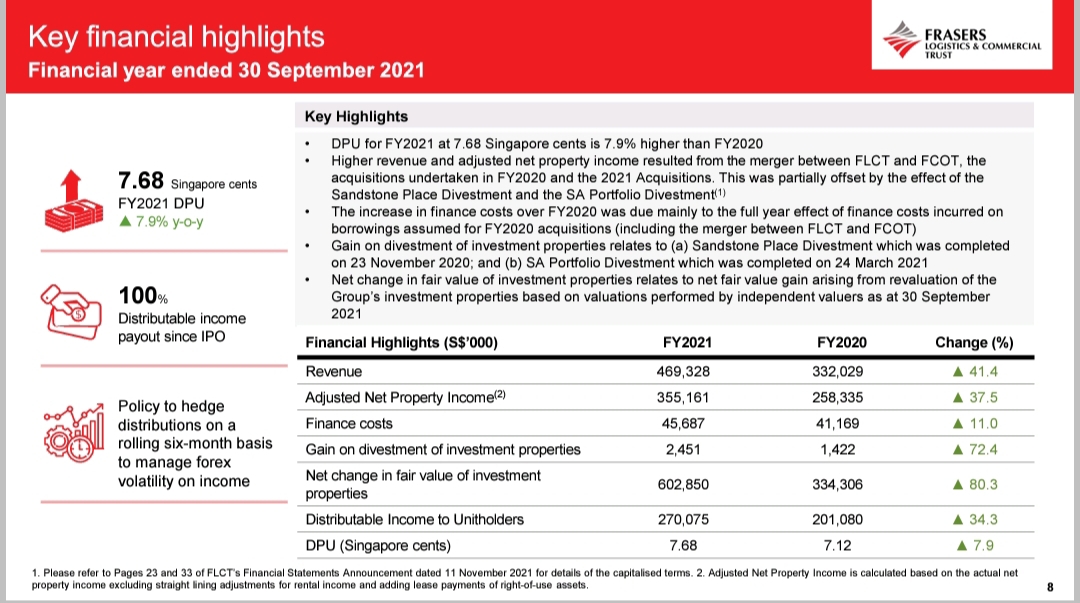

In the recent FY2021 report, FLCT reported a 41.4% and 37.5% increase in revenue and NPI, mainly due to the full-year contribution from the FCOT portfolio and the acquisitions done in FY20 and FY21. In FY21, FLCT delivered an acquisition of six properties in the UK and Europe valued at S$562.4m.

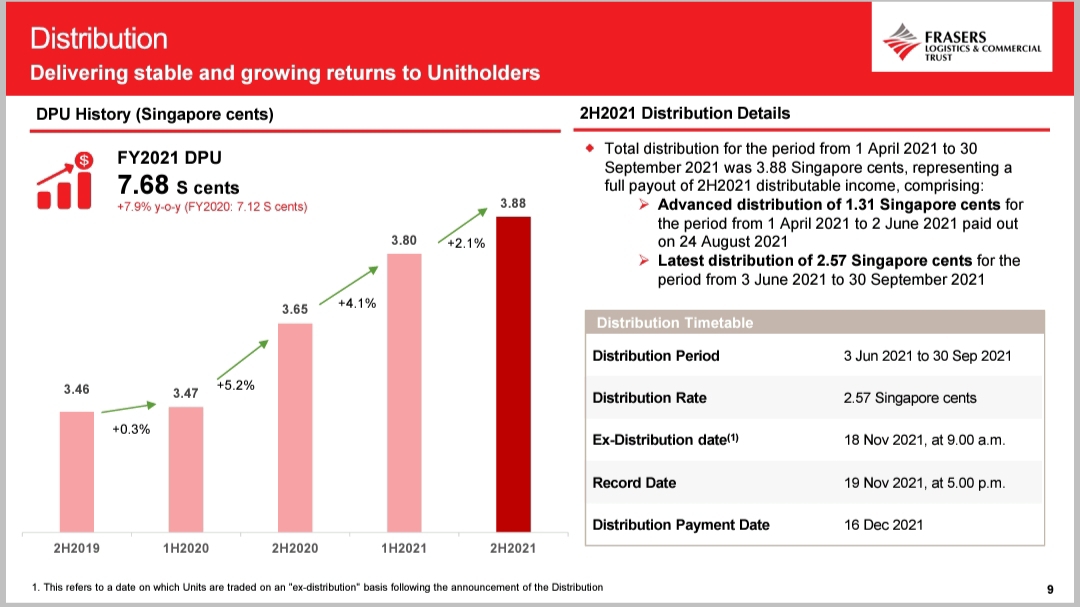

This has led to a 34% increase in FY21 distributable income and a 7.9% increase in FY21 DPU to 7.68cents.

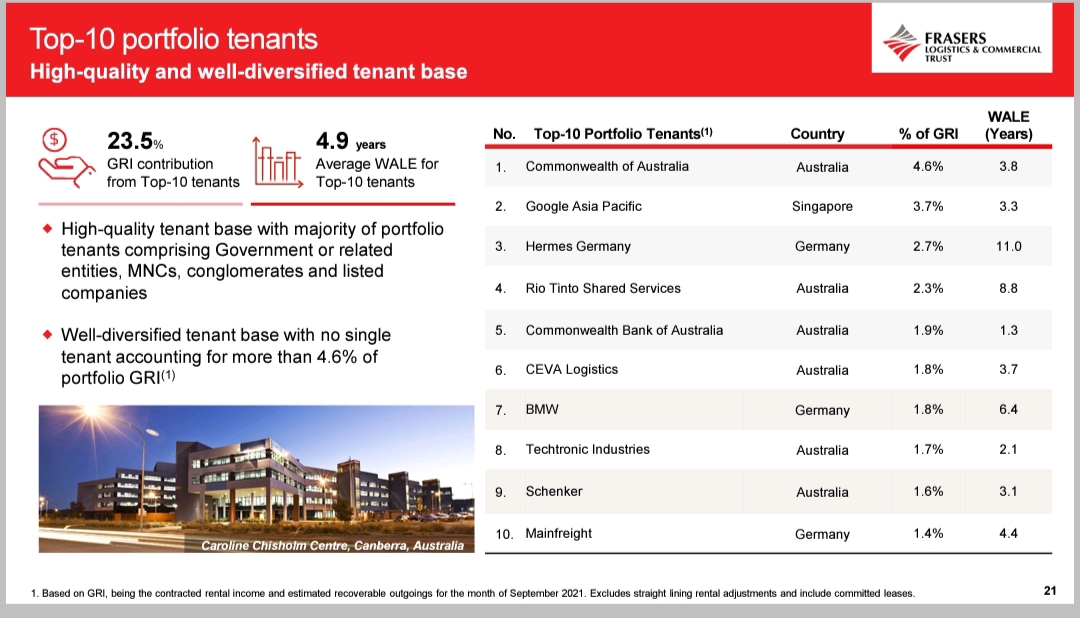

Overall portfolio occupancy rate remained healthy at 96.2%. The Logistics & Industrial portfolio remained 100% occupied, while the slight dip in occupancies at Alexandra Technopark and Farnborough Business Park led to a 0.3% decline in the commercial portfolio occupancy rate.

On the leasing front, FLCT has concluded a total of 353,000 sqm of leasing in FY21.

Another positive surprise in FY21 was the resilience of FLCT’s commercial portfolio. Although the commercial portfolio face pressure from the pandemic, it remained relatively resilient and managed to report slight positive rental reversions of +0.2% for the year. The segment most affected by the outbreak within its portfolio was the retail tenants. However, as retail leases only make up a very small 1.7% of FLCT’s income, the S$1.6m of rental rebates given to retail tenants in FY21 had no material impact to distributable income.

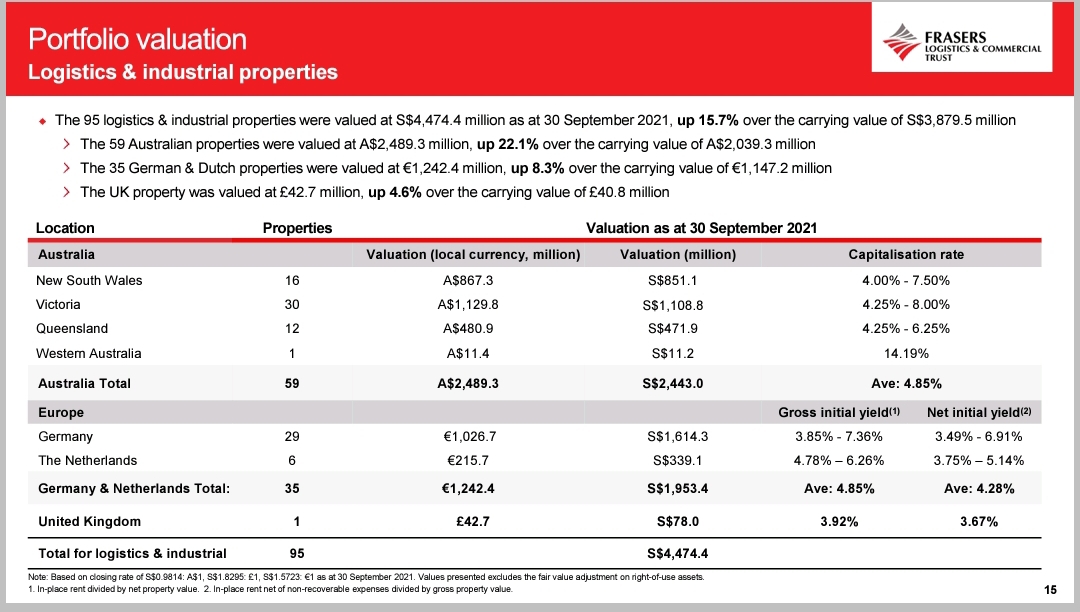

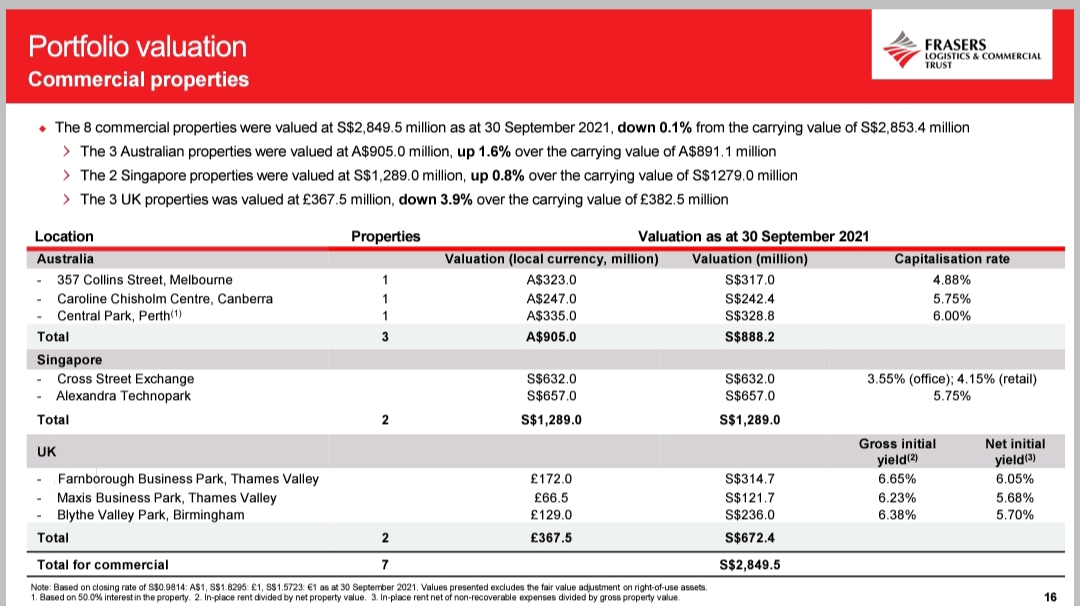

FLCT also saw a strong portfolio revaluation uplift of 9.0%, a S$604m uplift. Although valuations for its commercial portfolio remained flat, there was a slight uplift in valuations for its Australia and Singapore commercial properties. Commercial properties in Australia reported a 1.6% increase in valuation, while Singapore properties saw a 0.8% increase. The only dip in valuation was from Farnborough Business Park, as occupancies continued to face more downward pressure from the return of space.

The valuation uplift in FLCT’s portfolio came from the Logistics & Industrial portfolio which reported a 15.7% increase.

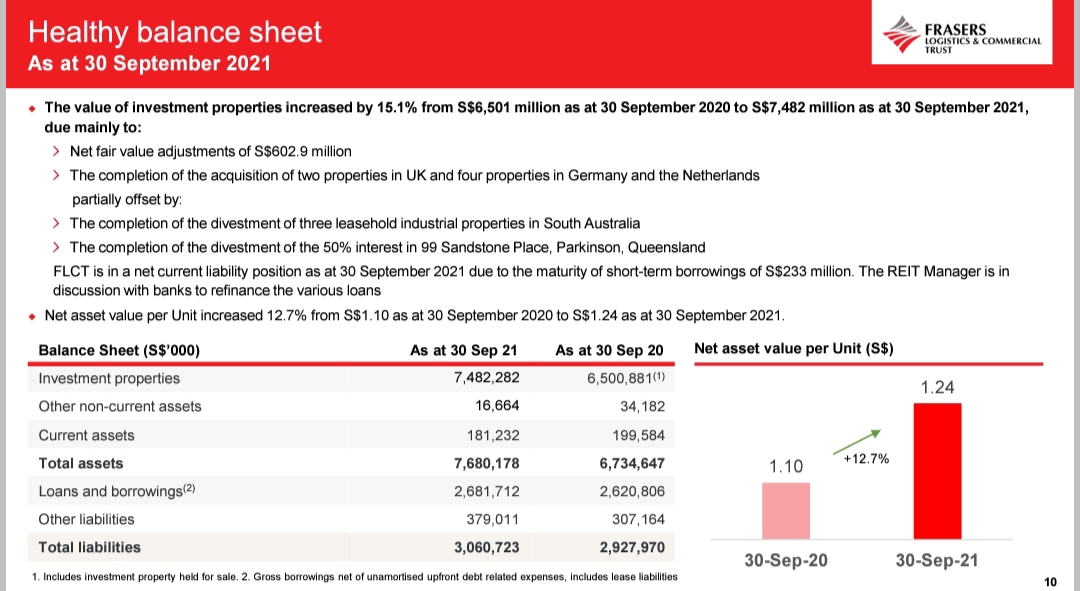

As a result of the S$604m revaluation uplift, FLCT’s NAV saw a 12.7% increase to S$1.24. Based on its current share price, this translates to a P/NAV multiple of only 1.19x. On a P/NAV basis, FLCT is the one of the cheapest large-cap industrial S-REIT that is expected to generate a very attractive forward dividend yield of 5%.

The increase in portfolio valuation also led to an improvement in FLCT’s gearing, which is currently at 33.7%. Based on an optimal gearing level of close to 40%, similar to a level that its peers are trading at, this implies a debt headroom of $800m. This provides FLCT with the firepower to embark on further acquisitions or redevelopment and AEI works at its properties.

Pesonally I remain positive on FLCT given its strong set of results for FY21, and the resilience of its portfolio to pandemic. The portfolio remains very stable with its full occupancy and built-in annual rental escalations in its leases will drive further growth to earnings.

The S$562.4m acquisition of a portfolio of assets in Europe and the UK contributed approximately only half a year of revenues in FY21, and the portfolio’s full-year contribution in FY22 is expected to be the main driver for FLCT’s FY22 DPU growth of 2.7%.

Since April 2021, FLCT was included into STI index component stock.

I continue to stay vested and have regular DCA through Syfe Reit and also STI ETF@Tiger Stars

Thank you for reading and happy investing

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- LesleyNewman·2021-12-06It looks great, but I'll have to think about it for a while. by the way your analysis is very good😊2举报

- BonnieHoyle·2021-12-06as you can see from the chart, they have a perfect capital structure with a lot of disposable income, which is good news good luck2举报

- JackPowell·2021-12-06companies that are profitable are worth investing in, obviously this one is clearly a good choice2举报

- BartonBecky·2021-12-06to be able to stay steady through this whole thing is really good business. good for me😁2举报

- MariaEvelina·2021-12-06your analysis is very thorough and thank you very much for sharing. good choice2举报

- BlancheElsie·2021-12-06but in the long run, the real estate industry has not developed very much and can only be used as a basic investment2举报