2021 Investment Resumption and Review

2021 Investment Resumption and Review

Time flies. We are coming to the last lap of 2021. To me, 2021 is a reality check. A reminder to all investor that what a stock market is all about. Also a lesson learnt that how fast a situation can change.

I still remember in 2020, despite the very bad and unclear Covid situation, stocks continue to rally. Everyday talking point were Tesla, ARK etc. And I believe most of us would have felt we were as good as Investment Guru such as Warren Buffet and Cathie Woods.

We felt like we are 股神。[LOL] [LOL] [LOL]

But heading into 2021, we are like this below.[Facepalm] [Facepalm] [Facepalm]

And the talking points have switch to 1) US and China situation, 2) China going after their own listed companies and Evergrade meltdown 3)Delta variant and Omicron lately 4)Fed Interest hike and Hyper inflation.

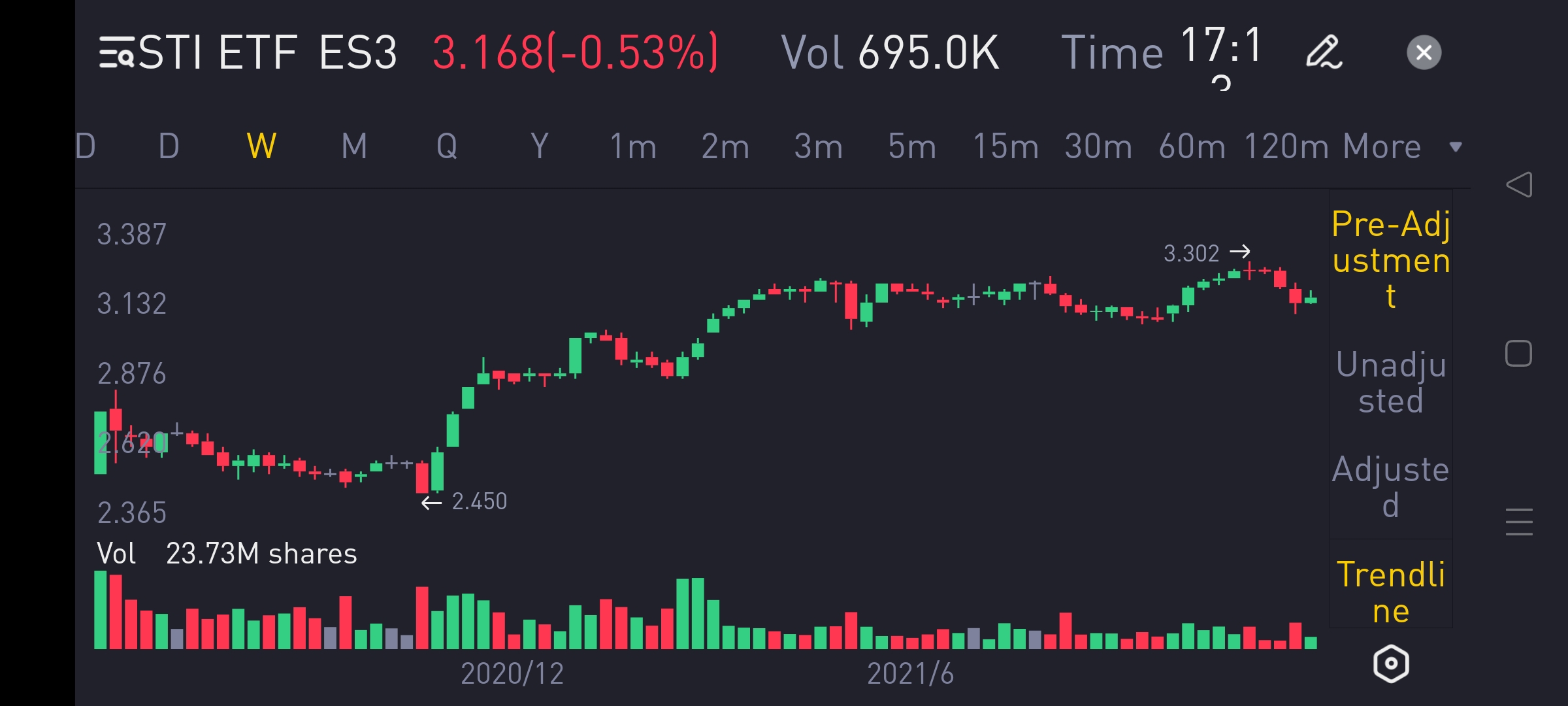

Before going into how my portfolio perform in 2021, first of all, let me share a bit on my investment objective and strategy. My ultimate goal is to build a retirement fund that can provide me with a consistent flow of income stream in the next 5 years. And my strategy is to set aside an amount to perform DCA (Dollar Cost Average) on funds such as STI ETF, Syfe Reit ETF and Stashaway higher risk fund.[USD] [USD]

At the same time I continuously look out for buying opportunity in 1) Singapore Reit, and High Dividend stocks to speed up my dividend portfolio building. 2)US Semiconductor and Technology Stocks for capital gain 3) Small amount in higher risk but potentially high return investment.[OK] [OK]

For my STI investment, overall, i consider myself fortunate that my DCA strategy works well here. The bank stock and reit in Singapore did quite well in 2021. In fact STI outperform the regional market in 2021 gaining close to 9% since the beginning of the year. Key component stock such as DBS, UOB and OCBC all recovered and surpass their pre covid 19 performance. For me, I stay vested in DBS and few other reits. Beside staying vested, I am into DCA on a monthly basis through investing in STI ETF and Syfe Reit fund. I consider this portion of my portfolio as dividend portfolio. My strategy is to build a steady income stream through this pot. And I will continue with my DCA till retirement. And hope this portfolio can generate a monthlyi ncome stream of $2500.[smile] [smile]

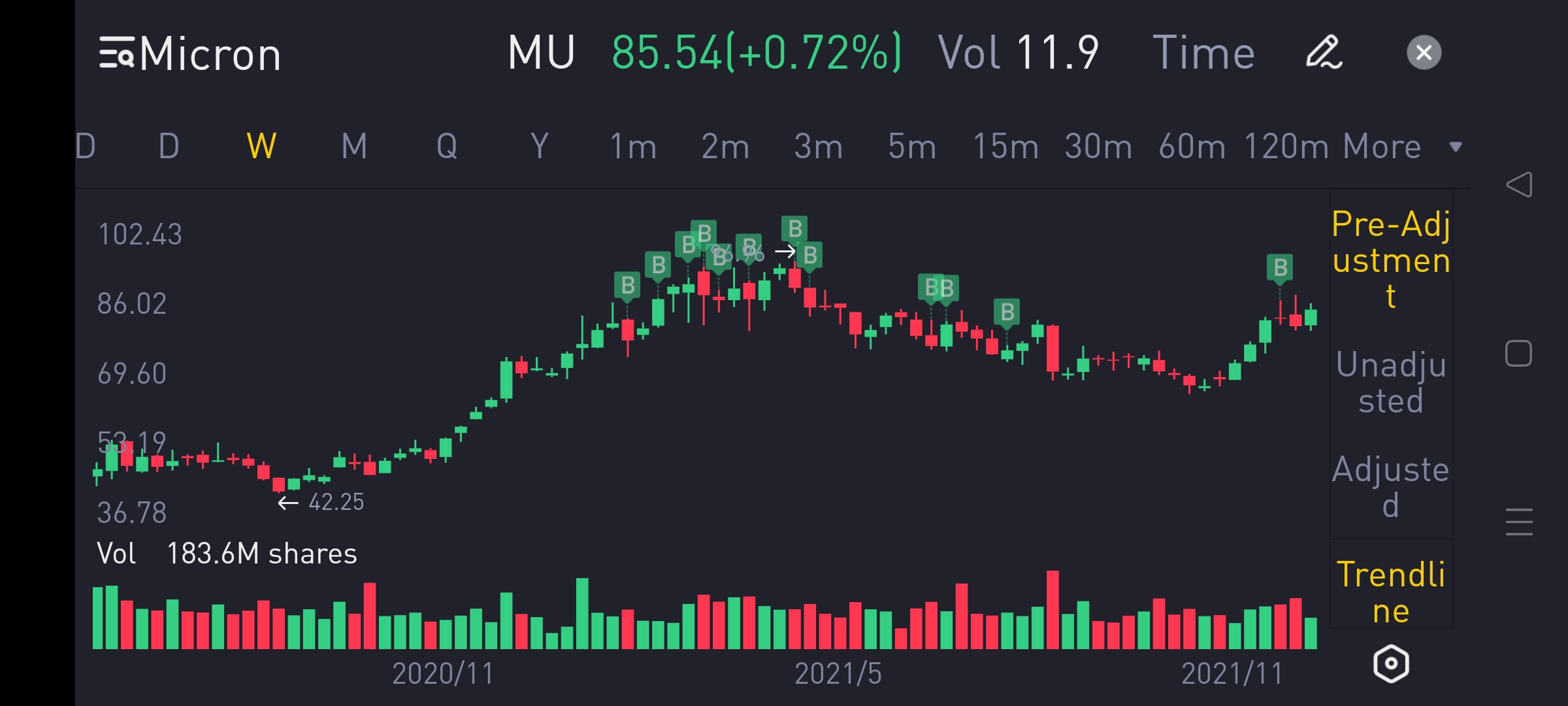

For my US market portfolio, as mentioned, my objective of investing in US market is to have capital gain.

My portfolio consist of mainly semiconductor and tech stock. I also have small position in those high risk, high return stock, such as PLTR, Opendoor and Nio. Apart from the above I also perform DCA through Funds.

2021 has been decent performance for semiconductor stock. On average its about 10% gain on my US portfolio. As seen, stock such as ASML, KLA, Micron all did well in 2021.

For this sector, I am very positive for 2022 outlook. However the small amount that I invest into in PLTR, NIO, Opendoor, all did not do well. But I believe in their business, and will continue to Hold long term.[smile] [smile]

China Stocks

This is the market segment that I suffer losses. But overall my China market exposure was low. Probably less than 10% of my portfolio. Most of these losses were incurred due to Alibaba, Bilibili, OCBC HangSeng Tech fund. At present I no longer have position in Alibaba and Bilibili. But in some of DCA fund investment still invest in China. Again, in the long run, China will recover, so I think its still the right thing to do to DCA in China market. Again lesson learnt here, how fast a government policy amendment can change the situation of a company. From a profiting business to a non profit for the educational listed firm. And Alibaba was flying high at one point, Jack Ma was as high profile as Elon Musk. But look where is Jack Ma now.[Sad] [Sad] [Sad]

In summary, my overall portfolio return in 2021 is somewhere around 10-15%. Personally I am happy with the result in 2021.[Happy] [Happy]

Top return are mainly semiconductor related stock such at ASML, KLA, LAM, and for non semiconductor, Estee Lauder also give me decent return. Have to mention, this was really a unexpected catch. Never have I thought I would invest in Cosmetic Company. I shares in one of my article previously. It was a pure coincidence.

[Happy] [Happy]

Top losses are China related stock in Alibaba, Bilibili, HangSeng Tech. Glad that I did not have big position in it.[Speechless] [Speechless]

My plan for 2022, will be to continue to perform DCA in STI, Reits and US funds. As to individual stock, will adopt the same DCA strategy to increase my position in Company such as APPL, EL, ASML, KLA in the US market. And in Singapore, i am looking at taking up more reit position and high dividend stocks.[Like] [Like]

Lesson learnt in 2021, investment is for long term and only invest with excess fund, so that you will not be affected emotionally with the market swing. Market will go up and down. But we know, the next upturn is higher than the previous.

As to the learning from my losses, do your own research and do not listen to any random youtuber and even analyst for stock pick. Bilibili is a good lesson for me. I did not know what the business was about, just listen to some random youtuber, saying that its youtube of China. Glad that it was a very tiny position.[Bless] [Bless]

As for my most successful trade, i would say its ASML. Started my position last year, and continue to add position regularly in 2021. With the low brokerage fee from Tigerbroker, I can perform DCA without having to incur high minimum trading fee.

All the best to you reader and fellow investor. I hope all of you can learnt something from each others experience and achieve our investment objective together.

Merry Christmas and Happy New year to all.[Love]

And not forgetting our Host, Tiger Broker for organizing this event. Thank you.@Tiger Stars@小虎活动

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。