Kuaishou Technology IPO,BILI is underestimated

Kuaishou is listed with a trading market value of 1.23 trillion Hong Kong dollars. Compared with it, BILI is really underestimated.

Waiting for long time, Kuaishou was finally listed. Kuaishou listed on February 5th. The intraday high was 345.0 Hong Kong dollars per share. As of the closing price, Kuaishou was priced at 300 Hong Kong dollars per share, and its market value was as high as 1.23 trillion Hong Kong dollars, equivalent to 158.7 billion US dollars. In fact, I was very surprised by the market value given by Kuaishou. Before Kuaishou’s listing, I estimated that Kuaishou’s value was between US$50-80 billion. I didn’t expect Kuaishou’s listing to be so popular.The market is offering such a price, which really shocked me.

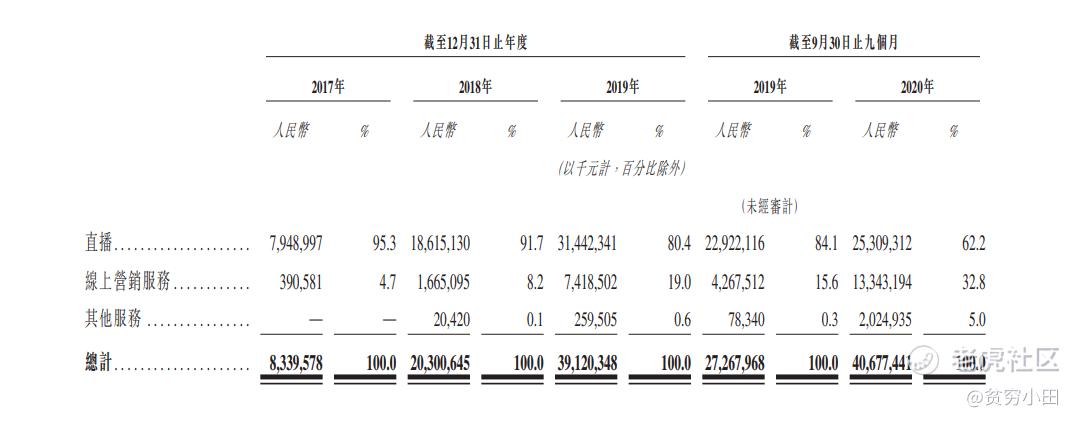

Why should I talk about Kuaishou? I did not participate in the Kuaishou intraday trading, nor did I participate in the Kuaishou's IPO. The reason why I care about Kuaishou is that Kuaishou can be used to value BILI. I hold BILI. As we all know, there are currently three major UGC video platforms (user-made content platforms) on the market, namely TikTok, Kuaishou and Bilibili. The three have their own differences in content and users. Today we will not talk about TikTok and only look at Kuaishou and bilibili. First, let’s look at the general aspect of the 2020 Q3 quarterly report, showing that the number of monthly active users of BILI reached 197 million. As of June 30, 2020, the average monthly active users of the Kuaishou main application was 485 million. In terms of financial income, the revenue of Kuaishou in the first three quarters of 2020 was 40.68 billion¥, an increase of 49.13% from the previous quarter. The revenue of the first three quarters of BILI was 8.159 billion¥, a chain growth rate of 71.04%。

In the context of global quantitative easing, high-growth companies can only be favored by capital. It is a pity that the current Kuaishou will soon reach the ceiling of growth, as can be seen from the revenue growth in the first three quarters of 2020. , Kuaishou’s current growth is weak, and it is urgently needed to open up new growth businesses. From the perspective of revenue structure. The live broadcast business accounts for a large proportion of Kuaishou. Although the proportion in the first three quarters of 2020 has dropped to the lowest level in previous years, it is still as high as 62.2%. The online marketing business, that is, advertising business (including patch ads, banner ads, advertising videos, etc.) accounted for 32.8%. These two income sources together account for 95% of the income source, which shows that Kuaishou's income source is too single. At present, other services that Kuaishou wants to expand, that is, e-commerce and games, have surged from 78.34 million yuan in the first three quarters of 2019 to 202.935 million yuan in the first three quarters of 2020, an increase of 2584.8%. Amazing!!!"

But behind this miracle is really quick for the listing of the "performance" rushed fierce ah! This is not my nonsense, we can see from its own goal. In 2019, the transaction volume of Kuaishou e-commerce is only 35 billion yuan, and the target of 2020 is as high as 250 billion yuan. And in order to achieve this goal, Kuaishou even protect the bad host Simba, is to drive performance. After all, Simba sold more than 15 million fakes in Kuaishou's studio, and they were food fakes. Moreover, Simba had refused to admit to the incident before it began, and had made verbal threats to the suspect. Even if he commits such a crime, Kuaishou authorities can only punish him with a 60-day ban. Just to show good performance . In case of poor performance in 2020 and 2021, how can executives' stock and options be sold at such a high price that they know the lockup period? Have no good performance how can let leek be willing to accept their dish? To make money, They just want to get more money out of the stocks.

At present, Kuaishou's three major revenue projects, broadcast income and advertising income are good, But nothing special, this is the current video companies are doing income. Such money can be earned quickly, TikTok, BILI , watermelon, tiger tooth, Douyu, volcano, video number, Momo, Tencent music (TME) can be earned. Even now Thunderbolt, a downloadable software, is doing short videos and live streaming. I'm not saying that live broadcasting and advertising are bad. After all, most Internet companies rely on advertising to realize their income. I'm trying to point out that a structure like Kuaishou doesn't deserve such a high market value, such a high price tag, and that these revenue growth can't be achieved without Kuaishou spending a lot of marketing money. Of course, this is just one factor in Kuaishou's wildly overvalued market value.

This is just a part of the discussion of Kuaishou and BILI. I will continue to write about it in the future. If you want to know more,Subscribe to my channel and I will update you with more and more fresh ideas in the future.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。