美联储今年不会减息?

另类资产管理公司APOLLO的首席经济学家Torstern Slock写了一篇短文认为联储今年不会减息,这两天在市场上引起广泛讨论。2023年的大部分时间他都认为美国经济会软着陆,但是最近他转变观点认为软着陆成为在几个选择(no landing/soft landing/hard landing)中几率最低的选项. 下面是他的短文:

The market came into 2023 expecting a recession.

The market went into 2024 expecting six Fed cuts.

市场在2023年预期经济衰退。 市场在2024年预期联邦储备委员会(Fed)将进行六次降息。

The reality is that the US economy is simply not slowing down, and the Fed pivot has provided a strong tailwind to growth since December.

As a result, the Fed will not cut rates this year, and rates are going to stay higher for longer.

How do we come to this conclusion?

事实上,美国经济并没有放缓,自去年12月以来,Fed的转向为经济增长提供了强劲的支撑。 因此,Fed今年不会降息,利率将维持较高水平更长时间。 我们如何得出这个结论?

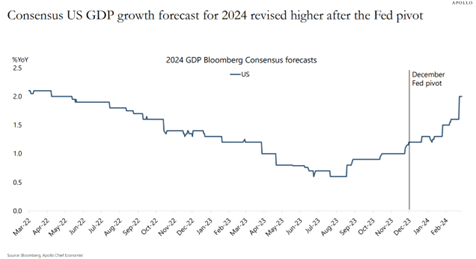

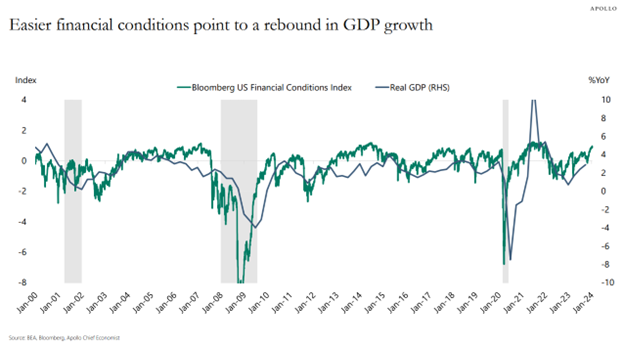

1)The economy is not slowing down, it is reaccelerating. Growth expectations for 2024 saw a big jump following the Fed pivot in December and the associated easing in financial conditions. Growth expectations for the US continue to be revised higher, see the first chart below.

经济没有放缓,而是重新加速。自去年12月Fed转向和相关金融条件宽松以来,2024年的增长预期大幅上升。美国的增长预期持续上调。

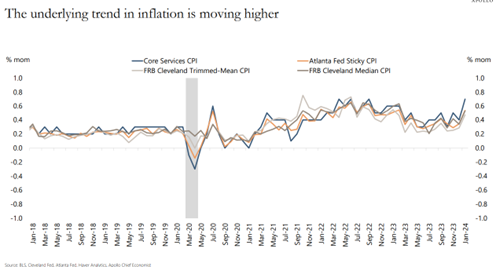

2)Underlying measures of trend inflation are moving higher。

潜在的通胀趋势指标正在上升,包括两个地区联储的CPI预测。

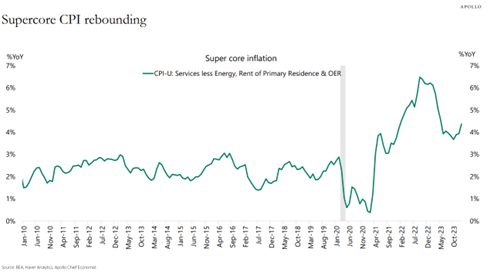

3)Supercore inflation, a measure of inflation preferred by Fed Chair Powell, is trending higher

超核心通胀,即Powell主席偏好的通胀指标,正在上升

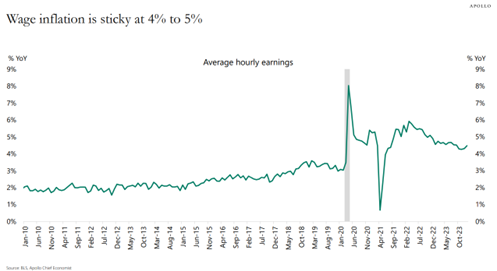

4) Following the Fed pivot in December,the labor market remains tight, jobless claims are very low, and wage inflation is sticky between 4% and 5%.

自去年12月Fed转向以来,劳动力市场仍然紧张,失业率非常低,工资通胀率在4%至5%之间

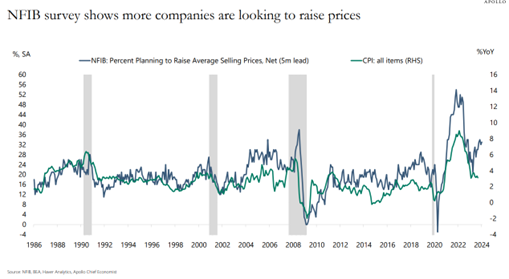

5) Surveys of small businesses show thatmore small businesses are planning to raise selling prices

对小型企业的调查显示,更多的小型企业计划提高售价

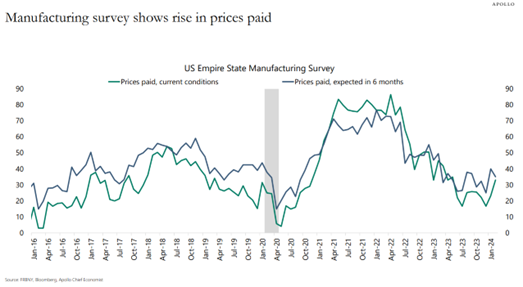

6)Manufacturing surveys show a higher trend in prices paid, another leading indicator of inflation

制造业调查显示,付出的价格呈上升趋势,这是通胀的另一个领先指标

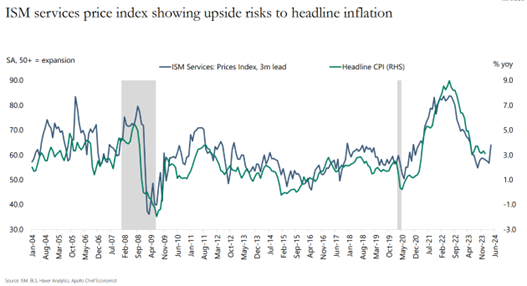

7)ISM services prices paid is also trending higher

ISM服务业价格也呈上升趋势

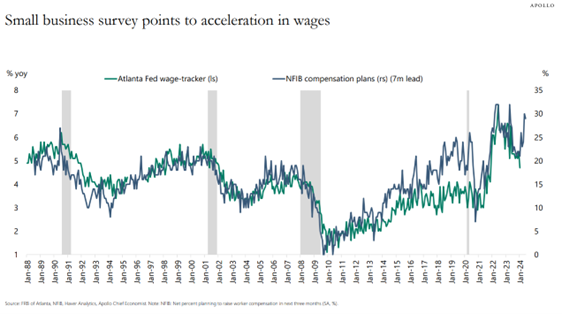

8) Surveys of small businesses show thatmore small businesses are planning to raise worker compensation

对小型企业的调查显示,更多的小型企业计划提高员工薪酬

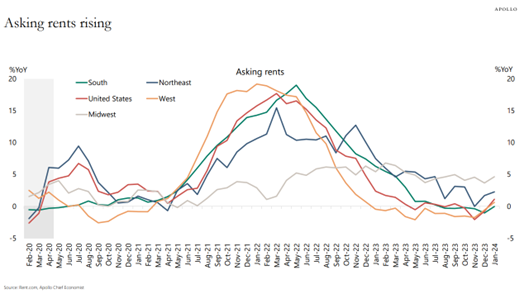

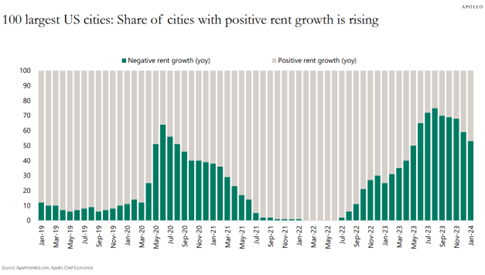

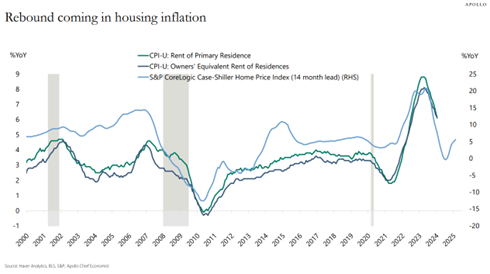

9)Asking rents are rising, and more cities are seeing rising rents, and home prices are rising

租金正在上涨,越来越多的城市正在出现租金上涨,房价也在上涨

10)Financial conditions continue to ease following the Fed pivot in December with record-high IG issuance, high HY issuance, IPO activity rising, M&A activity rising, and tight credit spreads and the stock market reaching new all-time highs. With financial conditions easing significantly, it is not surprising that we saw strong nonfarm payrolls and inflation in January, and we should expect the strength to continue

自去年12月Fed转向以来,金融条件继续放松,投资级债券发行创历史新高,高收益债券发行量大增,IPO活动增加,并购活动上升,信贷利差收窄,股市创下历史新高。随着金融条件明显放松,我们不出意料地看到了一月份强劲的非农就业和通胀数据,并且我们应该预计这种强劲势头会持续下去

The bottom line is that the Fed will spend most of 2024 fighting inflation. As a result, yield levels in fixed income will stay high.

总之,Fed在2024年将大部分时间都用于对抗通胀。因此,固定收益领域的收益水平将保持较高

---------------------------------------------

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。