--Did "squid game" win? Why didn't price rise after Q3 earnings?

$Netflix(NFLX)$ 's earnings is probably the whole market's focus on October 19th, not only Netflix was almost the benchmark of growth stocks in the whole market, but also it reveals the whole earnings seasons as an growth Giant.

The reason why the financial report of 21Q3 attracts so much attention is purely from the drama "Squid Game", which is on fire recently. It helps Netflix sweep away the depression in the first half of the year.

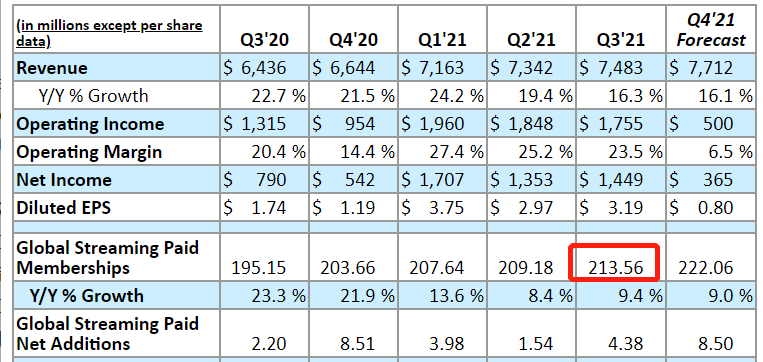

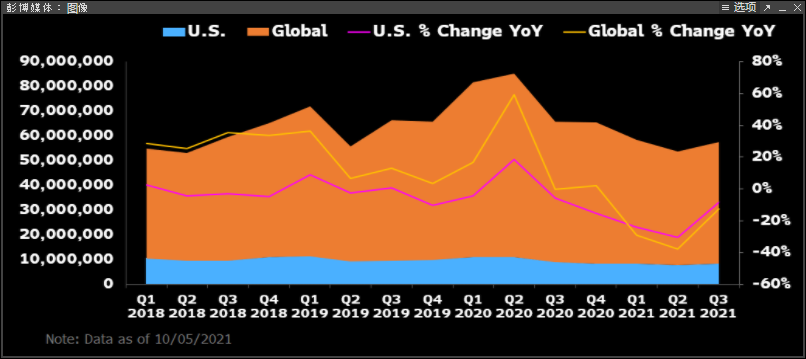

From the perspective of subscribers , Q3 increased 4.38 million worldwide, which is better than its company's guidance of 1.54 million a quarter's ago, than Wall Street's expectation of 3.5 million, and at the same time, than it has doubled from 2.2 million a year ago. This also makes its global streaming media paying users reach 214 million, up 9.4% year-on-year.

In the interview, the CEO put on the characteristic green sportswear of Squid Game with pleasure.

Why is subscribers so important?

To some extent, Netflix and $Tesla Motors(TSLA)$, with single business are much alike. However, it happens to become the top of industry. It is said, first-class enterprises determine the standards, and Netflix not only sets an example for streaming medias, but also traditional ones.

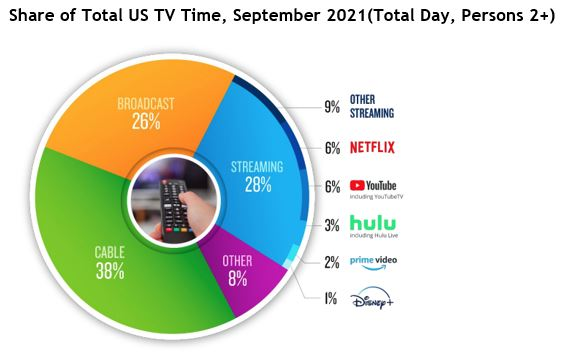

Disney+ is now its strongest competitor, but according to Nielson, Netflix took 6% of US TV Time for Person 2+, while Disney+ only 1%, less than one-fifth of Netflix's users in the user market. Meantime, Disney+ has half of the subscribers of Netflix.

Although the fire of "Squid Game" occupied the time of a large number of viewers around the world, this Korean drama, only launched on September 17th, can squeeze out other streaming peers, also shows that the moat of content creation can not be crossed casually.

Netflix's revenue basically increases with subscribers, but at the same time, the efficiency of monetization is constantly improving. Q3's overall revenue was US $7.48 billion, up 16% year-on-year, which was basically the same as expected, while EPS under GAAP was US $3.19, exceeding the expected US $2.56.

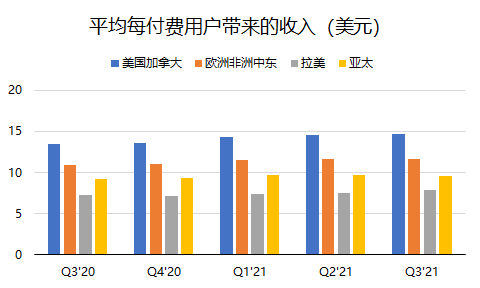

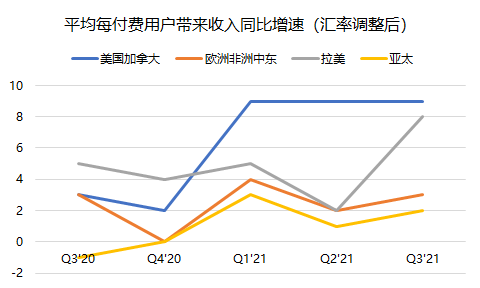

The improvement of monetization efficiency is mainly reflected in the increasing average income brought by each paying member. Among them-

- The average revenue of paying users in North America increased from 13.4 US dollars in the same period last year to 14.68 US dollars this year, a year-on-year increase of 10%, which is relatively the highest;

- Latin America increased by 8% year-on-year, mainly due to price increases;

- Europe and the Middle East increased by 7% year-on-year, but the growth after excluding the influence of exchange rate was only 3%;

- The Asia-Pacific region grew by 4% year-on-year, which was 2% after excluding the influence of exchange rate.

As long as these growth rates remain positive, the monetization efficiency of Netflix can be continuously improved. Although the stock price did not rise sharply post-hours, the increase in the past month has far exceeded the broader market, and investor sentiment has actually been Price-in earlier. It may be a report on the rebound of Netflix App downloads, which disclosed relevant information to investors in advance.

The other side of Netflix is content anxiety

Q2 Earnings' Waterloo, is majorly due to the bottleneck of content creation. Although popularity is quite random, but for a giant, the loss of 430,000 users in its North American in one quarter is indeed the biggest wake-up call.

Netflix is going to start entering the game industry, and has alreadyAcquired the first game companyNight School Studio. For Netflix, which holds a large number of IP including House of Cards, the game is perfect, but it is too early to monetize it.

On the other hand, Netflix acquired Roald Dahl Story Company, a company focusing on children's entertainment content. As we all know, children's entertainment content has always been $Walt Disney(DIS)$'s world. In addition, the company also started to set up an e-commerce website and cooperated with $Wal-Mart(WMT)$ Established a cooperative partnership.

Facing content anxiety, Netflix chose to "Out of comfort zone", And the last successful company in the circle $Bilibili Inc.(BILI)$ , andThe results are obvious.

Stock price surge in the end of Q3, What are investors optimistic about?

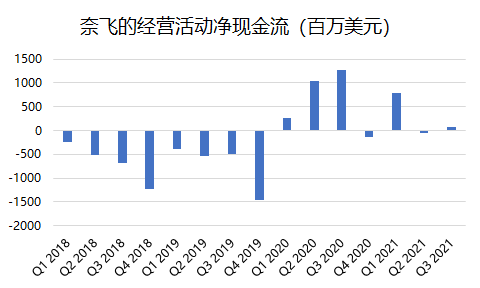

It is not appropriate to discuss Netflix with profit indicators such as P/E ratio and EV/EBITDA. Due to different financial statement processing, Netflix put the biggest cost expenditure-the content expenditure of film and television works, in the cash flow statement and balance sheet. However, the cost of making content and amortization of long-term intangible assets are not fully included in the income statement. Therefore, Netflix's income statement shows that it is a profitable company.

However, from the cash flow statement, before 2020, the cash flow of Netflix's operating activities is negative.

The negative cash flow from operating activities indicates that its own operating activities are still bleeding, so Netflix also needs to issue bonds to support its operating activities.

The epidemic in 2020 has given Netflix the best development opportunity, not only the highest growth of subscribers in five years ,Its cash flow from operating activities is therefore "positive", which means "real profit".

Observing its quarterly net cash flow from operating activities in recent two years, we clearly find that even though the impact of the epidemic gradually subsided, Netflix began to achieve positive cash flow, rising from-63. 8 million US dollars in 21Q2 to 82.4 million US dollars in Q3. The market has always been enthusiastic about companies that turn losses into profits.

According to Netflix's guidelines, the number of Q4 subscribers may reach 8.5 million in 2021. This shows that the future can only be better for Netflix. When games and other businesses begin to realize, other businesses derived from IP will further improve the efficiency of monetization and increase profit margins.

After half a year's silence, Netflix finally is starting to showed investors its other abilities.

精彩评论