If you are not familiar with options, I would suggest reading my first 8 posts:

Part 1 - Introduction to options

Part 2 - Selling Put options

Part 3 - Buying Put options

Part 4 - Selling Call options

Part 5 - Buying Call options

Part 6 - Common Issues faced when selling or buying options

Part 7 - LEAPS

Part 8 - Rolling Options

Time Decay in Options

Time decay is the decline in the value of an options contract as time passes. It accelerates as the time to expiration draws closer since there's less time to realize a profit from the trade. Time Decay is an important component in the extrinsic value of an option.

Why is Time Decay important?

Time decay is important because it affects the option premium. If you are a buyer of an option, you want to pay as little premium as possible for the longest duration of coverage you can get. If you are the seller of an option, you want to get as much premium as possible for the shortest duration of coverage to limit exposure. This is where understanding time decay will help you as a buyer or seller obtain the best bang for your buck.

What is the characteristics of Time Decay?

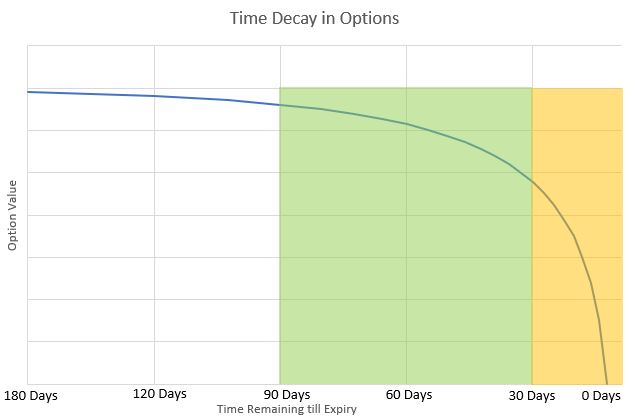

The relationship between time to expiry and option premium is important. The plot below shows the option value (vertical-axis) plotted against the time remaining (horizontal-axis).

One can see that if the time remaining is longer than 90 days, the option value stays high and does not change a great deal (White area). As the time remaining drops to between 30 to 90 days, you start to see an increase in the loss of premium in the option value (Green area). As it progresses to the yellow area, where the time remaining is less than 30 days, the loss in premium is very large compared to the amount of time that passes.

How to use Time Decay to our advantage as a seller?

For a seller, we want to get maximum premium with the shortest duration coverage to minimise exposure to price fluctuation and the risk of being ITM on option expiry. This means that we want to be in the position where the curve starts to get steeper. When the curve gets steeper, it means that a small change in time will give rise to a larger drop in the option value. This means that the option value drops a lot more as it gets closer to expiry (larger depreciation). Notice that the "sweet spot" is somewhere around the 30 day mark. This means that for sellers of options, you should be targetting options that are expiring in approximately one month so you still can get relatively high premium with minimum exposure to price fluctuation.

However, if the option seller is willing to take more risk and lock in their capital longer, it is perfectly acceptable to sell options with longer expiry to maximise the option premium collected.

For traders, it is also perfectly acceptable to trade options with only a few days left till expiry. They can compensate the lower option premium of each contract with a larger number of contracts. However, do note that the more contracts traded, the higher the commission. Do note that the extrinsic value of an option is not solely reliant on the time decay, it is also dependent on the distance of the stock price to the strike price and the volatility of the stock price.

How to use Time Decay to our advantage as a buyer?

For a buyer, we want to pay minimum premium with the longest duration coverage. This is difficult as the longer the coverage duration, the higher the premium.

For a long term investor, you want to give more time for the stock price to move to your desired strike price. Therefore, you will want to buy an option with a very long expiry period, prefeably longer than 180 days. This ensures that your time decay does not play a big factor in the loss of your option value. However, it also means that the premium you need to pay is high. In any case, since you are already paying a big premium, you can opt for long option expiry dates (LEAPS) to allow more time for the stock price to move to in your desired direction, thus increasing the probability that your option will make money.

For short term option traders, you want to pay minimum premium to get maximum profit within a short time. This means that you will be looking at options with time to expiry that is less than 30 days. However, this means that you run the risk of losing more than you can profit if the stock price does not exhibit big swings. Therefore, short term option traders will also look at other factors such as volatility and also track news and sentiments to determine if it is a good time to enter a position.

In Demystifying Options part 10, I will be moving to discuss multi-leg options..

Always remember.. If you do not understand what is happening, do not blindly follow and execute the trade!

精彩评论