22Q4

- 营收19亿,同比增长24%,同币增长31%。Q4 revenue of $1.9 billion was our highest fourth quarter ever. Revenue grew 24% year-over-year (31% ex-FX) driven by solid growth in Nights and Experiences Booked.

- 第四财季的利润为3.19亿美元,净利率17%,同比升4个百分点。Q4 net income of $319 million was our most profitable fourth quarter ever. Net income improved by $264 million compared to Q4 2021 primarily due to our revenue growth and expense discipline. In Q4 2022, we delivered a net income margin of17%, up from 4%in Q4 2021.

- 自由现金流4.55亿。We generated $463 million of net cash provided by operating activities in Q4 and $455 million of Free Cash Flow

- 调整后EBITDA为5.06亿美元。Q4 Adjusted EBITDA of $506 million was a record fourth quarter. Adjusted EBITDA in Q4 2022 increased 52% compared to $333 million in Q4 2021. Adjusted EBITDA margin was 27% for Q4 2022, up from 22% in Q4 2021.

#Q4净利率提升,高速增长同时,现金流率24%保持稳定

2022FY

- 爱彼迎的营收为84亿美元,与上一财年相比增长40%,不计入汇率变动的影响为同比增长46%,

- 净利润为18.93亿美元,上一财年的净亏损为3.52亿美元

- 来自于业务运营活动的净现金为34.30亿美元,上年同期来自于业务运营活动的净现金为23.13亿美元。过去12个月,爱彼迎的自由现金流为34亿美元,与上年同期相比增长49%。

其他重要数据

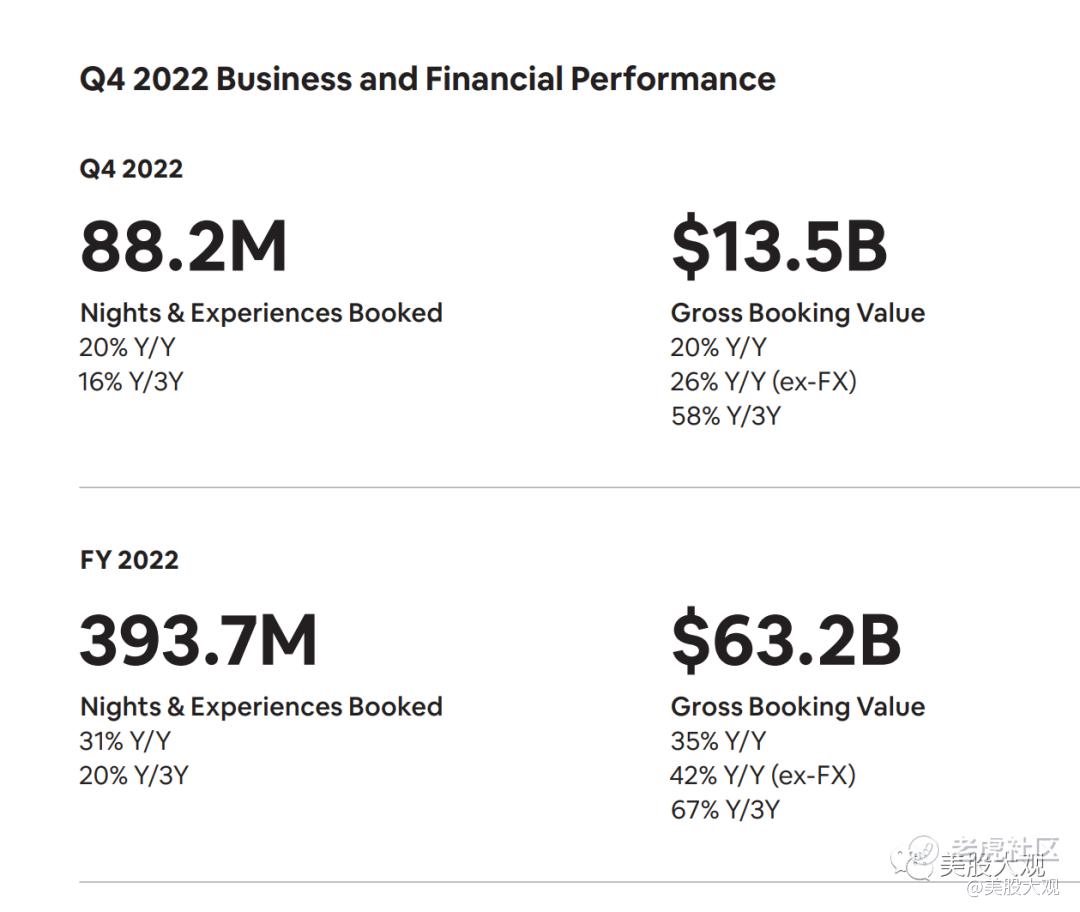

- During Q4 2022, we had 88.2 million Nights and Experiences Booked—our highest fourth quarter ever— representing a significant increase from a year ago (20% Y/Y).During Q4 2022, we had 88.2 million Nights and Experiences Booked—our highest fourth quarter ever— representing a significant increase from a year ago (20% Y/Y).

- . In Q4 2022, GBV was $13.5 billion, representing a year-over-year increase of 20% (26% ex-FX).

#Q4高速增长超出预期

业绩指引

We expect revenue of $1.75 billion to $1.82 billion in Q1 2023. This represents year-over-year growth of between 16% and 21% and on an ex-FX basis between 18% and 23%. We expect our implied take rate (defined as revenue divided by GBV) in Q1 2023 to be similar to Q1 2022. We anticipate that the implied take rate seasonality in 2023 will be similar to 2022.

营收17.5亿美元到18.2亿美元的指引,超出分析师预期的16.9亿美元。对于整个2023财年,爱彼迎预计该公司将可保持与20222财年一样强劲的调整后EBITDA利润率,原因是递增的可变成本效率和固定成本纪律将可抵消每日平均房价下降数据所带来的负面影响。

#23Q1预计同比增长16%-21%,同币增长18%-23%

S:

前不久关注并跟踪了ABNB爱彼迎的Q3财报,从本次Q4的财报来看,业绩略超预期。

按目前爱彼迎的成长性,当前估值具有了吸引力。

未来3年爱彼迎的平均净利润预计会达到50亿美金级别。

2023年往后,1000亿美金以下都属于便宜范畴。

观总的小马甲,公众号:美股大观

ABNB爱彼迎22Q3财报跟踪,未来三年内达成50亿美金年利润?

毛利率,净利率,现金流率基本都跑赢了营收增长,公司经营质地全面提升,更关键的是持续增长,属实是难能可贵。

预计2024Q1就能实现50亿美金的年度自由现金流。从目前的盈利能力来看,未来两年潜在的平均PE是低于20x的。

昨晚盘后财报涨了10%。

最近跟踪:ABNB爱彼迎22Q3财报跟踪,未来三年内达成50亿美金年利润?

这家公司IPO始开始跟踪,关键词直达:

美股大观

推荐搜索

夜报输入股票代码$爱彼迎(ABNB)$

精彩评论