If you are not familiar with options, I would suggest reading my first 6 posts:

Part 1 - Introduction to options

Part 2 - Selling Put options

Part 3 - Buying Put options

Part 4 - Selling Call options

Part 5 - Buying Call options

Part 6 - Common Issues faced when selling or buying options

What are LEAPS?

LEAPS (Long-term Equity AnticiPation Securities) refers to option contracts with expiration dates longer than a year, and can go up to 3 years. If you hear people saying they are selling or buying LONG PUTs or LONG CALLs, they are referring to LEAPS.

What is the difference between LEAPS and normal options?

LEAPS are just normal options with long expiration dates. They are traded the same way as normal PUT and CALL options. You can BUY and SELL them just like normal options.

Where can I find LEAPS?

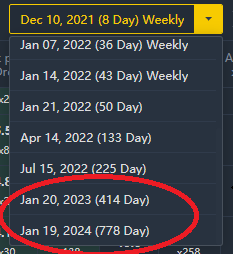

You can find them in the normal option chain. If you see options with expiration longer than 1 year, those will be considered LEAPS (Circled in red).

What is the use of LEAPS?

LEAPS allow investors to buy or sell options for hedging without having to "roll" contracts over regularly. For example, if a stock holder wants to hedge against a fall in stock price for 2 years by BUYING PUT options, and the longest duration options available is only 6 months, the stock holder will need to BUY PUT-contracts for 4 times, "rolling" over the contract everytime the expiry date is due. Everytime a contract rolls over, a new premium has to be paid by the buyer to the seller. The premium will depend on the share price at that point in time. It may cost more for the option buyer as the premium during renewal may be much higher than what is available now. In addition, the option buyer and seller will also have to pay commission for 4 trades over 2 years instead of 1 with LEAPS.

However, as LEAPS are options with very long expiry dates, the premium are typically higher than normal options due to the larger time value component. This is good for the the options seller (SELL PUT and SELL CALL) as more premium can be collected. For options buyer (BUY PUT or BUY CALL), it will mean paying more premium to secure a long term hedge against price movement of the stock. I will discuss time value in the next post.

When to use LEAPS and when to use normal options?

It depends! A few questions you should ask yourself if you should do LEAPS or normal options...

1) Are you willing to tie up your capital (SELL LONG PUT) or tie up your stock position and forgo potential capital gains (SELL LONG CALL) for a year or more?

2) Do you really want to hold the company stocks? (SELL LONG PUT)

3) Are you desperate to hold the company stocks?

4) Are you a short term trader?

If your answer is NO to Q1 and Q2 and YES to Q3 and Q4, then you might not want to consider LEAPS.

That said, LEAPS is just another tool in the options toolbox to be deployed under certain circumstances.

How to determine what is a reasonable premium to accept for selling or buying normal options and LEAPS?

This is subjective as different people have different risk profile.

For SELLING normal options, you want to be fairly compensated for the amount of risk you are taking on. Therefore, my personal preference is at least 10% return on capital per annum. This is how I calculate the returns... You take the (premium per share / strike price) * (No. of days in 1 year / duration of option in days). For example, a stock with strike price of $100 has a premium of $1 and expires 30 days from now. Putting it into the equation (1/100) * (365/30) = 12.17% per annum. This is acceptable risk for me.

For BUYING normal options, you want to pay as little as possible and get returns as high as possible. My personal preference is at least 150% return on premium paid per annum. This means that for every dollar I pay, I want $1.5 back. Using the screenshot as example, current stock price is $52. The BUY premium for strike price of $55 is 3.50 per share (Circle in blue). In order for me to get 150% return, the premium must rise to (3.5 * 150% = 5.25) per share on expiry. Looking at the screenshot, this means the stock price must rise about 6 dollars for my SELL premium (To close a BUY position is to SELL) to hit around 5.4 per share on expiry (Circle in yellow). If I am confident that the share price will rise 6 dollars within 35 days (Note the expiry of the option in red circle), then I will execute the trade, otherwise I will look for better deals.

For SELLING LEAPS, the consideration will be slightly different. As you are tying up your capital for long duration (SELL LONG PUT) or tying up your stock position and forgoing potential capital gains (SELL LONG CALL), you want to be compensated much more for it to be worth your time. Therefore, my personal preference is at least 1.5x to 2x what you would get from your normal options. This means at least 15% to 20% return on capital per annum. Anything less and I personally feel that it is not worth your time. You can get better returns from short term options. However, if this is used as part of a multi-leg option strategy, the considerations would be different.

For BUYING LEAPS, this is a special category. This is usually used as part of a long term option strategy to amplify your gains. For example, if you found a company with the business that is turning around or has the potential to be the next big thing in 1 or 2 years time... (e.g you found Tesla in Dec 2019 and see potential for it to go to the moon 2 years later), you can buy a LONG CALL for 2 years or more. When the share price soar, you will reap the benefits just as well as a normal option can, but in this case, many times more than normal options because the difference in the strike price will be huge due to the run-up in share price over a longer period.

I will cover multi-leg strategies in future posts.

In Demystifying Options part 8, I will discuss rolling over options and time value of options.

Always remember.. If you do not understand what is happening, do not blindly follow and execute the trade!

精彩评论

Thanks WayneQQ for your effort [Love]