xeige

暂无个人介绍

IP属地:未知

76关注

4粉丝

0主题

0勋章

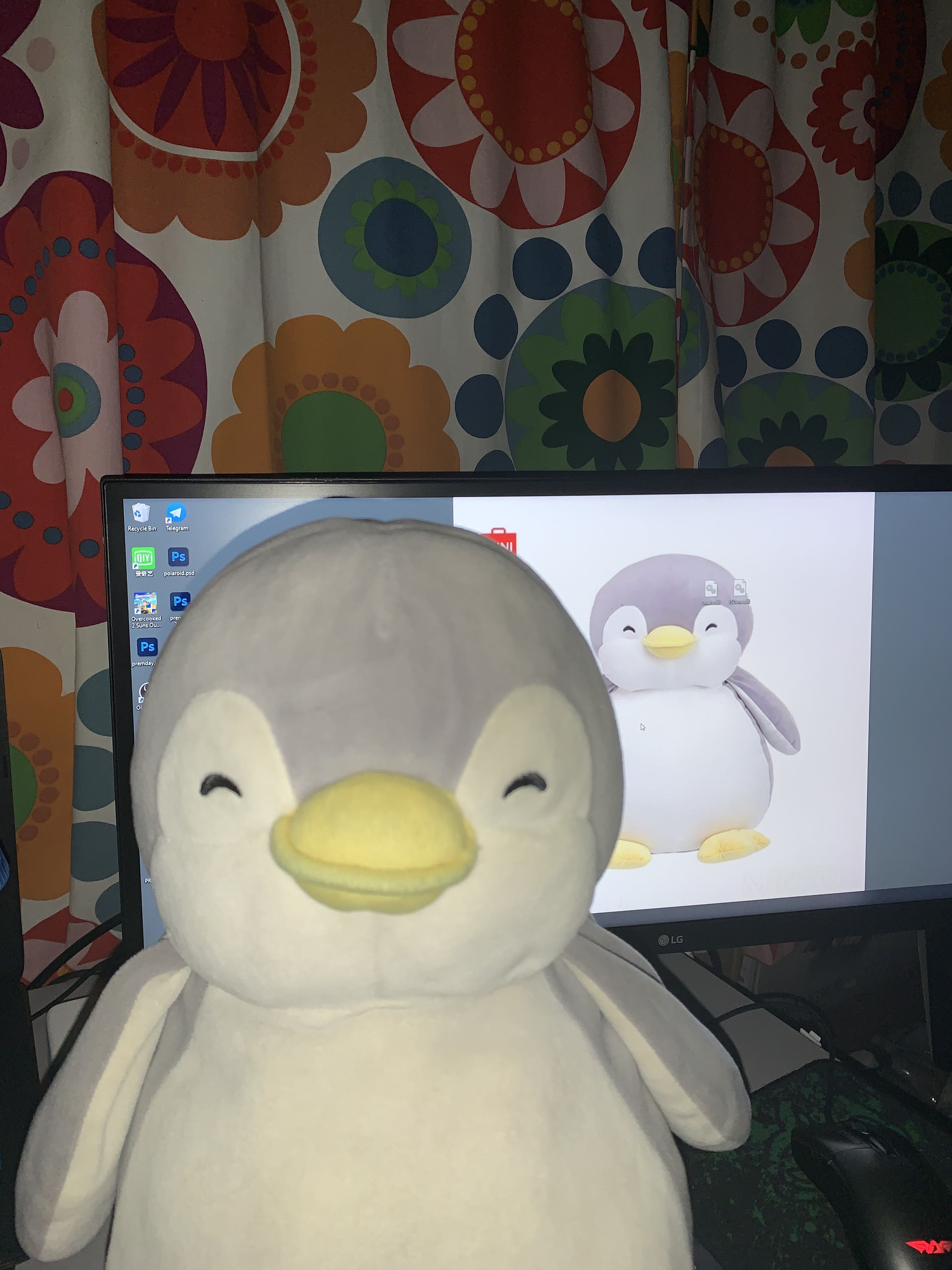

I am a penguin

Zhihu Technology fall on its first day of trading<blockquote>知乎科技上市首日下跌</blockquote>

烟火里的尘埃

抱歉,原内容已删除

$High Tide Inc.(HITIF)$bullish

Wow

Jobless claims preview: Another 730,000 Americans likely filed new unemployment claims<blockquote>初请失业金人数预览:另有73万美国人可能申请新的初请失业金</blockquote>

Comment and like thanks

抱歉,原内容已删除

Wow

抱歉,原内容已删除

Like and comment thanks 😊

抱歉,原内容已删除

Nice 🙂

抱歉,原内容已删除

Wow

Meituan's Annual revenue jumps 17.7%, above forecast<blockquote>美团-W年收入增长17.7%,高于预期</blockquote>

Help a penguin out

抱歉,原内容已删除

去老虎APP查看更多动态