炒股,本质上炒的是业绩增长和资本回报率,业绩增长+资本回报率=股价上涨。近日,国际著名股票投资平台simply wall st发表了一篇名为“我们该如何看待易恒健康的使用资本回报率”的文章,对易恒健康的投资前景进行了深入分析,并且得出明确结论,从ROCE (使用资本回报率)这一核心指标来看,对于广大投资人而言,易恒健康是一家具有长期投资价值的好公司。趁着机会,我略微翻译一下,有心人可以看出可操作性。

今天我们将找寻易恒健康是否具有投资潜力(NASDAQ:MOHO)。为了更高地评估公司的商业逻辑,我们计算了使用资本回报指标。

什么是ROCE (使用资本回报率)?

ROCE衡量公司运用资本所带来息税前利润的能力。简单来说,ROCE越高说明公司的资本运用能力越好。著名的投资研究学者Michael Mauboussin建议高ROCE的企业,每投资到公司1美元,将获得更多收益。

我们如何计算ROCE?

ROCE的公式是:息税前利润/(总资产-短期负债)

易恒ROCE:

0.2=US$10m ÷ (US$160m – US$108m) (根据截止到2019年9月底向前滚动12月数字计算)

因此 易恒ROCE为20%

易恒的ROCE高吗?

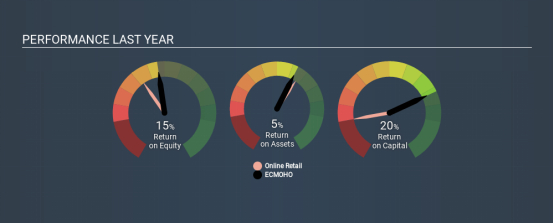

ROCE普遍用来评价行业同类企业。显然,易恒健康远高于线上零售行业平均7.7%。这意味着,易恒运用资本的效率显著优于同类企业。如不考虑行业比较,即使从绝对值来看,易恒健康的ROCE也很出色。

下图为与同类企业相比,易恒过去的增长表现:

ROCE有一定度量局限,在衡量过去表现时很好,但在预测未来时会有偏差。因此对于周期性行业来说,ROCE指标有失公允。

易恒健康的短期负债以及对ROCE的影响

短期负债包括票据、供应商应付、短期贷款、和税单。这些需要在12月内偿还。根据公式等式,短期内到期的大额票据会让公司看起来好像用了更少的资本,从而使ROCE看上去更高。为了验证,投资可以通过查看是否公司有高的短期负债比例。

易恒短期负债为1.08亿美元,总资产为1.6亿美元。其短期负债比例为67%。即使考虑到短期负债比例较高,易恒仍在ROCE指标上具有吸引力。

原文如下:$易恒健康(MOHO)$

https://simplywall.st/news/what-can-we-make-of-ecmoho-limiteds-nasdaqmoho-high-return-on-capital/

What Can We Make Of ECMOHO Limited’s (NASDAQ:MOHO) High Return On Capital?

Today we are going to look at ECMOHO Limited (NASDAQ:MOHO) to see whether it might be an attractive investment prospect. Specifically, we’re going to calculate its Return On Capital Employed (ROCE), in the hopes of getting some insight into the business.

First, we’ll go over how we calculate ROCE. Second, we’ll look at its ROCE compared to similar companies. And finally, we’ll look at how its current liabilities are impacting its ROCE.

Return On Capital Employed (ROCE): What is it?

ROCE measures the ‘return’ (pre-tax profit) a company generates from capital employed in its business. Generally speaking a higher ROCE is better. Ultimately, it is a useful but imperfect metric. Renowned investment researcher Michael Mauboussin has suggested that a high ROCE can indicate that ‘one dollar invested in the company generates value of more than one dollar’.

So, How Do We Calculate ROCE?

The formula for calculating the return on capital employed is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

Or for ECMOHO:

0.20 = US$10m ÷ (US$160m – US$108m) (Based on the trailing twelve months to September 2019.)

Therefore, ECMOHO has an ROCE of 20%.

See our latest analysis for ECMOHO

Does ECMOHO Have A Good ROCE?

ROCE is commonly used for comparing the performance of similar businesses. ECMOHO’s ROCE appears to be substantially greater than the 7.7% average in the Online Retail industry. We consider this a positive sign, because it suggests it uses capital more efficiently than similar companies. Regardless of the industry comparison, in absolute terms, ECMOHO’s ROCE currently appears to be excellent.

You can click on the image below to see (in greater detail) how ECMOHO’s past growth compares to other companies.

NasdaqGM:MOHO Past Revenue and Net Income, February 10th 2020

When considering this metric, keep in mind that it is backwards looking, and not necessarily predictive. ROCE can be misleading for companies in cyclical industries, with returns looking impressive during the boom times, but very weak during the busts. ROCE is only a point-in-time measure. Since the future is so important for investors, you should check out our free report on analyst forecasts for ECMOHO.

ECMOHO’s Current Liabilities And Their Impact On Its ROCE

Current liabilities include invoices, such as supplier payments, short-term debt, or a tax bill, that need to be paid within 12 months. Due to the way the ROCE equation works, having large bills due in the near term can make it look as though a company has less capital employed, and thus a higher ROCE than usual. To counter this, investors can check if a company has high current liabilities relative to total assets.

ECMOHO has current liabilities of US$108m and total assets of US$160m. As a result, its current liabilities are equal to approximately 67% of its total assets. ECMOHO boasts an attractive ROCE, even after considering the boost from high current liabilities.

Our Take On ECMOHO’s ROCE

So we would be interested in doing more research here — there may be an opportunity! ECMOHO shapes up well under this analysis, but it is far from the only business delivering excellent numbers . You might also want to check this free collection of companies delivering excellent earnings growth.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

精彩评论