In a market full of bulls, bears, and apes, we're all forgetting one thing — Mr. Market abides by 2 rules.

The past two years have been a doozy. Actually, that doesn’t do it justice. The past two years have been fucking madness.

We saw a virus sweep the globe, yet it was only the United States that politicized the event until hell froze over. We saw the economy abruptly shut down for the first time in human history, resulting in a market collapse of epic proportions… for a few weeks. We saw the Federal Reserve take matters into their own hands, giving money out like it were parking tickets — so much so that 30% of all dollars ever printed were done so last year.

We saw markets rally toward all-time ceilings, then blow the roof completely off the building. We saw terrible companies have their stocks squeeze historically high, and perhaps even worse, we saw their “investors” try to rationalize the move. We saw an electric vehicle company roll their truck down a hill and call it good enough, Fortune 100 CEOs have a pissing match in outer space, and the largest property developer on earth rack up $300B in debt, shocking the world once they said they probably can’t pay it off.

We saw crypto become the future, then the past, then the future again. We saw individuals become multi-millionaires by selling some pixels and we saw top government officials make millions by timing the market. We saw inflation be labeled as transitory… then we saw it rise over 6% with threats to push higher, catching everyone completely by surprise. And, most recently, we saw a decentralized autonomous organization collect over $43M in donations during a frantic attempt to buy the U.S. Constitution, only to be outbid by a billionaire geezer.

Can you believe its only been two years? Needless to say, investing has been a bit of a shitshow lately. Some made millions, others lost everything. Amazingly, some lost more than everything.

Investing in 2021 is kinda like if you were at the zoo but the exhibits were merged as one, the pathways were gone, and everyone was locked inside — exciting, terrifying, and one hell of a story to tell. You’re the apex predator until you’re not. This is a lesson that seems can only be learned the hard way. Being a wolf and chasing down mice is all fun and games until a lion strolls in.

Nobody Gives a Fuck About Long-Term Investing Anymore

If they do, they must be far from any social media platform. I hate it as much as you do, but it’s the truth.

I can’t really blame people for not caring, either. I mean, why should they? We live in the Glory Age of Instant Gratification. Have a question? Google tells you the answer in seconds. Hungry? DoorDash delivers whatever the hell you want straight to your house. Need to get somewhere? Call an Uber. Want groceries? Use Instacart. Want literally anything else? Amazon has it on your doorstep by tomorrow.

So why, in a world where everything is at the tip of your fingertips and available in minutes, should you have to wait for the one thing that controls it all? I’m not saying I agree, but I do see where they’re coming from.

Perhaps people just see the stock market differently. Some see it as an instrument to gradually build and preserve wealth. Others see it as more of a game; one filled with large numbers, seductive charts, and real-world effects. Neither is wrong, but both inherently disagree with the other. It’s interesting how that works.

Once you add social media and other platforms into the mix, everything really goes to hell. You login to Reddit and it’s just utter mayhem. Buy this, sell that. Hold the line. Never sell. We’re going to the fucking moon. Rocket emojis everywhere. Jimmy made 4,000% in seconds on GameStop contracts. Tommy has $5,000,000 in AMC shares. It seems like easy money. Worse yet, it feels like easy money. You start to think you can do it too. Why wouldn’t you?

There's a fine line between asymmetric bets and complete degeneracy, and WallStreetBets has built a reputation for not knowing what the fuck a line even is. I’d recommend being unwaveringly cognizant of human nature before treading anywhere near that rabbit hole. Then again, what do I know? I didn't 20x my portfolio in a week like some did.

Twitter is a different phenomenon entirely. It’s not so much people telling you how to invest, rather it’s them leading you to believe you made the decision for yourself. Both are equally scary.

It's bad enough when celebrities and people of influence join the party and intentionally rustle the masses, but they don’t stop there. The next step in this timeline toward complete disparity is gloating your gains while simultaneously implying that making ridiculous amounts of money is easy as long as you “know what you’re doing”

Speaking of celebrities on Twitter, let’s not forget Elon Musk took Dogecoin from less than a penny to over seventy cents in a few months just by tweeting random bullshit, effectively leading everyone on the planet to ape in at all-time highs. At Dogecoin’s peak, it valuation was larger than Coinbase. I’ll let that settle.

I guess I just wonder whether this is forever. Will people be satisfied buying and holding great companies and index funds again? Can they sacrifice years of grinding and saving now in return for financial freedom twenty years down the road? Is that too lame?

I’d like to think this revolution is temporary, but I just don’t know. Will the market ever return to normalcy? Can I go long on investing reverting to the mean? Is shorting bullshit just because it’s bullshit a viable thesis? Maybe, maybe not. Perhaps I can do both.

It’s Not All Cupcakes & Rainbows

This much is clear. This week has been the icing on the cake.

Last year was a freebie — if you were invested in any tech at all, you made a killing. This year is different. There aren’t as many handouts as there were a year ago and many of this year’s winners have experienced violent drawbacks. In this market, it takes a strong stomach and balls of steel to be a stock picker. You damn well better know what you own or your life will be made a whole lot harder.

That being said, there are more ways to invest than ever before. As such, there are more ways to lose money than ever before. You think those who bought GameStop and AMC at the top are having fun this year? Assuredly not. Those who took the options route have had $0 to their name for months now. Those who went on margin are probably in prison.

Likewise, how about those who bought Dogecoin before Elon’s SNL appearance? Those who minted the Raccoon Secret Society? Those who bought the Squid Game currency?

As if you needed more proof, there’s a sharp difference between investing and gambling. Oddly enough, those who gamble in their investments still refer to it as investing. Perhaps it’s easier to cope this way.

On the bright side, if it wasn’t for these “investors” we wouldn’t have the glorious symphony that is loss porn. If you’re unfamiliar with loss porn, this is the spectacle where individuals share their losses online so that others may make fun of them. I understand the theory behind the madness perfectly — laughing at your mistakes make them hurt less. There’s simplicity in the genius.

That said, when your day of fame blows over, you alone stand to face your consequences… that includes the shame, embarrassment, and debt that comes with them. Everyone else goes back to not giving a shit because it wasn’t their money. Seems like a pretty large price to pay for a few laughs.

Companies Are Selling Hopes & Dreams… And We’re Buying Them

Do we really think General Motors can even come close to catching Tesla’s market share by 2025? Do we really think Rivian will go from producing zero cars to over 150,000 in two years? Do we really think Skillz will forever change the trajectory of mobile gaming and Fubo will be the biggest sportsbook in the United States?

I am sick and tired of companies making broken promises without any repercussions and saying one thing while doing another. Likewise, I am sick and tired of executives worrying more about their stock price than the business.

Contrarily, I am all for companies setting lofty goals and doing all they can to reach them. I am all for companies acting on change and setting the record straight, and I’m definitely all for executives caring about their investors.

There is a difference. The line is dotted and becoming increasingly blurred, which makes recognizing this difference all the more important. When an executive speaks, it shouldn’t be manipulatively propitious, deliberately vague, or up for interpretation. Their intent should be completely understood and their vision should be crystal clear. I don’t see why it is so hard to call a rock a rock.

It’s Not Illegal, It’s Frowned Upon…

I’m beginning to think nothing is regulated. The SEC may as well be powered by a hamster wheel.

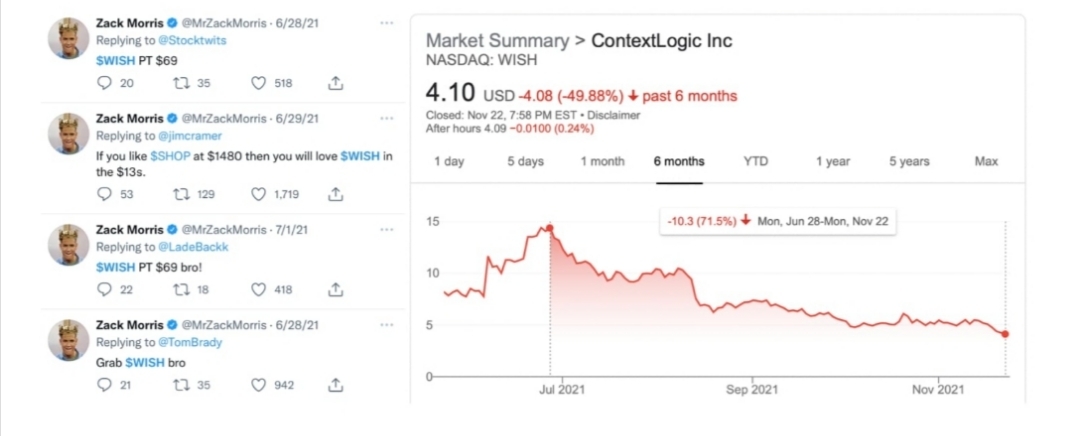

What kind of event must occur for the SEC to actually take action? What if government officials traded on insider knowledge and profited millions right in their teeth? Oops, Pelosi has that under control. Maybe some dude on Twitter sharing any ticker of his choosing to his half a million followers who blindly follow him into any trade would cause a stir? Oops, Zack Morris exists. How about if an expert investor went on national television and said to buy a stock that he doesn’t know shit about? Would that get the SEC up and moving? Oops…

There is no standard. There are no individuals being made into examples. We are waiting for a precedent to be set by a commission that has no urgency. If the people with the most influence and power in the entire country can do as they please, why can't we ?

精彩评论