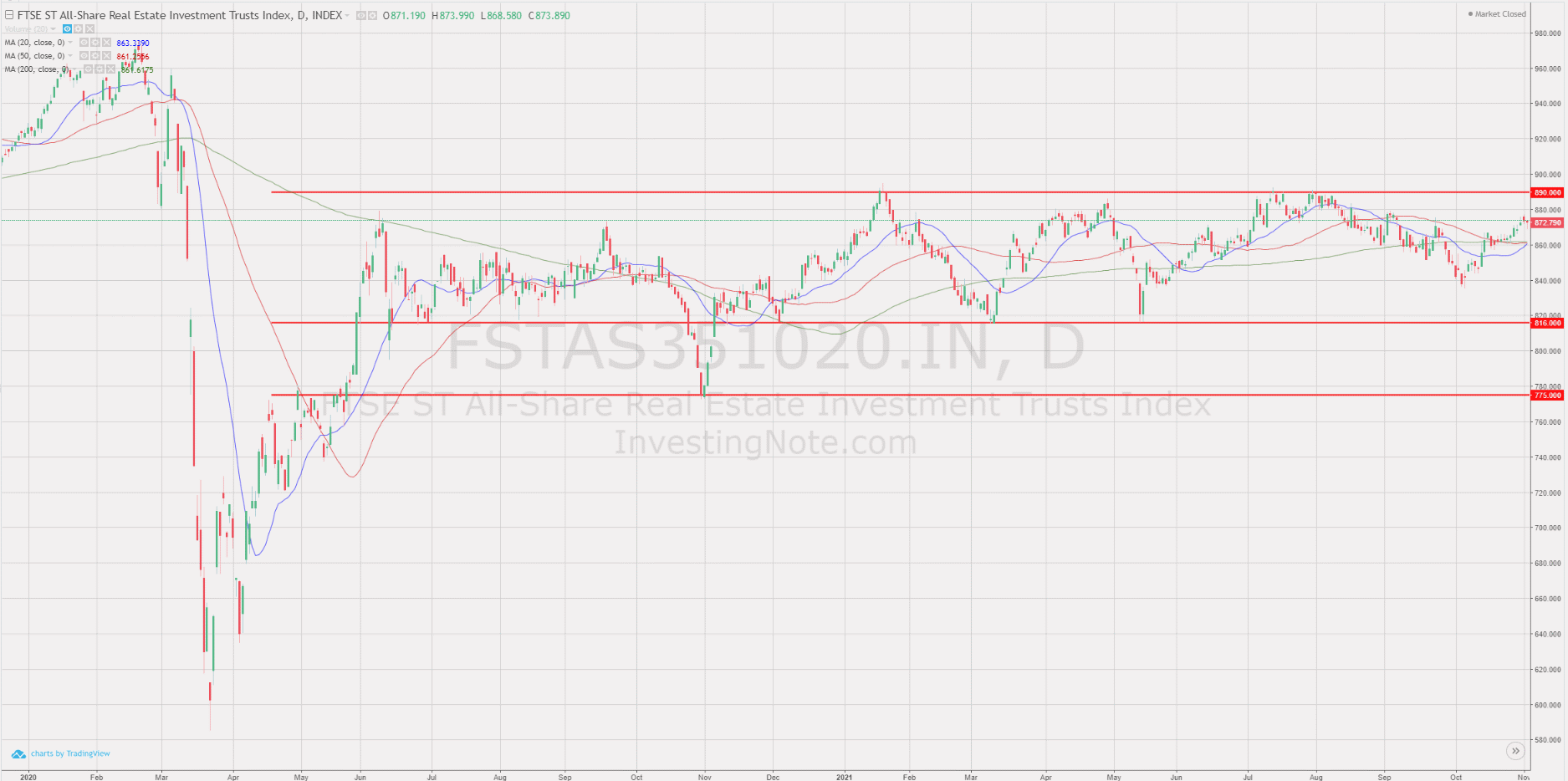

Technical Analysis of FTSE ST REIT Index (FSTAS351020)

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) increased slightly from 842.13 to 872.79 (+3.64%) compared to thelast month update. Currently the Singapore REIT index is still trading with a range between 816 and 890.

- As for now, Short term direction: Up.

- Medium direction: Sideway.

- Immediate Support at 816, followed by 775.

- Immediate Resistance at 890.

Previous chart on FTSE ST REIT index can be found in the last post:Singapore REIT Fundamental Comparison Tableon October 3, 2021.

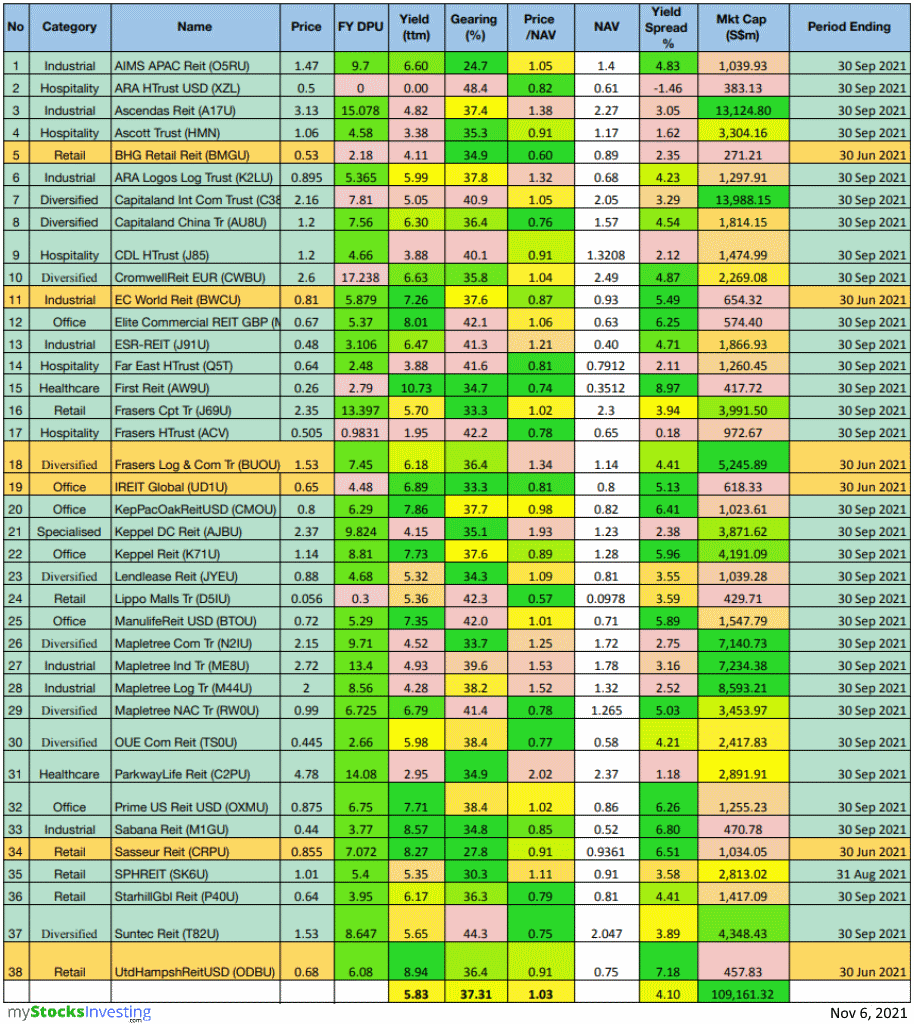

Fundamental Analysis of 38 Singapore REITs

The following is the compilation of 38 Singapore REITs with colour coding of the Distribution Yield, Gearing Ratio and Price to NAV Ratio.

- Note 1: The Financial Ratio are based on past data and there are lagging indicators.

- Note 2: This REIT table takes into account the dividend cuts due to the COVID-19 outbreak. Yield is calculated trailing twelve months (ttm), therefore REITs with delayed payouts might have lower displayed yields, thus yield displayed might be lower.

- Note 3: REITshighlighted in green (32 REITs) have been updated with the latest Q3 2021 business updates/earnings. REITshighlighted in yellow (6 REITs)are still using Q2 2021 business updates/earnings.

(Source: https://stocks.cafe/kenny/advanced)

- Price/NAVincreasedto 1.03

- TTM Distribution Yieldincreasedto 5.83%

- Gearing Ratiodecreasedto37.31%

- Most overvalued REITs (based on Price/NAV)

- Most undervalued REITs (based on Price/NAV)

- Highest Distribution Yield REITs (ttm)

- Highest Gearing Ratio REITs

- Total Singapore REIT Market Capitalisationincreased by 3.86%to S$109.2 Billion.

- Biggest Market Capitalisation REITs:

- Smallest Market Capitalisation REITs:

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. If you need help to start building your own investment portfolio, or want a portfolio review,book a consultation with Kenny now!First consultation is free.

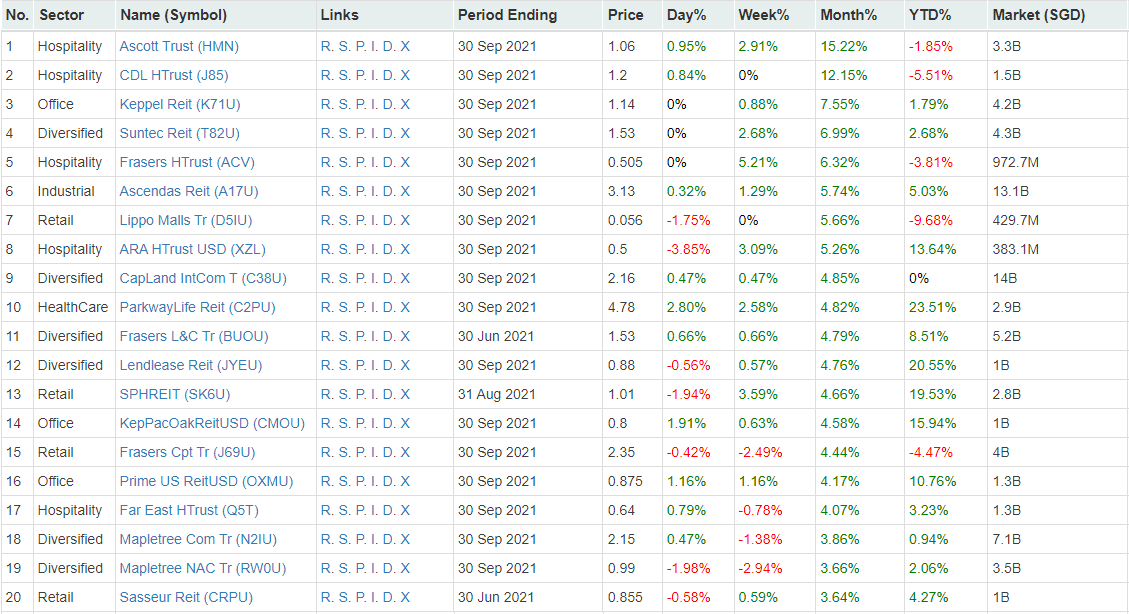

Top 20 Best Performers of the Month (November 2021)

(Source: https://stocks.cafe/kenny/advanced)

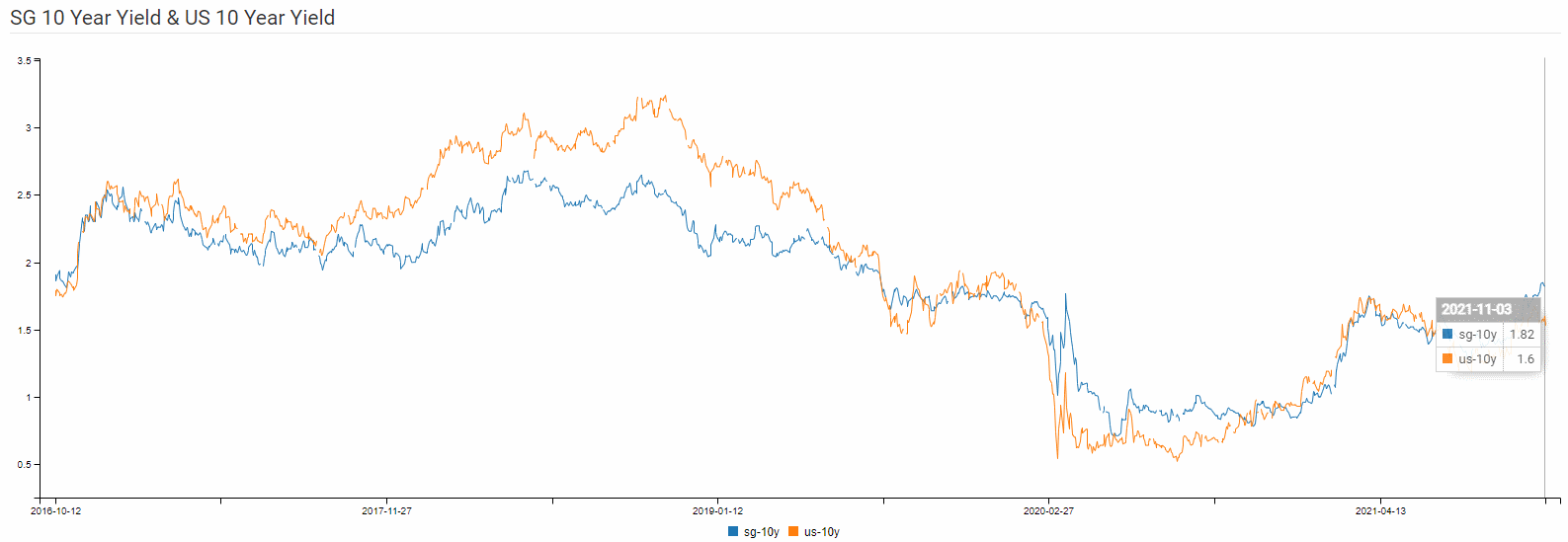

SG 10 Year & US 10 Year Government Bond Yield

- SG 10 Year: 1.77% (increasedfrom 1.57%)

- US 10 Year: 1.46% (decreasedfrom 1.47%)

Major REIT News in October 2021

ESR REIT and ARA LOGOS Logistics Trust propose $1.4 billion merger

The managers of ESR-Reit and ARA Logos Logistics Trust (ARA Logos) have proposed a $1.4 billion merger, where ESR-Reit will acquire all of ARA Logos’ units in exchange for a combination of cash and new units.

The proposed merger, which will result in the merged entity being named ESR-Logos Reit, will be effected by way of a trust scheme of arrangement. ARA Logos unitholders will receive a scheme consideration of $0.95 per ARA Logos unit – comprising $0.095 in cash and 1.6765 new ESR-Reit units, to be issued at $0.51 apiece. – The Business Times

SeeExclusive Insights: Interview with ESR REIT CEO

Summary

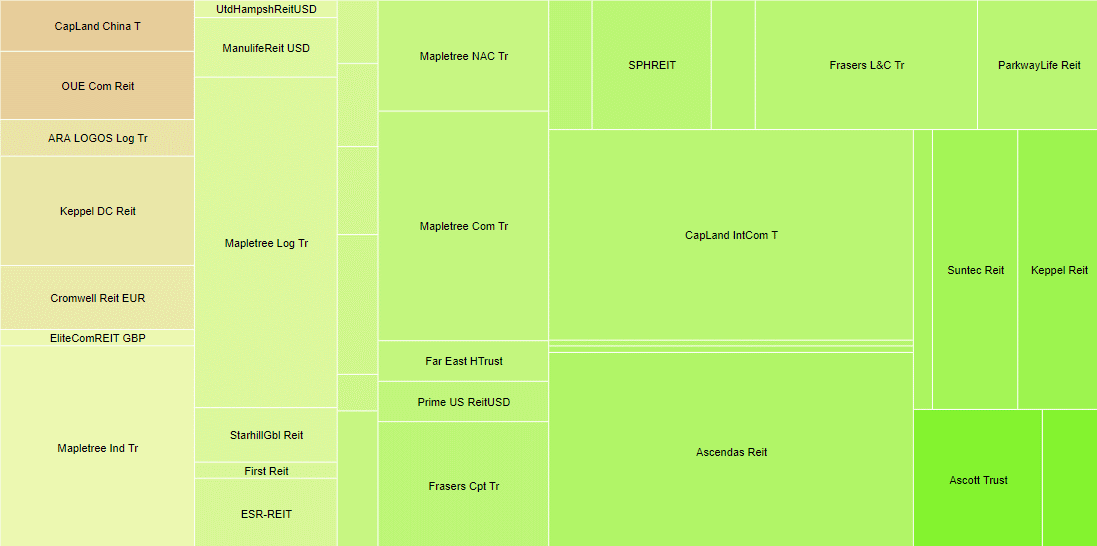

Fundamentally, the whole Singapore REITs landscape is currently at fair value due to the recent correction based on the average Price/NAV value of the S-REITs. Below is the market cap heat map for the past 1 month. Generally, most S-REITs in the past month have increased in market cap. Noteworthily, 3 of the Top 5 Performers are Hospitality Trusts, namely Frasers Hospitality Trust(6.32%)and CDL Hospitality Trust(12.15%), and Ascott Residence Trust(15.22%).

(Source: https://stocks.cafe/kenny/overview)

Yield spread (in reference to the 10 year Singapore government bond of 1.77% as of 7th November 2021) tightened slightly from4.21% to4.10%.This is due to the 10 year Singapore government bond rate increasing from 1.57% to 1.77%.

The risk premium is attractive to accumulate Singapore REITs in stages to lock in the current price and to benefit from long-term yield after the recovery. Moving forward, it is expected that DPU will increase due to the recovery of global economy, as seen in the previous few earning updates. NAV is expected to be adjusted upward due to revaluation of the portfolio.

Technically the REIT Index is currently on short term uptrend moving towards theresistance zone at 875-890. With the containment of China Evergrande debt issue and re-opening of the borders, it is expected the stablelisation of the share price of Singapore REIT and the return of the dividend for the next few quarters. Based on the latest earning releases, most of the REITs are growing in DPU and cautiously optimistic moving into 2022.

You can listen to mymonthly REIT radio interview on MoneyFM89.3here.

Note: This above analysis is for my own personal research and it is NOT a buy or sell recommendation. Investors who would like to leverage my extensive researchand years of Singapore REIT investing experience can approach me separately for a REIT Portfolio Consultation.

Kenny Loh is a Senior Consultantand REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments, Digital Assets and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also invited speaker of REITs Symposium and Invest Fair. You can join my Telegram channel #REITirement – SREIT Singapore REIT Market Update and Retirement related news. https://t.me/REITirement

精彩评论