Climate change is one of the hottest topics that is in focus in today’s context. According to the latest report by the Intergovernmental Panel on Climate Change (IPCC), changes observed in the climate have progressed faster than expected. New estimates showed that the rising of global temperature by 1.5 degree Celsius within the next decade is imminent unless there are immediate, swift, and extensive reductions in greenhouse gas emissions.

Knowing this, you are now more than ever, concerned over your daily activities ensuring that you do your part in preventing this catastrophe. At this juncture, you’d take the extra steps in performing your due diligence in ensuring that the companies that you invest in do not do harm to the environment. However, the next question lies “what can I invest in to receive a consistent stream of income from sustainable sources”?

Tiger Brokers (Singapore) is proud to be one of the exclusive participating dealer for the Initial Offering Period (IOP) of UOB APAC Green REIT ETF. This ETF tracks the performance of the iEdge-UOB APAC Yield Focus Green REIT Index as closely as possible and aims to replicate the index by using a direct investment policy of investing in all or substantially all, of the underlying Index Securities.

The iEdge-UOB APAC Yield Focus Green REIT Index is an index consisting of 50 constituent Real Estate Investment Trusts (REITs) which tracks the performance of REITs that are listed across the Asia-Pacific region with a specific focus on yield selection and a weighting method that is tilted toward the environmental attributes of real estate assets.

What is the aim of this fund?

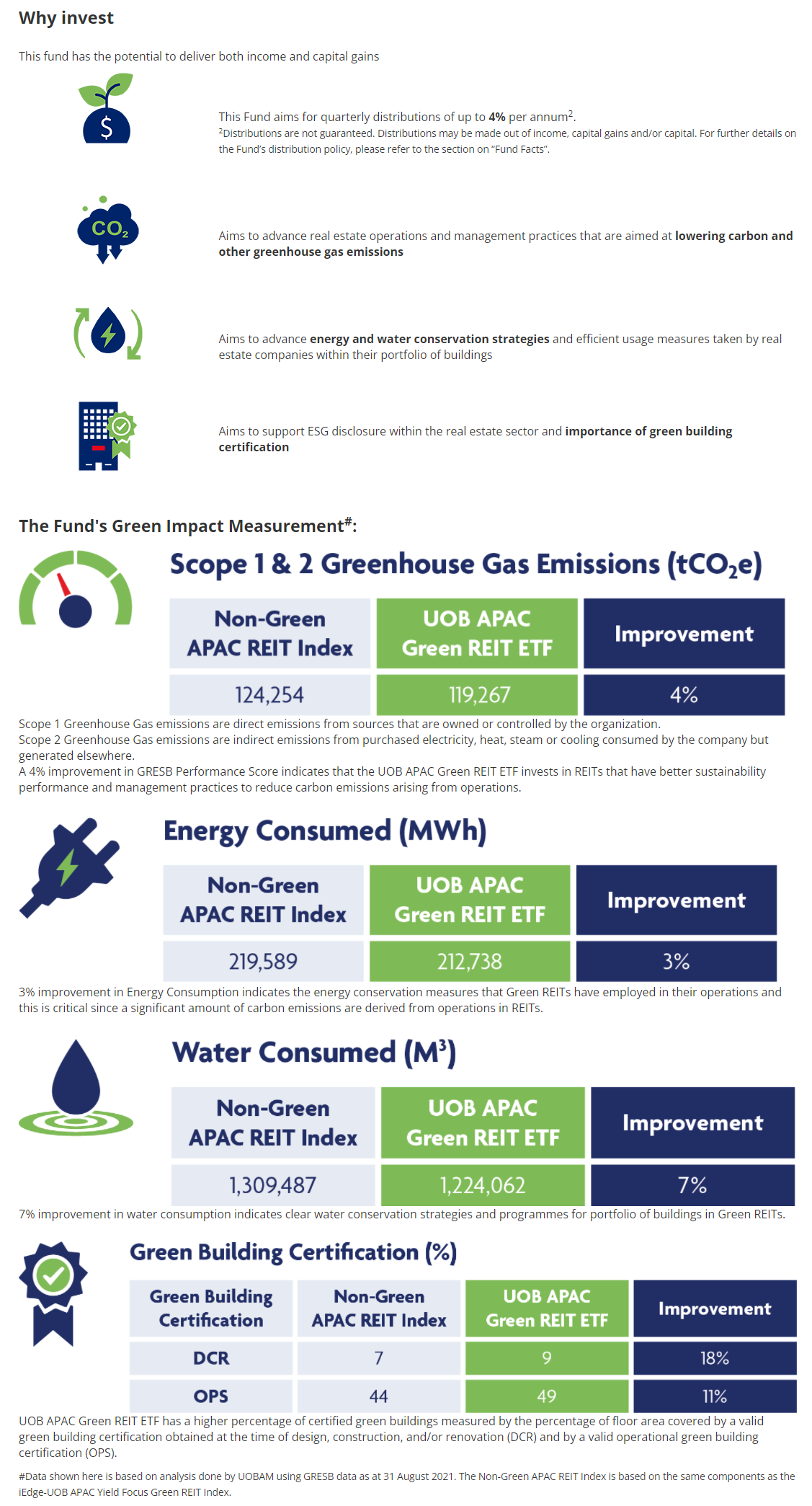

- Aims to deliver high dividend yield to investors

- Aims to select high quality, environmentally-sound real estate assets with good growth potential

- Aims to contribute to sustainability outcomes and greening of real estate sector

Clients will be able to apply via the Tiger Trade App during the subscription period from 5 November 2021, 10am to 16 November 2021, 12pm.

You may do so via your Tiger Trade app under “Trade > IPO > SG”.

For more information, please refer to the Prospectus, Brochure and Index Design.

Name of Counter |

UOB APAC Green REIT ETF |

Listing Price |

SGD 1.00 |

Traded Currencies |

SGD and USD For the IOP, the subscription will be in SGD |

Tiger Brokers Subscription Period |

5 November 2021, 10am to 16 November 2021, 12pm |

Subscription Quantity |

Min 1,000 units, in multiples of 1,000 units |

Allocation |

100% (i.e. if you subscribe 1,000 units, you will be allocated 1,000 units) |

Subscription Fees |

0.08% of the subscription amount or min SGD 10 |

Listing Date |

23 November 2021 (Tuesday) |

Stand a chance to win up to an additional SGD 500 worth of units when you subscribe to the UOB APAC Green REIT ETF during the subscription period from 5 November 2021 to 16 November 2021

Investors who make a minimum subscription of SGD 5,000 during the subscription period 5 November 2021 to 16 November 2021 (both dates inclusive) will stand a chance to win up to an additional SGD 500 worth of UOB APAC Green REIT ETF. Terms and conditions apply.

Subscription Amount |

Lucky Draw Prize |

SGD 10,000 and above |

3 X SGD 500 worth of UOB APAC Green REIT ETF |

SGD 5,000 to SGD 9,999.99 |

3 X SGD 250 worth of UOB APAC Green REIT ETF |

Exchange Traded Fund (ETF) are categorized as SIPs (Specified Investment Products); which may only be suitable for clients who have met CAR (Customer Account Review) requirements.

Terms & conditions click here.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Any views shared with Prospective Clients (“Prospects”) are suggestive in nature and on a sample basis only. This may also be predicated on assumptions that are made by Tiger Brokers (Singapore) Pte. Ltd. (“Tiger Brokers”) about the Prospects’ investment objectives and risk profile. Our suggestive and sample views extended to Prospects are not to be considered as recommendations made by Tiger Brokers. Suggestions provided are also based on information that may be shared by the Prospects, the accuracy and comprehensiveness of which Tiger Brokers is not in a position to verify.

Tiger Brokers may, to the extent permitted by law, participate or invest in other transactions with the issuer of the products referred to herein, perform services or solicit business from such issuers, and/or have a position or effect transactions in the securities or options thereof. The information herein is for recipient’s information only and not an offer to sell or a solicitation to buy. Any date or price information is indicative only and may be changed without prior notice. All opinions expressed and facts referred to herein are subject to change without notice. The information herein was obtained and derived from sources that we believe are reliable, but while reasonable care has been taken to ensure that stated facts are accurate and opinions are fair and reasonable, Tiger Brokers does not represent that it is accurate or complete and it should not be relied upon as such. The information expressed herein is current and does not constitute an offer, recommendation or solicitation, nor does it constitute any prediction of likely future stock performance. Investment involves risk. The price of investment instruments can and do fluctuate, and any individual instrument may experience upward or downward movements, and under certain circumstances may even become valueless. Past performance is not a guarantee of future results. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any person or affiliated companies. Before making an investment decision, you should speak to a financial adviser to consider whether this information is appropriate to your needs, objectives and circumstances. Tiger Brokers assumes no fiduciary responsibility or liability for any consequences financial or otherwise arising from trading in securities if opinions and information in this document may be relied upon.

精彩评论