Option Strategy – Straddle or Short-Straddle?

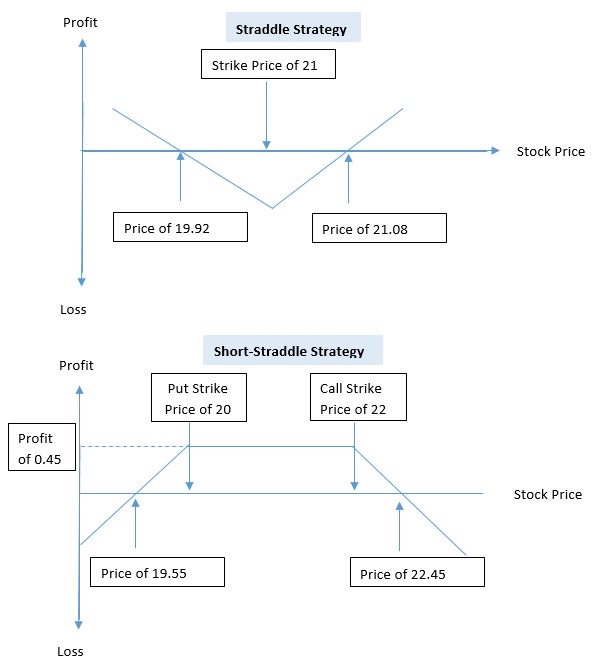

1. Straddle – buy a Call Option and buy a Put Option at the same strike price and with the same expiry date.

2. Short-Straddle – sell a Call Option at a higher price and sell a Put Option at a lower price, with the same expiry date.

In the Straddle Strategy, you will at least be able to exercise one of the 2 options, and whether you profit from it depends on how far the actual price is, from the strike price.

In the Short-Straddle Strategy, you will at least gain from 1 of the option, since either the call or the put option will go expire, with the other option being exercised. In a fortunate situation in which the final stock price falls in between the Call and Put Option strike price, both options will expire and you gain from the fees from selling them.

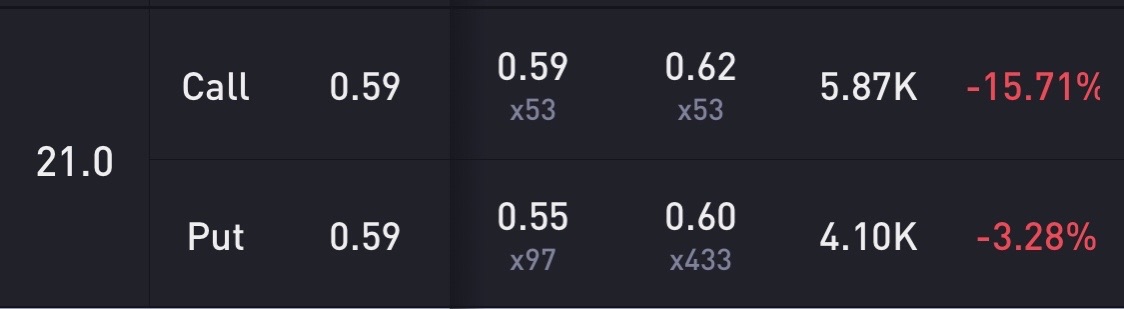

Using Straddle Strategy, PLTR as a example, buy 1 lot of Call (0.59) and 1 lot of Put (0.59) at strike price of 21 will cost 1.08 x 100 = $108, and to profit from it, the price of PLTR has to either fall below price of 19.92 or rise above price of 22.08.

Using Short-Straddle Strategy, sell 1 lot of Call (0.21) at strike price of 22 and 1 lot of Put (0.24) at strike price of 20 will gain 0.45 x 100 = $45, you will always profit of $45 if the price of PLTR stays within 20 to 22. However, if the price falls below 20, you will only start to make a loss if the price of PLTR falls below 19.55. On the other fall, if the price increases above 22, you will only start to make a loss if the price of PLTR rises above 22.45.

My personal thought, I prefer Short-Straddle Strategy, and it is especially ideal if you already own shares of PLTR with average cost below 22. This is to protect yourself from unlimited losses from an extremely bullish situation, where the call you sold is actually ‘covered’. In such as event, you are technically not losing either, as long as the average cost of PLTR you owned is below 22.

Invest safe.

精彩评论