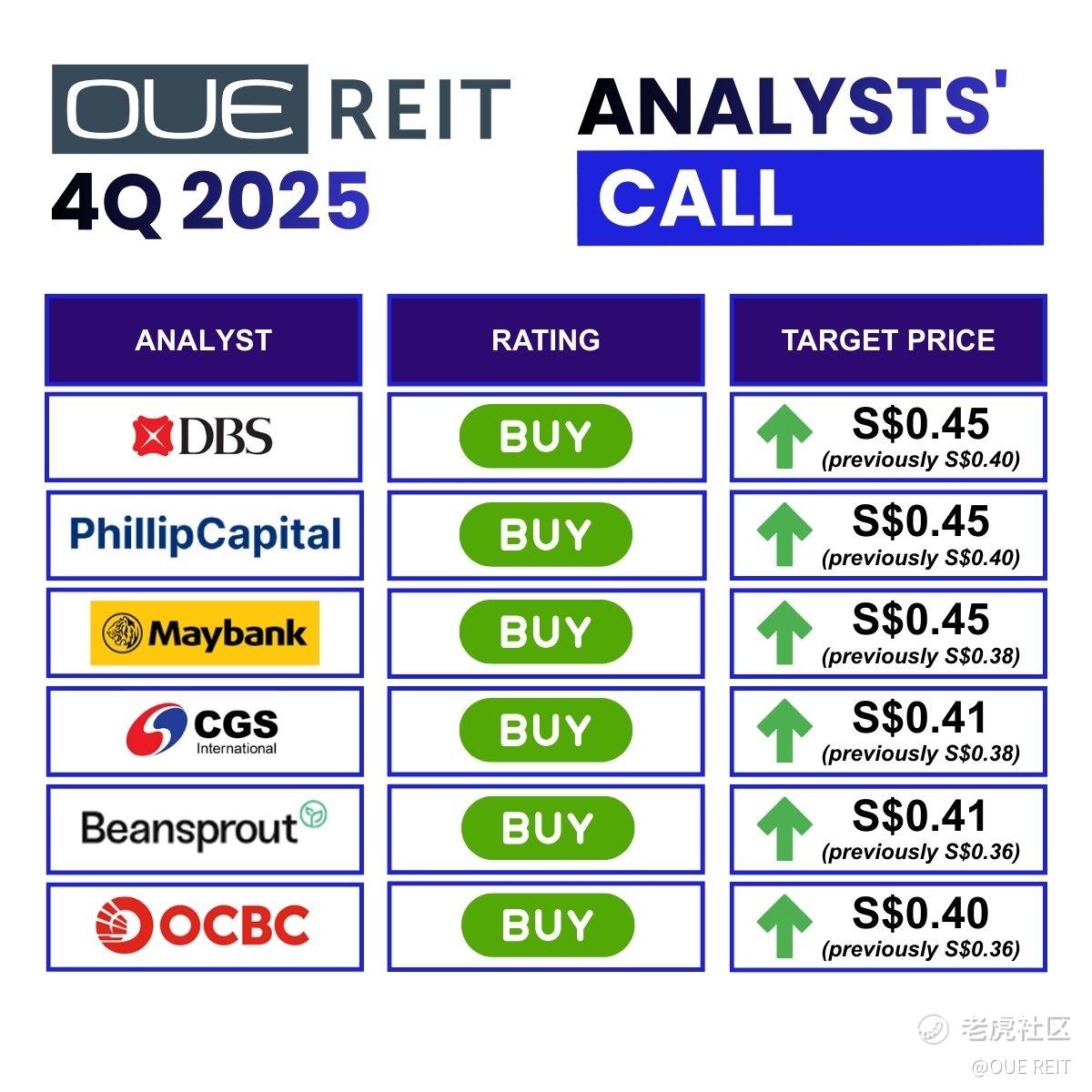

Following our resilient 2H/FY 2025 performance, we are grateful to see that our covering analysts reaffirm their confidence in OUE REIT’s outlook in their latest reports. All houses that have released updated reports have increased their target prices, maintained their “BUY”/“ADD” ratings and raised FY DPU forecasts.

[强] DBS Bank, PhillipCapital and Maybank lifted their target prices to S$0.45, citing significantly higher interest savings and improved contribution from the hospitality segment.

[强] CGS International Securities Singapore and Beansprout target price raised to S$0.41, reflecting a positive view on rental reversions for commercial assets and better outlook for hospitality segment, driven by a stronger event calendar.

[强] OCBC raised its fair value estimate to S$0.40 from S$0.36, with FY25 results underscoring management’s execution capabilities.

Analysts also noted that the REIT is entering its next phase of growth, with capital efficiency and portfolio reconstitution in focus to enhance total returns for unitholders.

Key takeaways:

𝐋𝐨𝐰𝐞𝐫-𝐭𝐡𝐚𝐧-𝐞𝐱𝐩𝐞𝐜𝐭𝐞𝐝 𝐟𝐢𝐧𝐚𝐧𝐜𝐞 𝐜𝐨𝐬𝐭𝐬

✅FY 2025 finance costs declined by 17.6% YoY as management’s efforts to optimise balance sheet over the past few years bore fruit, coupled with a declining interest rate environment

✅Anticipate further cost savings ahead, supported by refinancing opportunities on its high-cost loans and expiring interest rate swaps

𝐒𝐭𝐚𝐛𝐥𝐞 𝐜𝐨𝐦𝐦𝐞𝐫𝐜𝐢𝐚𝐥 𝐨𝐩𝐞𝐫𝐚𝐭𝐢𝐧𝐠 𝐩𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞

✅Resilient commercial segment performance with FY 2025 revenue and NPI increasing 0.1% YoY and 1.6% YoY respectively on a like-for-like basis

✅Office portfolio committed occupancy largely stable at 95.4%, with positive rental reversion at 9.1% for FY 2025

𝐈𝐦𝐩𝐫𝐨𝐯𝐞𝐝 𝐩𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞 𝐟𝐫𝐨𝐦 𝐭𝐡𝐞 𝐡𝐨𝐬𝐩𝐢𝐭𝐚𝐥𝐢𝐭𝐲 𝐬𝐞𝐠𝐦𝐞𝐧𝐭

✅Hospitality segment has likely bottomed out in 2H 2025, with RevPAR flat YoY at $277, supported by several high-profile concerts

✅Better outlook for hospitality segment is underpinned by better revenue management, stronger sales execution and enhanced F&B offerings

𝐏𝐡𝐚𝐬𝐞 3 𝐕𝐚𝐥𝐮𝐞 𝐂𝐫𝐞𝐚𝐭𝐢𝐨𝐧 𝐉𝐨𝐮𝐫𝐧𝐞𝐲

✅Focus shifting from strengthening capital structure to efficient capital allocation to drive growth

✅Singapore will remain the core market, as management seeks out opportunities to capture alpha overseas

精彩评论