全球重要股指表现(美元计价)和估值

-

上周美股震荡加剧,标普与纳指收平。盈利层面美股韧性十足,已披露Q3业绩的公司中,有82%公司的EPS超预期;标普500净利率有望达13.1%,创15年新高。同时,宏观层面有所降温,12月降息预期的概率降至不到50%。但是受高赤字和债务供给压力驱动,中期宽松趋势并未改变。结构层面,高β板块拥挤且估值偏高,回调风险上升。建议逢高减持高β题材,聚焦盈利确定性强的平台型AI与存储板块,并通过股指对冲应对波动。

-

近期,大中华市场表现相对温和。10月通胀数据虽有回暖,但主要由节假日和促销因素驱动,剔除金价因素后,消费需求依然偏弱。此外,政策以定向支持为主,全面宽松有限,盈利修复节奏偏温和。在此背景下,难现大盘式行情,更适合通过结构和个股获取超额收益。短期内指数或维持震荡,我们将聚焦高质量科技股与低估值周期股,挖掘结构性机会。

-

本周重点关注美联储FOMC纪要、延迟发布的9月非农就业数据,以及英伟达财报和对AI的行业未来指引。

本周市场主线分析

美股:降息虽存疑,盈利韧性不减,AI还需把握确定性

-

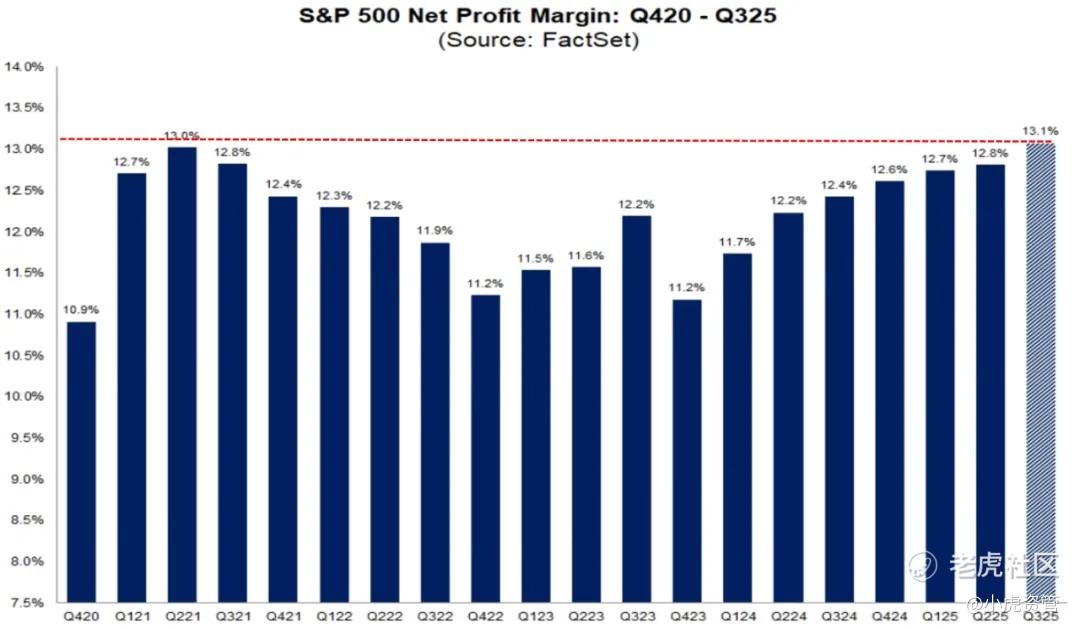

上周,美股经历了一波先涨后跌再反弹的过山车行情,兜兜转转标普和纳指最终又回到了起点,单周涨幅都几乎为0。总的来说,美国目前仍处于增长放缓,但盈利韧性较强的后周期阶段。根据FactSet的统计显示,目前超90%的标普成分股已披露Q3业绩,其中约82%的公司EPS超预期,约76%的收入超预期。不仅如此,其预估标普500 Q3的综合净利率将达到13.1%,大超前值与均值,将录得近15年来的最高水平。

-

利率方面,市场对12月降息的押注明显降温,从最初的90%到上周的65%,再到近期的50%。一方面,政府停摆导致关键经济数据推迟发布,美联储内部对短期节奏出现战术性分歧。鸽派主张继续保险式宽松,鹰派如卡什卡里则公开反对。不过我们认为,这些争议并未改变中期宽松趋势。高企的财政赤字和国债供给压力,决定了美联储中期需要以更大幅度的降息来维护债务可持续性和金融稳定性。

-

资金方面,CTA等系统性资金对美股仍维持偏高多头暴露,一旦指数出现中等幅度回调,模型化被动卖盘有放大波动的潜在空间;同时高β与小盘成长股拥挤度已接近历史极端,估值溢价也处在高位。我们认为当前结构对逼空者不再友好,更容易演变为杀拥挤和杀估值。策略上倾向逢高减持二线高β题材股,继续偏好有清晰盈利兑现路径的AI上游硬件股,并在股指对冲上保持高抛低吸的交易思维。综合来看,AI相关配置上我们重点关注两个板块,一是有清晰盈利兑现路径,有全栈优势的平台型AI赢家,另一个是在硬件链条中需求激增确定性极高的存储板块。

大中华:震荡还将持续,盈利修复成为下一阶段关键

-

与美股的大起大落不同,大中华市场近期行情相对温和。宏观层面,10月CPI与PPI虽然出现阶段性回暖,但主要推动因素是节假日和促销活动等一次性因素。剔除金价上涨和抢金潮之后,整体消费趋势仍然偏弱。另一方面,居民名义收入增长被房地产与工资增速预期所拖累,信贷和社融数据也反映出实体经济部门惜借态度。政策方向上,更多聚焦定向支持与供给端优化,而非全面宽松,这意味着名义增长与企业盈利修复的节奏将较温和。

-

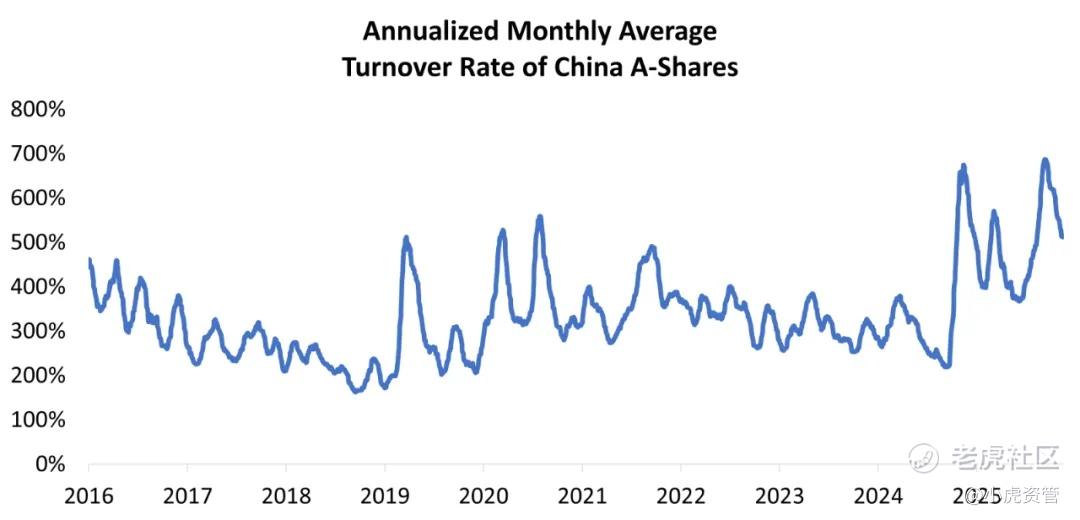

在此环境下,大中华市场较难出现大盘式beta行情,更应将大中华视为一个需要耐心、通过结构和个股赚阿尔法的市场。从交易面看,A股情绪指标位于中性偏多区间,但市场成交额与股指期货量能近期有所回落,反映资金行为逐渐谨慎。同时,盈利预期修正仍偏负,整体指数更可能维持箱体震荡,而非单边趋势行情。港股方面,南向资金持续流入价值股与高股息,AI、半导体在内的高β板块在全球风险偏好下降时,往往被优先减仓,波动放大。

-

尽管整体节奏偏弱,但平台型AI企业的盈利修复已经开始逐渐体现。腾讯Q3财报营收与利润均恢复双位数增长,广告、游戏和金融科技全面受益于AI驱动的定向投放和运营效率提升。但值得注意的是,公司并未大举新增资本开支,而是通过存量算力整合和精细化投入来推进AI。由此,自由现金流与股东回报能力也得以巩固。同时,另一巨头阿里巴巴在上周遭到了美国国家安全的指控,带来了短期的情绪波动。但作为拥有自研大模型、云基础设施及多场景生态的全栈型AI平台,其高质量自由现金流和深度商业整合能力仍使之具备长期竞争优势。

-

总体来看,大中华市场的下一波大行情仍需盈利修复预期作为支撑,中短期内指数或仍以震荡为主。后续我们将降低对大盘beta的依赖,继续围绕高质量科技股和低估值周期股这两个长期叙事,把握更多的结构性机会。

Disclaimer

本研究报告由老虎资产管理团队“老虎资管”发布,老虎资管包括老虎资产管理团队(香港)和老虎基金管理公司(新加坡)。对某些司法管辖区或国家而言,撰写、分发或使用本材料可能会抵触当地法律、法则或规定,或其它注册或发牌的规例。本材料不是旨在向上述司法管辖区或国家的任何人或实体分发或由其使用。

老虎资产管理团队(香港)

本研究报告由老虎资管(香港)发布,老虎资管(香港)是⾹港证监会持牌法团⽼⻁证券(⾹港)环球有限公司(“⽼⻁证券”)(中央编号:BMU940)的资产管理部门。

本报告所包含的资料均为⽼⻁证券从据信为准确的来源编制,惟本公司并不就此等内容之准确性、完整性及正确性作出明示或暗示之保证。本报告内之所有意见均可在不作另⾏通知之下作出更改。⽼⻁证券对有关报告所引致之任何损失或亏损概不负责。 本报告所载的数据只供参考⽤途,并没有法律约束⼒,亦不构成投资建议、邀约、购⼊、出售任何产品。

投资涉及风险,有可能损失投资本⾦。你应咨询专业⼈⼠,就本⾝的投资经验、财务状况、个⼈⽬标及风险取向,以提供投资意见。各类产品的风险,请参阅本公司网页客户协议第四部分风险披露声明。

以上资料为老虎证券拥有并受版权及知识产权法保护。除非事先得到老虎证券明确书面批准,否则不应复制、散播或发布。撰写研究报告内的分析员(“此等⼈⼠”)均为根据证券及期货条例注册的持牌⼈⼠,此等⼈⼠保证,文中观点均为其对有关报告提及的个别市况及/或行业及/或投资产品之一般及实际因素的观点。截⾄本报告发表当⽇,此等⼈⼠均未于本报告中所推介的股份存有权益。

投资产品面临一定的风险,包括但不限于利率、信贷、行业前景和监管要求。投资者在做出投资决定前, 应详细阅读相关发行文件并咨询专业投资顾问。本资料仅供香港投资者参考, 不应视为投资建议。

老虎基金管理公司(新加坡)

Tiger Fund Management( Singapore )

Tiger Fund Management Pte. Ltd. (UEN: 202223754K) ("TFM") is a holder of Capital Markets Services License (License No. CMS101343) issued by the Monetary Authority of Singapore for fund management.

The information in this publication is for information only. The information and opinions contained in this publication has been obtained from sources believed to be reliable, but TFM makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose. Opinions and estimates are subject to change without notice.

Where specific products are advertised and/or recommended, please note the following: (i) The recommendation is intended for general circulation; (ii) The recommendation does not take into account the specific investment objectives, financial situation or particular needs of any particular person; (iii) Advice should be sought from a financial adviser regarding the suitability of the investment product, taking into account the specific investment objectives, financial situation or particular needs of any person in receipt of the recommendation, before the person makes a commitment to purchase the investment product. Should the person choose not to do so, he should consider carefully whether the product is suitable for him. In particular, all relevant documentations pertaining to the product should be read to make an independent assessment of the appropriateness of the transaction. (iv) This advertisement has not been reviewed by the Monetary Authority of Singapore, or any regulatory authority elsewhere.

TFM, its related companies, their directors and/ or employees may have positions or other interests in, and may effect transactions in the product(s) mentioned here. TFM may have alliances or other contractual agreements with the provider(s) of the product(s) to market or sell its product(s). Where TFM’s related company is the product provider, such related company may be receiving fees from investors. In addition, TFM, their directors and/ or employees may also perform or seek to perform broking or financial services for these product providers.

Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment. There is no assurance that the credit ratings of any securities mentioned in this publication will remain in effect for any given period of time or that such ratings will not be revised, suspended or withdrawn in the future if, in the relevant credit rating agency’s judgment, the circumstances so warrant. The value of any product and any income accruing to such product may rise as well as fall. Foreign exchange transactions involve risks. The reader should note that fluctuations in foreign exchange rates may result in losses in foreign exchange.

To the extent permitted by law, TFM accepts no liability whatsoever for any direct indirect or consequential losses or damages arising from or in connection with the use or reliance of this publication or its contents. This publication is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation.

精彩评论