Hong Kong, November 13, 2025 — DL Holdings Group Limited (Stock Code: 1709.HK) announced through a filing on the Hong Kong Stock Exchange that it has signed a legally binding term sheet with Youngtimers AG (YTME), a Swiss-listed investment company specializing in asset management across the Asia-Pacific region. DL Holdings plans to subscribe for newly issued shares of YTME for a total consideration of up to US$12 million (approximately HK$93.6 million). Upon completion, DL Holdings will become the largest institutional shareholder of YTME. This marks a significant step in DL Holdings’ global expansion — following its existing presence in Hong Kong SAR, Shanghai, Silicon Valley, Singapore, and Tokyo, the Group is now extending its footprint to Zurich, Switzerland and Sydney, Australia, achieving strategic coverage of the world’s major financial centers.

According to the term sheet, the investment will be made at a price of CHF 0.42 per share (approximately HK$4.10) and will comprise two components: direct subscription and share warrants. DL Holdings will subscribe for newly issued YTME shares for a total consideration of US$10 million, representing approximately 7.76% of YTME’s enlarged share capital, becoming one of its major shareholders, and will be entitled to nominate one representative to YTME’s board of directors. In addition, YTME will grant DL Holdings a warrant giving the Group the right to further subscribe for additional shares within six months after completion, for a total consideration of US$2 million. If the warrant is fully exercised, DL Holdings’ equity interest in YTME will increase to 9.17%. All YTME shares subscribed by DL Holdings will be subject to a two-year lock-up period from the date of issuance and placement, during which the Company shall not offer, pledge, or sell such shares without YTME’s consent.

Figure 1: Global business footprint of Youngtimers AG. Source: Youngtimers official website

Youngtimers AG is a publicly listed investment company on the Swiss Stock Exchange. In November 2024, YTME completed the strategic acquisition of C Capital, an asset management platform co-founded by Hong Kong entrepreneur Adrian Cheng. C Capital manages approximately US$900 million in assets, focusing on growth-stage investments in the consumer and technology sectors across the Asia-Pacific region. Its diversified portfolio includes leading companies such as NIO, XPeng Motors, Rednote, Lalamove, Biren Technology, AgiBot, SenseTime, Agile Robots SE, and Casetify. Following the acquisition, YTME now operates under the C Capital brand, transforming itself into a new-generation investment platform bridging European and Asian capital markets. DL Holdings’ entry marks the platform’s strategic linkage in Asia, signaling a new stage of collaboration — one led by a publicly listed financial group with comprehensive asset management capabilities rather than solely by brand alliances.

The direct subscription portion of this investment will be settled through a cash-and-share consideration structure. Of the total, US$3 million will be paid in cash using DL Holdings’ internal resources, while the remaining US$7 million will be settled through the issuance of up to 17,901,639 new shares of DL Holdings to YTME. The issue price of the consideration shares will be HK$3.05 per share, and any sale or transfer of such shares within two years of issuance will require prior written consent from DL Holdings.

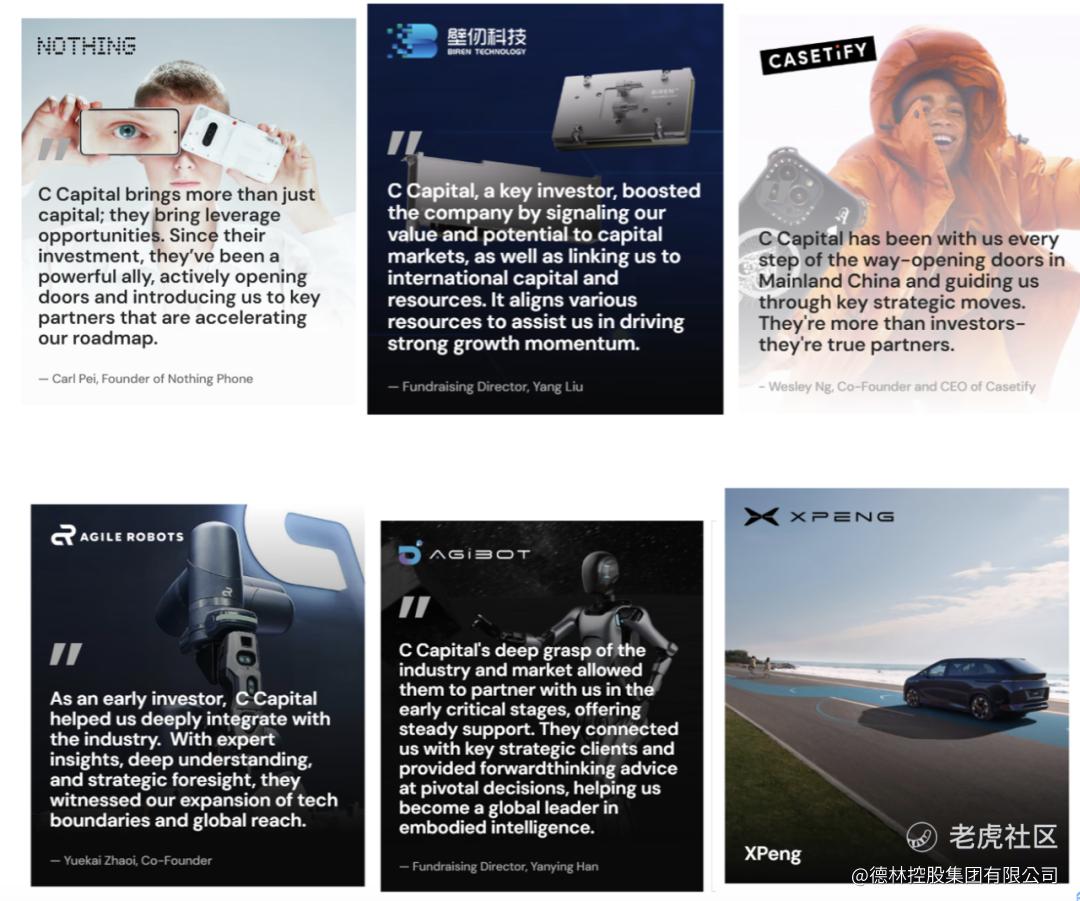

Figure 2: Selected portfolio examples of C Capital’s private equity investments. Source: C Capital official website

This strategic investment represents a major milestone in DL Holdings’ global development. Through this transaction, DL Holdings officially enters Europe’s top-tier family wealth management sector, further strengthening the core competitiveness of its family office business. The Group’s business network already spans Hong Kong SAR, Shanghai, Silicon Valley, Singapore, and Tokyo — the addition of Zurich, a global hub for private banking, will enable the Group to directly access Europe’s family wealth management market, while the planned expansion into Sydney will further complete its Asia-Pacific service network.

Mr. Andy Chen, Chairman of the Board of DL Holdings, stated: “YTME represents a strategic flag for DL in the European capital market. Through this partnership, DL gains direct access to high-quality small and mid-sized enterprises in Switzerland and Europe. DL’s financial technology DNA and deep understanding of Chinese Mainland and Hong Kong markets will strongly complement YTME’s local investment expertise in Europe. Together, we can explore cross-border mergers, acquisitions, and investment opportunities spanning China and Europe. Both sides will also place special focus on frontier sectors such as virtual assets, combining DL’s insights from Asian markets with Youngtimers’ European roots to seize early advantages in this emerging field — ultimately building a digital finance bridge between East and West.”

Mr. Ben Cheng, Chief Executive Officer of Youngtimers AG, stated: “We warmly welcome DL Holdings as an important strategic shareholder of YTME and as a long-term partner of C Capital. This collaboration not only reflects market confidence in C Capital’s long-term development, but also strengthens our ability to allocate resources and coordinate projects between Asia and Europe. With the completion of this financing round, C Capital will transform into a dual-track investment institution, possessing both asset management and principal investment capabilities, thereby injecting powerful momentum into the growth of our portfolio companies.”

Through this innovative share-swap cooperation model, DL Holdings will strengthen its long-term alignment with YTME and the European capital network, fully leveraging synergies in digital finance and cross-border asset management. By combining YTME’s strategic position in Switzerland’s financial center with C Capital’s expertise in Asia-Pacific technology investments, DL Holdings will accelerate the establishment of a high-net-worth client service network spanning Europe and Asia-Pacific, further reinforcing its global technology investment strategy, and creating sustainable long-term value for investors.

免责声明

本文章仅供参考,投资者应仅依赖公司公告所载资料作出投资决定。

未经本公众号授权,任何人不得擅自转载。

精彩评论