23Q1

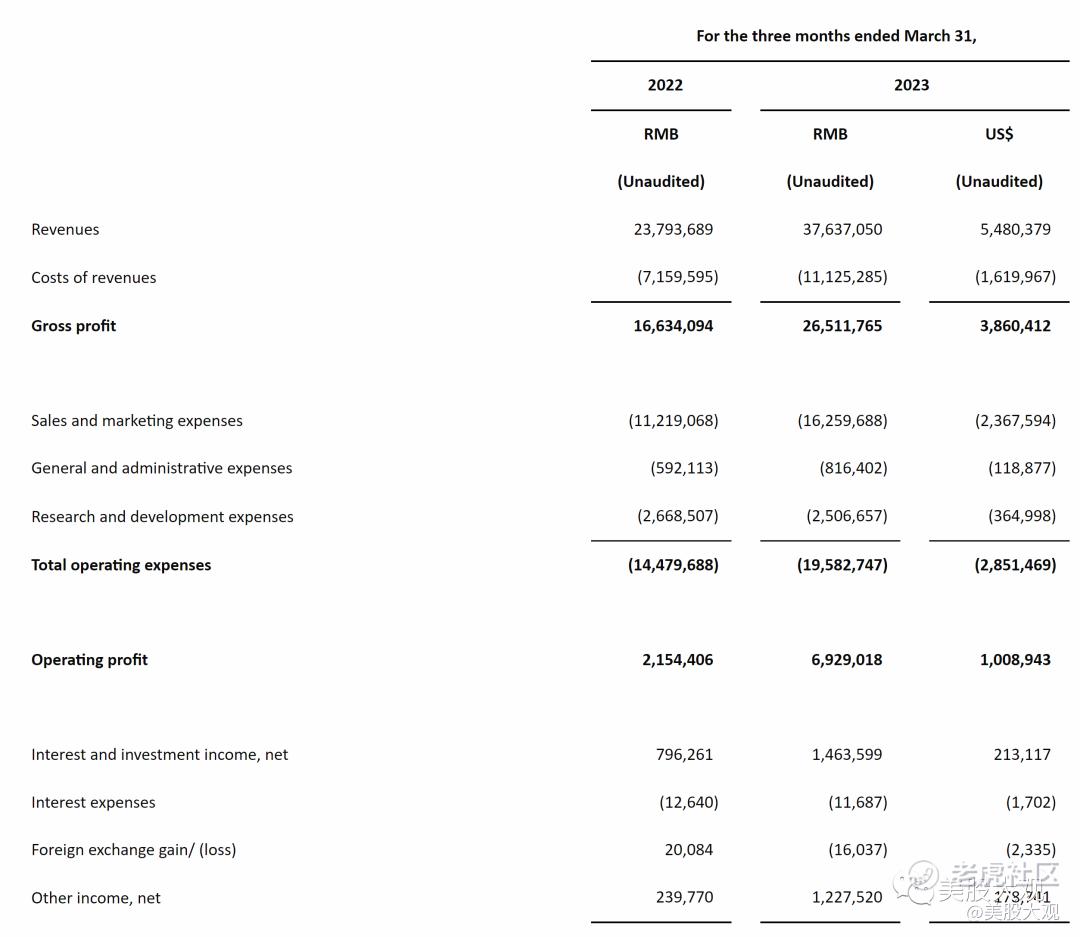

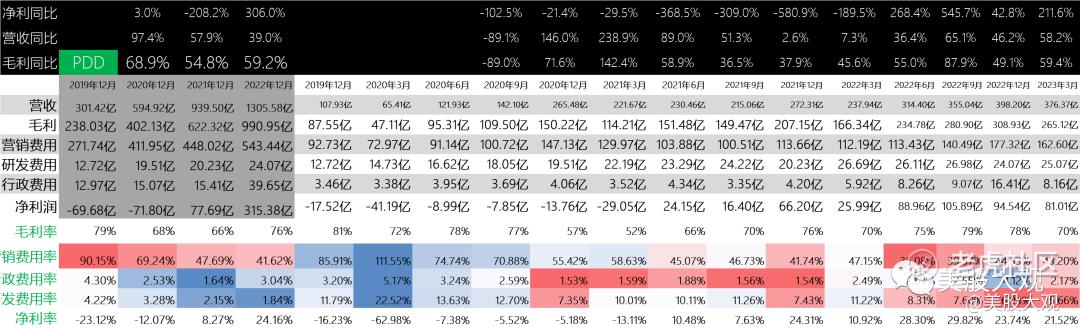

Total revenues in the quarter were RMB37,637.1 million (US$15,480.4 million), an increase of 58% from RMB23,793.7 million in the same quarter of 2022.

Operating profit in the quarter was RMB6,929.0 million (US$1,008.9 million), an increase of 222% from RMB2,154.4 million in the same quarter of 2022. Non-GAAP2 operating profit in the quarter was RMB8,462.4 million (US$1,232.2 million), an increase of 130% from RMB3,677.2 million in the same quarter of 2022.

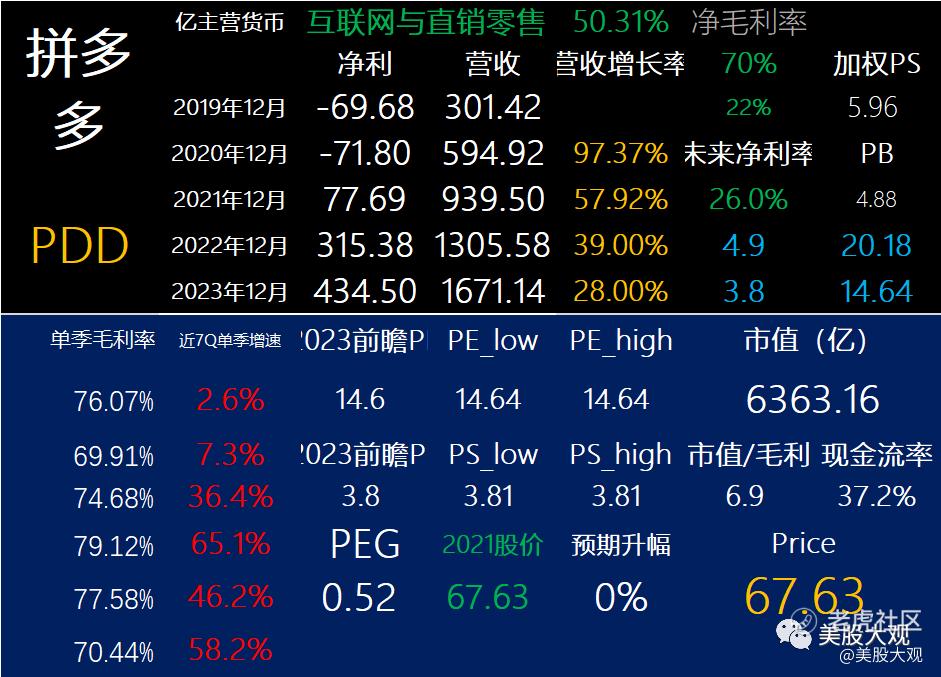

Net income attributable to ordinary shareholders in the quarter was RMB8,101.0 million (US$1,179.6 million), an increase of 212% from RMB2,599.5 million in the same quarter of 2022. Non-GAAP net income attributable to ordinary shareholders in the quarter was RMB10,126.4 million (US$1,474.5 million), an increase of 141% from RMB4,200.4 million in the same quarter of 2022.

#Q1增长靓丽,营收增长58%,毛利增长59%,净利润大增211%

营收细分:

Revenues from online marketing services and others were RMB27,244.4 million (US$3,967.1 million), an increase of 50% from RMB18,202.3 million in the same quarter of 2022.

Revenues from transaction services were RMB10,392.6 million (US$1,513.3 million), an increase of 86% from RMB5,591.4 million in the same quarter of 2022.

其他重要数据

Cash, cash equivalents and short-term investments were RMB157.0 billion (US$22.9 billion) as of March 31, 2023, compared with RMB149.4 billion as of December 31, 2022.

业绩指引

\

S:

拼多多23Q1业绩增长出色。过去4个季度利润总和370亿RMB,早已达到我一年前的预测的50亿美金级别。

目前结合纳指的估值来看,拼多多的估值偏低了。越接近阿里巴巴半成的零售规模,拼多多的瓶颈越在迫近。阿里的估值会对拼多多产生强烈的压制。我觉得拼多多未来会是一个非常适合低买高卖的标的。范围大约在800-1200亿市值。

观总的小马甲,公众号:美股大观PDD拼多多22Q4财报跟踪,估值有瓶颈,低买高卖最佳

对拼多多的估值模型并没有其他更新,800亿买入1200亿卖出,做做波动非常合适。另外拼多多仍然是投资中概的首选。

最近跟踪:PDD拼多多22Q4财报跟踪,估值有瓶颈,低买高卖最佳

这家公司IPO始开始跟踪,关键词直达: $拼多多(PDD)$

精彩评论

以前觉得拼多多上的东西不可靠,如今觉得离不开它 $拼多多(PDD)$

拼多多在中概股中仍然具有很高的投资价值 $拼多多(PDD)$

拼多多不愧是中国电商市场的一匹黑马 $拼多多(PDD)$