China's Baidu Inc on Wednesday reported quarterly revenue above Wall Street estimates, helped by stronger advertising sales and demand for its artificial intelligence and cloud products.Baidu said total revenue was 31.92 billion yuan ($4.95 billion) in the third quarter, slightly above analysts' average estimate of 31.71 billion yuan, according to IBES data from Refinitiv.

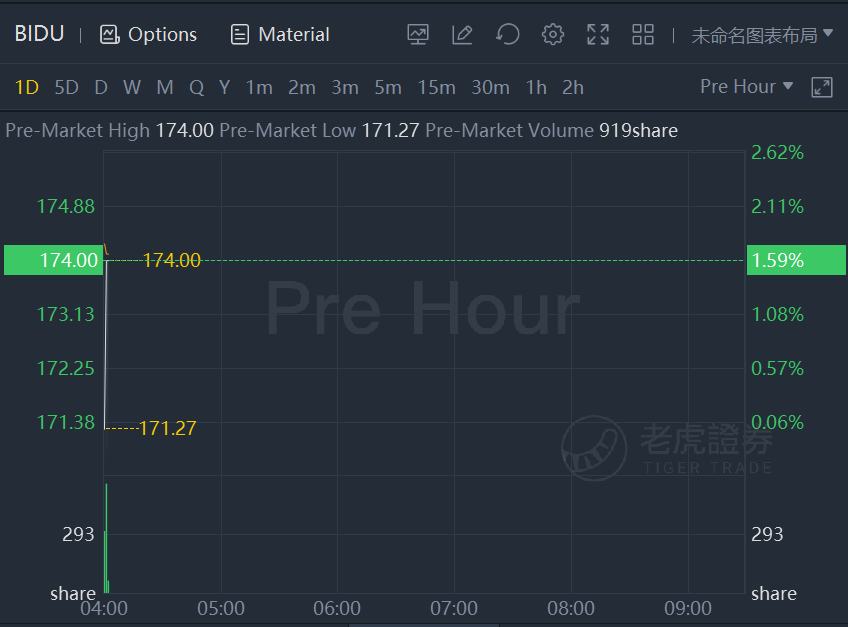

Baidu stock climbed 1.6% in premarket trading.

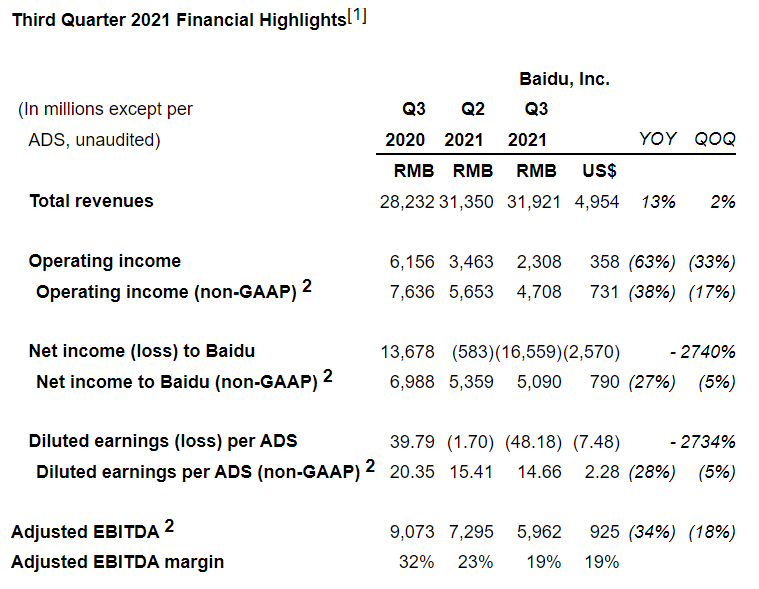

Total revenues were RMB 31.9 billion($4.95 billion), increasing 13% year over year.

- Revenue from Baidu Core was RMB 24.7 billion($3.83 billion), increasing 15% year over year;online marketing revenue was RMB 19.5 billion($3.02 billion), up 6% year over year, andnon-online marketing revenuewasRMB 5.2 billion($806 million), up 76% year over year, driven by cloud and other AI-powered businesses.

- Revenue from iQIYIwasRMB 7.6 billion($1.18 billion), increasing 6% year over year.

Cost of revenues was RMB 16.1 billion($2.50 billion), increasing 26% year over year, primarily due to an increase in traffic acquisition costs, content costs and cost of goods sold related to new AI business.

Selling, general and administrative expenses were RMB 7.3 billion($1.14 billion), increasing 56% year over year, primarily due to an increase in channel spending, promotional marketing, personnel-related expenses and contingent loss pertaining to legal proceeding involving former advertising agency.

Research and development expense was RMB 6.2 billion($957 million), increasing 35% year over year, primarily related to personnel-related expenses.

Operating income was RMB 2.3 billion($358 million).Baidu Core operating income was RMB 3.7 billion($577 million), and Baidu Core operating margin was 15%.Non-GAAP operating income was RMB 4.7 billion($731 million).Baidu Core non-GAAP operating income was RMB 5.8 billion($904 million), and Baidu Core non-GAAP operating margin was 24%.

Total other loss, net was RMB 21.5 billion($3.34 billion), which included aRMB 18.9 billionnon-cash, mark-to-market loss in long-term investments. Such quarterly fair-value adjustment may result in further net income volatility in the future.

Income tax benefit was RMB 1.8 billion($286 million), compared to an income tax expense ofRMB 1.6 billionfor Q3 '20, primarily due to an increase in deferred tax benefit recognized on fair value loss of long-term investments and deduction on certain expenses that were previously considered non-deductible.

Net loss attributable to Baidu wasRMB 16.6 billion($2.57 billion), and diluted loss per ADS wasRMB 48.18($7.48).Net loss attributable to Baidu Core was RMB 15.6 billion($2.43 billion).Non-GAAP net income attributable to Baidu was RMB 5.1 billion($790 million), and non-GAAP diluted earnings per ADS wasRMB 14.66($2.28).Non-GAAP net income attributable to Baidu Core was RMB 5.9 billion($909 million).

Adjusted EBITDA was RMB 6.0 billion($925 million).Adjusted EBITDA for Baidu Core was RMB 7.0 billion($1.09 billion) and adjusted EBITDA margin for Baidu Core was 28%.

As ofSeptember 30, 2021,cash, cash equivalents, restricted cash and short-term investments were RMB 194.6 billion($30.20 billion), andcash, cash equivalents, restricted cash and short-term investments excluding iQIYI were RMB 183.6 billion($28.49 billion).Free cash flow was RMB 691 million($108 million), and free cash flow excluding iQIYIwasRMB 2.9 billion($449 million).

Other Highlights

Corporate

- Q3 21 net loss includes aRMB 18.9 billionnon-cash, mark-to-market loss in long-term investments arising from quarterly fair-value adjustment.

- ESG:

- - Baidu donatedRMB 90 millionto helpHenanprovince cope with its recent natural disaster.

- - Xiaodu launched "visual assistance" to enable visually impaired voice control and on-demand screen-text reading for a smoother audio experience.

- - In October, Baidu established a Data Management Committee, to consolidate its existing committees on data management, data privacy & protection and data security, to further improve its policies and oversight around data management.

AI Cloud

- Baidu releases end-to-end AI cloud solution, powered by Kunlun AI chip and PaddlePaddle deep learning framework, to help financial services firms digitize and automate their operational processes, enlisting leading customers likeChina Lifeand Bank of Jiangsu.

- Lijiang, a UNESCO Heritage Site with 800-year old bridges and waterways, is using Baidu smart-city cloud to keep the city safe and clean for visitors. Leveraging the digitalization of tourist areas, Baidu AI solution helps local authorities timely detect and address infractions, e.g., illegal parking and littering.

- Tongxiang,Zhejiang(province) signed with Baidu to enable its manufacturing-based enterprises with Baidu AI solutions, allowing Baidu to further penetrate into industrial Internet.

- Baidu ACE smart transportation has been adopted by 24 cities, tripling year over year, based on contract amount overRMB10 million.

Intelligent Driving

- Apollo L4 has accumulated over 10 million test miles, up 189% year over year, and has received 411 autonomous driving permits, reflecting Apollo's broad geographic coverage and wide-ranging test scenarios.

- Rides provided byApollo Godoubled sequentially, which are available inShanghai, Beijing,Guangzhou,Changshaand Cangzhou.

- WM Motor, a ChineseEV OEM, signed with Baidu to install Apollo Navigation Pilot (ANP) in its new W6 SUV, taking the total makes that have partnered with Apollo for self-driving and infotainment solutions to 31.

Other Growth Initiatives

- Xiaodu ranks No.1 in smart display shipments globally and smart speaker shipments inChinafor Q2 2021, according to Strategy Analytics, IDC and Canalys.

- InAugust 2021, Xiaodu completed Series B financing at a valuation ofUS$5.1 billionwith Baidu retaining super-majority shareholding.

Mobile Ecosystem

- In September, Baidu App's MAUs reached 607 million, up 12% year over year, and daily logged in users reached an all-time high of 79%, reflecting positive user experience.

- Managed Page reached 43% of Baidu Core Q3 online marketing revenue, through continuous marketing-cloud enhancements, such as expanded e-commerce features and tools.

- The open nature of Baidu's Internet infrastructure is leading to top smartphone makers to select Baidu's smart mini program as the landing page for their browser search.

iQIYI

- iQIYI subscribers reached 104 million inSeptember 2021, creating a strong foundation to provide innovative, self-developed blockbusters.

Financial Guidance

For the fourth quarter of 2021, Baidu expects revenues to be between RMB 31.0 billion($4.81 billion) and RMB 34.0 billion($5.27 billion), representing a growth rate of 2% to 12% year over year, which assumes that Baidu Core revenue will grow between 5% and 16% year over year.

精彩评论