为什么非农不好市场不担心,反而开始担心通胀?

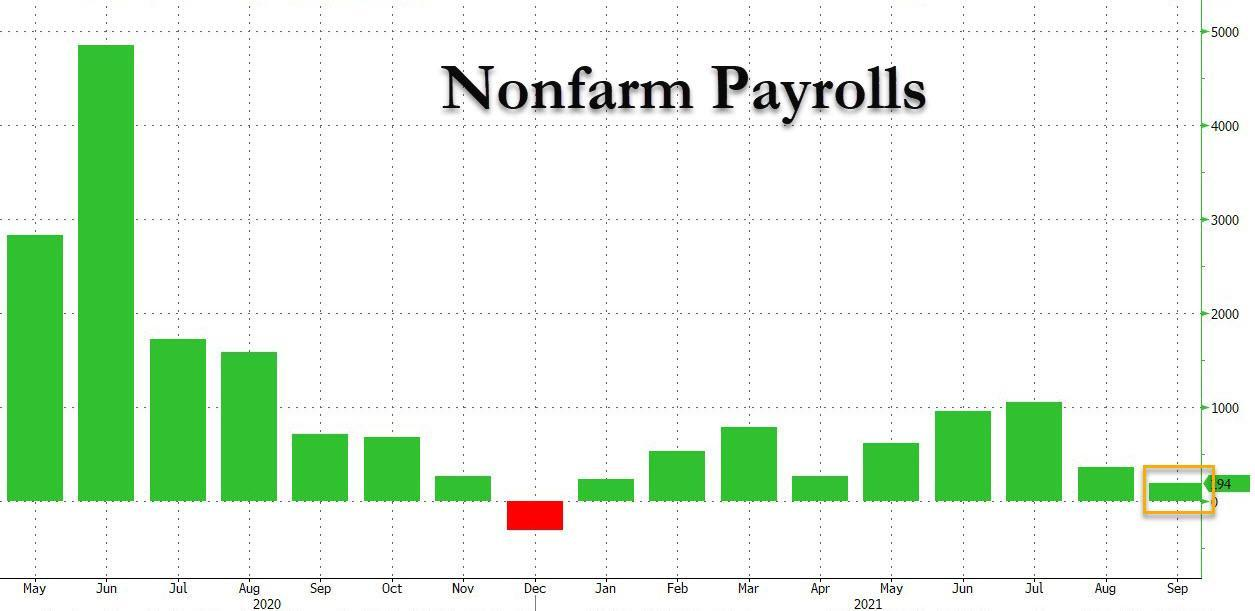

上周五(10月8日)公布的美国9月非农就业人数仅增加19.4万人,增幅大幅不及预期的50万人,创下了今年以来的最小增幅。

但市场反应并不强烈。主要原因,还是整体就业数据依然偏好。比如

- 8月份非农新增就业人数从23.5万人上修至36.6万人;

- 7月份非农新增就业人数从105.3万人上修至109.1万人;

- 9月失业率降至4.8%,好于市场预期的5.1%,也是2020年3月以来新低;其中包括因经济原因从事兼职工作的人在内的更全面的失业率数字降至8.5%,也是疫情以来最低水平。

非农就业人数为何会一再走低?

疫情开始以来,随着不同时期疫情的反复,美国劳动力市场的复苏一直以来就存在变数。因为美国没有采取严格的管控措施,大部分行业适龄劳动力其实都可以采用远程办公等方式持续工作,酒店、出行等相关受影响较大的行业除外。所以,大部分行业对劳动力的需求还是比较旺盛,这也是疫情以来美国非农就业人数可以持续恢复的根本原因。

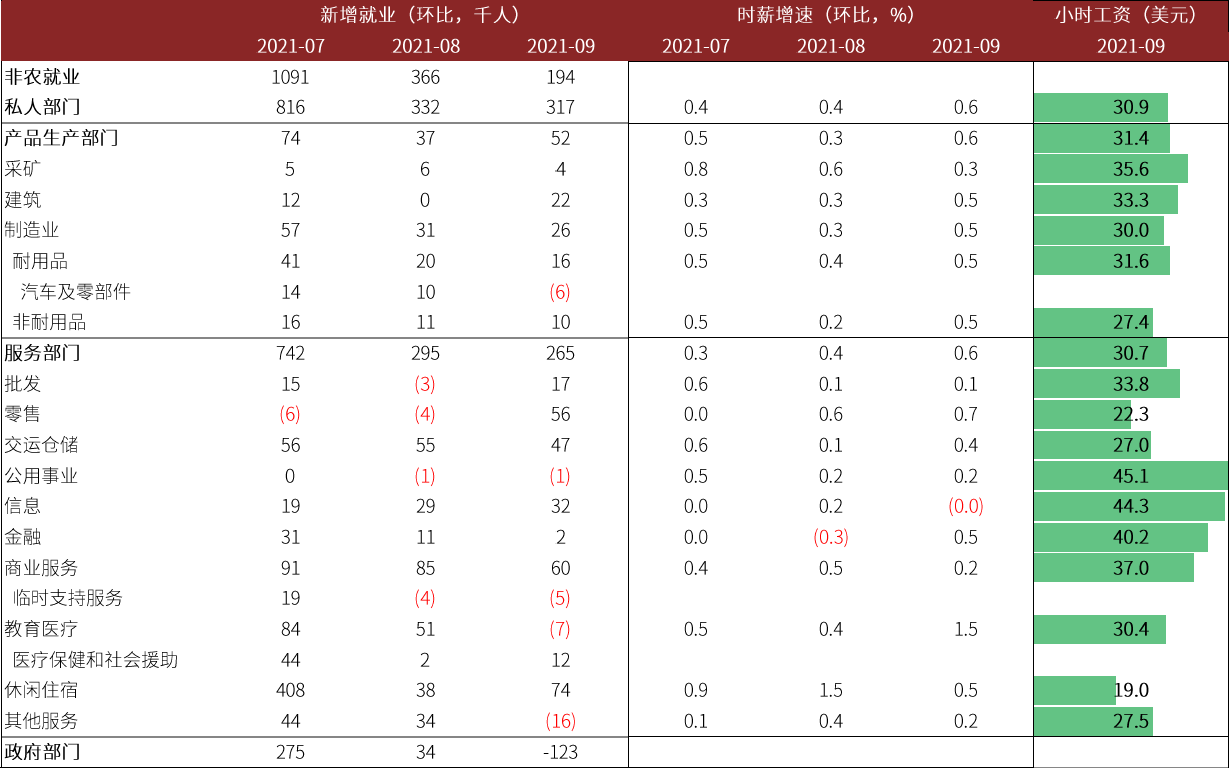

此外,从不同行业来看,私人部门的新增就业31.7万人,与8月相当,而公立政府部门新增就业下降12.3万人,教育工作岗位减少14.4万个,不及预期。这一方面是季节性原因(学校学期等),另一方面也是反应出相当一部分可工作可不工作的人还是由于疫情原因暂时退出劳动力市场。

从年龄分布上来看,55岁以上的劳动参与率为38.6%,较疫情前下降1.7个百分点,是主要的影响因素。这也是因为疫情后的几波“全民性补贴”也让更多的临退休人员“提前退休”。而美国家庭资产负债表也在疫情后恢复强劲,降低了劳动意愿。

还有一个原因是供给端,除了一些疫情后急切需求的岗位之外,整体劳动力供给端也受到有如通胀、税率等因素的影响。

未来对美国非农就业人数的期待可以不用很高。

9月非农是否意味着宏观形势变差?

恰恰相反,非农就业人数可能会在后续进行修正,比如7月和8月的前值均上修,比之前公布的数据共多出16.9万个工作岗位。

更重要的是,员工的薪水在上升。私营雇员平均时薪环比增0.6%、同比增长4.6%,均高于预期,企业尽管面临原材料价格上升等成本变化,但同时也要提薪来吸引和留住员工,劳动力的供需在某种程度上是较为积极的。

而临时失业和永久失业人数均继续降低,说明失业人员重新找到工作的前景仍较为顺利,是相对利好的局面

当然,通胀预期走高可能是目前面临的更大问题。但这应该不会改变,至少不会减缓预期在11月-12月开启的Taper。

市场暂未Price-In加息预期

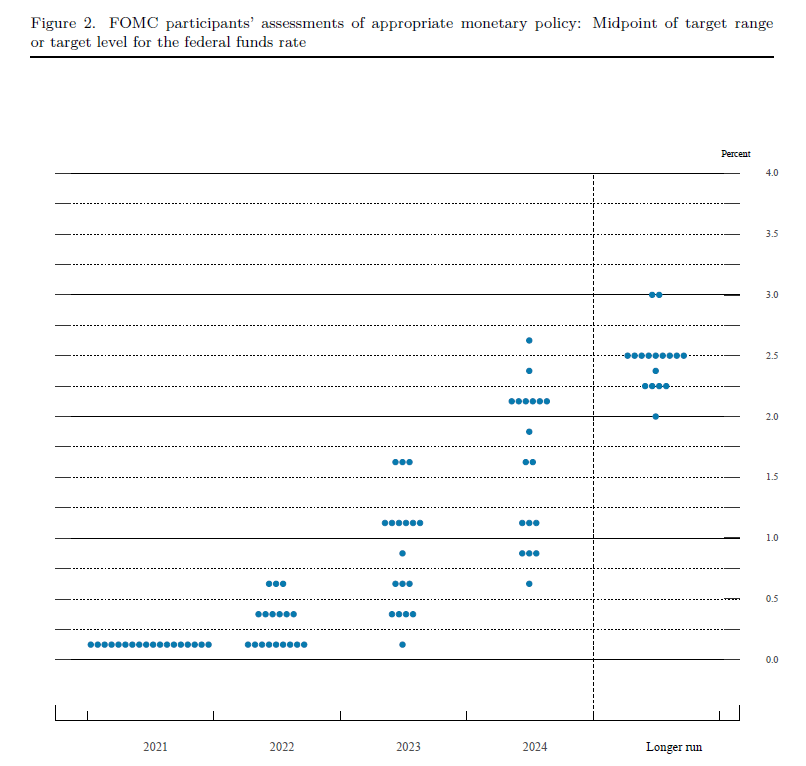

目前的大宗商品、能源市场,也开始显现出供需端的矛盾,而随着越来越多的企业公布供应链问题,眼下美联储在退出宽松的政策中,除了市场已经开始Price-in的Taper之外,还要考虑“提前到来”的加息。

毕竟,身为美联储主席的鲍威尔在上次FOMC会议后表示,“通胀高企是暂时的,对美国劳动力市场和经济改善保持乐观,不需要一份超强的9月就业数据就足以满足taper门槛”。

当然,美联储考虑“加息”是极为谨慎的,需要满足的条件更多。而目前美联储至2023年有投票权的委员当中,鸽派的偏多。包括鲍威尔自己也是,他的预测是2022年加息0次,2023年加息2次,2024年加息2次,比中值点所暗示的更温和。

最后我们再重提一下,通胀上升过快对美股大盘科技股和成长股带来的打击会更明显。

一个重要的指标就是美债收益率,目前10年期美债收益率已经飙升至1.5%以上,在年底可能升高至1.7%以上,这会让此前估值偏高的科技股面临更大的估值回调压力。

股票市场估值很少会在其自身的权重下突破,而且通常需要其他一些更基本的催化剂。此前几个季度,优秀的财报是重要的助推剂之一。

而现在,成本端有原材料和供应链的问题,运营端面临不断提升的员工工资,企业税也将面临提高。像$苹果(AAPL)$$微软(MSFT)$$Netflix, Inc.(NFLX)$$亚马逊(AMZN)$$谷歌A(GOOGL)$等科技公司的增长可能会迎来限制。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 丹尼尔加·2021-10-12非农的危害性是不是被低估了?我怎么会有这种感觉?1举报

- 重庆GEL·2021-10-11美国暂时找不到工作也不算什么坏事,反正失业金高1举报

- 刀哥拉丝·2021-10-12要真的是像你分析 的这样,我现在空仓是不是更好?2举报

- 迪士尼迪斯尼·2021-10-12很喜欢小虎的文章呀,感觉每次都能把复杂的问题深入浅出的表述出来。1举报

- 豆腐王中王·2021-10-12非农是一时的,但是要是通胀却可能造成泥沙俱下 的系统性经济问题。1举报

- 宝宝金水_·2021-10-12你说的有理,通胀上升过快对美股大盘科技股和成长股带来的打击会更明显。1举报

- 贝克汉姆零距离·2021-10-11目前来看,这些企业因为成本而产生的影响还是微小的1举报

- 做空做空者·2021-10-11科技公司倒是没什么,只是苦了那些做实体行业的1举报

- 又踩雷了·2021-10-11不知道有多少人失业了,因为这个疫情1举报

- Oops_7971·2021-10-13你这么行为什么你不上点赞举报

- 鑫鑫洋·2021-10-11[微笑]1举报