价投标尺下 B站能否新生?

我本人对企业分析的很大乐趣在于,他可以矫正我性格中的短视和投机的一面。在初对企业进行价值分析时,我糟糕的性格缺陷就会显现,常见的就是以当前市场价值去倒推内在价值,并且追求短期内的股票涨幅,当然在具体实践中,短视和投机的矛盾经常令我头痛不已。

本着长期价值投资的原则告诫自己,在分析时尽量忽略或者降低企业当下的市值权重,尊重企业内在价值的客观性,深以为排除这一干扰才是理性分析的开始。

在我对B站分析中就经历了上述变化,当B站在60美金上下时,我曾认为其被高估了,理由为对版权的大量投入会使其盈利周期大大延后,单以市销率去估值恐难以维持较高水平,随着疫情下美国大放水的开始,文章写毕股价飙升两倍有余,文章引发群嘲,如今B站股价从高点跌破50美金,外界又出现了严重的唱衰心态,必然有分析人士开始以股价去倒推基本面,认为企业存在如此这般的问题,并认为股价还会继续下跌,如果用股价去衡量市场情绪,在股价下挫是时评论中的企业问题明显增多,而这显然是与股价无关的。

分析师究竟要跟着股价走,还是走在股价前边呢?我们继续以B站为样本进行分析。

B站股价在过去一年有如过山车一般刺激,即便市场可以用“行业不景气”为借口解释全年股价下挫这一现象,但事实上股价也确实跑输了中概股整体,对比恒生科技指数就可以证实:

以一年期为限,B站股价固然面临着极大的压力,但在2021大多数时间里其表现要优于恒生科技指数,也就是表现优于大多行业企业,但在年末股价迅速下挫,如“跳水”一般,最终表现不及同类,这也引发了业内唱衰的声音。

从时间轴看,股价断崖下行始于2021年Q3财报,当期财报又究竟发生了什么,这就引起了我们的兴趣?

当期财报中很大的争议点可能在于亏损,当期经营性亏损接近19亿元,较上年同期增加8亿元,短期内扭亏似乎变得遥不可及,市场悲观情绪蔓延。

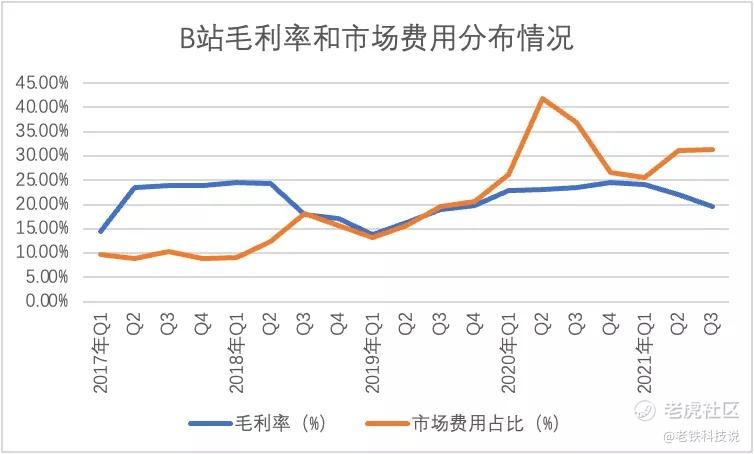

在损益表中最引人注意的乃是毛利率和市场费用,在过去市场乐观派对此两组数据是持乐观态度的,逻辑为:广告收入占比增加,刺激毛利率水平利好,而用户达到一定规模之后,可有惯性成长优势,也就降低了市场费用支出水平。

此逻辑在2021年Q2前后大致成立,彼时两组数据都在改善区间,但在2021年Q3情况出现了一些变化,见下图。

在2021年Q3,毛利率承压极大,市场费用又大有重新进入膨胀区间的态势,这也自然就恶化了损益表。

尽管我们对B站会冠以各种标签,如中国互联网最接近YouTube的产品,最具年轻人社区属性产品等等,但我们投资一家企业并不完全是投资他所描绘给我们的“梦想”,更多是投资企业能持续带给我们的盈利性或现金流储备。以此提高我们在市场中的定力。

那么我们就有此疑问:Q3盈利性的扭转,究竟是短期的还是长期,对未来企业究竟有何其他影响呢?

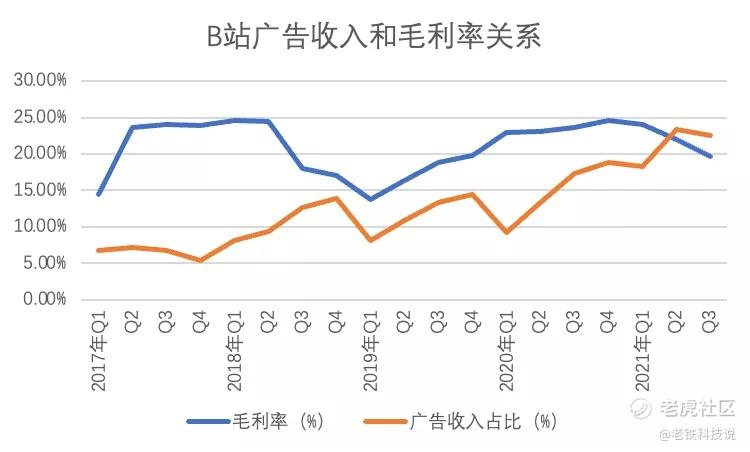

先看毛利率情况,在很长时间以来,B站毛利率的改善确实是拜广告收入的增长所托,我们制作下图

在上图中两条曲线呈高度一致的相惯性,尤其在2018年之后,广告收入占比攀升,毛利率迅速得到改善。其原因也很容易理解,早期B站的商业模式以游戏为主,这就使得收入中相当部分包括了虚拟产品与内容创作者的分成,收入的质量相对较低,而广告收入则有效优化了上述问题。

但我们亦可以看到,2021年Q3,广告收入占比仍在高处,但毛利率却有了明显的下挫,这又是为何?

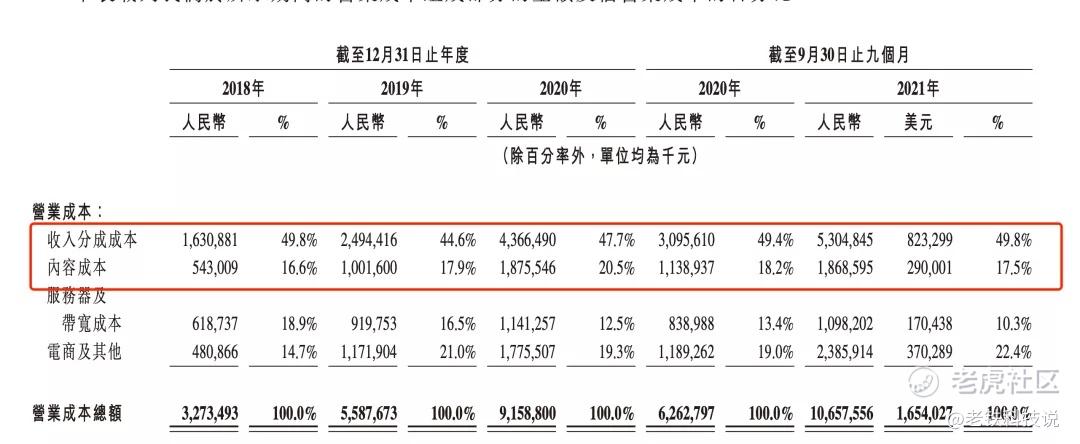

当我们对经营成本进行分析时发现,收入分成成本与内容成本乃是最大的成本,后者是可以理解的,我们此前也提出过警示,B站强化版权储备能力后,就必然要承担购买版权的现金成本以及版权摊销的高成本,如今这一问题已经显现。

收入分成成本就显得有些奇怪,该部分占比在2020年之前是不断下降的,理由也很简单,平台从早期的游戏收入向多种经营迈进,也就会降低该部分成本占比,但为何进入2021年之后该比例数字开始放大呢?

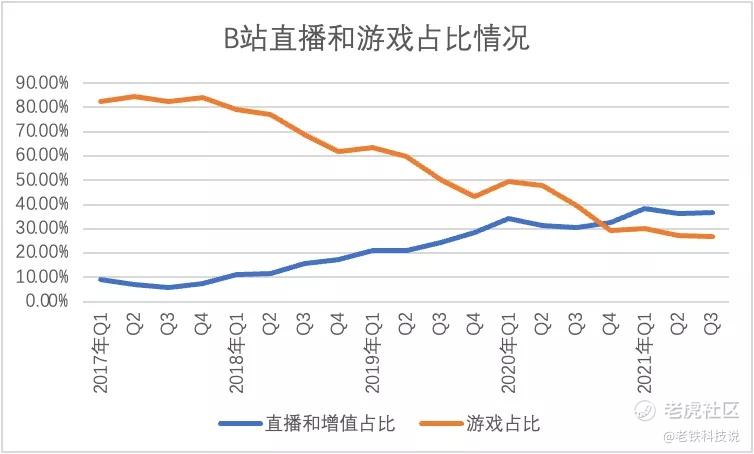

在上图中情况就比较清晰了,进入2021年之后,B站的直播和增值类收入占比跃升,幅度超过广告收入占比,另一方面游戏类收入占比经过几年调整后也趋于稳定,考虑到收入分成成本包括支付给游戏开发商、发行渠道(应用商店)及支付渠道的费用,以及给主播及内容创作者分享的费用,当此部分收入增加,自然就意味着成本要随之增加。

当我们在解释毛利率的缩水时,不妨将其归纳为基石业务与广告收入为代表的新业务之间的此消彼长。

我们对毛利率缩水的情况进行财务层面归纳:

其一,增值和游戏类市场占比与广告收入占比要有所平衡,如前者占比过大可能稀释毛利率水平;

其二,过去几年B站加大了版权采购力度,希望以版权构筑自己的第二道护城河(如果第一道防线是特有的社区文化),但也给其后的盈利性带来极大压力;

其三,B站如果要持续改善毛利率情况,就需要跑得快和跑得稳,要兼顾高质量发展与成本控制之间的关系,此前靠强融资能力对诸多领域进行投资,难免有冒进,这就为此后的运营提出了更高的要求。

对毛利率分析之后,我们再看市场费用。

市场费用几乎是中国乃至全世界消费互联网公司共同的敏感点,大多商业模式也较为粗暴,用强市场费用去买流量,平台再对流量进行内生或分发,产生流量的差价,也就是利润。

很多公司在此跑了出来,通过前期市场费用将用户流量化为自有,其后市场费用削减,迎来盈利,但也有许多公司过分依赖市场费用,一旦融资出现问题,市场费用被迫削减,增速旋即下降,并迎来一轮恶性循环。

那么B站是属于哪类呢?我们也知道股价下挫之后是会严重影响企业融资能力的(如可转债的发行是以股价为价值锚的),这是否会影响B站的长期价值呢?

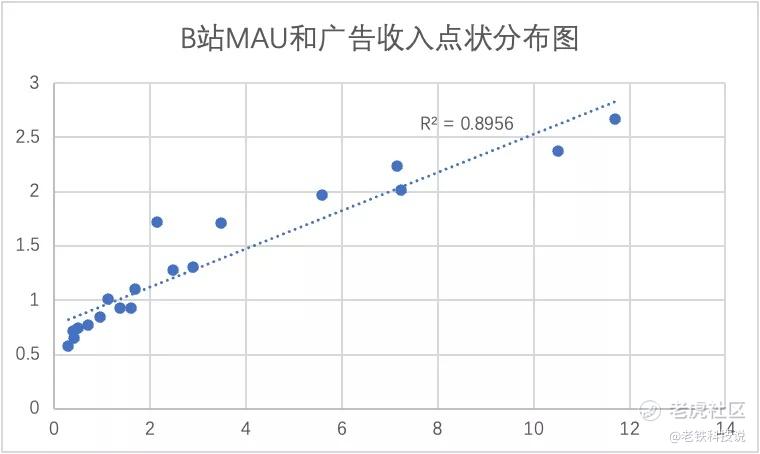

市场费用固然有许多功能,如品牌溢价,导流等等,但对于我国互联网企业,市场费用的首要任务仍然是“拉新”,在移动互联网周期内就是对MAU提高,市场费用与MAU之间是存在比较密切关系的,见下图

我们把2017年Q1开始B站的MAU与市场费用进行拟合,得出上图曲线,其相关性高达0.8956为强相关性,也就说明上述拟合线效果有效。

在上图中我们可以发现最近两个季度内,点状分布偏离在拟合线的下方,换成容易理解的语言则是,在过去的两个季度以来,市场费用对MAU的转化率有所下降,在确保MAU增长同时也就过大透支了市场费用,给损益表带来负担。

在过去的一年时间里,监管加之企业自身用户总规模的攀升,都意味着用户红利的离去,对于企业如果仍然纠结用户规模的扩张,要以“破圈”为姿态提高用户获取效率,那就意味着此后市场费用很容易陷入持续居高不下的处境,会进一步透支企业的盈利性,这在2022年资本市场开始更多以审慎角度考虑企业估值当然不是好消息。

那么对于B站未来我会持以什么态度呢?

我个人虽然在前文分析中对企业提出了种种的疑问,但如果要总结我仍然对企业给予中性偏积极的看法,以下是我的一些思考。

对于B站的亏损,有些是难以避免的属于商业模式自身的问题,而有些则是可以在其后的增长中逐渐稀释甚至是淡化的。

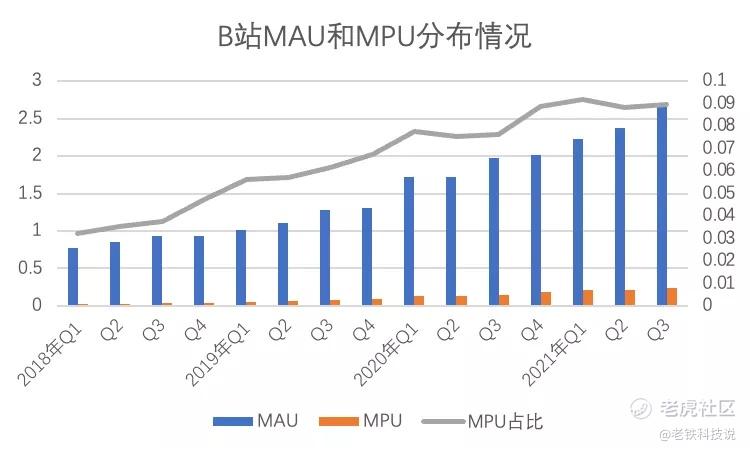

B站的用户规模在强大品牌尤其是市场费用的刺激下不断成长,但与此同时我们也发现MPU占比情况几乎已经达到瓶颈,也就是说积极主动意愿在平台进行消费支付的用户规模增长实际已经比较缓慢,而此部分主要集中在打赏以及游戏中,前文中我们所分析的此部分收入占比提高则主要是由于单用户消费支出的提高,见下图

在游戏业务权重不断下降中,直播收入价值放大,用户付费意愿上升,结合总付费用户变缓这一事实,那就是B站在“圈层内”用户粘性已经形成,即便削减市场费用可能会也不会造成太大影响,这与平台特有的文化属性和竞争力有关。

在MAU放大之时,流量规模溢出,平台广告效应理应也是放大的,在Q3广告收入同比增长110%达到12亿元,当期爱奇艺广告收入为17亿元(同比下降10%),考虑到爱奇艺的用户规模是超过B站的(仅会员就超过了1亿人),可以想象B站广告收入的ARPU极有可能是接近甚至是超过爱奇艺的。

这是否意味着广告主在对视频类广告投放策略的调整我们尚不得而知,也需要动态去观察,只是用此来看,B站可能仍有较大的广告收入挖掘潜力,若真如此,那就可以摊薄部分成本。

关于B站如何估值大家仁者见仁,但我想说在过去市场对B站乃是以市销率对待的(如今ttm市销率仍然接近8),这是一个比较高的数据,正常情况下当企业进入成熟期,要么调低营收预期,也就是下调市销率,要么企业需要提高盈利性,市盈率就成为重要参考。

如今,B站正处于市销率高企,但市盈率尚未奏效的关键时刻,对于企业要么继续保持快速增长,要么提高盈利能力,这些都可以相应调整市场预期,而在2022年,我本人更倾向于后者,事实上B站也是有这种潜力的。

以上是我对B站的不成熟阶段性看法,欢迎拍砖。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- LuckT·2022-01-04B站基本面没有问题,用户粘性依然很强,未来收费模式创新可期,现在处于超卖阶段,别人恐惧。2举报

- 隔壁王中王·2022-01-05现在中概股做这种分析意义不大了,一个文件来了可以把你的分析全盘推翻3举报

- carlzheng·2022-01-07如果按照价值投资,还用分析么?肯定是泡沫。。。成长股就是看市场预期他未来的增长速度,慢了就跌1举报

- 尚上品·2022-01-06可以小仓位加个观察仓1举报

- 东西西东·2022-01-06B站发展很快点赞举报

- SilenceMoon·2022-01-05这篇文章不错,转发给大家看点赞举报

- 毛票神·2022-01-05泡沫两个字就完了,分析半天点赞举报

- 千岛z9·2022-01-07[微笑]1举报