提前加息?吓坏华尔街市场,美股重挫

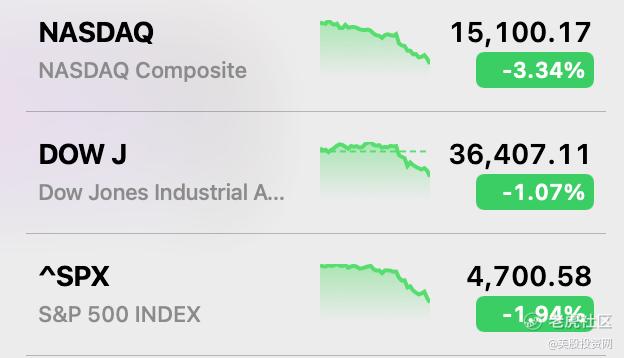

今日,科技股领衔下跌,美股大幅收跌,$道琼斯(.DJI)$ 收跌1.07%,$标普500(.SPX)$ 收跌1.94%,侧重科技股的$纳斯达克(.IXIC)$ 惨跌3.34%。

今日公布的FOMC会议纪要表示,美联储可能会比决策者此前预期的更快地撤回对经济的支持,12 月会议纪要显示,因为令人不安的高通胀迫使他们调整政策路径。

央行行长上个月预计,随着经济复苏且通胀仍高于美联储的目标,他们将在 2022 年加息三次。经济学家和投资者认为,这些加息最早可能在 3 月份开始,届时预计美联储将结束其一直在与低利率同时使用以刺激经济的大规模债券购买计划。

会议纪要显示,美联储官员指出经济增长和劳动力市场前景更加强劲,通胀持续,并表示“可能有必要比参与者早先预期的更快或更快地提高联邦基金利率”。

然后,官员们可能会采取行动,通过缩减资产负债表的规模来进一步给经济降温——他们购买的债券就存放在那里。这可能有助于推高长期利率,这将使许多类型的购买借贷更加昂贵,并进一步削弱需求。

会议纪要称:“一些与会者还指出,在开始提高联邦基金利率后,相对较快地开始缩减美联储资产负债表的规模可能是合适的。”

美联储1月维持利率在0%-0.25%区间的概率为94.4%,加息25个基点的概率为5.6%;3月维持利率在0%-0.25%区间的概率为32.2%,加息25个基点的概率为64.1%,加息50个基点的概率为3.7%;5月维持利率在0%-0.25%区间的概率为20.1%,加息25个基点的概率为52.1%,加息50个基点的概率为26.4%,加息75个基点的概率为1.4%

市场对这一消息反应迅速。周三小幅走低的主要股票基准指数在美联储于下午 2 点发布该文件后大幅下跌。标准普尔 500 指数下跌 1.9%,为数周以来的最大跌幅。

代表投资者对利率预期的政府债券收益率飙升。10 年期美国国债收益率攀升至 1.71%,为 4 月以来最高。

美联储在考虑未来的道路时面临权衡取舍。更高的利率可能会削弱就业市场,而就业市场在 2020 年大流行封锁之后仍使人们从观望中撤出。但如果美联储等待太久或行动太慢,企业和消费者可能会开始调整他们的行为,以适应过去一年大部分时间里拖累经济的高通胀。这可能会使价格上涨更难重新得到控制——迫使利率进一步大幅上涨,甚至可能导致经济衰退。

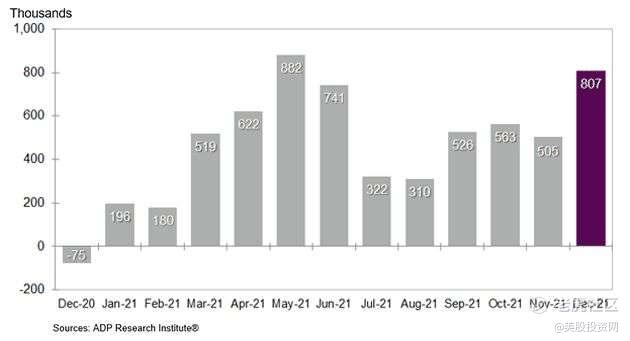

周三公布的ADP就业报告显示,2021年12月美国私营部门就业人数增幅创七个月来新高,表明越来越多美国人重返就业市场,填补了数量空前的职位空缺。

ADP Research Institute数据显示,12月私营企业就业人数增加80.7万,11月数据下修为增加50.5万。经济学家预期中值为增加41万。

远超预期的ADP就业报告,显示出薪资上升和工作条件的提升,改善了企业招聘形势。

但即便如此,如果近期新冠疫情恶化导致更多人放弃旅游和外出活动,企业经营将重陷困境、进而可能影响招聘。加之美联储的加息步伐加快,这一促进经济恢复的关键动力将大受影响。

而疫情又怎么样呢,周一新增新冠确诊病例数创单日增幅纪录新高达100万人次。最新基因测序结果表明,Omicron变异毒株感染病例占美国新增新冠确诊病例的95.4%。据美国顶级传染病专家福奇博士估计,美国疫情可能要在1月底才能见顶。

尽管福奇博士表示,Omicron确实比Delta致病性更低,Omicron的人住院或死亡的风险比感染Delta的人低65%, 但传播之广之快,依旧让医院面临巨大压力。

基于诸多因素,一些官员指出,如果通胀出现失控迹象,即使就业市场尚未完全复苏,加息也可能是明智之举。

美联储采取如此鹰派的立场是有原因的。惊人的高通胀持续时间的比央行官员预期的要长得多。去年,本来政策制定者预计,随着航空公司和餐馆等受大流行影响的行业复苏,价格将暂时上涨,然后恢复正常。

截至 11 月的价格涨幅为 1982 年以来最大,而且月度涨幅依然强劲。工厂停工和混乱的航运使供应商难以赶上消费者对商品的蓬勃发展需求,从而迫使成本上升。价格上涨也开始蔓延:租金上涨更快,这可能会使高通胀更加持久。

普遍预计今年春季通货膨胀会消退,因为价格是根据一年前相对较高的水平来衡量的。官员们希望,随着生产商赶上需求,价格也可能会下降。但他们不确定何时会发生这种情况。

与会者指出,住房成本和租金不断上涨,劳动力短缺推动的薪资增长更为普遍,以及全球供应面摩擦更为持久,而Omicron的持续扩张无疑会减缓经济的增长即就业恢复,为经济前景披上重重迷雾。

华尔街市场对此消息免不了担忧,避险情绪高涨,今日收跌也是难以逃脱的结果。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 灌饼高手00·2022-01-06现在的美联储比较聪明,学会了提前放消息。3举报

- 银河小铁骑00·2022-01-062022 年加息三次基本上是没有悬念了,参照2021的缩表,利空出尽就好了。3举报

- 低买高卖谁不会·2022-01-06大通胀环境下是不是买点可口可乐比较抗跌?2举报

- 玉米地里吃亏·2022-01-06Omicron的人住院或死亡的风险比感染Delta的人低65%,这是好事还是坏事?1举报

- 揭人不揭短·2022-01-06在新的一年里面尝试做空美股,你觉得会不会胜算比较大?2举报

- 豆腐王中王·2022-01-06我有点想买比特币,这个应该会在明年吸引避险资金吧?1举报

- 迪士尼迪斯尼·2022-01-06热点散乱,熊市 的必备特征,小心谨慎一点。1举报

- 灯塔国02·2022-01-06美图投资网的文章每一篇都做得比较用心。2举报

- 哎呀呀小伙子·2022-01-06现在的金融市场有点杯弓蛇影,稍微有点状况就跌给你看。1举报

- 喜洋洋与灰太狼·2022-01-07我买空的股票不解套我是不会相信美股会大跌点赞举报

- belowsky·2022-01-07M过根本不知道啥叫重挫,欢迎来A1举报

- 以肉克刚·2022-01-06疫情带来的牛市终于也要随着疫情的离去而离去。点赞举报

- 丹尼尔加·2022-01-06吓得我赶紧买点黄金压压惊,随便加息。1举报

- Iigerme25639·2022-01-06美国人民的命根子点赞举报

- 上山打王者888·2022-01-06这是要大跌吗点赞举报