美联储纪要,如何刺痛市场的神经?

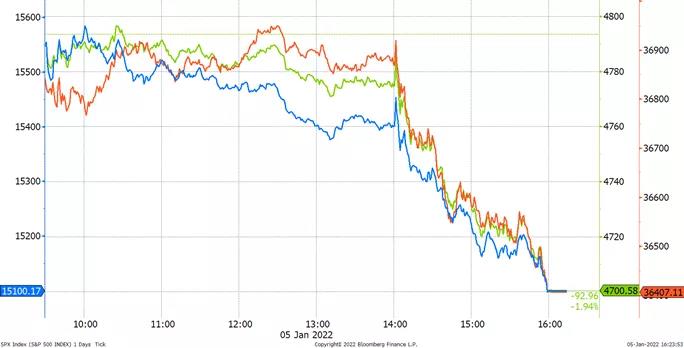

1月5日,美股市场在美联储公布12月会议纪要之后应声下跌。$标普500(.SPX)$ $纳斯达克(.IXIC)$ $道琼斯(.DJI)$

核心问题是两个:加息、缩表。

如果你以前没有了解过这两个概念(如果了解请跳过)——

加息,顾名思义,是指提高美国就是提高市场的基准利率,从而使商业银行的借贷成本提高,进一步迫使市场的利息也进行增加,是最基本的货币政策之一。其目的包括减少货币供应、压抑消费、压抑通货膨胀、鼓励存款、减缓市场投机等。

缩表中的“表”是指的美联储的“资产负债表”。美联储虽然是美国的“央行”,但它却是一个私人机构。如果我们把它看做是一家公司,那美联储也有“资产负债表”。虽然,我们不应该用看待$(AAPL)$这样普通公司的角度去理解,但是美联储的资产负债表依然也包括资产和负债。而缩表这一行动,意味着美联储将减少持有的资产(及负债)。

这两项行动,都是显著地减少市场上的货币供给,降低流动性。

这一次,美国股市带领着全球股市尿了

其实,美联储纪要并不是把会议的每一句话,每一个梗都抛出来。它其实是非常有目的性地将美联储在12月会后没有表达完整的意思,或者市场解读过于乐观/悲观的部分进行适当的补充,是美联储特意给市场传递的补充信息。

比如,12月会议时,美联储对Omicron病毒的认知显然不会有现在这么全面,即便美联储可以揣测美国政府的可能措施,也预计不到其他国家会做和反应。而其他国家的反应,又会影响到另一个重要因素——供应链,这是实实在在推高美国通胀的因素。

再比如,美联储在12月之前对通胀的描述一直都是“暂时的”。不管是给拜登政府留情面也好,还是真的这帮老古董信息滞后也好,这一表达传递都是“错误及滞后的”。因此美联储急于删去原先“暂时的”表达,并给市场灌输更激进的预期,以此来表达“纠错”。

我们现在可以肯定的是——

一、我们看到的这份12月会议的纪要内容,远比当时美联储主席鲍威尔在会后表态更鹰。市场大跌,就是在“修补没有表达到位的预期”。包括:

- 加息的节奏会比之前参会时预计的更快。

- 加息可能会紧跟缩表。

当然,加息对科技股的影响更大,这点我们曾在9月和10月的文章中就提到——通胀上升过快对大盘科技股和成长股带来的打击会更大。

二、比起加息,股市更惧怕的其实是缩表!缩表!缩表!

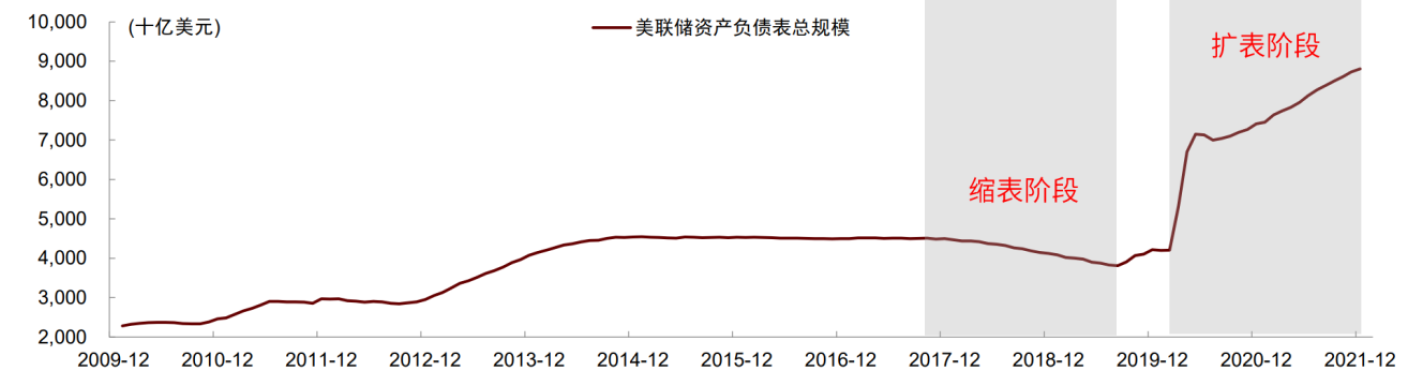

首先,美联储为什么要缩表呢?不如先看看美联储的资产负债表变化的情况:

很明显,在2020年之后的这波“扩表”,直接从之前的4万亿美元水平提升至目前的8万亿水平。放水程度可想而知。

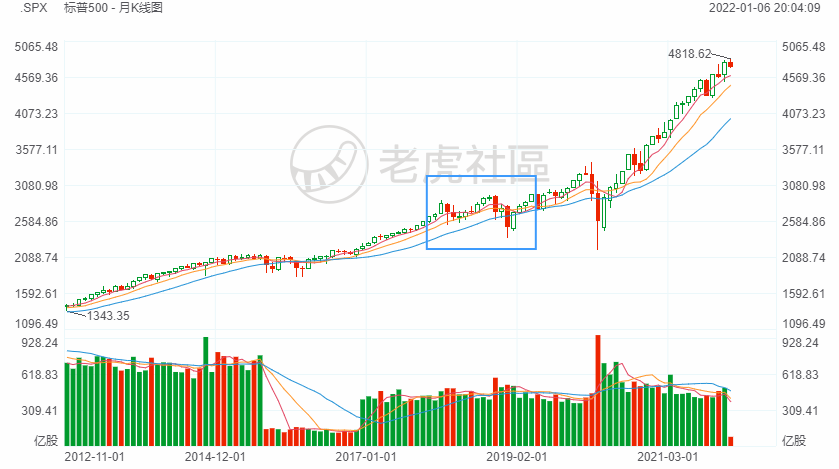

加息对于经济的影响较为全面,而缩表,则更大程度上影响市场变动,比如股市。2018年美联储缩了表,标普500指数老老实实地成为了2008年金融危机以来回撤最大的一年。

美联储的资产负债表里有很大比例的美国国债,一旦要缩表,必然要卖掉国债,把钱重新从市场上收回来,因此会降低市场的流动性。而金融机构也要相应调整风险敞口,调整自身的流动性,也会降低风险资产(比如股票)的比例,因此对股市造成的影响非常直接。

同时,更快的“缩表”预期,增强了“信号作用”(signal effect)。在目前零利率下限时, “扩表”的作用会“显著增强”,而当利率远高于0时,扩表的作用才不明显。

这一概念出现在圣路易斯联储主席布拉德2019年的研究报告 《当量化紧缩不是紧缩》。简单地理解就是一种市场的“预期管理”(预判)。很显然,股市的这种预判则更为明显。

美联储为何要如此煞费苦心地警告市场?

它肯定是想甩锅——别到时候怪我们没提醒你!

当然,美联储是看到了风险。

第一、其通胀目标已经达成,现在的货币政策是为了追赶通胀,加速“货币政策正常化”。

其实也说明美联储并不是一个“先知”的组织,更多的则是在顺应市场的变动。并且,在信息传递越来越迅速的今天,这帮老古董可能接受来自市场反馈越来越迟钝。仅2021年超出预期的通胀就够他们提几壶了。

第二、政治压力影响他们的发言

民主党执政,往往在资金上要大开大合,鲍威尔既然是给拜登政府办事,自然要照顾它们颜面。恰巧,本届的财政部长是此前的美联储主席耶伦,而鲍威尔和耶伦曾经共事那么久,很多政策心有灵犀,也更方便通气。因此耶伦的很多态度,也表达了美联储的一些无奈。

比如,近期耶伦多次喊话“降低关税”,主要目的还是为了缓解物流问题、供给短缺以及需求上升带来的价格上涨。

因为美联储手头的工具并不多,而没有财政政策的辅助,很多货币政策会大打折扣。

最后的提示

第一、市场的流动性一定会降低,而且流动性收紧的情况一定不会比2018年更好!

第二,市场上很少有基金经理完整地经历过经济周期,很多机构都不知道加息环境是什么样的。

而目前的市场由量化主导,大家动作出奇的一致,这也能解释为何1月5日尾盘能泄气泄得如此快。

所以,现在面临的情况,可能是10年来崭新的。

美联储“缩表”会影响你今年股票收益率吗?(单选)

美联储“缩表”会影响你今年股票收益率吗?(单选)免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

缩表比加息和缩减QE更让市场恐慌

这篇文章不错,转发给大家看看