春江水暖鸭先知,港股美股新能源开门红

声明:

1)股市有风险,投资需谨慎。文章里提到的所有上市公司,仅作为分析之用,不作为交易参考!

2)本公众号不荐股、不诊股。文章内容和观点仅仅是个人投资的思考感悟的分享,仅供参考,不构成任何投资建议!

一、港股美股新能源都开门红

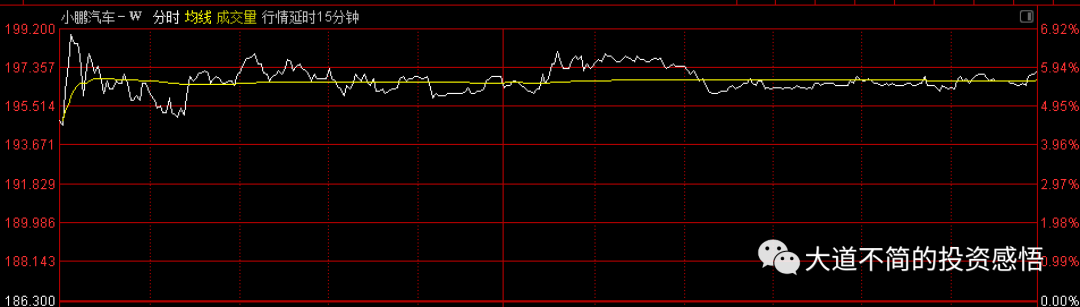

在新势力和主要新能源汽车车企发布12月销量后,今天港股开盘,新势力的小鹏和理想都涨势不错,

小鹏港股涨5.85%

理想港股涨3.5%

特斯拉盘前涨6.5%

在看看港股光伏相关的股票

洛阳玻璃股份(01108)涨13.00%,

彩虹新能源(00438)涨11.01%,

保利协鑫能源(03800)涨6.36%,

水发兴业兴源(00750)涨5.68%,

协和新能源(00182)涨3.66%,

无论是新能源汽车还是光伏,都在2022年的第一个交易日来了个开门红。

还是之前说的,新能源在22年继续是大年,无论是新能源汽车,还是光伏储能。新能源汽车观察每个月的销量,12月销量无论是同比还是环比都很不错,我们后面再密切关注1月份的销量,特别是同比增速。

而光伏由于组件、硅片、硅料持续降价,拉动了安装的需求量。降价只会不断持续,因为新增产能会逐步释放,伴随着降价就是安装量的高速增长。

元旦期间宁波有疫情,有些区域属于管控区域,有些区域是防范区。及时是最受影响,在管控区的申洲国际也只跌7.8%

YD应当是在防范区,可能有一些影响,包括港口出口发货,但是应当是短期影响,完全不影响投资逻辑。

从新年开门走势来看,虽然港股大盘是跌的,但是新能源走势强劲,这也和我对2022年的判断比较一致,2022年可能是结构性行情,就是大盘可能不会有太大的涨跌,特别是A股,上涨和下跌的空间都不会太大。但是新能源还是最有持续性的赛道,每次调整都是机会,当然每次调整都会有认为这个赛道高估的,都会有恐高症患者。“悲观者往往正确,乐观者往往成功”,特别是对时代最大机会的赛道,选对了赛道的乐观者更容易成功。

光伏在港股普涨,但是大家会发现有两个板块涨幅大,第一个是配料板块,然后是下游电厂。还有逆变器,由于港股没有逆变器公司上市,逆变器没体现出来。

根据我的看法,光伏、储能最好的三个细分板块:

1、逆变器、PCS,之前反复说过,这个是内生增长赛迪,有很深的护城河。

2、配料板块,由于光伏安装大幅增长,配料需求大幅增长,而且有的配料内卷没有像逐渐、硅片那么强,所以会有比较好的投资机会

3、下游新能源电厂,由于组件持续下降,新能源电厂的建设成本越来越低,投资回报ROI越来越好,相应的利润会越来越好,而且这个是在整个2022年都是可持续的,所以新能源电厂也会有好的投资机会。

新能源汽车2022年国内的销量预测上调到510万,之前乐观的估算是500万。2022年全球的新能源车的销量应当是会突破1000万以上。

21年大概是340万,22年有50%的增长,这个增速的惊人的。这么大的一个行业有半倍的增长。

二、特斯拉和比亚迪的12月销量再创新高在新势力当月第一天就发布销量相比,比亚迪总是要慢几天,还是传统势力的风格。

比亚迪12月新能源汽车销量9.39万辆,上一年同期为2.88万辆。2021年全年累计销量为60.38万辆,比2020年增长218%。11月是90121,环比增长还不错。

比亚迪的销量增长非常快,但是比亚迪的利润率一直不高,虽然已经有了很大的规模,没体现出规模效应,今年新能源汽车达到60万,特斯拉在60万销量的时候,利润已经非常好了。不过,目前对比亚迪的估值影响不是特别大,期待比亚迪的市值新高。

特斯拉2021年全年交付93.6万,离100万不远。

特斯拉盘前涨6%,市场已经很认可这个交付量了。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。