美通胀热到烫手,这里有15项通胀保值投资

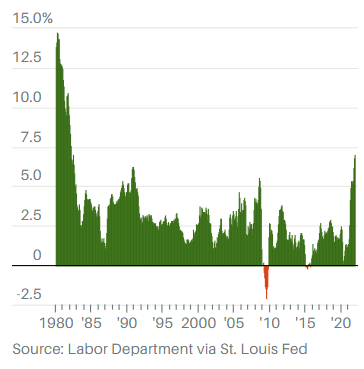

美国的通胀率已升至20世纪80年代初以来最高水平。

目前通货膨胀已经上升到令消费者、美联储和投资者头疼的水平。市场人士预计,在美联储与不断上涨的物价抗争之际,利率即将上行。2022年初,物价上涨就已经导致美股遭到抛售。

所有人都难免受到通胀某种程度的影响,但在通胀给股市带来的压力面前,投资者可以主动出击,对自己的投资组合做一些调整。

周三公布的数据显示,2021年12月份美国消费者价格指数(CPI)同比上升7%,升幅高于11月份的6.8%。通货膨胀率已经升至20世纪80年代初以来最高水平。

在通胀加剧之际,投资者可以回顾一下过去的高通胀环境里哪些投资的表现更好。Hartford Funds策略师肖恩·马科维奇(Sean Markowicz)研究发现,在高通胀时期,公用事业、房地产投资信托(REIT)、能源、消费必需品和医疗保健这五个板块的回报都为正值。

REIT和能源可以打败通胀是因为,房地产和油价会随着整体物价一起上涨。此外,当物价上涨时,消费者会放弃部分消费,但公用事业、消费必需品和医疗保健相对来说是不可或缺的,即便电价或食品价格上涨,这类行业的需求也不会下降,因此可以维持自己的利润率。

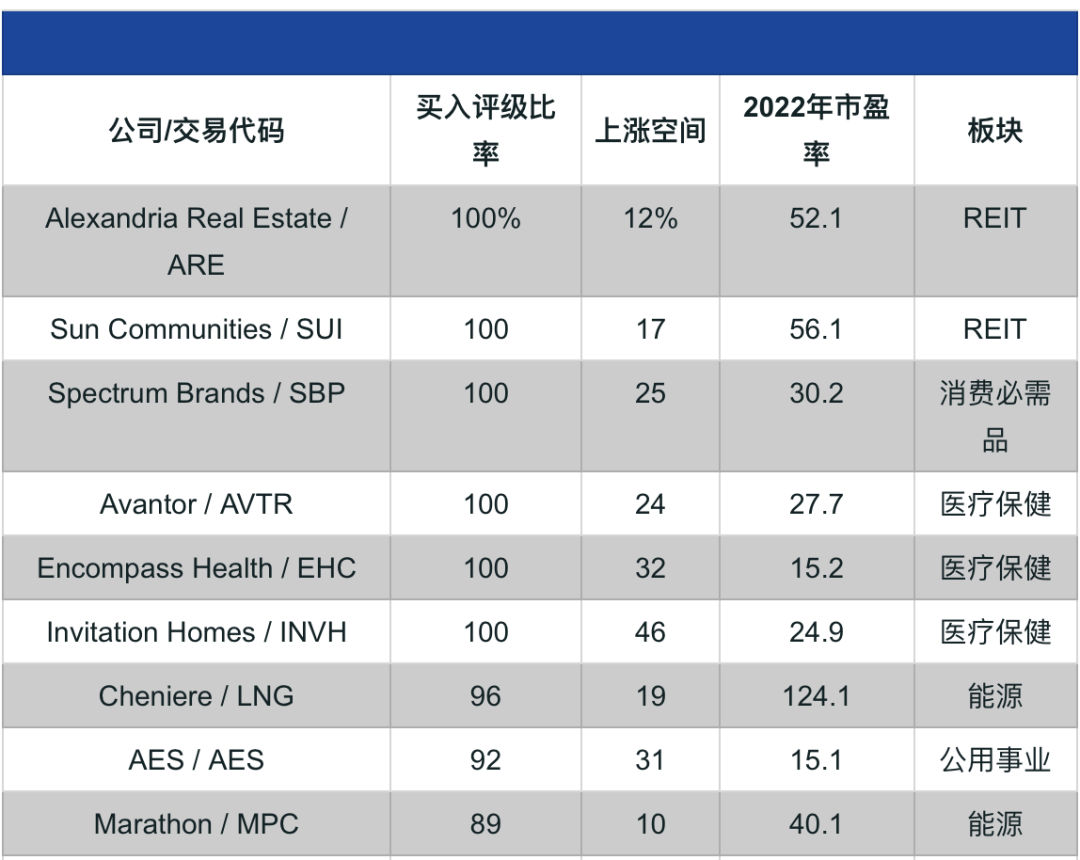

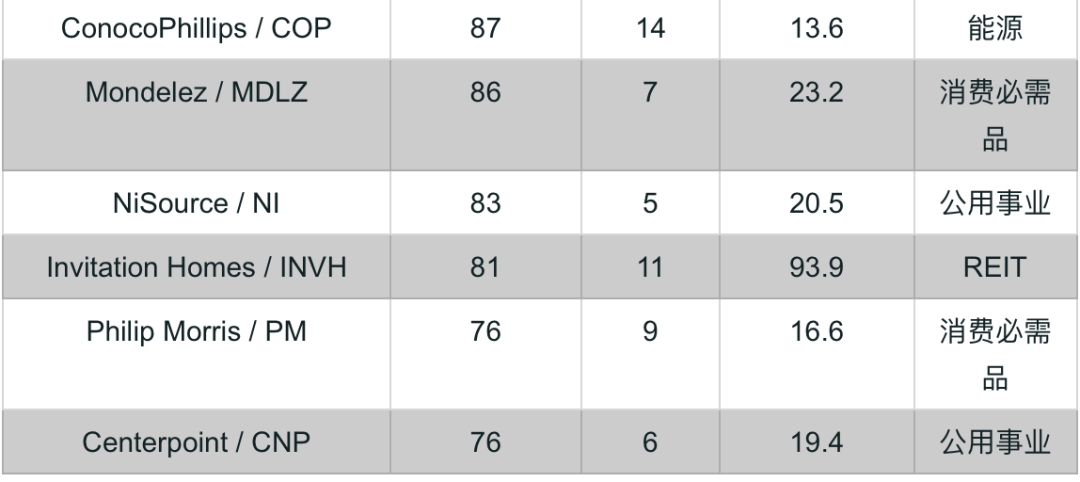

在构建通胀保值投资组合时,投资者可以以上述五个板块为起点,然后从中挑选最好的股票。

《巴伦周刊》根据华尔街分析师给出的评级,从这五个板块中各挑选了三只最被分析师看好的股票。《巴伦周刊》从大盘股指数罗素1000里筛选了15只股票,排名不分先后。

REIT:Alexandria Real Estate Equities (ticker: ARE)、Sun Communities (SUI)和Invitation Homes (INVH)。

能源:Cheniere Energy (LNG)、Marathon Petroleum (MPC)和康菲石油(COP)。

公用事业:AES (AES)、CenterPoint Energy (CNP)和NiSource (NI)。

消费必需品:Spectrum Brands (SPB)、Mondelez International (MDLZ)和菲利普莫里斯国际(PM)。

医疗保健:Avantor (AVTR)、Encompass Health (EHC)和Sotera Health (SHC)。

整体而言,跟踪分析这15只股票的分析师有约90%的人给出的评级为“买入”,相比之下,罗素1000成分股获得的平均“买入”比率约为60%。

通胀保值投资

分析人士看好能保护投资者免受价格上涨冲击的板块。

资料来源:彭博

按分析师给出的平均目标价计算,这15只股票的平均上涨空间约为20%,与罗素1000成分股的平均上涨空间差不多,但如果分板块来看,该指数不同板块的潜在上涨空间差异巨大。

这15只股票的表现一直不错,过去一年平均涨幅约为27%,相比之下,罗素1000同期涨幅约为20%。标普500指数和道琼斯工业平均指数同期涨幅分别为23%和16%。

过去一年,这15只股票中有12只上涨,Encompass Health、Sotera和AES同期下跌。

筛选股票是选股的第一步,对于所有寻找通胀保护的投资者来说,可以以这五个板块中的15只股票为起点进行更多研究。

文 |《巴伦周刊》撰稿人阿尔·鲁特(Al Root)

编辑 | 郭力群

翻译 | 小彩

版权声明:

《巴伦周刊》(barronschina)原创文章,未经许可,不得转载。英文版见2022年1月12日报道“Inflation Is Running Hot. 15 Stocks to Help Tame It.”。

(本文仅供读者参考,并不构成提供或赖以作为投资、会计、法律或税务建议。)

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 马路边的硬币·2022-01-14房地产还能上涨吗?虽然通胀,自然规律肯定会造成房地产成本增加,房价上涨,但是在国内的宏观政策调控下,房价不敢涨啊!点赞举报

- 高富不帅W·2022-01-14公用事业、房地产投资信托(REIT)、能源、消费必需品和医疗保健这五个板块是抗通胀的吗?那我好好研究一下!点赞举报

- 富不过二代·2022-01-14今年肯定要加息了,真加息了,股市里的资金少了,流动性小了,会普遍跌吧?点赞举报

- 高抛低不吸·2022-01-14博主真的是活雷锋啊,把研究成果直接告诉我们!点赞举报

- 该买哪一只·2022-01-14看来房地产股今年的通胀年中,还是会有一波行情啊!点赞举报

- 骑母猪闯红灯·2022-01-14看来买股票,除了选热门板块,也要根据实际情况行情来买!点赞举报

- 说你逗你还真逗00·2022-01-14今天涨幅靠前的A股就是抗通胀板块,能源股!点赞举报

- 港谷小子·2022-01-14能源股是指石油,煤炭资源吗?电力和风能和光伏算不算啊?点赞举报

- 会唱歌的小包子·2022-01-14消费必须品肯定是抗通胀的首选!点赞举报

- 明天周日·2022-01-1415个财富密码,实在太棒了,感谢博主!点赞举报

- Manatee·2022-02-02阅点赞举报

- 小宝老高·2022-01-14阅点赞举报