三点理由:为什么英特尔是2022年最具配置价值的半导体个股

毫无疑问,英特尔这家曾经的芯片巨头掉队了。PC市场份额的丢失以及失去最重要的客户苹果,英特尔一再被市场边缘化。

要知道疫情期间半导体是绝对的热门赛道,$iShares费城交易所半导体ETF(SOXX)$2020、2021年分别上涨51%、43%。我们再横向对比一下四家主要芯片厂商过去两年的表现,AMD由46美元一路飙升至最高164美元,英伟达从两年前的60美元涨至最高346美元,高通也已经翻倍,而英特尔两年间跌去15%,10倍的TTM市盈率显然不符合作为科技股的“贵族”身份。

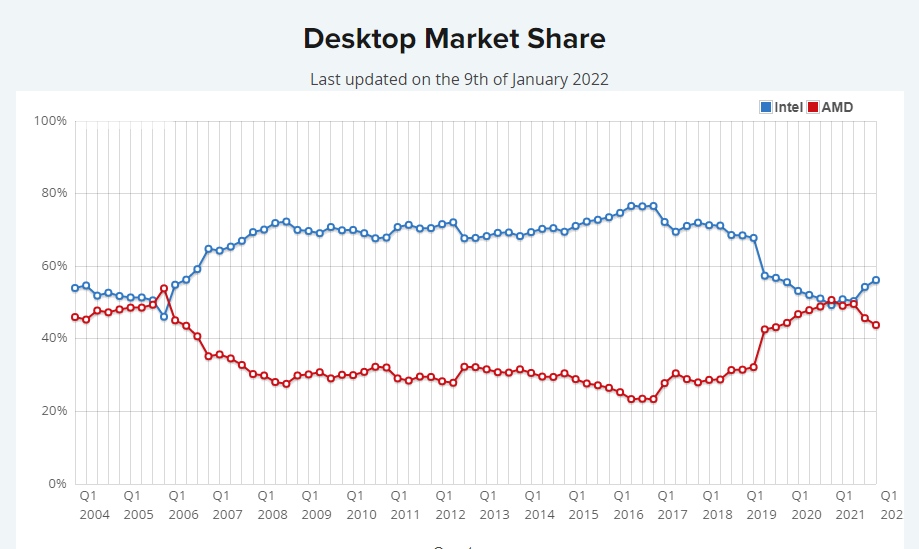

时间来到2021年第一季度,AMD在全球台式机CPU市场份额达到50.8%,超过了英特尔的49.2%的份额,这是15年来AMD终于首次在全球台式机CPU市场份额上超过英特尔,上一次AMD领先还要追溯到2006年第一季度。

沉寂了整整两年,期间不仅面临AMD、英伟达和高通等同行的产品竞争,并且苹果、谷歌也纷纷转向自研芯片。

不过,历史总是惊人的相似,上次AMD市场份额领先英特尔只保持了一个季度。如今,2021Q1被反超后,2021Q2英特尔又再次反超AMD,近几个季度英特尔的优势继续在扩大。

十几年的优势被蚕食殆尽显然不能接受,AMD的追赶加速了英特尔的变革。

改变一:管理层大换血。

去年二月,英特尔任命技术背景出身的Pat Gelsinger为新任CEO,换掉财务出身的CEO。意图很明显,力求在芯片技术取得突破。另一方面,Pat Gelsinger是一名有着40年经验的科技行业老兵,此前在Intel有长达30年的工作经验,他可以在不背负传统关系包袱的情况下,开启英特尔更大范围的管理、运营和结构变革。

就在前几天,苹果M1芯片设计总监Jeff Wilcox离开苹果,重返英特尔。有一种说法是苹果不太需要Jeff Wilcox做系统架构的人。况且,即便Jeff Wilcox经验丰富,一个人也很难改变芯片行业的格局,因此他的上任效果还有待观察。

改变二:拒绝挤牙膏,新品性能硬刚AMD。

在11月和本年初1月CES2022,英特尔接连推出了第12代酷睿处理器桌面版和移动版,全新的混合架构产品让整个市场感觉到耳目一新,被认为是最好的游戏处理器,2022的PC市场必然迎来新一轮的大洗牌。

其实从酷睿11代CPU开始,英特尔就不再挤牙膏,从制程工艺到底层架构,从规格参数到应用性能全都焕然一新,堪称英特尔近些年来最大的一次飞跃。而最新推出的酷睿12处理器无论是桌面端还是移动端更是毫无保留,完全可以与AMD的锐龙处理器一较高下。

改变三:发力自动驾驶,Mobileye或成为下一个突破口。不知道虎友们是否赶上了2020年和2021年新能源的快车,下游整车制造厂商都有几倍、几十倍的涨幅。进入2022后,整车产量和销量预期其实已经打的很满了,我认为汽车智能化将会开始讲故事,譬如自动驾驶,有这方面合作、技术领先的芯片厂商比如英伟达、高通、英特尔大概率有超出同行的表现。

在CES2022上,英特尔旗下自动驾驶子公司Mobileye发布专为L4自动驾驶打造的EyeQ Ultra系统集成芯片,有望与特斯拉、英伟达和高通在高级驾驶计算芯片领域中一争高下

数据显示,2021年Mobileye得到了30多家车企的41项新订单,EyeQ芯片的出货量达到了2810万,整体营收达到了14亿美元,同比增长40%左右。12月8日,英特尔宣布有意将Mobileye分拆上市,市值有望达到500亿美元。自动驾驶很有可能帮助英特尔完成弯道超车。

最后,鉴于持续在技术和产品端发力,英特尔已经度过了最黑暗的时期,基本面拐点显现。过去两年,英特尔滞涨虽然更多是自身原因,但芯片设计和制造从来都是高景气行业,相比AMD、英伟达几倍的涨幅,英特尔显然有被低估的成分。加上新产品认可度和市占率持续提升,个人认为2022年英特尔可能是半导体行业中最具配置价值的个股。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

价值,估值,资金。