“毒王”来袭,市场恐慌,这一次,坐等全球大放水!

周末这两天,朋友圈充斥着各种新冠变种疫情的报道,满屏都是藏不住的担忧。

对于很多股民来说,周末好像不快乐了。两天苦苦的煎熬更像是在牢狱里等待担待那最后的时刻,茶饭不香是肯定的,有的心慌到不知所措都成为了正常反应。

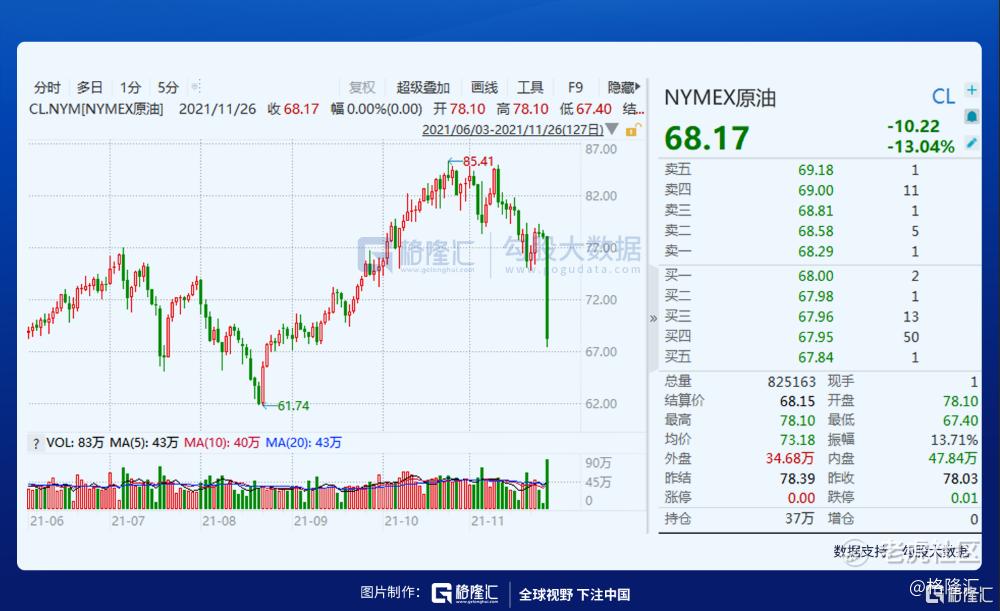

没办法,周五晚上的全球金融市场暴跌是在太惊人,美欧股市全面暴跌,国际原油高达13%的恐怖跌法,让人不禁想起去年疫情爆发初期的恐怖时刻。

现在,率先开盘的中东股市又是跳水暴跌开局,迪拜金融市场综合指数开盘跌逾5%,一副恐慌指数爆表的节奏,说不吓人,那是骗人!

明天我们的A港股,能幸免于难吗?现在没有一个人敢往侥幸的方向去想。

更长远的考虑,现在,不仅是疫情,还有地缘政治、供应链危机,上一轮超级放水带来的全球滞涨后遗症,导致现在的全球金融市场陷入更加复杂的局面。

在种种巨大的不确定性下,今年的最后一个月,以及明年,我们的投资应该怎么办?

1

2021,不及预期

去年全球新冠疫情爆发之后,全球很多国家的经济和产业很快都遭受到全面打击,中国是抗疫成效最好也是第一个率先经济复苏的国家,但海外大部分国家都长时间陷入因防疫疫情导致的经济崩溃局面。

在抗疫的同时,为了挽救岌岌可危的经济,全球很多国家纷纷开启新一轮史无前例的超级放水,然后放水的效果也算明显,除了带来畸高的通胀问题外,大多数国家的经济重新复苏,尤其中国,下半年起的经济活动很多行业都表现强劲。

到在去年底的时候,国内的疫情已经基本归零,很多人笃定2021年随着疫情结束和经济扶持政策出来,经济会继续迎来报复性的强劲回升,然后刺激股市也迎来报复性大反弹。所以今年春节之前的一段交易日,A股几度疯狂暴涨,股民信心爆棚。

然而,事实结果是大家“想多了”,甚至很多行业的结果与想象中的截然相反——2021年,比2020年更惨!

沪深指数今年为止才2%涨幅,比没有遮羞布更让人难堪。当然,港股更惨,夹在不断创新高的美股和涨不动的A股中间,它选择了直接躺下,放弃治疗。

今年有太多行业的发展趋势,远远掉出了所有人的预期下限。

比如线下消费和国内旅游,即使逐渐放开了流通管制,电影院和餐馆也不再控制顾客数量,但依然没有出现明显一点的消费回流。

地产更惨,一直被政策严控,炒房交易被冰封,一个个地产企业的经营业绩大幅暴跌转亏,陷入债务危机,几个我们一度认为“大而不能倒”头部地产巨头接连倒下。在股市上,它们成为资本唾弃的对象。

教育更不用说了,整个产业的资本逻辑都被蹲掉,在港美股上市的几个教育巨头,去年到现在的市值蒸发超过8成以上,好未来甚至跌去9成半,变成没有未来。

医药股也是,反垄断和集采大刀之下,CXO也好,原料药、医疗器械也罢,大多无一幸免,作为被机构和股民追捧的最具成长性的黄金赛道,但整个医药的整体表现甚至没有跑赢普通的制造业。

恒瑞医药、智飞生物、通策医疗、长春高新这些行业茅,一个个变身成为了深套股民的收割机。

这背后,其实是有着即使超级放水和大量政策刺激也难以逆转的宏观大趋势,也可以说是一个下行周期,这并非在去年疫情时就突然出现的。疫情只是打乱了这个趋势的节奏,仅此而已。

2

2022,开局不顺

现在到2021年底,肯定有不少人是期待2022年会比2021年更好。实际情况谁也无法预测,但至少从现在来看,不那么美妙。

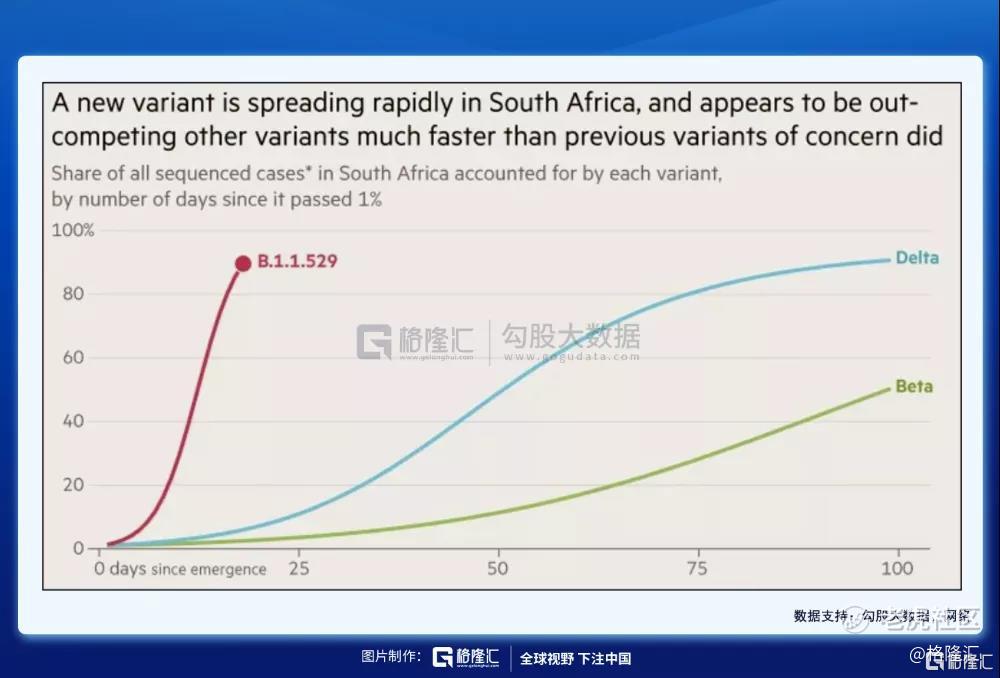

因为更大的不确定性——新冠变种又来了。新型变异新冠病毒“奥密克戎”来势汹汹,是迄今为止变异最多的新冠变种病毒,它总共含有超过50个突变,其中,仅刺突蛋白的突变就有30多个,其传染力与抗疫苗能力远超Delta变异毒株。

更令人担忧的是,有科学家推测,新病毒可能由艾滋病人身上变异而来,目前还无法确认疫苗或者各种特效药对新的变种起到明显的效果,需要数周来确认。

该变异株短短20天左右在南非国内所有变种中占比已经高达90%,远超Delta和Beta爆发初期增速,这明显提升了海外经济复苏的不确定性,这也是周五全球金融市场巨震的罪魁祸首。

面对突如其来的变异病毒,周末海外多国紧急布控。随着英国率先停止多个国家的边境通关,以色列、美国、德国、土耳其、俄罗斯等越来越多国家加入了紧急边防布控的阵列。

这变异病毒对接下来资本市场的影响到底有多大,很难说。目前,大家各执一词,有说传染率高,但是致病性不行,有说不必要紧张的。但不管传闻怎么说,从越来越多国家阻断航线的反应,以及资本市场恐怖暴跌来看,应该影响不小。

还有,大概预想一下,如果现在的疫苗对这个新变种效果不好,而且由于传播速度相对更快,尤其是突变位点更趋向复杂,这意味着要研发对应新的疫苗也将要花费很多宝贵时间。

尽管周末全球六大疫苗巨头快速做出行动,但参照之前新冠疫苗的研发的艰难过程,最少也要几个月的空窗期。辉瑞和BioNTech也说了,最迟两周内才会有实验室测试的数据,最快也得100天内才能开始批量发货。这也将意味全球的疫情防控难度将比前两波更加艰难。

虽然新变种疫情再次把全球经济再次拖入泥潭的概率不大,但只要有概率,资本肯定都要做出防范,一旦做出规避的力量多了,更大的连锁反应就会出现。这是需要认真思考到的。

3

不止疫情

除了疫情之外,从全球的角度看,还有更多的风险因素深刻而不可避免地影响了全球的金融市场,也包括中国。

如果说疫情是不可抗力的天灾,那么地缘政治导致的风险就是无可奈何的人祸。

去年以来,疫情把全球经济搞成一锅烂粥,但即使如此,很多国家依然没有团结一致共渡难关,美伊谈判擦枪走火,中东战乱动荡不停,俄欧能源关系紧张,还要很多资源国限制出口,导致全球供应链接连崩溃,对经济复苏产生全面影响。

去年下半年到今年的上半年,大宗商品涨价潮超级周期引爆全球资产价格泡沫,很多国家陷入货币灌水带来的经济虚假繁荣和滞涨。

可以说,目前全球经济面临的问题都是各国这一轮超级放水带来的后遗症,没有一个是无辜的。

2021年11月,美联储才启动Taper第一个月,土耳其的货币就崩溃了。

国际上还有很多外部经济依赖度超高的小国家,某种程度上,它们甚至比土耳其的经济更加脆弱,现在土耳其都倒下了,它们也还不知能撑多久。

4

覆“水”难收

如果没有这一次突然其来的变种疫情,很多国家原本是有打算进入收水周期的,现在美国也开始启动taper了。

但如今这个新变种病毒,又带来了新的不确定性,后续病毒如果继续演变,预计美联储taper的速度会减慢,加息也不会提前。

而对于我们来说,逆周期调节政策可能就上来了,无论是货币政策还是财政政策。

上周三,央行在三季度货币执行报告的表述上去掉两个关键词,意味着信用见底成为一致预期。一是删去了“坚决不搞大水漫灌”的表述;二是删去了“管好货币总闸门”的表述。前者对应银行间市场流动性,后者对应的是信用社融。此外,在政策基调上,删除了“坚持正常的货币政策”。

在新毒株阴霾短期压制市场情绪下,未来发展趋势仍然不明朗,这样就意味着海外经济恢复和货币宽松退出节奏可能放缓。那么可以预见,12月的中央经济工作会议对稳增长表态将更积极。

更广泛的意义来讲,世界各国应对疫情,目前除了放水仍然没有别的办法,虽然这是一个饮鸩止渴的无奈之举,所以大概率2022年会是继续放水的一年。

但放水并不是解决问题的根本,它只会把原本要暴露的问题无限期拖延下去。不过从资本市场的角度,只要是放水,股票和资产价格泡沫是肯定会继续“吹”的,一如去年来的美国股市。

尤其对于我们国内,逆周期的预期可能会加大,所以这样看来,我们股市好像也不用太担心,起码短期和表面上看上去会是这样。

至于是不是今朝有酒今朝醉,马照跑舞照跳的末日前狂欢,只有天知道了。

5

结语

经历过惨痛的2020年,迷茫的2021年,大家都展望着2022年,但明天和意外,你永远都不知道哪一个会先到来。

末日时钟从未像现在这样逼近零点,但是看看你身边的人吧,哪个像末日要来的样子。就像刚刚结束的COP26峰会上,100多个国家签署碳中和碳达峰军令状。所有人都知道如果地球温度上升2度、3度、4度,人类就会完蛋,但没有人愿意放弃当下的狂欢,去为地球降低一度做哪怕一点点事情。

现在的全球金融市场,同样如是。

如果新一轮的新冠变种真的在海外泛滥起来,难道又是一轮放水?然后金融市场会不会把去年的表现重演一遍?

如果真是这样,那可以肯定的是,2022年,大概率也不会变得更好。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。