新病毒奥密克戎确实更厉害,但我们也没必要太恐慌!

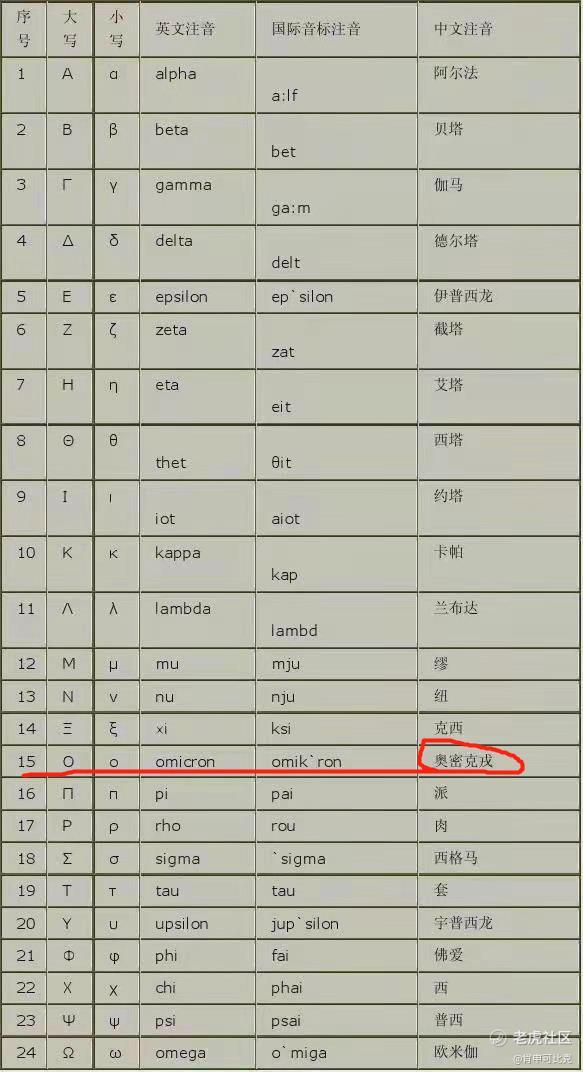

想必周末这两天大家都被南非的新冠病毒变种事件刷屏了,世卫组织26号以24个希腊字母之一的Omicron(奥密克戎)为该病毒命名。

被命名为Omicron(奥密克戎)后,留给病毒的希腊字母并不多了。世卫以希腊字母命名,从侧面也间接认定它可能具有更强的传染性或致死性。更让大家恐慌的是,它可能会使现有疫苗出现无效的风险。

欧美指数应声下跌。

美股,道指跌2.53%;纳指跌2.23%。欧洲各大指数,德国DAX30指数跌4.22%,英国富时100指数跌3.68%,法国CAC40指数跌4.75%。

原油市场也出现暴跌。WTI原油期货一根大阴线,跌逾13%,报68.17美元/桶。

从最早的新冠到后面变异的德尔塔,再到现在的奥密克戎,每次出现新病毒变异都会让大家感到恐慌,这是正常的,人们总会对未知的东西产生担忧,金融市场也不例外,会第一时间反馈在市场的涨跌上。

未知,往往才是最可怕的。。而我们对奥密克戎的了解却少之又少。

但当我们熟悉了解后,对未知的恐惧会慢慢消失,从26号媒体报道到现在仅仅过去了两天时间,大家对新毒株带来的恐慌已经缓冲了好多,也更加理性的分析认知它。

我能理解的是,如果一种病毒的致死率特别高,那么它的传染性就会相对弱,因为宿主死亡了,病毒也就无法传播,典型如埃博拉病毒;同理如果传染性很强,那么它的致死率就会相对弱,典型如流感病毒。

现有消息看,Omicron病毒的传染性是很强的,那么从常理推断致死性应该是相对低的。。

当然这只是我们普通人的认知,权威分析是如何的呢?张文宏专家在微博上分享了一些专业的看法,我把内容大致归纳总结了几点:

1、Omicron的传染性很强基本上可以确定,但重症率和致死率还应进一步观察。(张教授比较严谨,我个人解读致死率应该相对较低)

2、因Omicron突变太多,现有疫苗可能需要推倒重新研发,进而打破全球大部分国家的防疫体系而扩散,从而引发一系列经济、社会问题。(个人分析欧美恐慌的原因就在于此,他们大部分都采取了躺平政策,前提是疫苗有效和大规模普及,一旦疫苗有效性被突破,那么与病毒共存的集体免疫政策也将失效,所以英国、以色列等国家第一时间出台应对政策,美国也将对南非等国实行入境限制。)

3、中国的防疫应急体系和“清零策略”不会让Omicron病毒对国内造成过多影响。(我们国家不搞集体免疫,即使付出更大成本也要严防死守,无论哪个国家人员入境,会无差别执行严厉的隔离“清零”政策,即便有个别漏网,到了国内还有层层隔离防疫制度,不会大范围传播扩散)

后市怎么走?

全球金融市场的动荡,病毒只是个充分非必要条件,核心原因应该是美联储担心通胀更多,加快启动的Taper政策预期,明年6月可能进入加息周期,开始货币紧缩。

加上欧美因疫情的放水政策,使其金融市场一直在高位运行面临调整的压力,病毒只是个宣泄口。

而我们国家近两年的货币政策,即便疫情也没有像欧美那样大放水,近两年A股属于结构性行情,一直在低位震荡运行,下跌空间不大。

这次全球大宗商品的下跌,虽然对我们国家相关的上游原材料企业是利空,但对整个经济是利好的,能够有效解决输入型通胀问题。

我们国家现在PPI指数高涨,已经创造近20年新高,同比涨幅达到了13.5%。国际原油大跌正好给我们相关上游原材料降低成本,等于帮我国降低PPI,从而减少过高PPI向CPI的传导。(PPI为工业生产指数,CPI为居民消费指数,没有专业知识的朋友可以简单将PPI理解为工厂生产价,CPI理解为消费零售价。)

所以如果煤炭、石油、天然气、铁矿等价格都能跌一波,对于我们国家的民生来说真是太好不过了。(现在加个95油都要8元了,我车都快开不起)

过去两年好多人质疑外国大放水为什么中国不放,因为我们国家有效的防疫政策,经济恢复比国外至少早一年周期,所以经济恢复周期不同,疫情中放水多少就不同。

这次事件来看,反而给中国的货币宽松政策,提供了更大的空间。起码未来一年我们的货币政策是宽松而不是更紧。

未来的世界金融方向是,欧美因为更高的通胀压力会有更快的加息预期,全球流动性会持续收紧;而中国未来的货币政策可能会相应的更加宽松,得益于我们优秀的防疫政策,经济恢复的周期没有被病毒打乱太多。

从这个角度看,无论经济还是民生,我们国家都不应该恐慌,该慌的不是我们。。

$腾讯控股(00700)$ $美团-W(03690)$ $拼多多(PDD)$ $小米集团-W(01810)$ $Moderna, Inc.(MRNA)$

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 弹力绳22·2021-11-29这个时候不能大意,谨慎乐观的前提还是要谨慎。2举报

- 低买高卖谁不会·2021-11-29中国这两年不敢放水太多,并不是想要克制,二十之前放多了。2举报

- 玉米地里吃亏·2021-11-29现在这防疫情况来看,确实国内的情况要比外面好很多。2举报

- 哎呀呀小伙子·2021-11-29A股属于结构性行情?结构熊差不多,真不好操作。2举报

- 灯塔国02·2021-11-29很理性的文章,没有像之前很多散布恐慌和焦虑的文章。2举报

- 权力的游戏厅·2021-11-29幸好上周四已经空仓了,要不然现在可能很煎熬。1举报

- 梅川洼子·2021-11-29手头有点点辉瑞的股票,这几天感觉很踏实。1举报

- 迪士尼迪斯尼·2021-11-29这个病毒要是真的能突破现在的防疫治疗体系,恐怕现在的跌仅仅是个开始。1举报

- 刀哥拉丝·2021-11-29确实,这波股市下跌也确实应该不仅仅是疫情的原因,本身股市就应该回调了。1举报

- 以肉克刚·2021-11-29如果又是全球的大危机,恐怕中国也很难幸免遇难。1举报

- 丹尼尔加·2021-11-29单单就防御体系来说,咱们国家应该是全球最全面稳妥的了。1举报