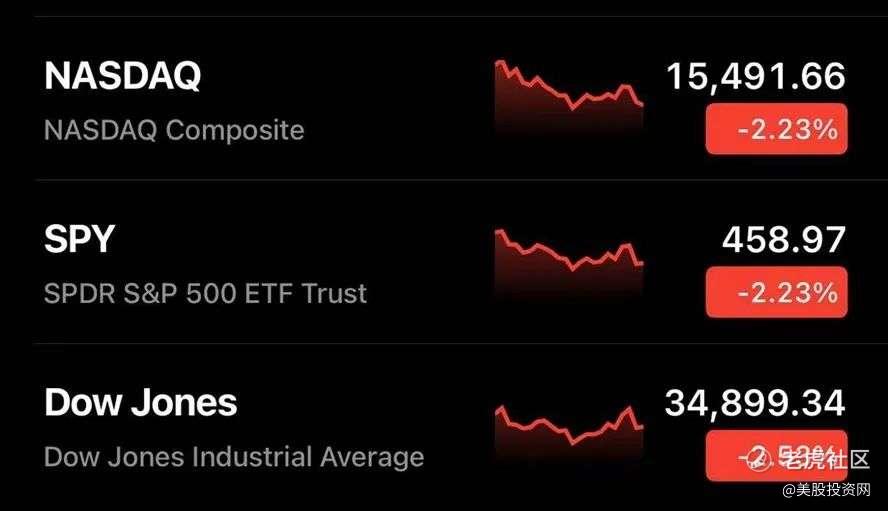

美股遭遇黑色星期五,下周大盘走势分析,机构不会轻易放过MAMATA,美联储进退两难

黑色星期五不仅仅是商品打折,连美国股票也打折了!贷款利率也打折了!

如果不是周五感恩节提前几个小时收市,估计大盘还能跌更多,现在这个长周末假期,算是给交易员和投资者一个喘息和冷静一下的机会,去思考市场是否反应过度激烈,是否华尔街过度紧张?还是空头借此机会收割一波韭菜呢?而散户投资者是否该减仓还是一个抄底的机会?

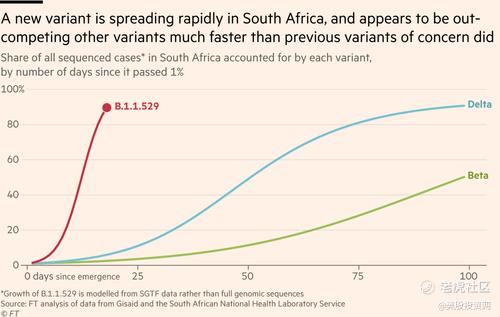

新病毒引起恐慌重要原因 是它的高传播性

B.1.1.529,世卫组织将其命名为Omicron,它是为迄今为止变异最多的新冠变种病毒,新变种总共含有超过50个突变,其传染力与抗疫苗能力远超Delta变异毒株,仅出现两周后,被这一新病毒感染的病例数就占据所有新感染病例数的90%,相比之下,Delta病毒需要3个月才能达到这样的水平。

但是Omicron的症状“不寻常但非常的轻微”,南非国家传染病研究所发表声明称“该病毒的突变不太可能比目前的病毒突变更糟糕,有的疫苗将继续提供高水平的保护力度,有效预防住院和死亡”

就在隔天,美国纽约州州长霍楚宣布纽约州进入“灾难紧急状态”,由于担心德尔塔病毒及新发现的Omicron变异毒株的影响。我们可以推演一下,接下来是否有更多的州份会宣布进入“灾难紧急状态”,不禁为旅游和餐饮业捏一把汗。

市场担忧现在最担心的是

新变种病毒会增加出行限制,影响经济复苏,从而促使市场推迟了对各国央行加息的预期时间,其中,市场将美联储首次加息25个基点的预期时间,从明年6月推迟到明年9月,并认为2023年之前不会有更多的加息次数。推迟加息预期其实是利好美股,但受此消息影响10年期美国国债收益率暴跌,下跌超过15个基点,至1.482%。30年期美国国债收益率下跌逾14个基点,至1.826%。这是2021年最近半年以来最大单日跌幅。

美联储现在的处境非常尴尬

美联储之前说高通胀是短暂的,但通胀现在高居不下,美联储被迫需要以更快的速度缩减购债规模,以控制通胀。但现在疫情又来了这么一出,将可能打击美国经济复苏,所以美国经济将继续需要量化宽松政策,而量化宽松直接影响美债,这也解释了为什么美国国债收益率暴跌,购房的贷款利率再次大跌,导致美国房市将继续火爆。

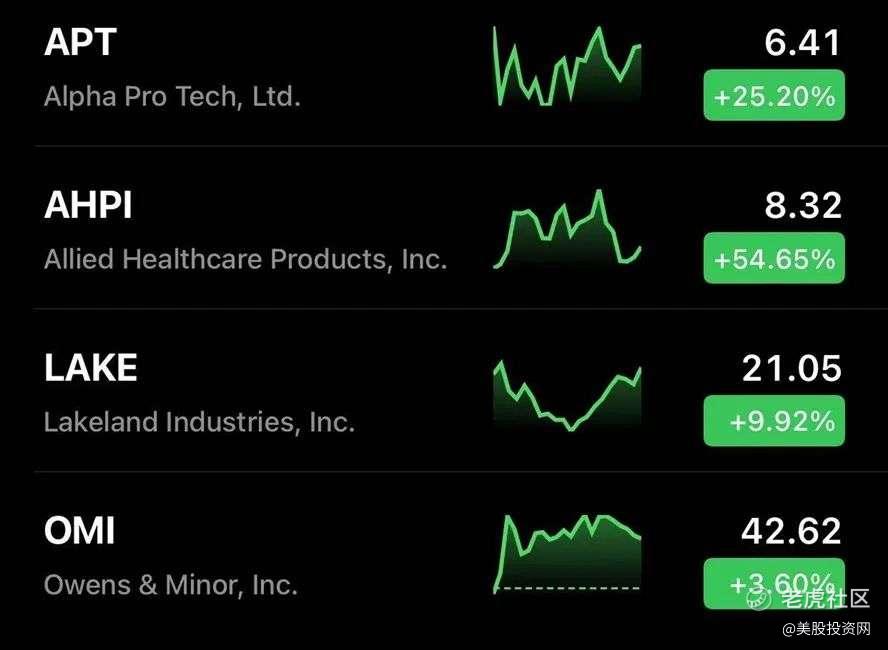

从整体来看,现在就Omicron病毒压力对全球经济造成多大威胁还为时过早,但可以肯定的是,经济重启股,航空、邮轮、博彩类都不是抄底的好机会。本周居家概念股再度被追捧,防疫防护用品股飙升,比如APT 大涨25%, $联合保健产品(AHPI)$ 大涨54%,LAKE大涨9.9%。

疫苗股更是牛气冲天,之前大幅度回调的莫德纳疫苗,$Moderna, Inc.(MRNA)$ 大涨20%,$辉瑞(PFE)$ 触及纪录高位,辉瑞公司的一位发言人在发给彭博社的一份电子邮件声明中证实:“如果疫苗逃逸变种出现,辉瑞和biotech预计能够在大约100天内开发和生产针对该变种的定制疫苗,但需获得监管部门的批准。” 居家和远程概念股也是受到追捧 ZM PTON DOCU TDOC 。

下周美股将继续笼罩在恐慌的情绪中,投资者会非常的谨慎,而且,就像我上面提到的,黑色星期五的卖压还没完全释放完,下周还能跌;而且,刚过去的黑色星期五的销售数据并不能提振投资者的情绪,根据我们美股投资网调研发现,今年因为全球供应链的问题,很多货都积压在东海岸和西海岸的码头,导致很多商家货源不足,让他们仅提供了较小的折扣,今年黑色星期五商家提供的清仓商品是五年或更长时间以来的最低水平。

机构Cowen的分析师在报告中称,许多购物者选择先网购再提货,而不是进店购物。沃尔玛WMT 和塔吉特 TGT 的销售情况会优于其他零售商,部分原因是他们提供的在线购买-到店取货服务。

根据(Adobe Analytics)公司对美国前100家零售商中80个零售商的跟踪数据显示,美国本次黑色星期五的网上销售总额大约是89亿美元,略低于2020年的90亿美元;感恩节当天的网上销售是51亿美元,与2020年持平。

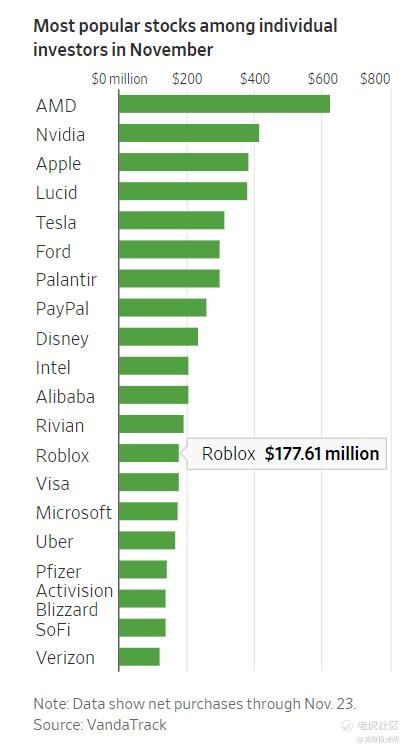

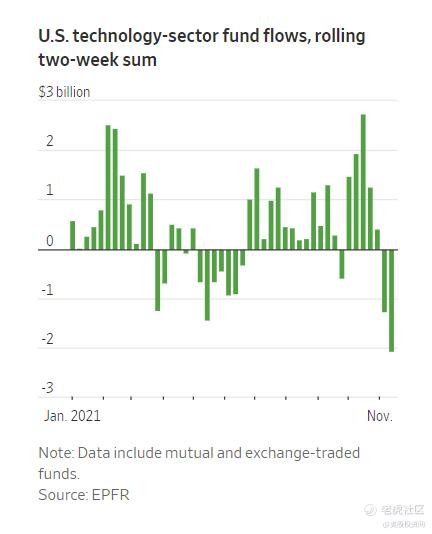

机构是不会轻易放过MAMATA的!!

FAANG已经过时,华尔街已经用新代号MAMATA,facebook的母公司Meta, Apple, Microsoft微软 ,Amazon亚马逊, Tesla和 谷歌的母公司Alphabet,每个公司的市值都在上万亿美元,剔除了市值只有2900亿美元的NFLX。

MAMATA 这六个科技巨头市值加起来占据标普500的比重超过26%,市值高度集中,创下了历史纪录,它们的涨跌直接影响大盘,苹果,亚马逊和特斯拉都是会受到全球供应链影响的,而疫情是利好微软业务。从最近一个季度的机构仓位来看,机构MAMAA的仓位没有太大的变化,只是微调仓,除了特斯拉,华尔街机构在第三季度选择离场,落袋为安。截止9月30日,共有986家机构股东清仓了特斯拉股票,另有333家机构股东进行了减持。以至于在三季度末,特斯拉机构股东数量已从二季度末的2048家减少至1654家,而机构持股总数也从二季度末的3.94亿股减少至1.53亿股,环比下降61.23%。

加上马斯克近日不断高位套现,行使了215万份的股票期权,以10.5亿美元的价格出手了93.41万股股票,11月8日以来,马斯克已经出售了约920万股股票,总价值约98.5亿美元,而他预计总共将出售1700万股,目前抛售计划已经过半。这波操作不禁让人们担忧,是不是马斯克对于特斯拉接下来季度的表现有所顾虑,才会在这高位抛售。

与此同时,大多数散户似乎并不在意,继续涌入成长型股票当中。AMD、英伟达和苹果是本月散户买入最多的三只股票。(AMD是我们唯一的重仓股)

芯片制造商AMD和英伟达在内的18只股票,在过去1年中平均市盈率接近13倍,远超标普500成分股的3倍平均市盈率。

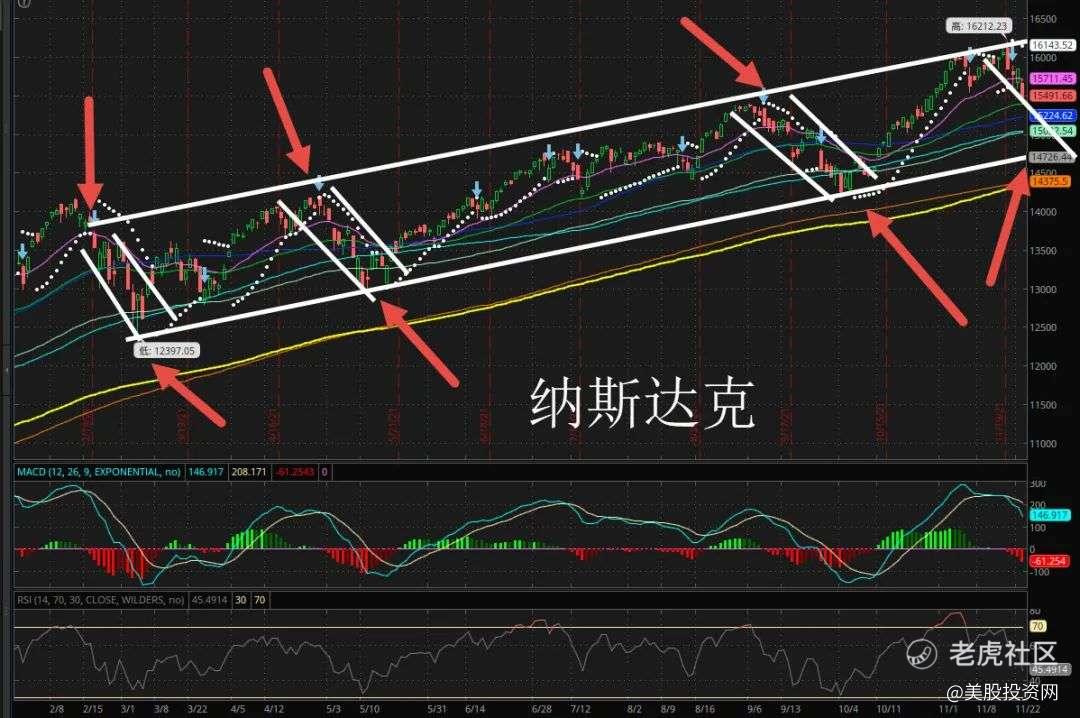

大盘技术面分析

由于多个股票市场处于历史高位,市场正接近超买状态,年末流动性稀少,而且新增新冠病例再次上升,回调似乎合乎逻辑。美股熊短牛长,每次的大跌都是短而急促。这都属于一种健康的调整,是一个逢低买入的机会。

如果周一周二大盘未能吸引机构抄底,那么,纳斯达克将会回调到100天均线上的支撑,在15000点,一旦跌破,纳指将跌到第二支撑在上升通道下方的14726点。故投资者可以考虑对目前仓位进行短期对冲。下周我们会通过自主研发大数据量化终端将会实时监控机构的订单流,掌握他们下单的动态。

下周关键的经济数据

周四有美国截至11月27日当周初请失业金人数,美国上周首次申领失业救济人数减少7.1万人至19.9万人;预估为26.0万人。

周五有美国非农就业报告和美国11月ISM非制造业PMI。预期非农就业人口达56.3万,前值53.1万,失业率则从4.6%跌至4.5%,同时平均时薪亦有所增长。美国10月ISM非制造业66.7,创新高,预期为62,9月为61.9。商业活动、订单、积压等分项指数,对本次ISM非制造业构成提振。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

大A啥也不是!