新季度财报来袭,中概股隧道尽头能看到哪些光亮?【下篇】

京东:各业务线稳步推进,收入稳健增长,未来仍有较大提升空间

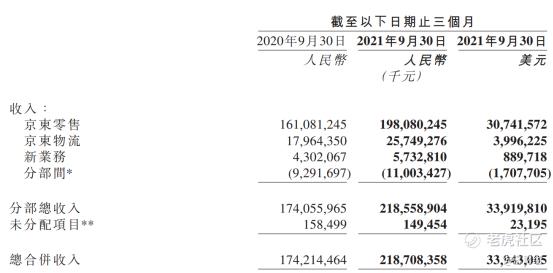

$京东集团-SW(09618)$ 本季度实现收入2187.08亿元,YOY+25.5%,超过彭博一致预期的2156亿元,实现Non-GAAP 归母净利润50.5亿元,YOY-9.2%,超过彭博一致预期额32.6亿元,整体经调整净利率为2.31%,超过彭博一致预期的1.51%,2020年同期为3.19%,公司经营利润率有所下滑主要在于京东新商业和物流业成本投入加大带来的亏损加大,导致整体经营利润率有所降低。

分业务板块来看:

• 本季度京东零售实现收入1980.8亿元,同比增长22.98%;

• 京东物流实现收入257.49亿元,同比增长43.3%;

• 新业务实现收入57.32亿元,同比增长33.24%;

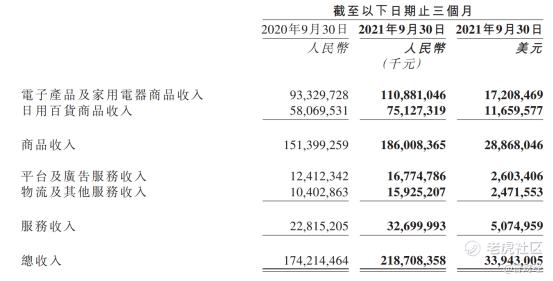

· 本季度,京东实现商品销售收入1,860亿元,YOY+22.9%,服务及其他收入326.99亿元,YOY+43.3%,前三季度全渠道GMV同比增长100%。

· 其中,电子产品及家用电器净收入1108.81亿元,YOY+18.8%,日用百货商品销售收入为751.27亿元,YOY+29.4%,对于阿里巴巴的日用百货商品个位数的增速表现,京东在日用百货销售上的表现无疑更好。

· 平台及广告服务收入168亿元,YOY+35.1%,公司广告收入增长速度超越自营业务增长,主要是因为日用消费品、服装等高佣金率的品类增速提升;物流及其他服务收入159亿元,YOY+53.1%,本季度京东物流的外部客户收入占比继续超过50%,并在本季度再创新高。

用户数据情况

从用户数据来看,本季度新增活跃用户2030万,使得京东的活跃用户数同比增长25%至5.52亿,更为惊喜的是,单用户的平均购物频次,三季度,京东用户的平均购物频次同比提升23%。

京东Q3季报总结:

对比竞争对手阿里巴巴与拼多多,京东本季度的财报无疑是更稳健的,受益于反垄断营造的新格局,以及公司的前瞻性布局,京东目前在自营电商、物流、京东健康、即时零售等领域都构建起深厚的护城河,在消费整体大环境低迷的大背景下,京东本季度无论是日用品销售的表现还是品类的扩张表现都远超行业,而用户增长仍有空间,用户的购买频次本季度表现抢眼,表明京东对于用户的粘性在迅速提升,我们长期维持对京东的看好。

拼多多:收入不及预期,盈利情况有所改善

2021年第三季度未经审计的财务业绩

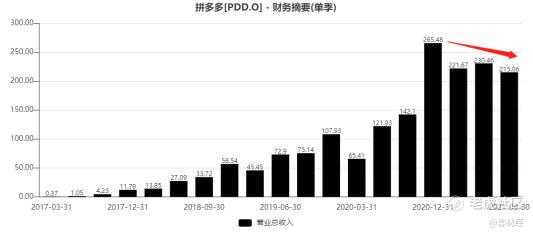

• 总收入为人民币215.06亿元,较2020年同期的人民币142.10亿元增长51%,主要是由于在线营销服务的收入增加。

• 网上营销服务及其他业务的收入为人民币179.46亿元,较2020年同期人民币124.85亿元增长44%。

• 交易服务收入为人民币34.77亿元,较2020年同期人民币13.32亿元增长161%

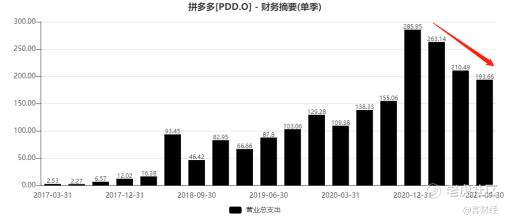

• 销售及市场推广开支为人民币100.5亿元,较2020年同期人民币100.7亿元略有下降。

• 一般及行政开支为人民币3.35亿元,较2020年同期人民币3.686亿元减少9%。

• 研发费用为人民币24.224亿元,较2020年同期人民币18.049亿元增长34%。这一增长主要是由于员工人数的增加和更有经验的研发人员的招聘。

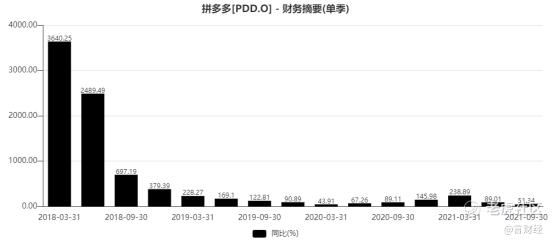

从上图也可以明显看出拼多多的营业支出近三个季度环比已经出现明显的下行,公司明显更加注重效率的提升而不是规模的扩张。

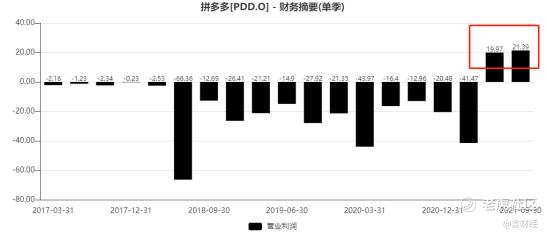

• 本季度营业利润为人民币21.393亿元,2020年同期营业亏损为人民币12.957亿元。本季度非GAAP营业利润为人民币32.607亿元,2020年同期非GAAP运营亏损为人民币3.398亿元。

• 本季度归属于普通股股东的净利润为人民币16.4亿元,而2020年同期净亏损为人民币7.847亿元。本季度归属于普通股股东的非GAAP净利润为人民币31.5亿元,2020年同期为人民币4.664亿元。

可以看到,拼多多已经连续两个季度实现盈利,在营业开支不断降低的同时,公司终于开始稳步的盈利,这也反应在公司的毛利率已经连续三个季度改善,从51.52%提升至69.5%。

• 从用户数据来看,月活用户及年度活跃买家增长均放缓:本季度,平均每月活跃用户数为7.415亿,较2020年同期的6.434亿增长15%,月活用户增长明显放缓,活跃买家在截至2021年9月30日的12个月期间,为8.673亿,比截至2020年9月30日的12个月的7.313亿增长19%。

拼多多Q3季报总结:

拼多多三季度报公布以后,股价暴跌接近16%,三季度虽然公司实现了215.1亿的营业收入,同比也增长了51%,但仍然远低于市场预期的264.7亿元,同时增速也较第二季度的89%有所下滑,同时用户增长也明显放缓,因此导致在国内电商竞争白热化的当下,对拼多多的未来产生了悲观的预期。

而根据业绩会的说法,拼多多董事长兼CEO陈磊表示,继二季度之后,本季度的利润也将全部投入“百亿农研专项”。“我们会将发展重心更多地转向研发,并利用拼多多在技术方面的优势,进一步推动农业数字化。”今年8月,拼多多设立“百亿农研专项”,宣布将第二季度及未来几个季度可能有的利润优先投入该专项。9月底,“百亿农研专项”获得了股东大会的批准。在第二季度利润全部投入该专项之后,拼多多本季度全部利润将继续投入该专项,进一步推动农业科技普惠。

由于在农业领域的巨大投入短期很难盈利而且趋势难以判断,在国内电商竞争仍在加剧的当下,对于拼多多我们也暂时持观望的态度。

小米集团:收入增速受困于手机出货量减少,互联网增速亮眼,毛利率与ASP提升

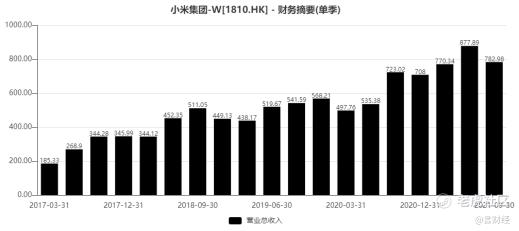

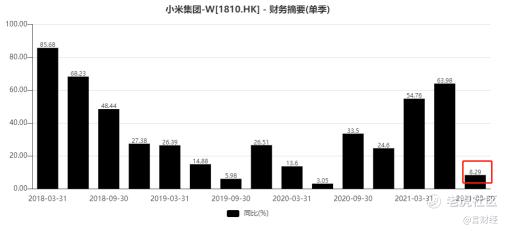

本季度,$小米集团-W(01810)$ 实现收入781亿元,同比增长8.2%;Non-Gaap净利润达到52亿元,同比增长25.4%,受困于供应链的短缺,本季度小米的手机出货总体不及预期,但受益于手机单机的提升及互联网收入增速的提升,本季度毛利率持续改善,净利润增速快于收入增速。

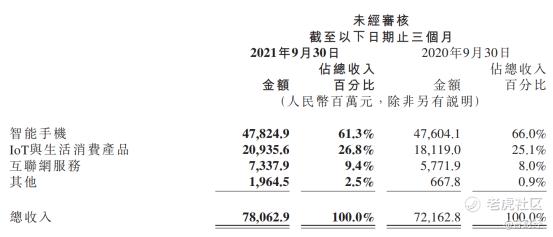

² 分业务来看:

1. 智能手机

智能手机分部收入由2020年第三季度的人民币476亿元增加0.5%至2021年第三季度的人民币478亿元。智能手机出货量由2020年第三季度的4660万台减少5.8%至2021年第三季度的4390万台,主要是由于全球核心零部件(包括SoC(片上系统))供应短缺。

智能手机的平均售价(「ASP」)由2020年第三季度每部人民币1,022.3元上升6.7%至2021年第三季度每部人民币1,090.5元。 ASP上升主要是由于2021年第三季度高端智能手机出货量增加所致。

智能手机分部毛利率由2020年第三季度的8.4%升至2021年第三季度的12.8%,主要是由于智能手机ASP增加6.7%。同时,每部手机的成本保持稳定。

2. IoT与生活消费产品

IoT与生活消费产品分部收入由2020年第三季度的人民币181亿元增加15.5%至2021年第三季度的人民币209亿元,主要是由于2021年8月推出的小米平板5 系列广受欢迎及智能电视及空调的销售额增加所致。智能电视及笔记本电脑的收入由2020年第三季度的人民币59亿元增加20.3%至2021年第三季度的人民币71亿元,主要是由于大屏电视产品组合进一步拓展(包括小米电视大师77”OLED及Redmi MAX 86”)及智能电视ASP上升所致。

AIoT连接设备数首次突破4亿,同比增长33%%;五件以上连接至公司AIoT平台的设备用户超800万,YOY+42.8%。(统计均不含智能手机、平板、PC)。

IoT与生活消费产品分部毛利率由2020年第三季度的14.2%降至2021年第三季度的11.6%,主要是由于产品组合及若干核心零部件价格上升所致。

3. 互联网服务

互联网服务分部收入由2020年第三季度的人民币58亿元增加27.1%至2021年第三季度的人民币73亿元,主要是由于公司广告及游戏业务增长所致。 2021年第三季度,得益于预装及全球用户规模扩大,小米的广告业务季度收入再创新高,达人民币48亿元,同比增加44.7%。境外互联网收入达15亿元,YOY+110%,占总互联网服务收入上升至19.9%,创历史新高。

2021年9月,MIUI的月活跃用户同比增长32.0%至485.9百万人,其中中国大陆的月活跃用户人数同比增长16.4%至127.3百万人。

互联网服务分部毛利率由2020年第三季度的60.4%升至2021年第三季度的73.6%,主要是由于广告业务收入占比增高,且金融科技业务的毛利率上升。

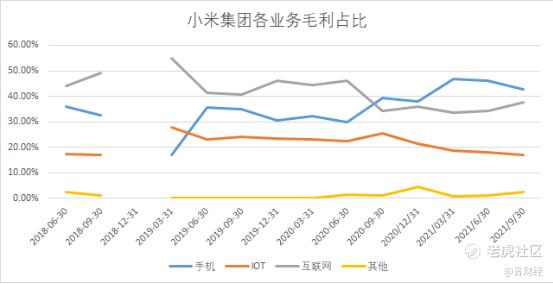

小米集团Q3季报总结:

三季度小米的业绩总体表现符合预期,因为供应链短缺,公司的智能手机分部收入总体不及预期,展望未来,在手机领域,小米面临的竞争依旧激烈,国内OV及荣耀持续强势,而在国外,小米的渗透空间已经较为有限,在高端领域与苹果抗衡的可能性较小,对于小米的智能手机业务,我们持比较谨慎的态度。

本季度,小米较为惊喜的点在于互联网收入的表现,在整体的业务毛利占比提升,手机的毛利占比则开始走低,互联网收入的提升有利于提升小米整体的毛利率及平滑整体的收入,因此,对于小米来说,未来互联网的变现是最大的看点之一。

AIOT,则保持较为稳健的增长,未来小米将继续优化产品组合,继续改进产品制造和品类,比如智能家电、冰箱、pad等反馈好的产品。AIot产品线丰富多样,预期未来业务会继续增长。

小米已经宣布2024年将量产第一批电动汽车,未来,从生态的角度,对于小米汽车还是存在一定的期待。

短期来看,连续下跌之后,小米的估值已经不贵,但是未来两三个季度公司的收入仍难有大规模的起色,如果新的变异病毒再度肆虐对于小米的海外业务来说会有比较大的影响,短期我们对小米持谨慎观望的态度,长期公司的看点在于互联网收入的持续提升以及电动车的远期期权。

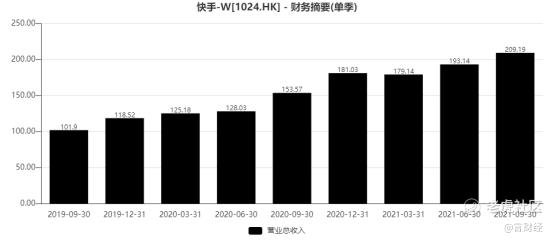

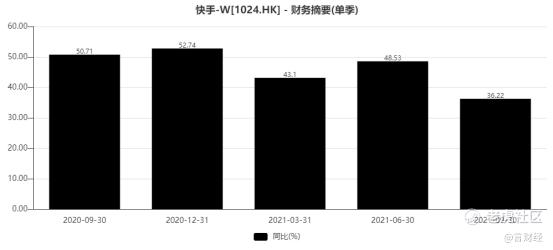

快手:粘性提高,电商和营销发力变现

$快手-W(01024)$ 本季度实现收入206.19亿元,YOY +36.22%,本季度营销收入表现亮眼,部分运营数据也表现相当不错。

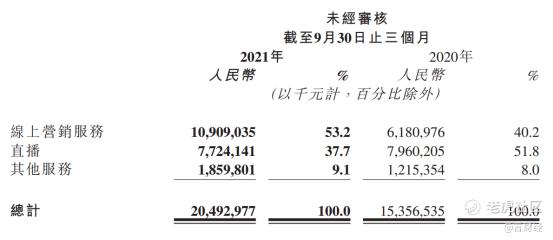

线上营销、直播与其他服务,收入占比分别为53.2%/37.7%/9.1%,直播收入占比继续下降,营销收入占比则提升至超过50%,成为公司的主要收入来源。

1. 线上营销服务:

线上营销服务收入由2020年同期的人民币62亿元增加76.5%至2021年第三季度的人民币109亿元,主要是由于流量增长以及广告主数量增加,这得益于广告精准度以及广告主的用户体验提升。

2. 直播:

2021年第三季度直播业务收入为人民币77亿元,2020年同期为人民币80亿元。

3. 其他服务:

其他服务收入由2020年同期的人民币12亿元增加53.0%至2021年第三季度的人民币19亿元,主要受电商业务的增长推动,本季度快手电商实现GMV为1758亿元,YOY+86%,其中快手小店的闭环交易的GMV占比持续提升至91%,主要因为快手投入了更多资源和精力在底层基础设施建设,逐步提升了电商直播的日活渗透率,并不断扩充SKU,丰富供给,提升匹配效率,强化用户体验,同时逐步提升了电商的曝光。

服务商体系的建设也是快手电商发展的重点之一,三季度开始大力发展品牌基地、战略服务商,快手的服务商绑定商家支付GMV占大盘比持续提升,有效的帮助了快手商家提升专业化、系统化的运营能力。此外,在品类扩张方面,公司将更多商品引入官方优选平台好物联盟,做更精细化的匹配优化,三季度好物联盟GMV占比持续提升,并持续加大了对品牌电商的投入,品牌GMV领涨电商大盘,在服饰、快销、数码、家电、珠宝玉石等主力行业都做出了成功的案例。越来越多的品牌入驻快手平台。

三季度,公司继续加大对信任电商的投投入,推出更多用户体验的保障措施,加强平台治理。月度ARPPU持续增长,今年9月快手电商月复购率进一步提升至70%以上。

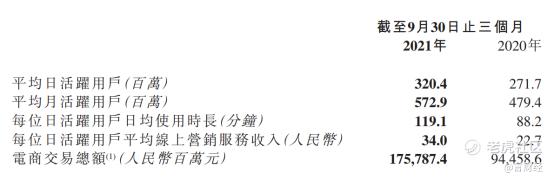

用户数据:本季度,快手应用平均MAU达到5.72亿,YOY+19.5%,,平均DAU达到3.204亿,YOY++17.9%,单季度净增6670万。主要是公司不断优化用户获取效率以及留存率情况,不断深化与拓展内容、商品及服务供给,和持续完善行业领先高效个性化内容推荐技术。

运营亮点:

1. 本季度快手应用的日均流量同比增长近60%。

2. 持续加强平台特色社区氛围和社交属性建设,本季度快手DAU/MAU比例在55.9%,基本维持稳定,表明用户的粘性已经较强。在用户使用时长方面,2021Q3快手日活跃用户日均使用市场为119分钟,同比+35%;

3. 持续进行内容侧的建设,优化内容分发策略,快手短剧在Q3的DAU达2.3亿, 累计观看量超过1亿的短剧超过了850部;

4. 体育内容也是从去年开始着重投入的内容垂类,Q3体育类内容消费较去年同比增长超过150%。

快手Q3季报总结:

快手作为今年恒生科技指数里面表现最差的公司,上市以后市值从一万多亿跌至目前不足四千亿,让市场对于快手的前景担心明显提升,从快手DAU/MAU的比率来看,快手对于用户的粘性确实是在稳步提升的,在日均使用时长方面,快手21年相比20年还在提升,根据相关数据公司披露的数据显示,日均使用时长占比方面,快手由去年同期的7.9%提升至今年的10.5%,提升明显。

中长期,我们仍然看好短视频赛道,三季度的增长也给了快手实现中长期实现4亿DAU目标的信心。用户和时长增长主要因为提供了更多的内容、商品和服务。内容侧,泛知识垂类推出了泛知识辩论赛,短剧、体育的观看量和时长也有很好提升;商品侧,引入新的品类丰富用户选择;服务侧,积极探索更多场景视频化机会,同时针对公私域特点,持续提高分发效率,提高用户的消费体验,最近也在单列上下滑中增加了更多关注创作者的内容,一方面加强了用户对感兴趣内容的推荐,另一方面也加强了公私域流量的转化。流量目前的增长比预期节奏更快,未来会以用户需求优先,持续迭代发展策略。

在广告侧,三季度快手广告表现优异:广告监管和宏观经济下滑的背景下,一些广告主收缩、调整了预算。但是公司的广告增速快于行业,持续获取了更多市场份额。原因在于:1)短视频行业整体在广告主处获得了更多的青睐,叠加公司的社交平台和内容社区定位,公私域流量的组合,有一定的广告主预算倾斜。平台自身来看,Q3流量增长强劲,助力广告业务保持高速发展,随着广告素材和推荐能力优化,Q3公司广告加载率仍按计划小幅提升,并开设了新的广告位。2)广告系统和产品不断迭代,小店通和粉条打通形成磁力金牛,客户可以同时在公私域投放,提高决策效率,在流量基础上释放出更多广告位。3)销售和服务能力提高,积极扩大行业覆盖,优化直营和代理渠道管理,同时快手正在逐步得到品牌广告主认可;4)快手为广告主提供了内生闭环的交易生态,大体量电商GMV使得快手在有条件的环境中保持自己的增长节奏。长期对自身广告业务增长保持信心,快手目前广告业务市占率仍有很大空间,未来会加强用户体验优化、对广告主的赋能以及自身变现能力的提升。

在变现方面,快手也在不断降低直播的收入占比,在线上营销与其他服务的收入占比不断提升,在2021年营销已经成为快手的最大收入来源,展望未来,快手能否借助高粘性在兴趣电商与线上营销打开更大的增长是未来最大的看点所在。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 咪咕蜡·2021-11-29京东的新业务指的是啥,增长了33%,看起来很有机会点赞举报

- 不看不亏·2021-11-29华为发展受阻,这应该是小米冲击的好时候,怎么还发货量减少了点赞举报

- 维克多1·2021-11-29拼多多专注农业,这一点很可能会减少现期收入,但我无比看好未来发展点赞举报

- 山头的小猪·2021-11-29快手有做什么调整嘛?用户日均使用时长增比还蛮多的点赞举报

- 超跌反弹NS·2021-11-29拼多多目前进入增速放缓的阶段,也是可以理解的吧?点赞举报

- 此时不买更待何时·2021-11-29小米什么时候才能支棱起来,已经在低位好久了点赞举报

- 抄底反弹·2021-11-29抛开外界因素,但看业务,京东有别人没有的物流渠道,这一点就很牛了点赞举报

- 霎风雨·2021-11-29京东的营收柱状图看起来就很让人放心,看好京东点赞举报

- XD绿意盎然·2021-11-29中概股的崛起还得是看阿里巴巴,不过现在疫情,应该没啥机会了1举报

- 王无所不知·2021-11-29Q2的时候我还不是很看好快手,Q3的数据有点吃惊点赞举报

- 涛声依旧1·2021-12-01好点赞举报

- sunny阳·2021-11-306点赞举报