新季度财报来袭,中概股隧道尽头能看到哪些光亮?【上篇】

导读:

近两周,国内互联网巨头陆续披露了最新季度的业绩,交卷完毕,从完成质量来看,几家欢喜几家愁。在反垄断及经济下行加大的当下,头部互联网巨头$腾讯控股(00700)$、$阿里巴巴(BABA)$本季度的业绩都差强人意,二线互联网$美团-W(03690)$、$京东(JD)$、$网易(NTES)$业绩保持稳健增长,算是业绩表现较好的代表,而拼多多业绩几乎就直接掉队,业绩披露后股价也出现了暴跌,三线互联网公司快手本季度业绩表现相对较好,而$百度(BIDU)$、$哔哩哔哩(BILI)$等本季度的业绩较差,让投资者担忧加重,业绩出来后百度、哔哩哔哩股价也都出现了暴跌,在互联网巨头们低迷的表现之下,恒生科技指数表现低迷,持续震荡探底。

新季度财报来袭,中概股隧道尽头能看到哪些光亮?在平台经济反垄断纵深推进的第二个完整季度,互联网巨头们的经营都面临了或多或少的压力,业绩公布后股价表现也大相径庭,总体来看,本季度,中概股巨头们业绩表现最好的是京东、美团、网易与快手,后文会结合新季度的业绩具体分析。

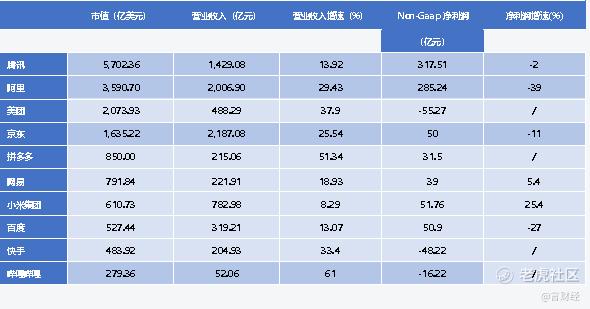

(一) 2021年第三季度,从收入增速来看,哔哩哔哩与拼多多收入增速超过50%,哔哩哔哩收入单季度增速61%,拼多多收入单季度增速51.34%,其次,美团收入单季度增速37.9%,快手收入单季度增速33.4%,阿里收入单季度增速29%(若不考虑高鑫零售的并表因素,则增速为16%),京东收入单季度增速25.54%,而本季度网易、腾讯、百度收入增速均不到20%,小米集团收入单季度增速为8.29%,收入小米垫底,尽管净利润表现超预期,但是收入端的严重放缓还是导致小米股价在业绩发布后重挫创近半年新低。

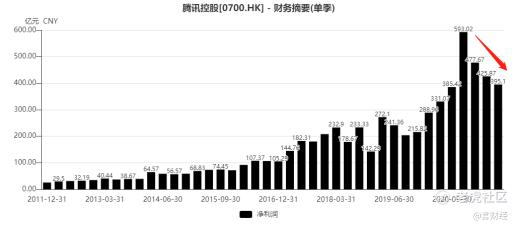

(二) 从净利润来看,本季度,巨头们净利润增速都差强人意,在反垄断的压力之下,互联网的经营压力都有所加大,竞争也在加剧,尤其是电商及互联网广告行业,竞争空前激烈,腾讯单季度的Non-Gaap净利润甚至近年来首度负增长,阿里本季度Non-Gaap净利润同比-39%,百度本季度Non-Gaap净利润同比-27%,网易与京东本季度净利润表现相对较稳定,小米本季度伴随互联网收入的提升以及手机ASP的提升,毛利率与净利率有所提升,净利润表现超预期。

(三) 从用户增速来看,美团与京东的用户增长最好,而阿里、腾讯、拼多多的用户增长红利已经接近尾声,阿里目前用户增速最快是淘宝特价版。

接下来,挑选重点公司结合新季度的业绩进行分析:

腾讯:单季度收入创十年新低,金融科技及企业服务增速各业务最快

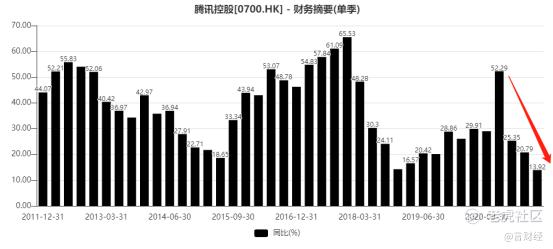

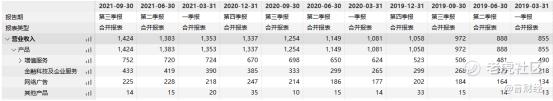

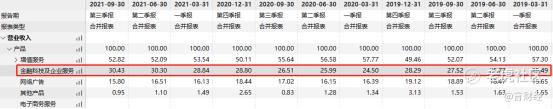

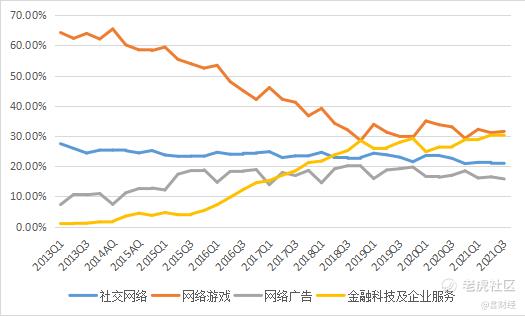

• $腾讯控股(00700)$ 腾讯(0700.hk):3Q21 公司实现营业收入1423.68亿元(+ 13%yoy);归母净利润达到395.10亿元,同比增长3%,非公认会计准则下的归母净利润317.51亿元(-2% yoy),公司业绩总体来看,全面放缓,分业务来看,广告、游戏等业务总体受累于行业增速低迷,金融科技及企业服务成腾讯最大的收入来源,增速在所有业务中也是最快的。

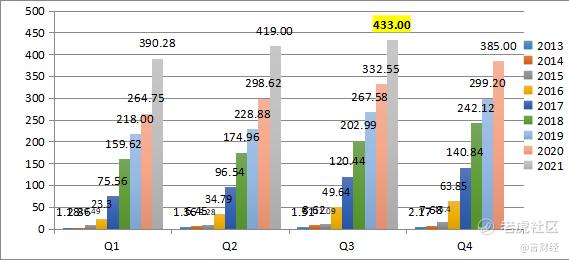

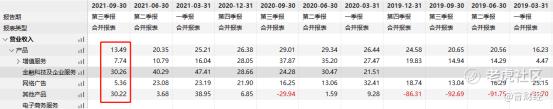

从季度收入增速来看,本季度腾讯收入增速为13.92%,这个增速已经创了腾讯近十年最低的收入增速,增速甚至低于2018年4季度版号被禁时候的单季度增速,腾讯收入已经连续三个季度明显放缓。

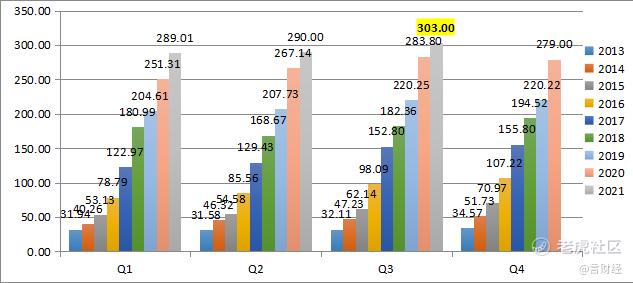

从各业务的表现来看:

1. 本季度增值服务实现收入752亿, YOY+7.74%,单季度收入增速自2019年Q1以来首次降入个位数增长区间,创近十个季度新低。

其中国内游戏市场实现收入336亿元,YOY+5%,海外游戏市场实现收入113亿元,YOY+28%,社交网络收入实现收入303亿元,YOY+7%;

2.金融科技及企业服务实现收入433亿,YOY+30.26%,收入增速在各业务中最高

但是同比增速相较于上两个季度的47.41%、40.29%则明显放缓,我们预计主要是受困于实体经济的下滑及消费数据的低迷,金融支付增速有所放缓,在企业服务领域,腾讯的CRM SaaS解决方案-腾讯企点已经服务了超过100万家企业,并愈来愈多地被大中型企业采用。腾讯企点为客户提供全天候多渠道的人工智能客户服务,帮助企业客户显著降低客服成本。腾讯的数据库PaaS解决方案-TDSQL现已服务超过3,000家客户,横跨金融、公共服务和电信等多个垂直领域。在金融行业垂直领域,TDSQL服务中国前十大银行中的六家,且愈来愈多金融机构在其核心系统中采用TDSQL,体现出对腾讯的数据安全性、可靠性及一致性的信任。

3. 网络广告实现收入225亿元,YOY+5.36%,从增速的角度,创近三年的新低。

本季度广告收入放缓主要是因为教育培训、保险及游戏行业的广告需求低迷所导致,其中,社交及其他广告实现收入190亿,YOY+7%,而媒体广告实现收入35%,同比-4%,主要是腾讯新闻应有的广告收入减少所导致。

l 腾讯Q3季报总结:

总结来看,本季度腾讯在反垄断规范的压力之下,收入增速创下近十年的单季度新低,Non-Gaap净利润增速也罕见转负增长,各业务来看,游戏受困于持续升级的游戏管控及版号的延迟,增速放缓,广告收入则因为教培、保险及游戏等广告投放大户的收入大幅度降低而出现明显放缓,金融科技及企业服务再度成为本季度业务最大的亮点,腾讯的业务更加多元化,金融科技及企业服务占比不断提升,未来将成为主要收入增长的主要驱动力。

在腾讯的发展历程中,公司的主要业务来源在不断的变化,在PC时代,主要是QQ增值服务及端游,而在移动互联网时代,微信发力,手游逐步成为公司业务主要增量的来源,尤其是王者荣耀等爆款手游给腾讯带来了收入体量上的又一次飞跃,而在2018年国家对游戏版号的控制趋于严格以后,腾讯的B端业务开始加速发展,云计算、微信支付、广告、小程序等业务齐头并进又将腾讯的收入带到了一个新的水平。

我们认为以金融科技与企业服务为代表的B端业务发力将使得腾讯来自金融科技与企业服务的收入即将超过网络游戏业务,成为腾讯的下一个业务的爆点,我们仍然看好金融科技与企业服务,腾讯与阿里差异化竞争,围绕微信与企业微信,腾讯正在软的层面(PAAS层面)建立属于自己的壁垒。

展望未来,对于腾讯而言,我们认为腾讯的B端业务正进入到加速期,小程序生态的变现才刚刚进入到加速期,围绕微信的小程序私域流量电商、广告仍会保持加速发展,也会反过来促进支付及云计算业务的发展,广告、金融科技及企业服务的发展还远未到天花板,而在云计算与元宇宙世代,腾讯的业务在阵痛之后也存在很大的预期差。

虽然,本季度腾讯的业绩受困于各种外在的环境变化而显得差强人意,作为社交与元宇宙游戏的最大平台,腾讯阵痛以后,仍值得重点关注。

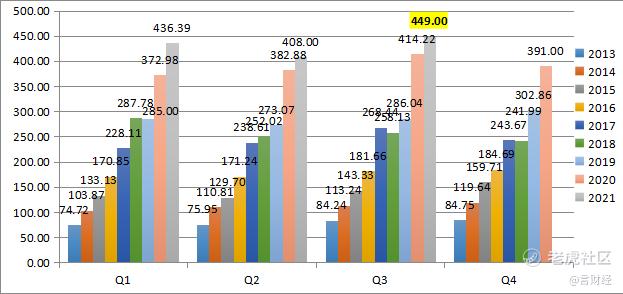

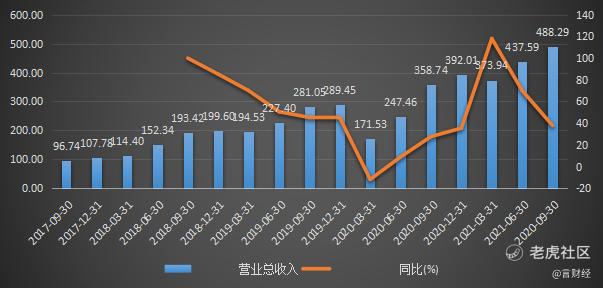

美团:本季度继续创历史新高,外卖与到店业务保持稳定,新业务仍在加大投入

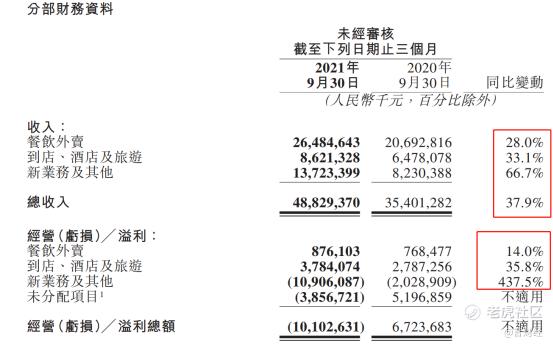

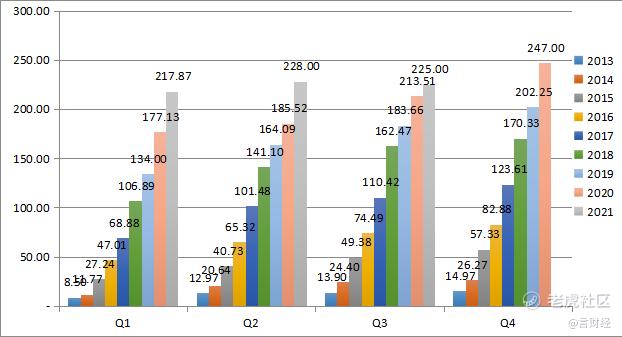

$美团-W(03690)$ 本季度实现收入488亿元,创上市以来单季度收入最高值同比增长37.9%超过彭博一致预期的485.73亿元,Non-Gaap净利润为-55.3亿元,本季度亏损有所扩大,从业务分部来看,新季度美团外卖占比为54.2%、到店业务占比为17.7%、新业务占比为28.1%。

l 分业务数据分析:

1. 外卖业务:

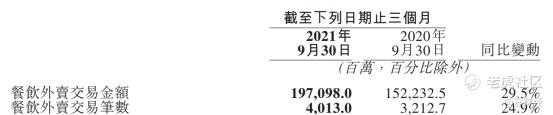

• 本季度,美团外卖实现收入264.85亿,YOY+28%,本季度实现GMV为1971亿,YOY+29.5%,从利润端来看,本季度外卖实现经营利润8.8亿,因为用户激励及营销投放增加,本季度美团经营利润率有所降低,同比降低0.4%(3.7%→3.3%)。

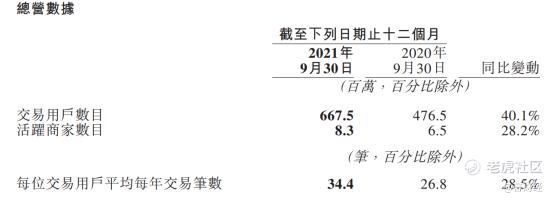

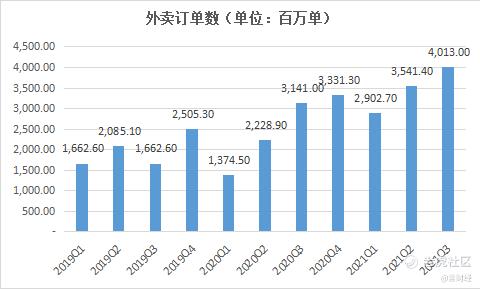

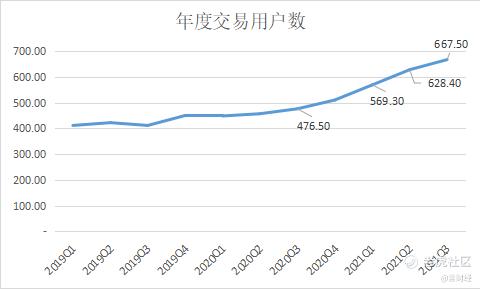

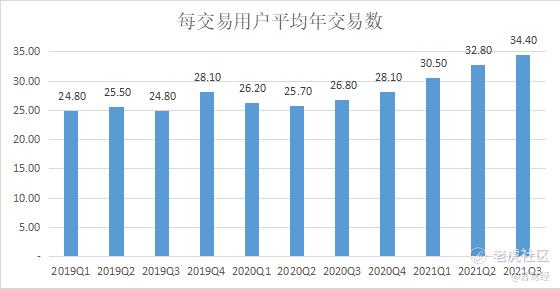

• 从用户增长来看,本季度美团的年均交易用户YOY+40.1%至6.7亿,用户增长依旧强劲,本季度实现订单量40.13亿,YOY+24.9%,本季度的ARPU同比小幅度增长3.6%至49.1元,而单用户本季度交易次数为34.4次,同比与环比均有明显提升(2020Q3为26.8次,21Q2为20.7次);

• 从GMV来看,本季度美团实现外卖GMV1971亿,YOY+29.5%;

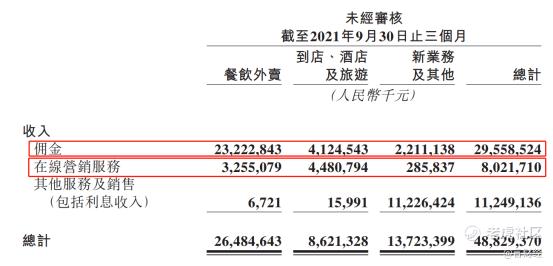

• 从外卖业务的收入构成来看,佣金收入依旧是绝对大头,本季度实现外卖佣金收入232.2亿元,YOY+27.2%,收入占比为87.7%,实现营销收入为32.6亿元,YOY+35.2%,收入占比为12.3%。

2. 到店、酒店及旅游业务

本季度,美团到店、酒店及旅游业务受惠于医疗、宠物、亲子、健身和休闲娱乐品类的带动,加强了商户的覆盖率并覆盖了更广阔的低线市场,本季度实现收入86.21亿元,YOY+33.1%,经营利润为37.84亿元,YOY+35.8%,经营利润率为43.9%,同比略增0.9%。

· 本季度,美团酒店的间夜量为1.198亿,YOY+5.2%,公司在高星酒店方面继续增加平台供应,对于低星酒店,则通过加快数字化进程和线下流量转换,进一步渗透低线市场。

· 从业务结构来看,本季度美团的到店酒旅业务实现营销收入44.8亿元,YOY+ 42.4%,实现佣金收入41.2亿元,YOY+ 24.2%;

3. 新业务

· 本季度,美团实现新业务收入137亿元,YOY+66.7%,新业务亏损有所扩大,单业务亏损近109亿元,美团零售业务持续扩张,投入不断加大。

· 从业务结构来看,本季度新业务实现佣金收入22.1亿,YOY+ 42.1%,其他服务及销售收入112.3亿,YOY+ 70.9%;

美团Q3季报总结:

从美团本季度的表现来看,本季度美团的增长依然稳健,相较于友商(阿里的饿了没、其他社区团购),美团的业绩明显更优,从新增年均活跃用户来看,美团的渗透率还在不断提升,平均交易次数还在大幅度增长,本地生活巨头的无边界扩张还在继续,用户还未到天花板,而美团打车、社区团购等新业务也在不断加速发展中,我们对美团未来的发展仍保持乐观,阵痛后可以逢低布局。

从外卖单数来看,Q3的外卖订单数创下单季度新高,表明美团的扩张还在继续,在低线级城市不断下沉,全面推升了美团的外卖规模。

三季度美团餐饮外卖的经营利润率环比二季度的10.58%大幅度下行至3.31%,主要是餐饮外卖分部的经营溢利由2021年第二季度的人民币24亿元减至2021年第三季度的人民币8.76亿元,该分部的经营利润率环比由10.6%减至3.3%,金额及占收入百分比减少主要由于季节性配送补贴(高温、台风、暴雨等极端天气在三季度较多)增加所致。

本季度的年度活跃交易用户为6.675亿,环比上个季度增加3910万,同比去年Q3则增加1.91亿,相较于年初则增加1.569亿,这个年度用户数的增长,在所有大的平台型公司里面是最多的,继续超越市场预期。

平台上的粘性持续提升,反应在平均每个交易用户的年交易数从2020Q3的26.80次提到了34.40次。

因此,从以上几个关键数据可以看到,美团的无边界扩张还在继续,用户还未到天花板,而美团打车、社区团购等新业务也在不断加速发展中。

阿里巴巴:电商基本盘受冲击严重放缓,云计算与新零售仍是未来最大的看点

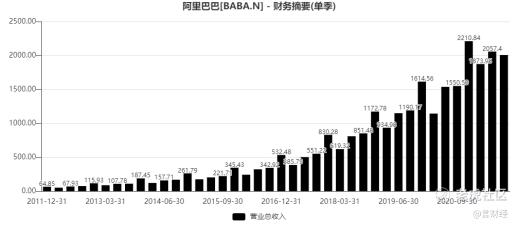

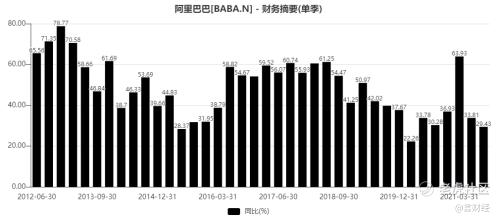

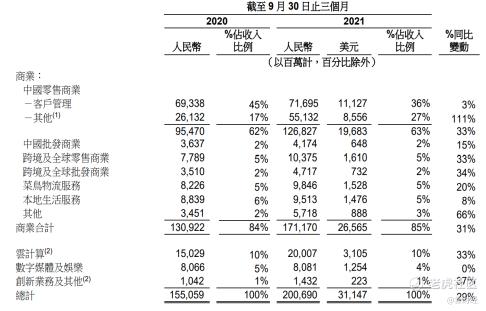

本季度$阿里巴巴-SW(09988)$实现收入2006.9亿元,同比增长29%,如果不考虑高鑫零售的并表,则收入同比增长16%至1804.38亿元。

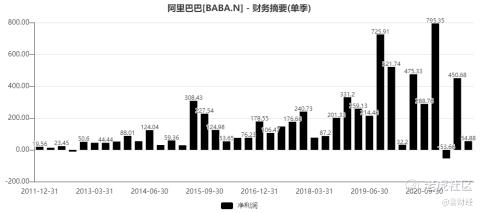

本季度实现经营利润150.06 亿元,同比增长 10%,主要由于与蚂蚁集团股权激励相关并授予公司员工的股权激励费用下降人民币 156.90 亿元。股权激励费用未计入非公认会计准则财务指标。经调整 EBITDA,同比下降 27%至348.40 亿元。经调整 EBITA,同比下降 32%至280.33 亿元,同比减少主要由于阿里巴巴对正展现稳健业务增长的关键策略领域投入的增加,以及支持商家的举措。本季度,公司于商业分部内的关键策略领域,例如淘特、本地生活服务、社区商业平台及 Lazada的投入同比增加人民币 125.75亿元。实现Non-Gaap净利285.24亿元,同比下降39%,表现较差。

分业务情况:

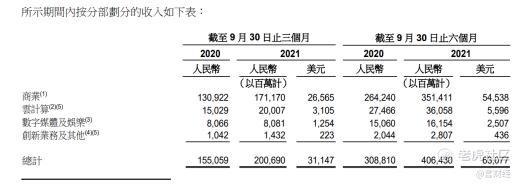

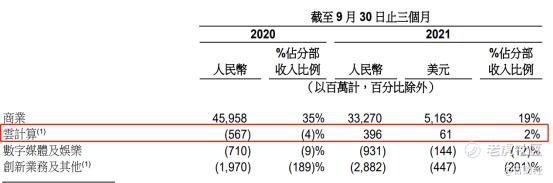

(1) 商业的收入主要来自中国零售市场、高鑫零售、盒马、1688.com、Lazada、速卖通、Alibaba.com、菜鸟物流服务及本地生活服务。

(2) 云计算收入主要由提供弹性计算、数据库、存储、网络虚拟化服务、大规模计算、安全、管理和应用服务、大数据分析、机器学习平台及物联网等服务所产生。

(3) 数字媒体及娱乐收入主要来自优酷、阿里影业以及其他娱乐业务。

(4) 创新业务及其他收入主要来自高德、天猫精灵及其他创新业务。其他收入亦包括自蚂蚁集团及其关联方收取的中小企业贷款年费。

(5) 自 2021 年 4 月 1 日起,阿里巴巴把钉钉业务的业绩由创新业务及其他分部重分类至云计算分部。

分业务来看,核心商业增速放缓严重,尤其是客户管理部分的收入同比仅增长3%,本地服务、数字媒体与娱乐、菜鸟物流及创新业务表现也比较差,云计算算是阿里本季度的亮点,同比增长34.28%,环比提升4.26%。

• 核心商业:剔除并表因素,放缓严重,客户管理收入同比仅仅增长3%,创下近年来最低增速

本季度,阿里巴巴来自中国零售商业的收入为人民币1268.27亿元,同比2020年同期的954.7亿元增长33%,但是客户管理收入同比仅仅增长3%,连续放缓,主要原因是来自市场状况放缓及中国电商市场上参与者增多而导致实物商品GMV同比录得单位数增长,这也表明,当下电商的竞争越来越白热化,而在社会零售增速保持低迷的情况下,阿里的增长也难以避免的大幅度放缓。

中国零售商业业务项下的「其他」收入为人民币551.32亿元,相较2020年同期的人民币261亿元同比增长111%,该增长主要来自合并高鑫零售,以及如天猫超市及盒马的直营业务的贡献所驱动。

• 中国批发商业

本季度,中国批发商业收入为人民币41.74亿元百万元(648百万美元),相较2020年同期的人民币36.37亿元增长15%。增长的主要原因是来自1688.com平台付费会员的增值服务消费上升。

• 跨境及全球零售商业

本季度,跨境及全球零售商业收入为人民币103.75亿,同比增长33%。增长的主要原因是来自Lazada和速卖通的收入增长;跨境及全球批发商业收入为人民币47.17亿元,同比增长34%,增长的主要原因是来自Alibaba.com付费会员数量的增加和付费会员的平均收入的上升,以及与跨境业务相关的增值服务收入的增长。

• 菜鸟物流服务

本季度,菜鸟网络物流服务收入主要来自其国内及国际一站式物流服务与供应链解决方案,抵销内部交易的影响后合计为人民币98.46亿元,同比增长20%,总体表现一般,增长的主要原因是快速发展的跨境及全球零售商业业务所带来的已履约的订单量的增长。

• 本地生活服务

本季度,本地生活服务收入主要来自饿了么的平台佣金、提供配送服务收取的服务费及其他服务费,抵销包括为新零售业务提供服务在内的内部交易的影响后合计为95.13亿元,同比仅仅增长8%,与美团的收入增速相比,表现较差,侧面印证,在本地生活这个赛道上,饿了么仍然在持续被美团抢占市场份额,与美团的差距也越拉越大。

• 云计算

本季度,阿里云计算分部的表现是阿里众多业务中表现相对较好的,单季度实现收入200亿元,首次突破200亿营收大关,同比环比均有不错的增长,主要由互联网、金融服务和零售行业客户收入的强劲增长所推动。

本季度,云计算分部实现盈利,云计算本季度经调整 EBITA 为盈利人民币3.96亿元,而2020 年同期为亏损人民币5.67亿元,主要因实现规模经济效益所致。

展望未来,我们认为云计算仍是阿里的最大看点所在,伴随云计算收入占比的逐步提升,本季度收入占比仍不到10%,伴随规模的提升,阿里云的利润释放将会加速,阿里的估值水平有望逐步修复。

• 数字媒体及娱乐:同比几无增长

本季度,来自数字媒体及娱乐分部的收入为人民币80.81亿元,2020年同期为人民币8,066百万元,同比几乎没有增长

• 创新业务及其他

本季度,来自创新业务及其他分部的收入为人民币14.32亿元,相较2020年同期的人民币10.42亿元,增长37%,我们预计主要是高德地图与天猫精灵的收入提速。

阿里巴巴Q3季报总结:

总体来看,阿里巴巴的三季度数据较为一般,除开云计算业务与新零售业务,公司的核心商业GMV严重放缓,在国内电商竞争白热化的当下,阿里的核心电商业务仍存在较大的压力,而且宏观层面,国内消费持续低迷,对于阿里来说也是必须要面临的客观环境,因此,我们预计接下来几个季度,阿里核心商业面临的冲击仍大,增速仍有可能放缓,甚至负增长,而在本地生活的竞争中,与美团相比,阿里越来越弱势,本季度饿了么收入增速仅个位数增长,与美团相去甚远,这会导致市场对于阿里的情绪持续悲观,需要等待电商业务的拐点。

从宏观数据来看,2021年三季度,中国的GDP及消费虽然稳中有升,但增速同比较前几个季度出现放缓,社会零售商品总额同比上升5%,实物商品网上零售额增速同比8%,而去年三季度为17%,线下消费绝对值刚刚恢复到两年前的水平。面对不确定的宏观环境以及日趋激烈的市场竞争,阿里巴巴在国内消费者业务的规模增速上也受到了影响,实物商品GMV的年度同比增速下降是个位数,主要是由于服饰和日用品这两个品类增速的放缓,与这些品类在中国商品零售的大盘表现基本一致。消费电子与家居行业本季度的增速仍然保持稳定。

淘特是公司未来的一个大看点:在大环境的挑战挑战下,公司没有放缓在开拓新用户方面的持续努力,特别是淘特在下沉市场取得快速进展。截止2020年9月,阿里巴巴集团的全球年度活跃购买用户AAC达到了12.4亿,比上个季度净增6200万,年度同比增长了20%。其中中国国内市场AAC从上季度末的9.12亿增长到9.53亿,海外市场AAC从上季度末的2.65亿增长到2.85亿。我们仍然以服务全球20亿消费者为长期战略目标,并且有信心完成在本财年末国内年度活跃消费者达到10亿的目标。在中国的下沉市场淘特为阿里国内消费者生态带来增量用户和活跃度的价值日益体现。本季度淘特的AAC超过了2.4亿,和手淘APP相比,淘特的独占会员DAU的比例已经接近50%,淘特的高性价比的商品以及差异化的用户体验受到了消费者的喜爱。另一方面,淘特致力发展M to C模式。通过一站式运营加物流解决方案,帮助产地制造商直达消费者。本季度这一部分订单同比增长了近400%。在社区团购领域,淘菜菜致力于建设健康可持续发展的数字化社区商业新模式。目前淘菜菜已经在接近200个城市开展经营。本季度GMV的环比增长超过150%。公司致力于充分发挥阿里巴巴大家庭多年来沉淀的商品、供应链、物流、网络、用户运营和渠道拓展的能力,建立数字化驱动的社区商业新型基础设施,为用户提供在品质基础上的高性价比的商品和服务。淘菜菜的发展也为公司的电商用户带来了更多的购买频次,超过50%的淘菜菜用户是第一次在淘系平台购买生鲜产品。公司认为这一社区商业基础设施的最终价值在于为社区消费者提供更好的日常服务,保障民生、助农增收、扶持就业。我们将坚持价值创造的理念,踏踏实实的为社区消费者做好服务。

展望未来,阿里云计算的EBITA从2020年Q4转正以后正逐季度改善,而新零售业务的投入也在逐步进入结果期,我们认为阿里的新零售与云计算正逐步发展成阿里收入的第二增长曲线,打开电商以外的新增长,因此对于阿里,超跌以后,后市也无需过度悲观,当下阿里的估值水平相对来说已经较低估,情绪的集中释放以后,有望逐步迎来修复反弹。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 不看不亏·2021-11-29看起来美团大有崛起之势啊,之前还和饿了么一起跑,现在飞起来了1举报

- 维克多1·2021-11-29新零售还能做出什么花来?好像基本上市场饱和了吧1举报

- 咪咕蜡·2021-11-29这三家只要看阿里就可以了,只要阿里恢复过来,中概股就有希望点赞举报

- 王无所不知·2021-11-29和腾讯差不多,今年的阿里也是多事之秋,拉跨的一批点赞举报

- 超跌反弹NS·2021-11-29美团用户大量增长确实是一个可喜的表现,不过他投入的成本也确实高点赞举报

- 此时不买更待何时·2021-11-29淘宝特价版,淘宝直播版,天猫啥的,阿里没有新活了嘛?感觉都在炒冷饭点赞举报

- 霎风雨·2021-11-29今年一下子这么多的动作,腾讯营收最低也是可以理解的点赞举报

- 抄底反弹·2021-11-29游戏方面不需要太担心,针对未成年人的管制其实对未来发展是有帮助的点赞举报

- XD绿意盎然·2021-11-29腾讯的金融科技服务估计也不行了把,收款码被限制了点赞举报

- 山头的小猪·2021-11-29腾讯明年会好起来嘛?目前有点想抄底点赞举报

- 星宿劫·2021-12-01差强人意这个成语用错了吧,这写作水平……1举报

- 玲玲秀秀·2021-12-01很好1举报

- 逍遥糊涂·2021-11-29拼多多就是一个不良平台1举报

- 老山古·2021-11-29谁要抄芒格大师的底的1举报

- 猛逃·2021-11-29大牛市才能看到尽头点光亮[疑问]点赞举报

- ddhjnh·2021-11-30,1举报

- 看多美股投资人·2021-11-30😃😃😃😃😃😃点赞举报

- ula·2021-11-30阅点赞举报

- 太棒了·2021-11-29好点赞举报