中丐股回归啦!微博-SW二次上市——2021年11月港股打新分析

微博-SW(09898)

总市值:910.22亿-910.22亿港币

发售股数:1100万股(包括550万股新股份及550万股销售股份)

香港发售占10%,国际发售占90%

公开发售股数:110万股 (55000手)

国际配售股数:9900万股 (49500000手)

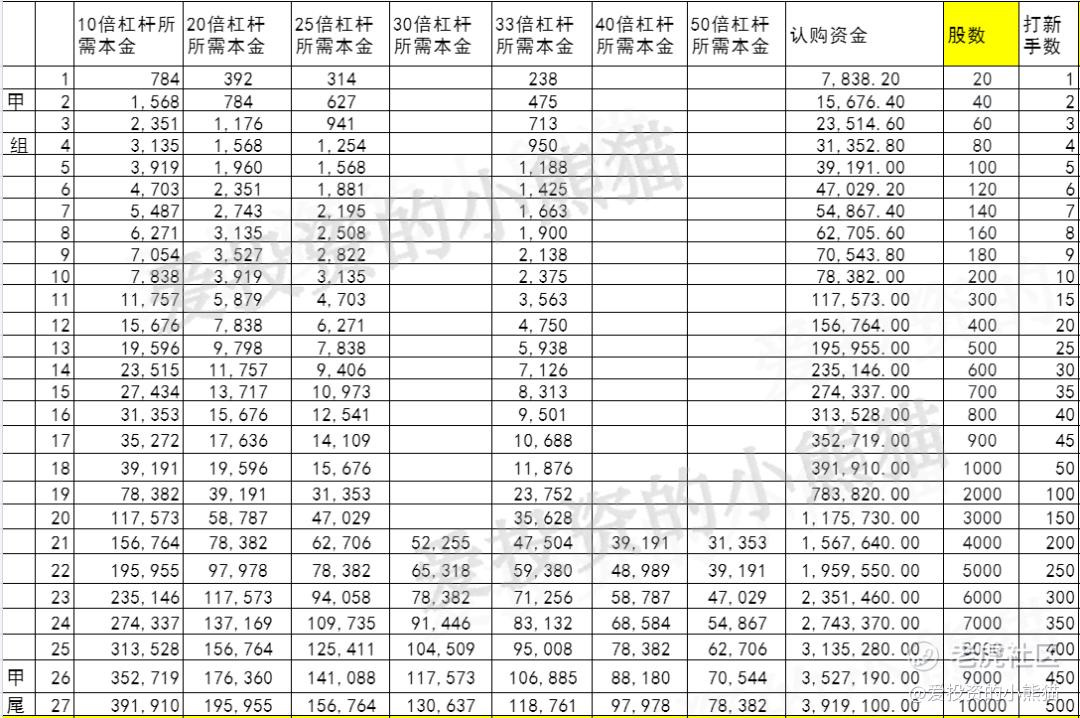

招股价:388港币

每手20股

一手入场费:7838.20港元

募资金额:20.04亿

保荐人:高盛(亚洲)有限责任公司、瑞士信贷(香港)有限公司、中信里昂证券资本市场有限公司、中国国际金融香港证券有限公司

稳定价格操作人:高盛(亚洲)有限责任公司

申购日期:2021年11月29日至12月02日

交易日期:2021年12月08日

绿鞋机制:有

最高市值:910.22亿港币

公司简介:

公司是中国领先的社交媒体平台,供人们创作、发现和传播内容。

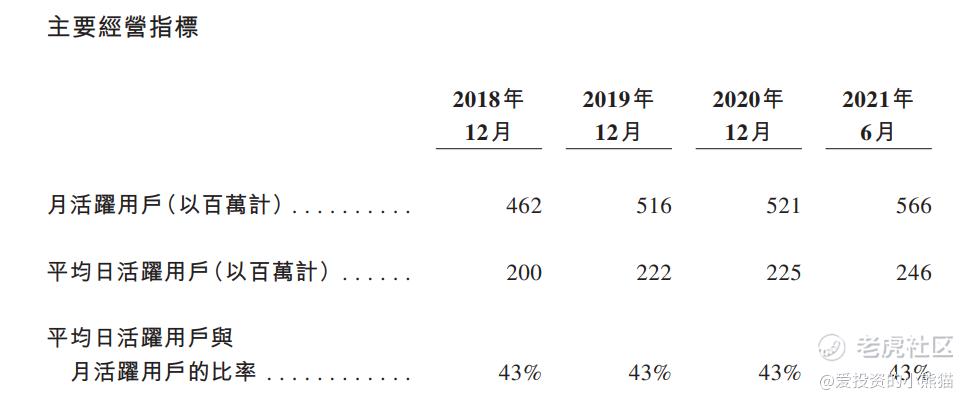

微博拥有庞大的活跃用户群,月活跃用户由2018年的4.62亿到2021年6月截止的5.66亿,平均日活跃用户由2018年的2亿到2021年6月截止的2.46亿。

(图来自招股书)

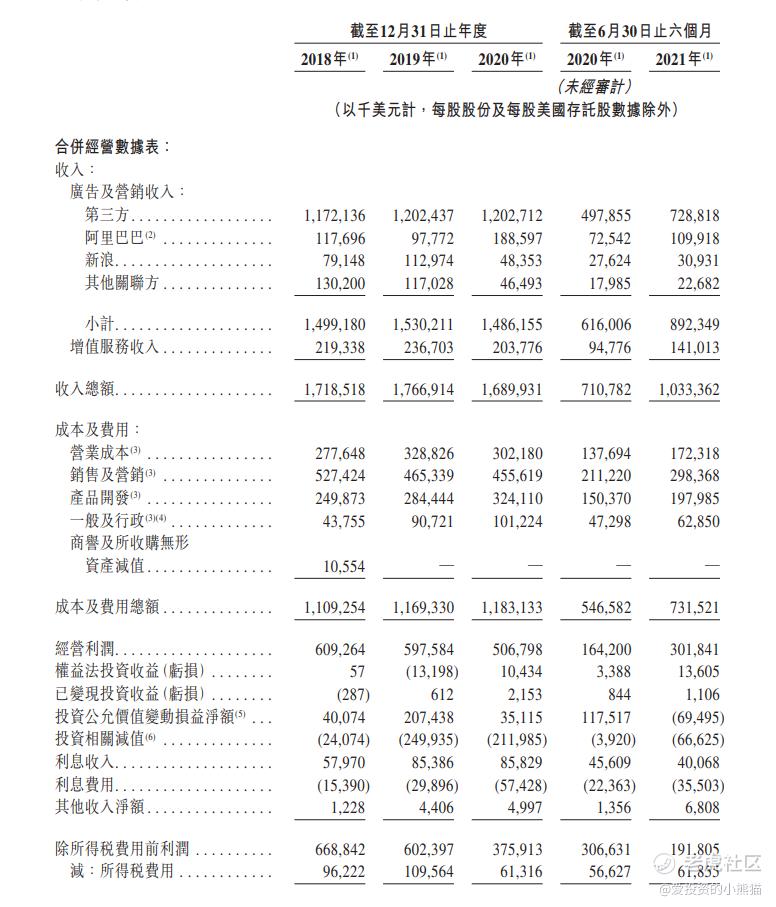

2018年至2020年收入分别为17.1亿美元、17.6亿美元、16.8亿美元,2021年截止6月30日6个月收入为10.3亿美元。

2018年至2020年经营利润分别为6.09亿美元、5.97亿美元、5.06亿美元,2021年截止6月30日6个月经营利润为3.01亿美元。

2018年至2020年纯利分别为5.72亿美元、4.92亿美元、3.14亿美元,2021年截止6月30日6个月纯利为1.29亿美元。

(图来自招股书)

基石投资者:

无

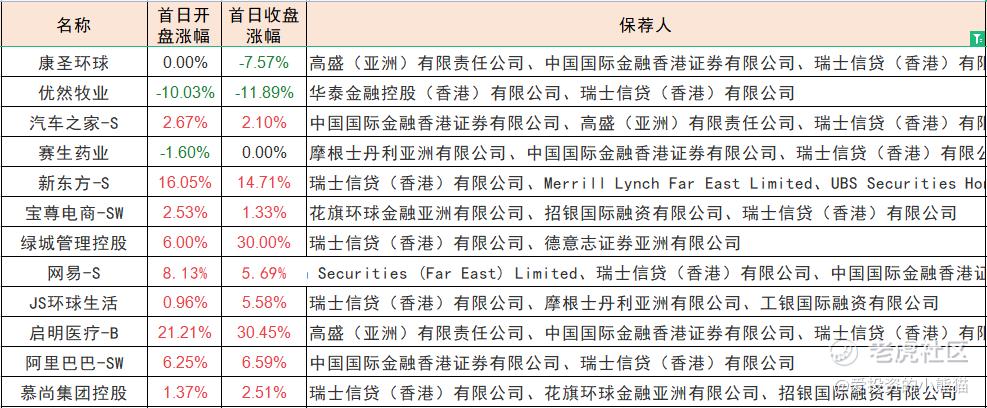

保荐人历史业绩:

高盛(亚洲)有限责任公司

中信里昂证券资本市场有限公司

中国国际金融香港证券有限公司

瑞士信贷(香港)有限公司

保荐人总体还行吧,稳价人是高盛(亚洲)有限责任公司,稳价的历史业绩还是不错的。

02

中签率和新股分析

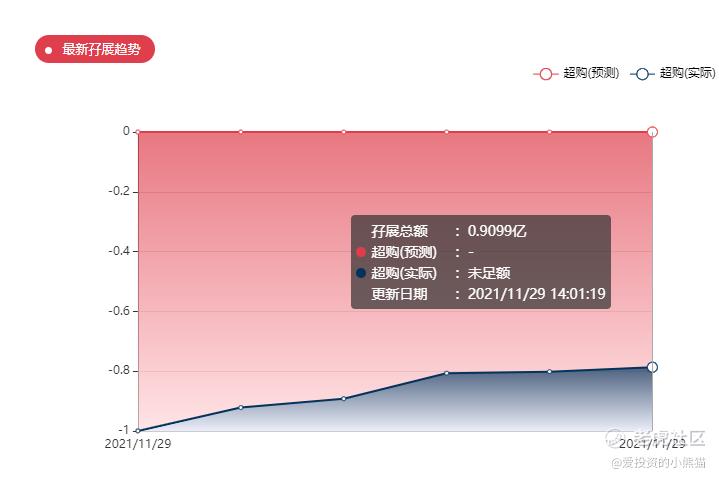

目前是未足额的状态

(上图来自AIPO)

中签率分析:

预估孖展应该就一倍了,参与人数预估也在1万人左右,一手中签率100%左右.

乙组20倍去乙头需要 本金39.1万,中签市值的金额肯定超过本金。

乙组的利息有5天,大约在2到4千左右。

(上图来自AIPO)

这票也是个中概股回归的票。来香港二次上市的,目前按照招股价上限,

有16.28%的溢价!以前打新很热的时候这类二次上市的都没人参与,更别说现在这么冷的情况下,还能有多少人愿意玩的?

而且现在中概股在美股那边可不平静,即便是买美股持股5天拿着,都可能出来一堆幺蛾子。目前的行情网上的段子都传出来了,这也是很多散户对中概股情绪的一种反应,放长线来说,可能是建仓点,但是短期来看,肯定风险很大。

$微博-SW(09898)$ 股市有风险投资需谨慎以上文章仅代表个人看法仅供参考不构成任何投资建议投资者需自行承担风险

今天的分享就到这里,欢迎关注【爱投资的小熊猫】,本人已经用这个ID发表了900多篇原创文章,全网都能找到本作者【爱投资的小熊猫】,欢迎交流

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 刀哥拉丝·2021-11-29微博的老板是不是张朝阳?之前用过微博,感觉用户的体验还不错。1举报

- 哎呀呀小伙子·2021-11-29现在的微博是不是都是用来打榜或者买排名什么的?1举报

- 梅川洼子·2021-11-29我身边很少人用微博,我身边有很多年轻人,所以我觉得这个股有点虚胖。1举报

- 权力的游戏厅·2021-11-29发行价有点高,要是还能给点溢价,我觉得可以考虑一下。1举报

- 以肉克刚·2021-11-29打新我是不会打新的,但是暗盘的 时候我可以偷偷的观察一下。1举报

- 灯塔国02·2021-11-29现在的微博价值肯定是远远被低估了,要不也不会二次上市,可以打新。1举报

- 丹尼尔加·2021-11-29已经准备好资金,准备上市的时候打新一下。1举报

- 迪士尼迪斯尼·2021-11-29公司的质地还是很不错的,只是当下的大盘可能会拖累个股。1举报

- 灌饼高手00·2021-11-29那个躺赢之歌写的真的好,写出了多少中国股民的心声。1举报

- 德迈metro·2021-11-29微博-SW这个时候进行二次上市是不是有点不明智?1举报

- 玉米地里吃亏·2021-11-29保荐人什么的看上去还是比较靠谱,不过想要赚钱估计也不容易。1举报

- Ryan.Z·2021-11-30看涨啊点赞举报