一周IPO观察:网易云招股,青瓷、商汤、中免通过港交所聆讯

港股IPO观察

截止11月26日当周,港股无新股计划上市,网易云音乐开启招股,招股价格区间为190-220港元,预计发行1600万股,上市后总市值将超395亿港元,代码为“$(09899)$”。

6家公司通过聆讯:青瓷游戏、雍和医疗、$中国中免(临时代码)(90013)$ 、$商汤科技(临时代码)(90006)$ 、祥生活服务、康耐特光学

新递交招股书的公司有3家包括:德银天下、中梁百悦、高视医疗科技

一、植发第一股雍禾医疗通过聆讯

植发机构雍禾医疗集团有限公司通过上市聆讯,摩根士丹利和中金公司为联合保荐人。雍禾医疗是中国的一家专门从事提供毛发医疗服务的医疗集团,其提供一站式毛发医疗服务,涵盖植发医疗、医疗养固、常规养护及其他配套服务。2018年~2020年,雍禾的市场份额分别为9%、10%、11%。根据招股书,收入和医生数量两方面,雍禾均排名行业第一、且超过行业第二、第三的总和。中国50个城市经营51家医院,拥有约1200人的专业医疗团队,包括229名注册医生和930名护士。

业绩方面2018年、2019年与2020年,雍禾医疗的营业收入分别为9.34亿元、12.24亿元和16.38亿元,净利润分别为5350.0万元、3562.4万元和1.63亿元。

二、青瓷游戏通过港交所聆讯

青瓷游戏通过港交所上市聆讯,联席保荐人为中金公司和中信证券。青瓷游戏旗下代表作为《最强蜗牛》、《提灯与地下城》、《不思议迷宫》、《阿瑞斯病毒》等四款游戏,也是2021年第一家通过港交所聆讯的游戏公司。

业绩方面,2018-2020年营收分别为0.98亿元、0.89亿元和12.27亿元,复合年增长率为253.1%;经调整净利润分别为0.39亿元、0.22亿元和1.66亿元,复合年增长率为106.8%。2021年上半年营收7.63亿元,同比增加757.3%。

股东方面,IPO前吉比特占股21.37%,阿里巴巴、腾讯、B站也分别持有4.99%股份,博裕资本占比1.87%。

三、商汤科技通过港交所聆讯

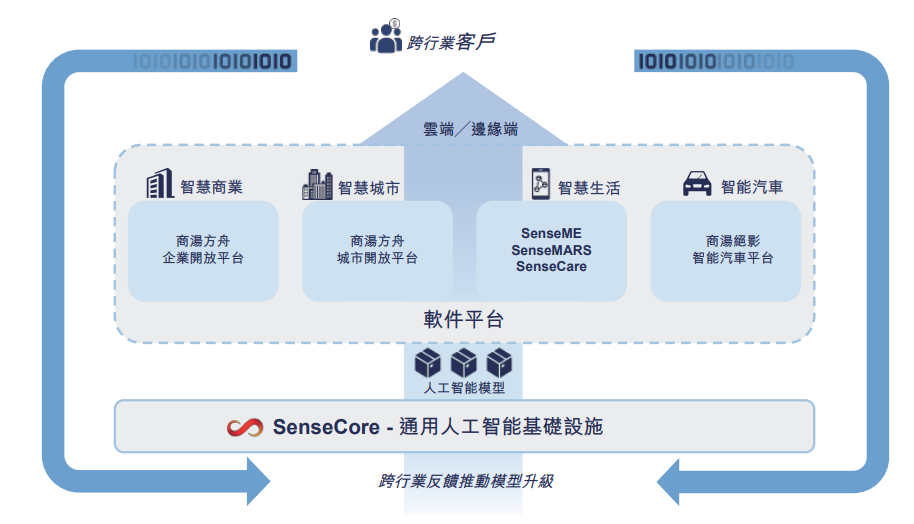

人工智能视觉领域,与旷视科技、云从科技、依图科技并称为“AI四小龙”。其中商汤科技正式通过港交所上市聆讯,有望年内完成IPO。从8月底提交申请算起,仅用不到三个月。商汤打造新型人工智能基础设施——SenseCore商汤AI大装置,打通算力、算法和平台,降低人工智能生产要素价格,实现高效率、低成本、规模化的 AI 创新和落地,进而打通商业价值闭环,解决长尾应用问题,推动人工智能进入工业化发展阶段。商汤科技业务涵盖智慧商业、智慧城市、智慧生活、智能汽车四大板块。

截至2021年6月30日,商汤软件平台客户数量合计超过2400家,覆盖250家《财富》500强企业及上市公司,119个城市以及超过30余家汽车企业,赋能超过4.5亿部手机以及200多款手机应用程序。

业绩方面,2018年、2019年及2020年的营收分别为18.5亿元、30.3亿元和34.5亿元;2021年上半年营收为16.5亿元,同比增长91.8%。同期毛利分别为10.5亿元、17.2亿元、24.3亿元;商汤2021年上半年毛利为12.1亿元,上年同期为6.2亿元,2021年上半年毛利率达73%。同期亏损净额分别为34.32亿元、49.6亿元、121.58亿元及37.12亿元,剔除掉非经营项目后调整的亏损净额分别为20亿元、10.37亿元、8.78亿元及7.26亿元。

美股IPO观察

当周没有新股上市。

一、电子数据发现和数据恢复服务提供商KLDiscovery(KLDI)递交招股书

KLDiscovery是全球领先的电子发现、信息治理和数据恢复解决方案提供商,为全球19个国家的公司、律师事务所、保险公司和个人提供服务。公司的集成专有技术解决方案使客户能够高效准确地收集、处理、传输、审查和恢复复杂的大规模企业数据。 KLDiscovery专门构建的创新的一个关键示例是Nebula——端到端人工智能/机器学习驱动解决方案,开发或外部开发的软件和基于云的或许多不同的内部部署数据存储 选项。

截止2021年9月30日,KLDiscovery公司支持了大约7950件法律技术事务,目前平均每年恢复超过44000件数据。 2020年公司的客户群包包括98%的美国收入最高的律师事务所以及64 的财富500强公司。截止21Q3, 公司过去12个月内的收入为3.13亿美元。

SPAC方面,当周有6家壳公司IPO。 确定协议的公司有:

BLTS与男士生活时尚品牌MANSCAPED合并

ASPC与拉美地区的客户资源数字整合平台Semantix合并

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 烽火戏猪猴·2021-12-02最先搞的垄断,专属会员歌曲,结果最后搞不赢腾讯,把一些乱七八糟的资源置顶在用户关键词搜索的前面,楞是让用户找不到原唱,最后通过反垄断介入才跳出来叫好,最后才获得一点版权,这种平台还有脸上市?点赞举报

- 一凡财经·2021-12-01中了几手网易云音乐,想哭,定价这么高,不就是忽悠韭菜的么,可是为啥机构认筹的也很多呢,不理解点赞举报

- 低买高卖谁不会·2021-11-29比较看好ASPC与拉美地区的客户资源数字整合平台Semantix合并,主业比较有想象力。1举报

- 刀哥拉丝·2021-11-29要是商汤科技能够盈利了,股价估计就立马就能飞了。1举报

- 迪士尼迪斯尼·2021-11-29感觉这一周上市的公司的质量都比较不错,钱不够用了。1举报

- 灯塔国02·2021-11-29KLDiscovery(KLDI)看着比较有想象力,这个我比较想摸一手。1举报

- 哎呀呀小伙子·2021-11-29青瓷游戏的投资人团队看着比较豪华,出品的游戏不怎么出名。1举报

- 玉米地里吃亏·2021-11-29商汤软件平台有核心竞争力,唯一的缺点就是还没有盈利。1举报

- 弹力绳22·2021-11-29中国中免不是内地上市公司吗?为什么又去香港上市?1举报

- 梅川洼子·2021-11-29我也看过构雍禾医疗集团有限公司的招股书,这个公司净利率太低了。1举报

- 权力的游戏厅·2021-11-29构雍禾医疗集团有限公司应该比较有想象力。1举报

- 以肉克刚·2021-11-29之前一直打新,结果一直被新股吊打,现在不敢了。1举报

- 穿越山河的箭·2021-12-03这波直接破发 这个市场还是太成熟了点赞举报