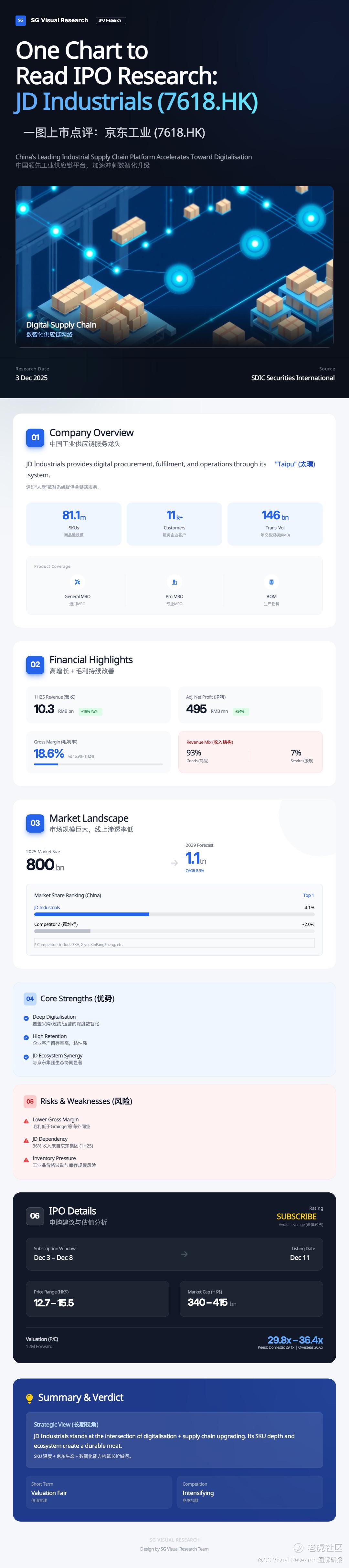

JD Industrials IPO: China’s No.1 Industrial Supply Chain Platform — Worth Subscribing?

JD Industrials (7618.HK) — often called “China’s No.1 industrial supply chain platform” — is finally coming to market.

Here are the key takeaways from the latest IPO review:

🔹 Huge Market Opportunity

China’s industrial supply chain market is heading toward RMB 1.1 trillion by 2029, with low digital penetration.

🔹 Strong Platform Fundamentals

Over 81 million SKUs, 11,000+ enterprise clients, and the largest share in China’s MRO/B2B industrial segment.

🔹 Solid Growth Trend

1H25 revenue +19%, improving gross margin (18.6%), and rising adjusted profit.

🔹 JD Ecosystem Advantage

Integrated logistics + supply chain + fulfillment give JD Industrials a real moat.

But there are risks:

⚠ Gross margin still lower vs global peers

⚠ Heavy reliance on JD Group (36% of revenue)

⚠ IPO valuation at ~30–36× PE isn’t cheap

Bottom line:

It’s a long-term structural story with a strong ecosystem behind it —

but the IPO pricing isn’t a bargain.

Analysts’ verdict: Subscribe, but avoid leverage.

Would you join the IPO?

Or wait for a better entry point?

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。