Guoshen

暂无个人介绍

IP属地:未知

11关注

1粉丝

0主题

0勋章

Pls like

抱歉,原内容已删除

Wow

抱歉,原内容已删除

Plz like

BofA Says Interest Rates Are at 5,000-Year Low<blockquote>美国银行称利率处于5000年来的低点</blockquote>

Like pls

抱歉,原内容已删除

Sad

抱歉,原内容已删除

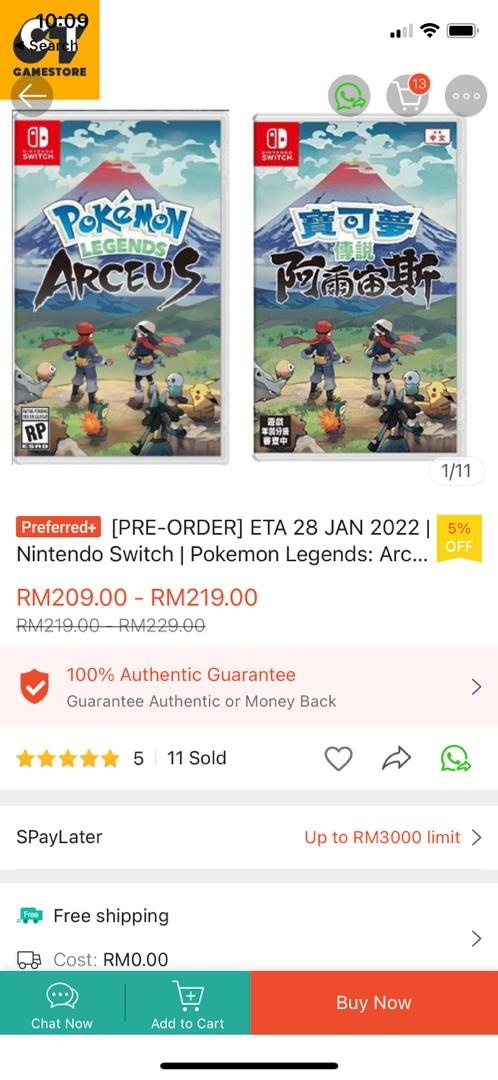

Buy buybuy

抱歉,原内容已删除

Wow

AMD Reports Earnings Tuesday. It’s All About the Data Center.<blockquote>AMD周二公布财报。这一切都与数据中心有关。</blockquote>

Wow

抱歉,原内容已删除

Great ariticle, would you like to share it?

How to handle market declines<blockquote>如何应对市场下跌</blockquote>

去老虎APP查看更多动态