As the end of the year approaches, many of us will begin our Christmas shopping, assuming we haven't already done enough shopping sprees over the 9.9, 10.10 and 11.11 sale. However, we should also not forget to save a little and put it into our investment portfolio given that investing has the ability to perform its magic of compounding and delivering long term returns. One fund we think investors can look into is the $Fidelity Global Multi Asset Income A-MINCOME(G)-SGD(LU1084809471.SGD)$ fund and here’s why.

Instead of holding cash, why not collect dividends and enjoy capital appreciation?

Lately, both the fixed income and equity market has been volatile as inflationary fears rise. Investing in such market conditions can be tricky and essentially causing investors to turn a winner’s game into a loser’s game. Amid such a backdrop, many of you may consider holding cash and wait for the ‘right’ time to enter the market or perhaps put your monies into a fixed deposit in order to limit your downside risk and yet generate some stable income. Instead of doing so, we think that the $Fidelity Global Multi Asset Income A-MINCOME(G)-SGD(LU1084809471.SGD)$ fund can bring about more benefits to you.

About the fund

$Fidelity Global Multi Asset Income A-MINCOME(G)-SGD(LU1084809471.SGD)$ fund is an unconstrained multi asset fund managed by George Efstathopoulos, who has 17 years of investment experience, together with his team of 17 analysts with expertise in market research and manager research.

Read: What are the different types of funds?

Read: What are Multi-Assets Funds?

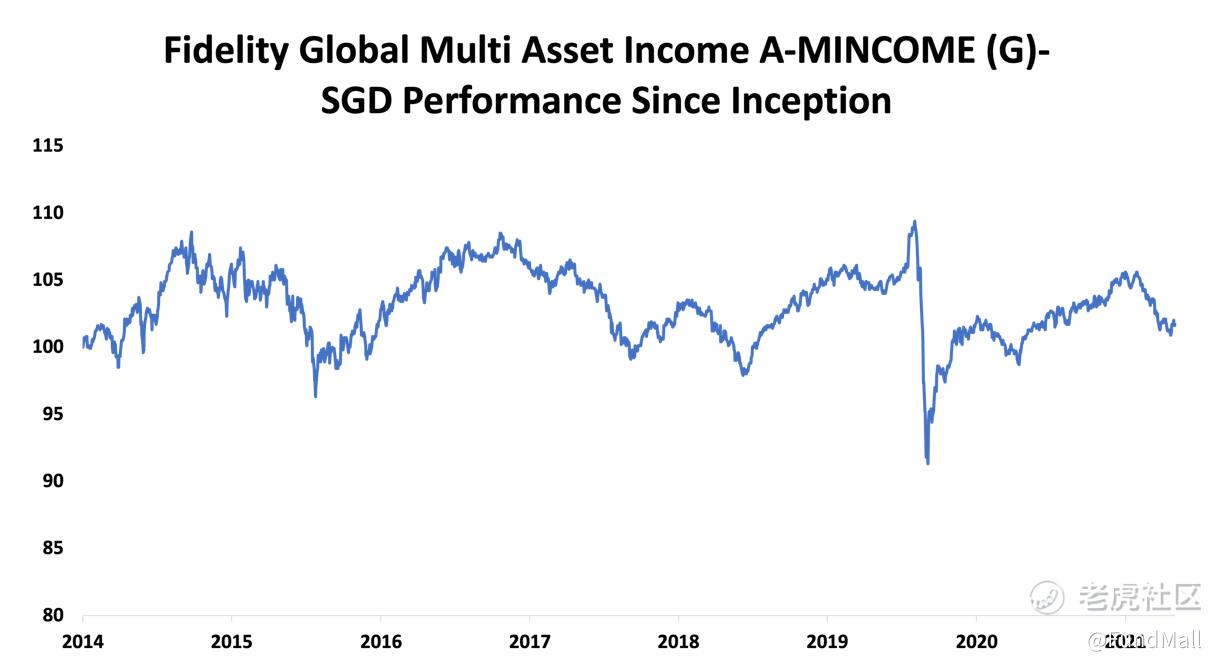

The fund aims to provide income and moderate growth over the medium to longer term by investing in global fixed income securities and global equities. What’s interesting about the fund is like its label suggests, it does not adhere to any benchmark. This allows the fund manager to actively allocate to, and within, different asset classes and geographies based on their potential to generate income and capital growth in the prevailing market environment. In addition, the fund may also seek to invest in alternative investments such as infrastructure securities and close-ended real estate investment trusts (REITS), in order to construct a portfolio with suitable risk-return characteristics.

To give investors more context, here are ways the fund manager can make use of the unconstrained strategy adopted to maximize returns for investors; In the event the market is bullish, the fund manager may decide to overweight equities and underweight fixed income to capture the upside on equity market rallies. On the flip side, when the market begins to show signs of bearishness, the fund may allocate its assets to overweight fixed income and underweight growth to limit downside risk. Lastly, at times when markets are normal, we may see the fund allocate neutral weighting towards both equities and fixed income.

What is the fund’s current positioning like?

At this current juncture, the fund has a weighting of 27% to equities, 59% to fixed income, 5% to alternative investment and the rest being cash (as at 30 September 2021). This allocation comes on the back of the team’s belief that growth momentum is decelerating and fundamentals will likely become more important after a liquidity-driven market recovery. As such, net equity exposure has been reduced and fixed income exposure has increased since there are clearer catalysts in the fixed income assets classes and categories, such as high yield and emerging market debt.

Such overweight into the fixed income segment may perhaps get some investors questioning the risk they are taking on given that the fixed income segment hasn’t been performing spectacularly in 3Q21, albeit with a handful of exceptions. To address this concern, we believe that the team has continued to keep the risk reward factor in mind – barbell strategy between defensiveness and income generation (balance allocation towards the safer and riskier segment of the fixed income market), and hence investors should not be too worried about the downside risk.

Delving deeper, we note that on a geographical level, the fund invests a significant amount of its assets into Asia ex Japan as the team sees 1) long term growth potential and 2) political stability – amid short term political events in the west, investors are better served by diversifying into Asia.

How has the fund performed?

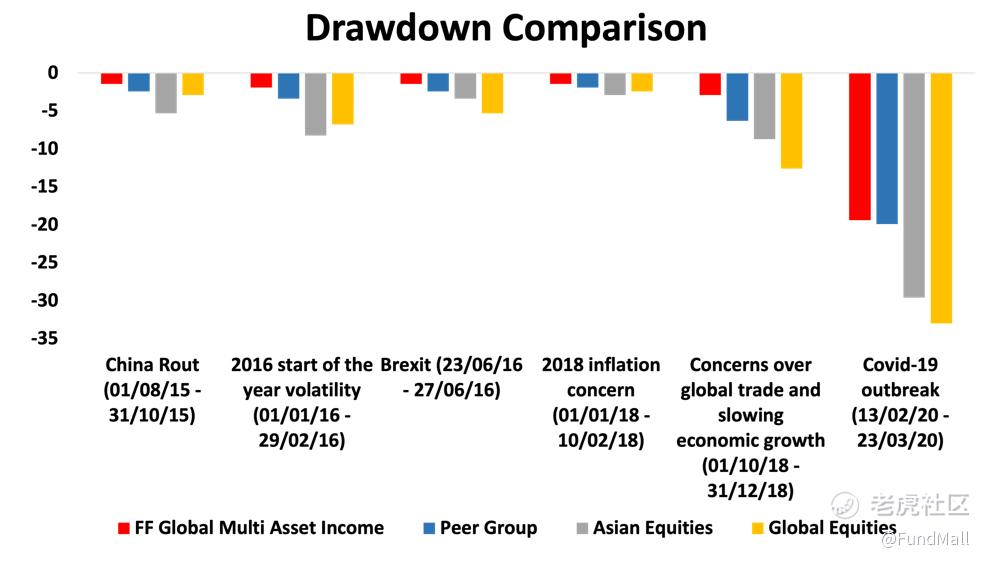

Historically, the $Fidelity Global Multi Asset Income A-MINCOME(G)-SGD(LU1084809471.SGD)$ fund has weathered market drawdowns relatively well. It is able to do so due to the fund manager and his team’s ability to assess market conditions and make decisions whether to rebalance the portfolio’s assets. For example, when Covid-19 hit global economies and oil price collapse in early 2020, sending markets into a whirlwind and later saw a promising stimulus package and easy monetary policy uplift investors’ sentiments, the team made the call to rebalance the holdings of the funds - some of the calls include; adding JPY exposure, reducing equity risk in late-stage of the economic cycle and adding China government bonds to diversify the defensive basket in a low yielding world.

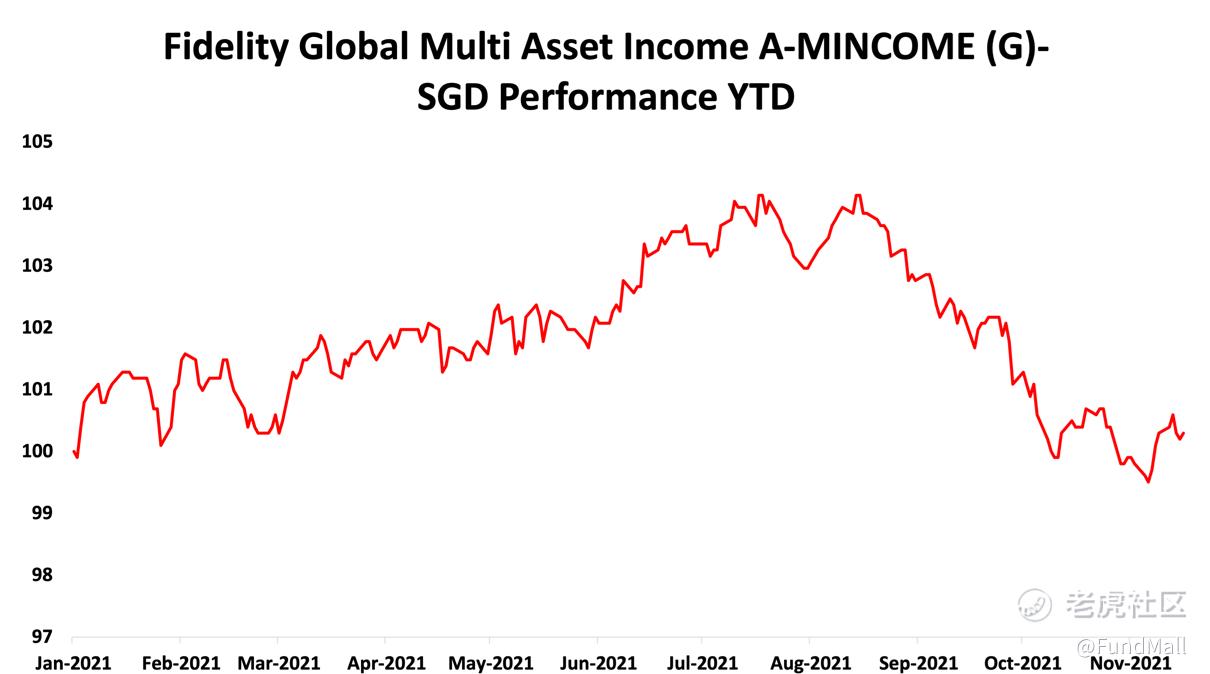

On a year to date basis, the fund has delivered returns of 0.2% (as at 22 Nov 2021) and paid out dividends consistently every month to investors. That said, it’s peak performance on a year to date basis saw a return of 4%. Its decline in returns from its peak this year, in our view, is attributed to the heavy weighting to the fixed income segment, more specifically Asian High Yield (“AHY”) - AHY were beaten down as default risk mounted and market sentiment soured for the prospect of Chinese property sector’s ability to repay their debt.

Why we like the fund?

By investing in the fund, investors can be sure to enjoy capital appreciation and stable income from the expert management provided by the team, yet at the same time stay diversified amidst a jittery market environment. For risk averse investors, we believe this is a fund you could consider including in your portfolio as we believe that there are a few positives that could boost the fund’s performance; 1) AHY, a significant holding in the fund is poised to benefit from a recovery play when credit concerns start to wane 2) An allocation towards Asian equities are less susceptible to a sell off compared to other markets trading at YTD highs and extremely stretched valuations.

We have something more for you...

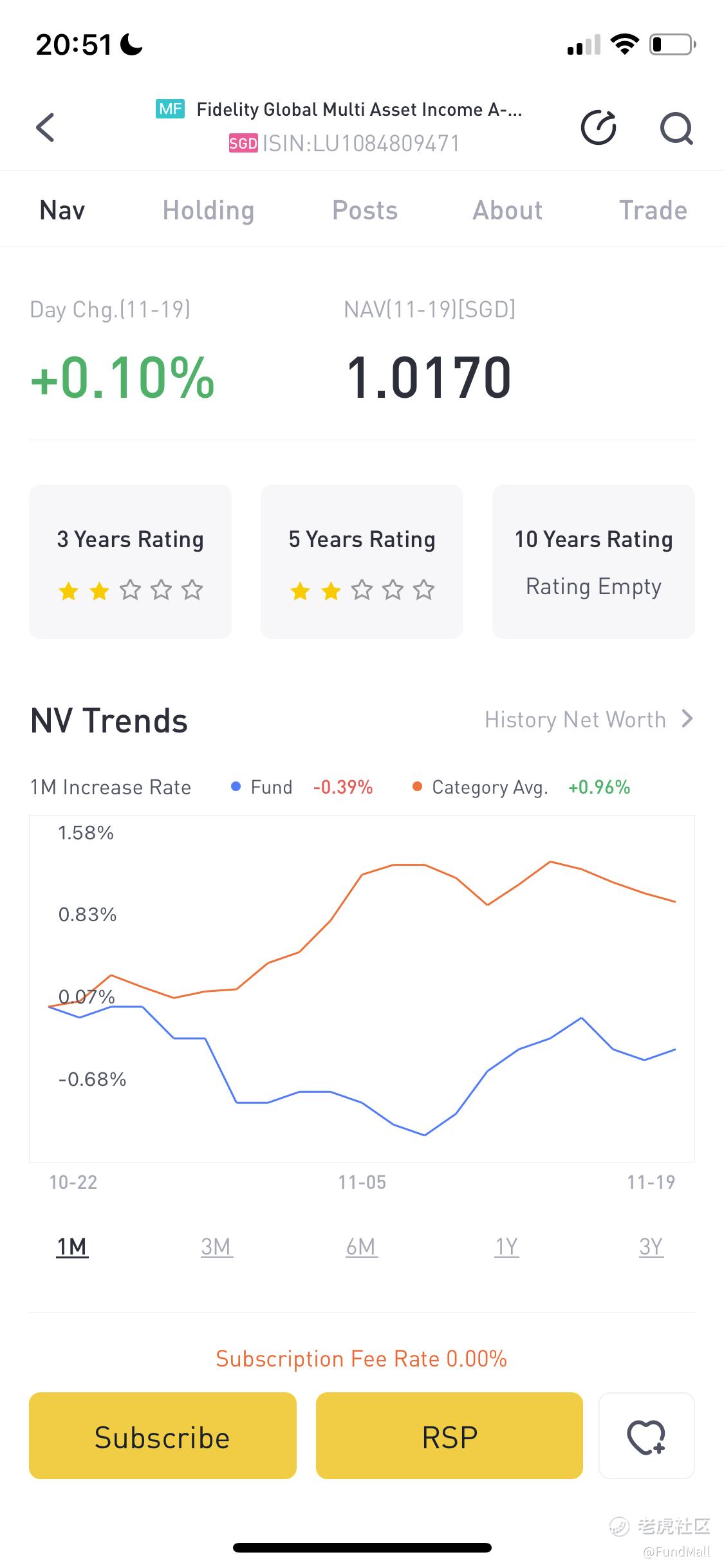

Aside from our fund recommendation, we are also having a give-away event for you! During this festive season, we will be giving out prizes to 3 lucky winners who predict the NAV of the Fidelity Global Multi Asset Income A-MINCOME (G)-SGD fund on 17 December 2021.

Chart 4: Fund NAV as of 19 November 2021

Terms and condition:

- To stand a chance to win the prizes, comment what you think the fund NAV will be on 17 December 2021 in the comment section down below. Multiple entries welcomed!

- We will choose 3 winners who have the closest answer to the Fidelity Global Multi Asset Income A-MINCOME (G)-SGD fund closing NAV.

- Entries after 17 December 2021 2359hrs will not qualify for the giveaway.

- The event will commence from 29 November 2021 to 17 December 2021

Prizes:

1st prize: 1888 Tiger coins and a log cake

2nd prize: 888 Tiger coins and a log cake

3rd prize: A log cake

Disclaimer:

The information herein was obtained and derived from sources that we believe are reliable, but while reasonable care has been taken to ensure that stated facts are accurate and opinions are fair and reasonable, Tiger Brokers does not represent that it is accurate or complete and it should not be relied upon as such.

The information expressed herein is current and does not constitute an offer, recommendation or solicitation, nor does it constitute any prediction of likely future stock performance.

精彩评论