9. Wells Fargo

inflation stock investing

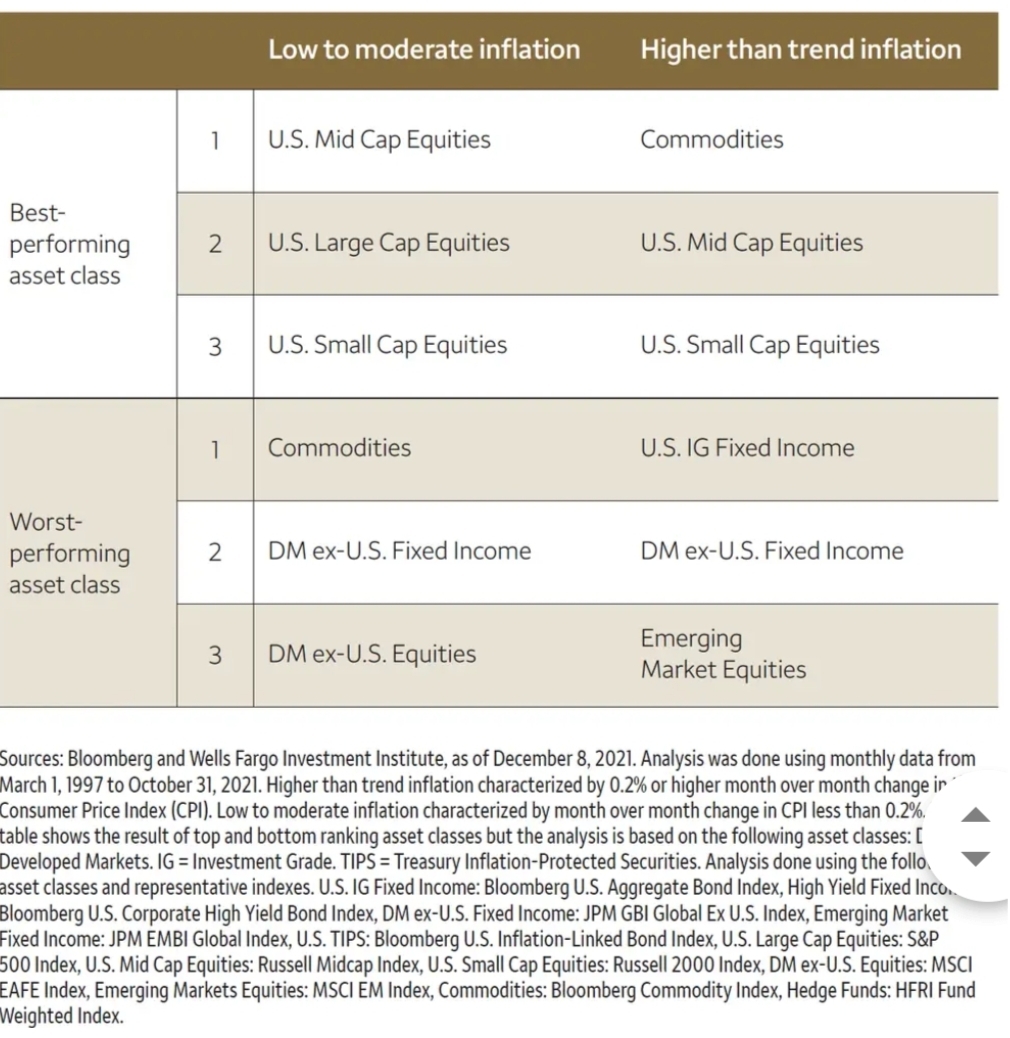

"Seek assets that perform well when inflation is above average." − Wells Fargo Investment Institute Wells Fargo

Inflation forecast:

"A shortage economy will likely keep inflation elevated well into 2022, before supply-chain pressures ease and allow inflation to subside during the second half of the year."

"The pandemic simultaneously built up consumer demand and unspent cash but thinned out the production and transportation of goods — taken together, an unusual way for an economic expansion to begin. We expect average consumer price inflation of 4.0% in 2022, down from 6.2% in October 2021. Inflation should remain above its pre-2020 pace but not high enough to end the expansion. The upside risk to inflation is that rents and wages become self-sustaining, but our conviction is that inflation should ease with supply shortages."

Investment recommendations:

"We favor U.S. large-cap and mid-cap equities over international equities, and cyclical and growth sectors over defensive sectors."

"Favored equity sectors: Communication Services, Financials, Industrials, Information Technology."

-Read more: https://www.businessinsider.com/stock-market-outlook-inflation-forecasts-prediction-2022-investing-ideas-recommendations-2021-12#4-goldman-sachs-4

精彩评论