4. Goldman Sachs

inflation stocks investing

Goldman Sachs

Inflation forecast:

"No near-term solutions exist to solve the supply chain and input cost problems that plague so many industries. However, managements have used price increases, cost controls, and technology to preserve margins, and many of the headwinds will ease in 2022. However, a tight labor market will persist and drive wage inflation. Our commodities research colleagues forecast Brent crude oil will peak at $90/bbl in early 2022 and then decline to $80 by year-end. Our economists expect annualized US GDP growth will decelerate from 4.5% in 1Q to 1.8% in 4Q 2022. During the same time, core PCE inflation will subside from 4.3% in 1Q to 2.4% by year-end."

Investment recommendations:

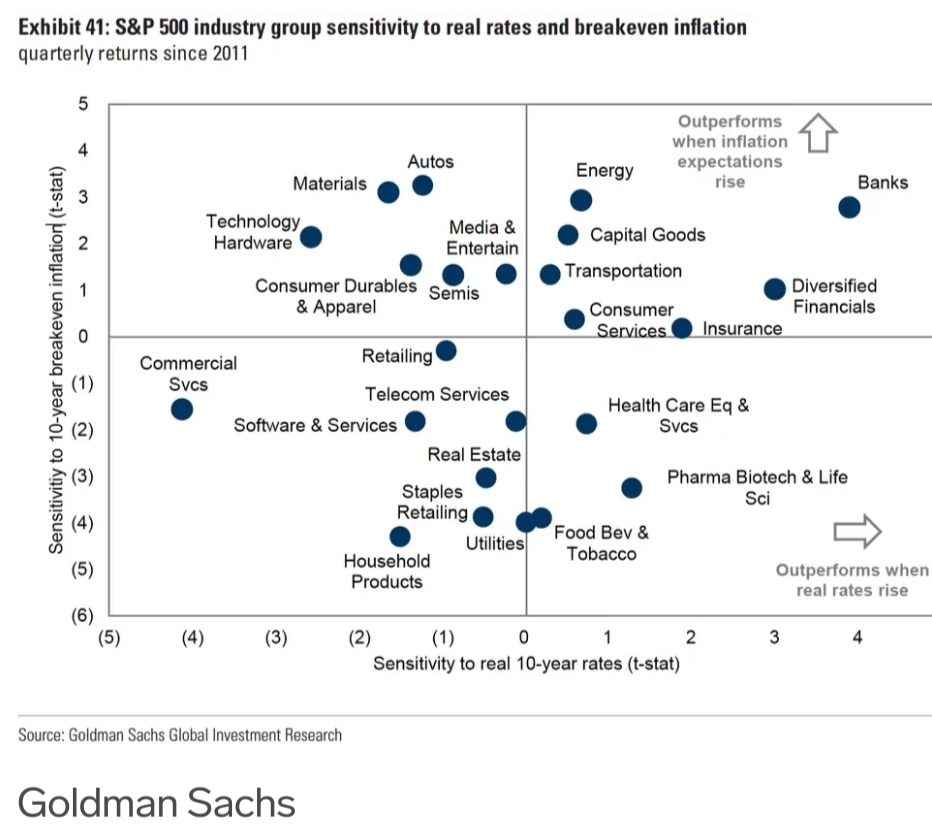

"Investment Strategies: (1) Own virus- and inflation-sensitive cyclicals; (2) Avoid high labor cost firms; (3) Buy growth stocks with high margins vs. low margin or unprofitable growth stocks. Overweight Technology, Financials, and Health

-Read more: https://www.businessinsider.com/stock-market-outlook-inflation-forecasts-prediction-2022-investing-ideas-recommendations-2021-12#4-goldman-sachs-4

精彩评论