Deutsche Bank

inflation supply chain issues

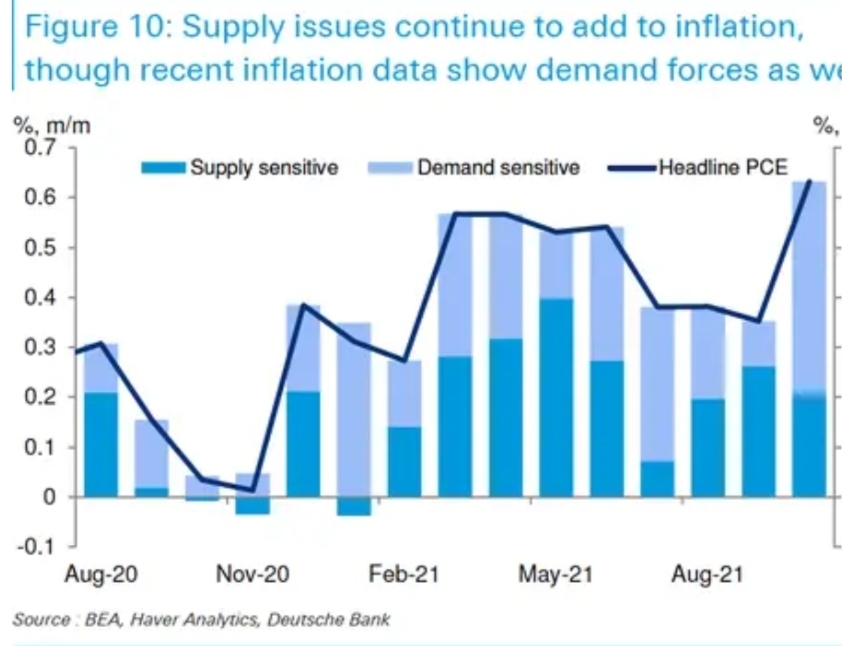

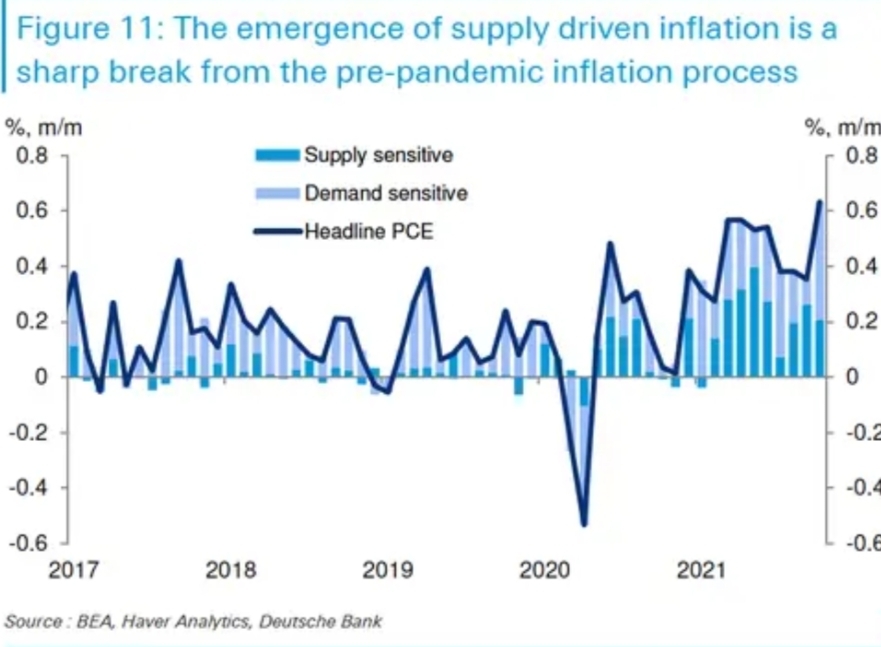

"Supply constraints were a major driver of the initial inflation surge earlier this year ... This stands in sharp contrast to the pre-pandemic mix of inflationary pressures where these categories only added a relatively small share to monthly inflation prints." —Deutsche Bank Deutsche Bank

Inflation forecast:

"Inflation has broadened and will take longer to dissipate. Rising underlying inflation, elevated inflation expectations and accelerating wages all support well above target inflation through 2022, with core CPI and PCE likely to end the year at 3.5% and 2.7%, respectively. As supply chains mend, labor supply returns, and commodities remain below their peaks, inflation should fall back closer to target by 2024. While risks to medium-term inflation are clearly to the upside, we see sources of both upside (rents) and downside (faster supply chain resolution) next year."

Investment recommendations:

"At a sector level, we maintain our overweights in Energy, Materials and Financials; turn tactically overweight other cyclicals; remain neutral the mega-cap growth and tech stocks and underweight the defensives."

-Read more: https://www.businessinsider.com/stock-market-outlook-inflation-forecasts-prediction-2022-investing-ideas-recommendations-2021-12#4-goldman-sachs-4

精彩评论