$NIO Inc.(NIO)$ China is a huge and fast-growing electric vehicle (EV) market, all the top EV makers are trying to capture a share of this rapidly growing pie, NIO, for example, has already taken its place. What will it look like in 2022 and beyond?

Can Nio survive in the competitive electric vehicle market?

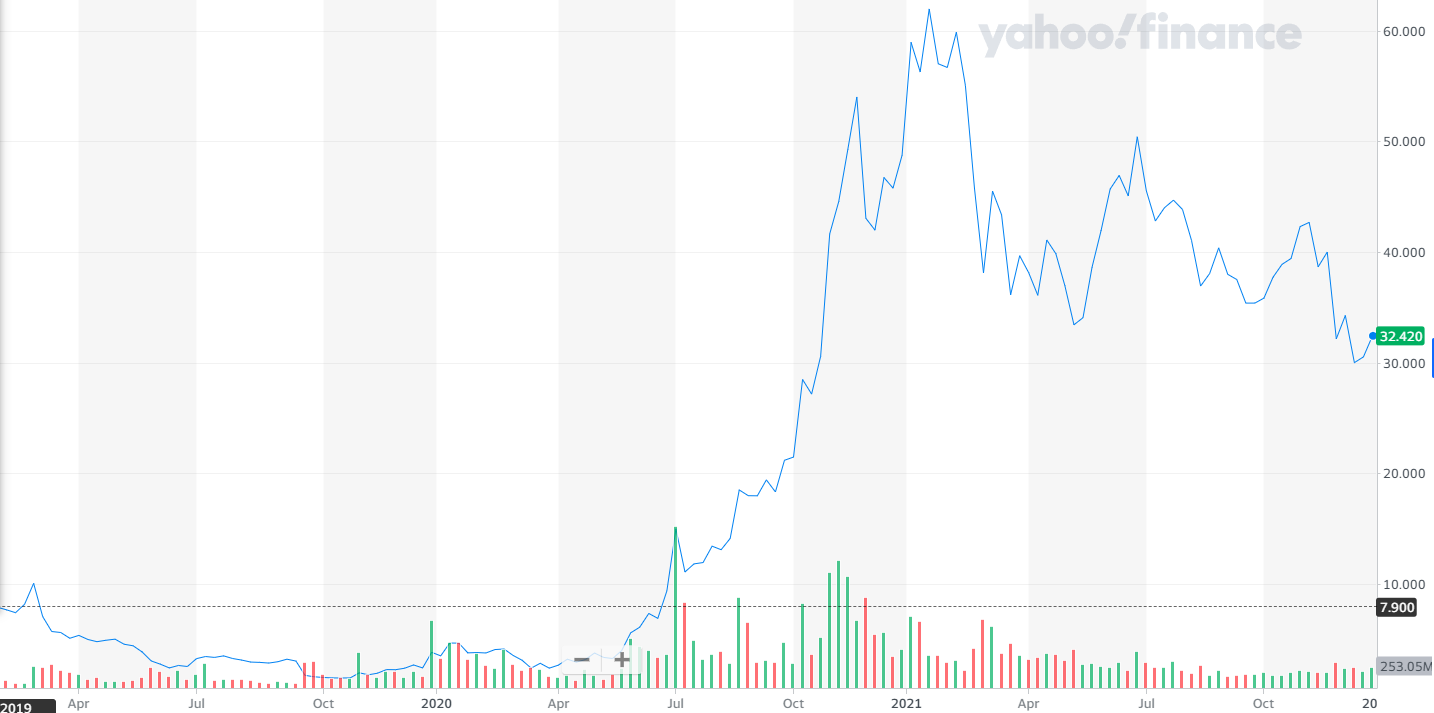

As of this writing, Nio stock is more than 50% off its high price in 2021. It still sports a price-to-sales ratio of 9, which isn't cheap. However, the P/S ratio has improved significantly from the stock's ratio at the start of the year, which was over 30.

While shares of NIO have declined around 40% year to date, the stock is likely to rebound in 2022 on the back of several positive catalysts. They could support Nio's long-term growth.

- First, Nio has grown significantly over the years, and the company has solid plans for the coming years. In 2022, the company plans to enter five more countries in Europe.

- Second, Nio's quality products, cutting-edge technology, and a strong network of swapping and charging stations could give it an edge over the competition.

- Finally, Nio is expanding its production capacity to meet the growing demand for its cars, building a second manufacturing facility. In 2022, Nio plans to introduce three new models, which should help boost its sales.

Although the stock has underperformed this year, it’s prudent to stay invested in NIO as it seems well-positioned for a rally next year.

In my opinion, The EV stock looks attractive in 2022. It could be a good time to add Nio stock to your EV portfolio.

Do you agree with me? Welcome to comment.

精彩评论