Market Overview

The S&P 500 closed in negative territory on Wednesday (October 26) as gloomy earnings guidance added to fears of economic slowdown.

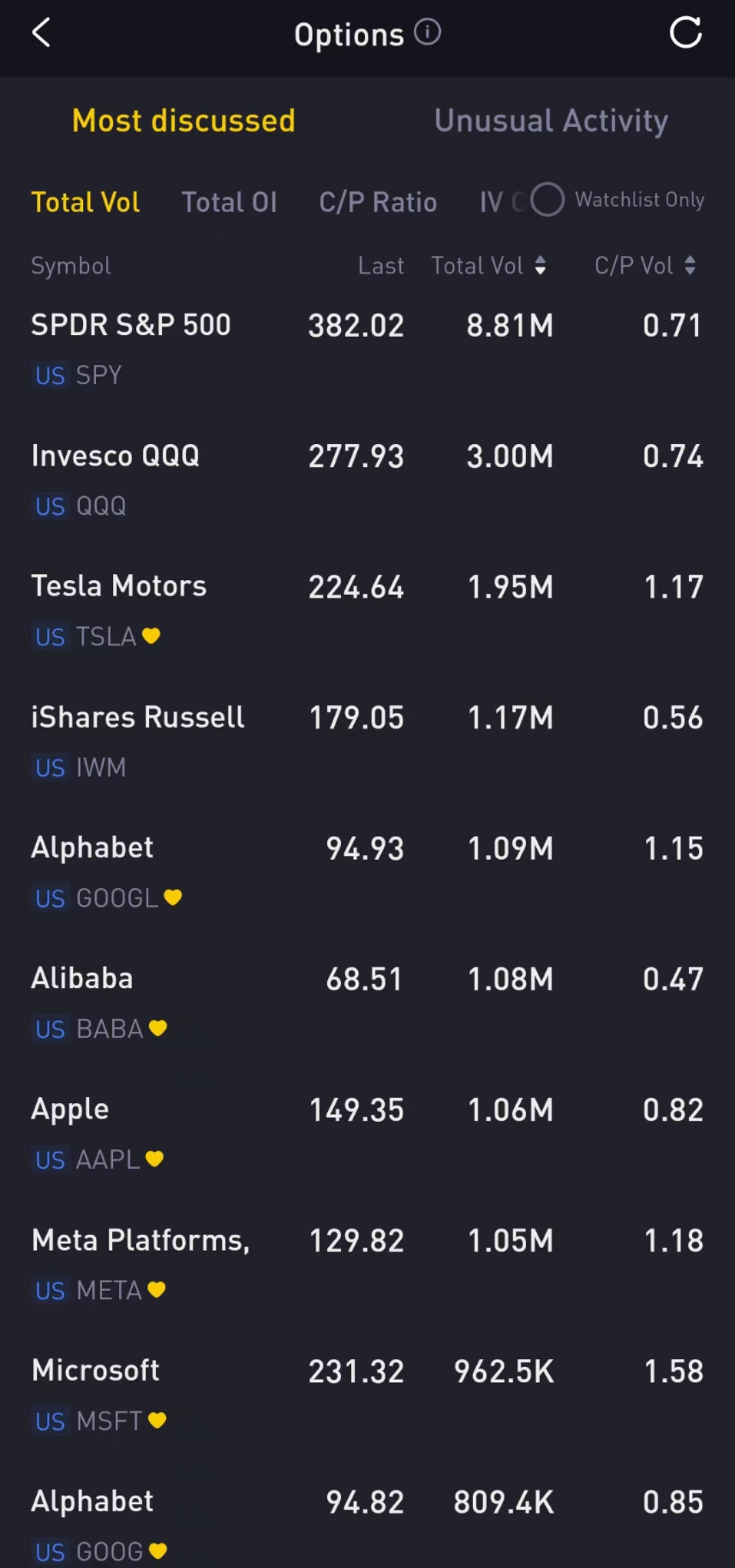

Regarding the options market, a total volume of 43,959,454 contracts was traded, up 19% from the previous trading day.

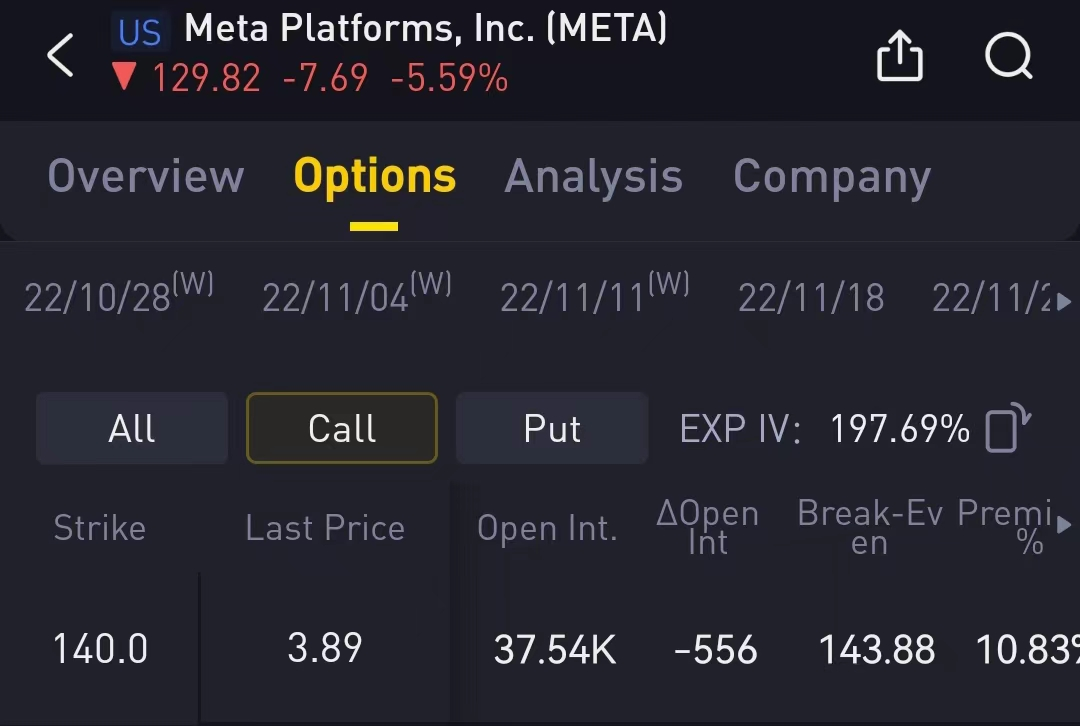

Traders tend to bet on options before earnings report for hedging or speculation, prompting total trading volume for Meta to reach 1.05 million. Open Interest for $140 strike call option expiring this Friday is particularly high, with 37.54K unclosed contracts as of Wednesday.

Top 10 Option Volumes

Top 10: SPY, QQQ, TSLA, IWM, AAPL, SNAP, GOOGL, AMD, VIX, MSFT

Options related to equity index ETFs are top choices for investors, with 8.81 million $SPDR S&P500 ETF Trust(SPY)$ and 3 million $Invest QQQ Trust ETF(QQQ)$ options contracts trading on Wednesday.

Total trading volume for SPY and QQQ up 28% and 37.6%, respectively, from the previous day. 58% of SPY trades bet on bearish options.

Facebook parent $Meta Platforms Inc(META)$ on Wednesday forecast a weak holiday quarter and significantly more costs next year.

The forecast knocked about $67 billion off Meta's stock market value in extended trade, adding to the more than half a trillion dollars in value already lost this year.

Traders tend to bet on options before earnings report for hedging or speculation, prompting total trading volume for $Meta(META)$ to reach 1.05 million. Open Interest for $140 strike call option expiring this Friday is particularly high, with 37.54K unclosed contracts as of Wednesday.

Based on the current price of $129.82 as of Wednesday's close and gloomy earnings guidance of Meta Platforms, investors are betting the stock price to be below $140 before the weekend. By selling $140 call options, investors have a chance to generate income from the downside of Meta stock and offset losses from stock declines in the case that they own the stock underlying the option.

In the third quarter, $Meta(META)$ posted revenue of $27.7 billion, slightly beating analysts’ average estimate for $27.4 billion. Net income fell 52% from the same quarter last year to $4.4 billion. Earnings per share were $1.64, below the $1.88 per share average estimate.

Meta now expects total expenses for this year to be $85 billion to $87 billion. For 2023, that number will grow to an expected $96 billion to $101 billion, it said on Wednesday.

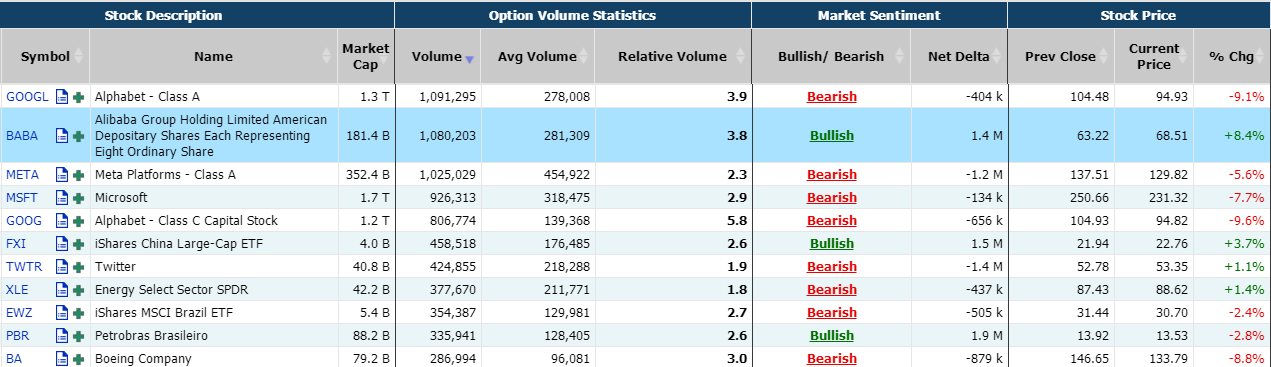

Unusual Options Activity

Google parent $Alphabet Inc(GOOGL)$'s disappointing ad sales sparked worries across the digital media sector as advertisers cut back on their spending in the face of an economic slowdown. Google's advertising revenue was $54.48 billion in the third quarter, compared with $53.13 billion last year but came in below analysts' expectations.

Shares in Alphabet tumbled as much as 9.14% on Wednesday's trading session. There were 1.09 million $Alphat-Class A(GOOGL)$ options trading on Wednesday. Call options account for 53% of overall option trades. Particularly high volume was seen for the $100 strike call option expiring October 28, with 39,220 contracts trading on Wednesday.

The negative results shattered many expectations that Google, which is the world's largest digital advertising platform by market share, would remain strong in a weakening economy and reinforced worries on Wall Street that inflation will continue to hurt advertising spending.

$Microsoft Corp(MSFT)$ also projected second-quarter revenue below Wall Street targets across its business units, stoking fear that macroeconomic headwinds are impacting the cloud business in addition to the PC unit.

Revenue growth in the first quarter was $Microsoft(MSFT)$'s lowest in five years, and shares of the software giant fell 7.7% on Wednesday's trading session. There were 962.5K MSFT options trading on Wednesday. Call options account for 61% of overall option trades. Particularly high volume was seen for the $240 strike call option expiring October 28, with 58,746 contracts trading on Wednesday.

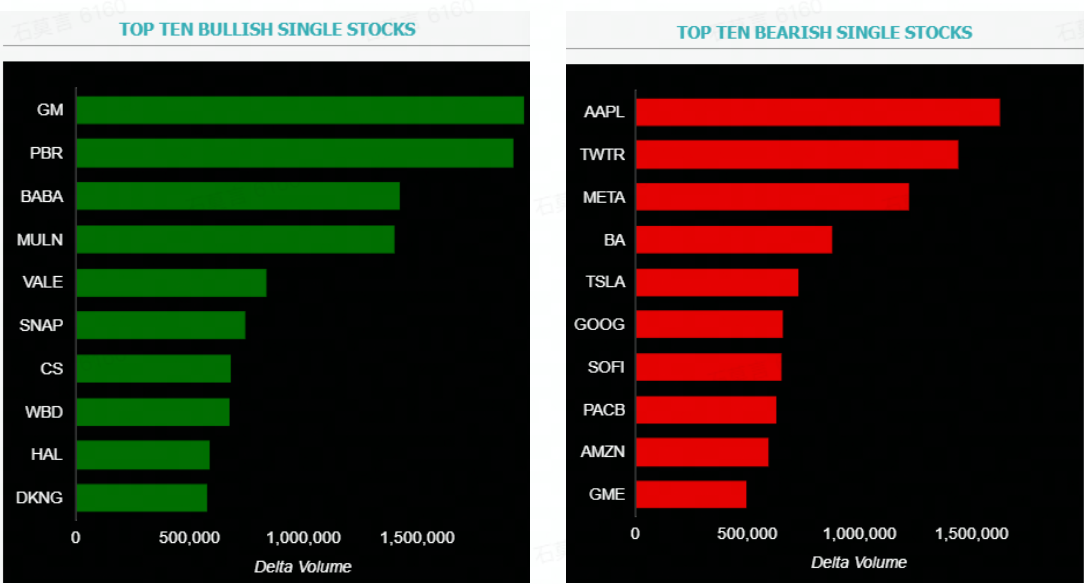

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: ACB, MULN, TSLA, PBR, COIN, SQ, RBLX, GME, GOOGL, MU

Top 10 bearish stocks: T, SNAP, KO, NIO, PLTR, OPEN, TCDA, TWTR, META, F

If you are interested in options and you want to:

- Share experiences and ideas on options trading.

- Read options-related market updates/insights.

- Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

精彩评论