Market Report 14/3/2022: Hong Kong market plunges on delisting fears, Covid resurgence in China

Hong Kong's Hang Seng index dropped 4.97% on the day to 19,531.66, leading losses among the region's major markets as Chinese tech stocks took a beating:Tencentfell 9.79%,Alibabaslipped 10.9% and Meituan plunged 16.84%. The Hang Seng Tech index tumbled 11.03% to 3,778.60. Source: CNBC

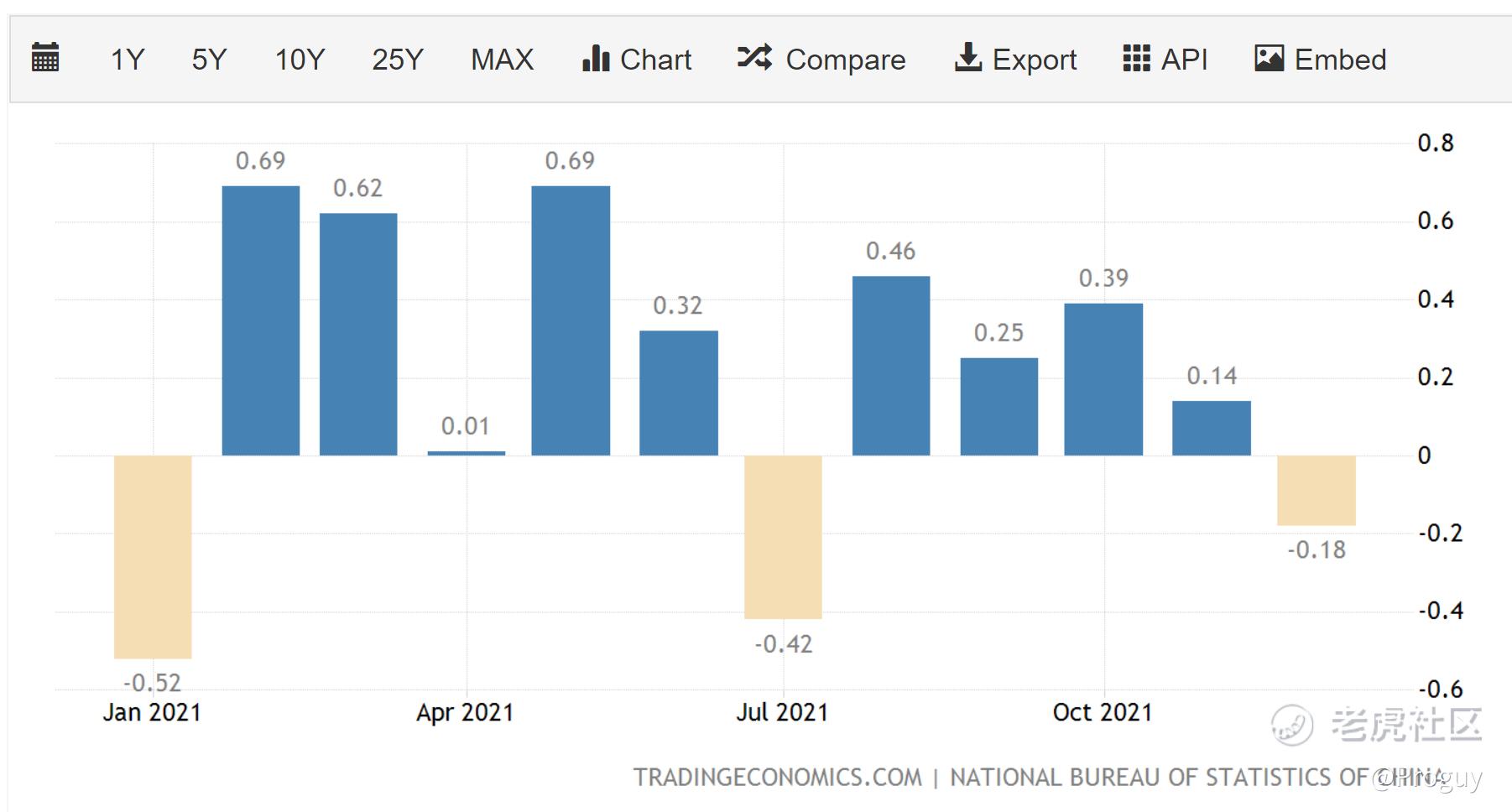

China reported a total of 3,300 Covid cases on Saturday, facing its worst outbreak since the early days of the pandemic. Shenzhen, known as China's "Silicon Valley", told all businesses not involved with essential public services to suspend production or have employees work from home for a week starting Monday. Apple supplier, Foxconn was forced to suspend its operations as Beijing tightened restrictions in line with its zero-Covid policy. This highlights the vulnerability of global supply chains, posing a threat of further disruption from the Russia Ukraine Crisis, even for the largest company in the world, Apple. The Covid restrictions could also damage the Chinese economy which appears to be in a fragile state. The Caixin Manufacturing PMI recorded its lowest reading in 23 months in January 2022 (49.3), bouncing back slightly to 50.4 the next month. Retail Sales in China also decreased 0.18 percent in December of 2021 over the previous month. In order to combat this economic slowdown, the PBOC is expected to cut borrowing costs for the second time this year, according to a trade survey by Reuters.

Twenty-nine out of the 49 traders and analysts, or 59% of all participants, predicted a reduction to the interest rate on one-year medium-term lending facility (MLF) when the central bank is set to renew 100 billion yuan ($15.75 billion) worth of such loans on Tuesday.

Implications on the market

The $HSI(HSI)$ weekly chart is currently sitting on a level of support at 19,500 and is in a deeply oversold region. The market has already priced in downside caused by this new wave of Covid restrictions, falling over 15% this month. Positive news from the PBOC including more monetary easing could soothe some of the recent concerns and result in a short-term rally. Should there be bullish price action at the 19,500 support level, the index could rally a short-term uptrend, filling the gap at the 22,000 level before resuming its downside. For investors trading Chinese tech equities, proper risk management and position should be exercised as a form of caution during this period of market volatility.

精彩评论