CRM: Undervalued Cloud and Software Leader

Investment Thesis

$Salesforce.com(CRM)$ is the world’s #1 customer relationship management (CRM) platform. Its cloud-based, CRM applications for sales, service and marketing allow businesses to connect with their customers in a whole new way. The transition to e-commerce has made CRM integral in providing technological infrastructure to companies seeking to expand their online presence. Increasing adoption of technology for sales, service and marketing provides tailwinds for CRM's business, allowing it to grow its revenue 20+% annually. I believe that this trend is going to perpetuate into the future as more businesses adopt CRM's leading digital solutions. In view of this, I expect CRM to continue its double-digit growth over the next few years, making it fundamentally undervalued by the market right now.

FY 2022 Highlights

“Fiscal 2022 was a remarkable year for Salesforce. I am particularly pleased with our focus on discipline and profitable growth which drove record levels of revenue, margin, and cash flow,” said Amy Weaver, President and CFO. “I’m confident in the momentum of the business as we build an even stronger company in FY23 and beyond.”

- FY22 Revenue of $26.49 Billion, up 25% Year-Over-Year

- FY22 Non-GAAP Operating Margin of 18.7%

- FY22 Operating Cash Flow of $6.0 Billion, up 25% Year-Over-Year

- Raises First Quarter FY23 Revenue Guidance to $7.37 to $7.38 Billion, up Approximately 24% Year-Over-Year

- Reiterates FY23 Non-GAAP Operating Margin Guidance of Approximately 20%

CRM had a fantastic FY22 displaying strong revenue growth as well as a higher operating margin. In its recent quarterly report, management has highlighted that they expect this trend to continue this year, with strong guidance on anticipated revenue and operating margins.

From these results and forward-looking statements, we can seek that the pandemic has created positive tailwinds for the company that continue to boost revenue and margin growth. Unlike stay-at-home stocks such as Zoom and Peloton, Salesforce has demonstrated stickiness and resilience in its business, becoming an integral software infrastructure for enterprises. As more businesses transition towards e-commerce, they will be looking for the best software to allow them to connect with customers. Therefore, I believe enterprise spending on CRM's solutions will continue to grow as the digital revolution continues.

Valuation

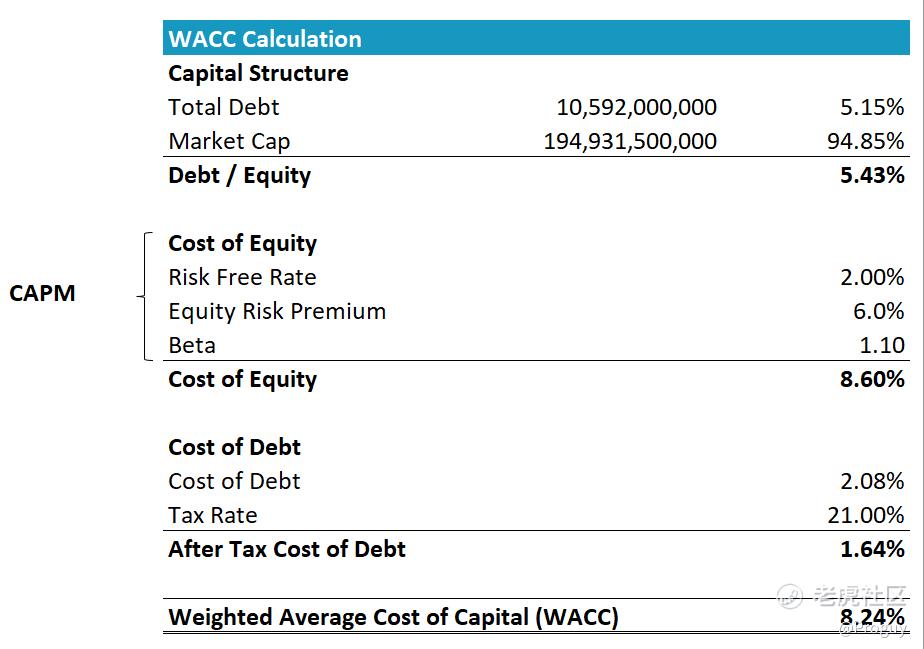

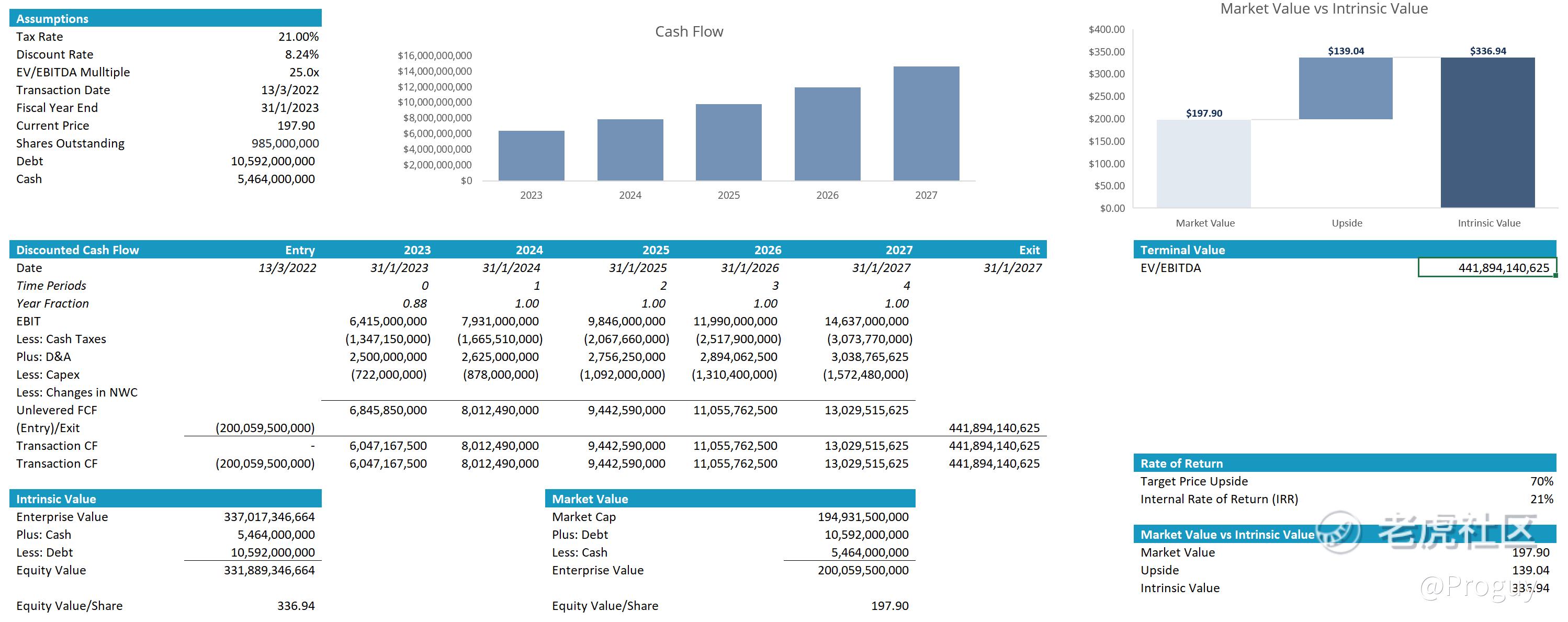

To derive the intrinsic value of CRM, I conducted a 5-Year DCF analysis on the unlevered Free Cash Flow (FCF) of the company. Firstly, I calculated the Weighted Average Cost of Capital (WACC) using the cost of equity derived from the CAPM formula and an after-tax cost of debt of 1.64%. The WACC for CRM was found to be 8.24%

I then projected CRM's EBIT for the next 5 years, using a hybrid of analysts' estimates and historical revenue growth rates and operating margin. I forecasted depreciation and Capex to grow at 5% and 20% respectively, due to large investments in technology CRM is undertaking. Terminal value was calculated using am EV/EBITDA exit multiple of 25x, which is below CRM's average multiple of 28.68 due to lower growth expectations. CRM's terminal value was calculated to be $442 billion which amounts to a $337 equity value/per share when discounted to present value using the WACC. This represents a 70% upside to the price CRM is currently trading at ($197.20) and an IRR of 21%.

Risks

Given that CRM is the leader in CRM applications worldwide, the main risk to its business would likely be an external threat. In my analysis, I identified this to be the possibility of a recession as the Fed is forced to raise interest rates to combat inflation. This analysis prices in a policy mistake by the Fed by either raising rates too quickly or by too dovish causing inflation to spiral out of control and needing to slam the brakes later on. Either way, this would trigger a recession in the US economy and lead to negative GDP growth.

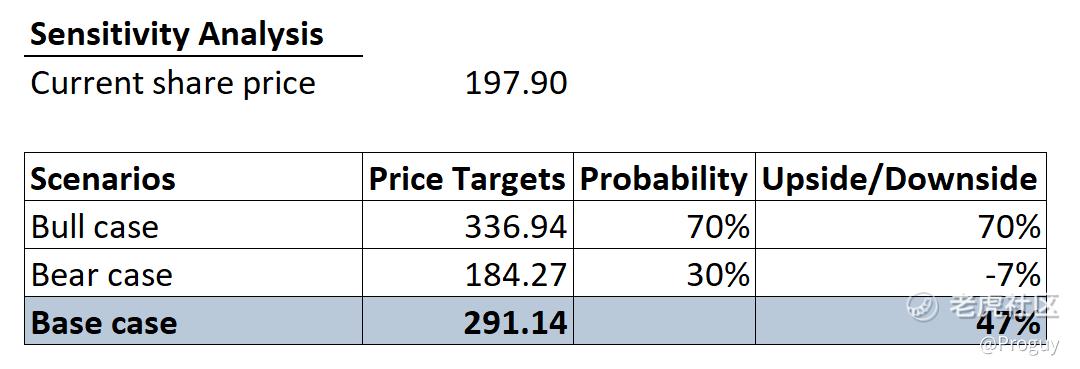

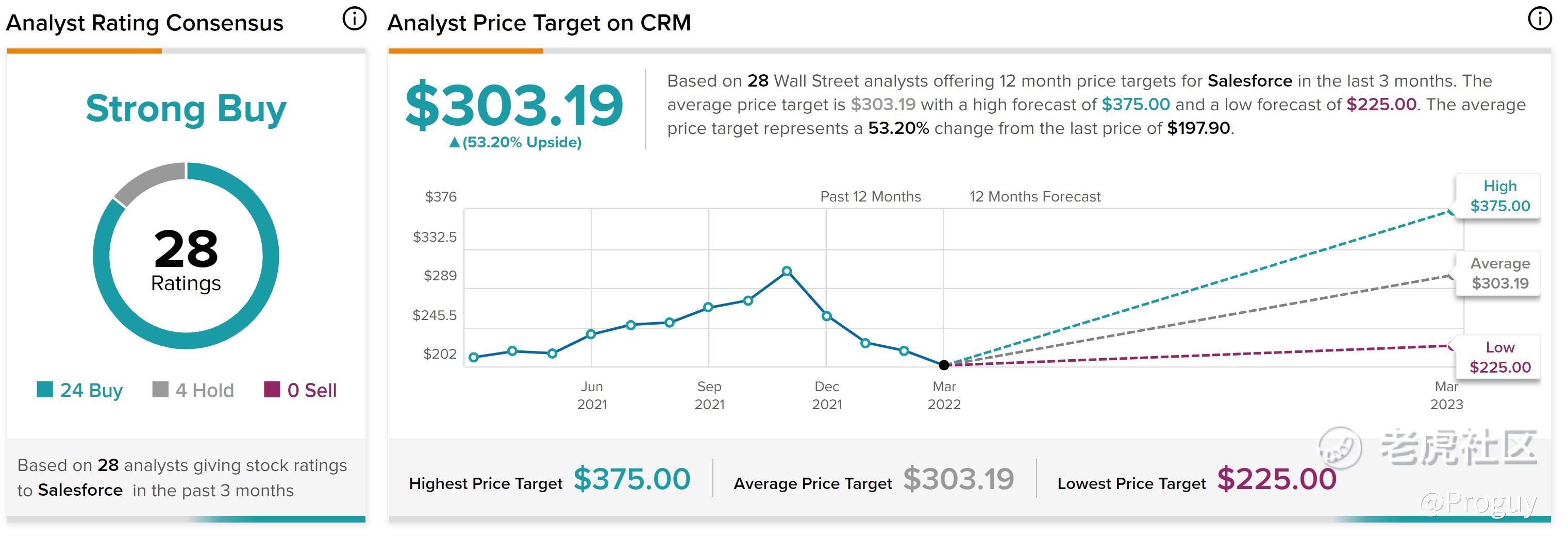

My bear case assumes that EBIT would not grow over the next 5 years in light of an economic recession. This scenario, while improbable should still be factored into the analysis. Keeping the remaining estimates constant, these projections gave CRM a price target of $184 which represents a 7% downside from what its shares are currently trading at. For my sensitivity analysis, I assigned a 70% and 30% probability to my bull and bear case respectively, giving CRM a weighted average price target of $291 and a 47% upside potential. This is slightly lower than the average price target of $303 assigned by analysts.

Conclusion

The increasing demand for e-commerce has made CRM a vital software infrastructure for enterprises. As businesses look for innovative solutions to connect with customers, CRM will be a beneficiary in its space and continue its strong financial performance and growth. Currently, the market is undervaluing CRM as many tech stocks have sold off on fears of higher interest rates. This presents an opportunity for investors looking to buy great businesses with a good future ahead and strong financial growth. Therefore, I initiate a buy rating on the company with a price target of $290 and an upside of 47%.

精彩评论