Investment Thesis

Baidu is a leading Chinese AI company with a strong Internet foundation. Its business is composed of two segments: Baidu core, which provides mainly online marketing services as well as products and services from new AI initiatives, and iQIYI, which is a Chinese streaming company. Baidu Core can be further broken down into three segments:

- Mobile Ecosystem: a portfolio of over one dozen apps, including Baidu App, which helps communities connect and share knowledge and information. Baidu App is the largest search engine in China with over 622 million MAUs.

- AI Cloud: a full suite of cloud services and solutions, including PaaS, SaaS and IaaS and uniquely differentiated by AI solutions.

- Intelligent Driving & Other Growth Initiatives (OGI): intelligent driving (self-driving services, including autonomous navigation pilot, intelligent electric vehicles and robotaxi fleets), as well as Xiaodu smart devices and AI chip development.

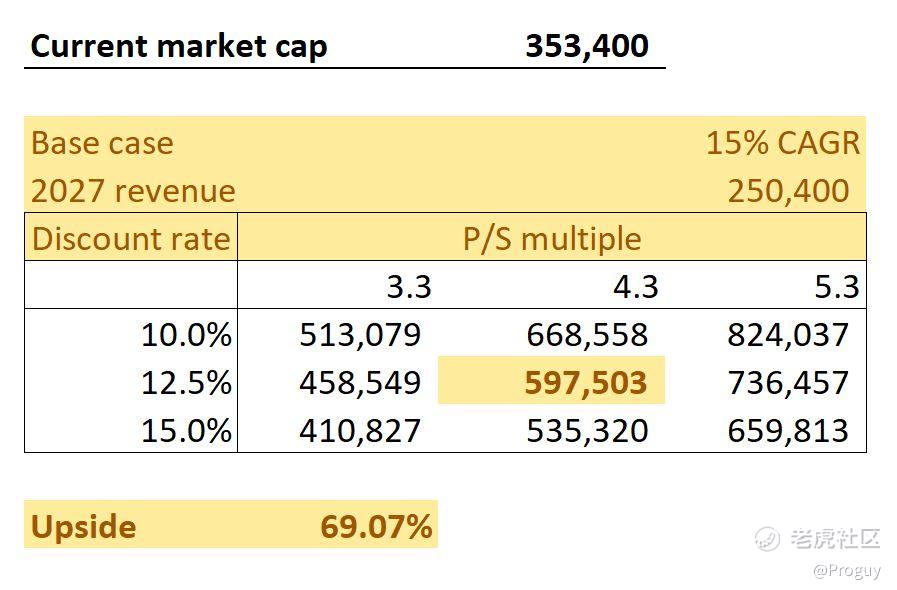

Baidu core has accounted for over 70% of Baidu’s total revenue in the past three years. Looking forward, Baidu’s AI Cloud and Intelligent Driving services are expected to drive the company’s revenue growth. With non-online marketing revenue projected to grow at 50%+ annually, Baidu is expected to grow its revenue to CNY 250 million in the next five years. Pair this with a historical P/S ratio of 4.3x, Baidu would reach a market cap of CNY 1,075 million by 2027. Using a 12.5% discount rate, Baidu should be traded at a market cap of CNY 597 million today which represents a 70% upside on the company’s share price.

FY2021 Highlights

- Revenue from Baidu Core was RMB 95.2 billion (US$14.93 billion), increasing 21% year over year; online marketing revenue was RMB 74.0 billion (US$11.60 billion), increasing 12% year over year, and non-online marketing revenue was RMB 21.2 billion (US$3.33 billion), up 71% year over year, driven by cloud and other AI-powered businesses.

- Operating income was RMB 10.5 billion (US$1.65 billion). Baidu Core operating income was RMB 15.1 billion (US$2.38 billion), and Baidu Core operating margin was 16%. Non-GAAP operating income was RMB 19.0 billion (US$2.99 billion). Non-GAAP Baidu Core operating income was RMB 22.2 billion (US$3.48 billion), and non-GAAP Baidu Core operating margin was 23%.

AI Cloud

- Baidu ACE smart transportation has been adopted by 35 cities, up from 14 cities a year ago, based on contract amounts of over RMB10 million, as of the end of 2021.

- PaddlePaddle developer community has grown to 4.06 million and has served 157,000 businesses, as of the end of 2021.

Intelligent Driving

- Rides provided by Apollo Go almost doubled sequentially, and reached around 213,000 in the fourth quarter of 2021.

- Apollo Go, Baidu's autonomous ride-hailing service, has begun to charge fees for the autonomous ride-hailing services on open roads in Beijing, Chongqing and Yangquan.

- Apollo Go expanded into Chongqing, Shenzhen and Yangquan, and is now available in eight cities, including Beijing, Shanghai, Guangzhou, Shenzhen, Chongqing, Changsha, Cangzhou and Yangquan.

Catalysts Moving Forward

- De-globalisation: The decoupling between the US and China means that each nation will have to invest heavily and develop their own technologies in what is dubbed as a ‘technological arms race’. Big tech companies such as Baidu which offer AI and chip solutions are crucial in China’s bid to win this race and would likely benefit from incentives in the long run.

- Electrification and the push towards self-driving: Autonomous cars are said to be able to solve the problem of traffic congestion using artificial intelligence. This is extremely applicable in large cities in China which have dense populations. Electric cars also bring benefits such as reducing air and noise population. With such a dense population and high pollution levels, the case for autonomous electric cars in China has never been stronger. The Chinese government has recognised the urgency of switching to electric cars and has made it a priority in its fourteenth five-year plan.

- Growth of the Chinese economy: There are currently 26 million businesses and 1.4 billion people in China. Baidu’s AI Cloud and Intelligent Driving businesses have barely scratched the surface of enormous market opportunities. By being the first-mover in its industries, Baidu could potentially grow its market size drastically and expand its business as the Chinese economy continues to grow.

Valuation

As the future margins of Baidu’s businesses are highly speculative, I chose to value the company using a Price-Sales multiple, since it is easier to project the company’s future revenue.

My base case assumes a 15% CAGR of revenue until 2027, in which revenue will reach CNY 250 million. I then assigned a 4.3 P/S multiple which is the average multiple Baidu has been trading at and discounted this to present value using a 12.5% discount rate. Based on these assumptions, Baidu should be trading at a market capitalisation of close to CNY 600 million which means that it is 70% undervalued compared to what it is currently trading. Therefore, I would issue a buy rating on the company with a price target of US $270 per share.

Risks

Investing never comes without risks and so I will lay out the risks of investing in Baidu shares below. The risk investors worry about the most at the moment is the Chinese government’s crackdown on Big Tech after Jack Ma’s antagonistic comments in 2020. As a result, many Chinese Tech companies have sold off as investors dump their Chinese shares.

Undoubtedly, Baidu share price has been badly affected by this broad-based sell-off, falling 60% from its peak. However, Baidu’s fundamentals still remain intact and it has experienced minimal disruptions to its business. Unlike companies such as Alibaba and Didi, Baidu has emerged from the sanctions relatively unscathed. This is likely due to Baidu’s compliance with the government authorities and leadership under CEO Robin Li, who has refrained from making comments against the authorities. In fact, these regulatory crackdowns could actually benefit Baidu in the long run as it has left its rivals distracted and disorganised. Both Alibaba and Didi have suffered operational consequences raising doubts about future growth and expansion. This could present an opportunity for Baidu to widen its moat and capture a larger share of the Chinese market.

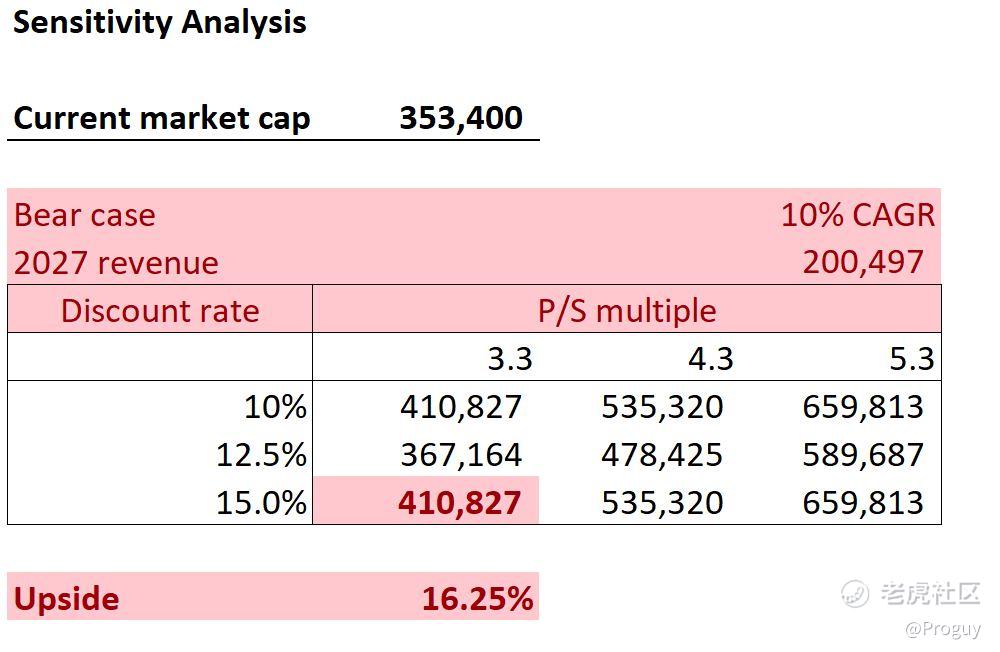

Data from my sensitivity analysis shows that Baidu is still 16% undervalued in a bearish scenario where regulatory changes could affect the company’s business. Using a revenue CAGR of 10%, a 3.3 P/S multiple and a 15% discount rate, Baidu should be valued at CNY 410 million compared to what it is currently trading at (CNY 353 million).

Conclusion

The broad-based selloff in Chinese equities has presented investors the opportunity to buy shares of great companies at a cheap price. Instead of buying shares in companies with regulatory risks and a high level of business uncertainty, investors should look to buy companies of great businesses that have remained resilient throughout the crises. An example of such company is Baidu which has demonstrated strong growth in the recent quarters. As the company continues to expand in areas such as AI and intelligent driving, there is a huge potential of profits to be tapped into. Therefore, I see tremendous upside potential in the company’s shares and consequent capital gains for investors.

精彩评论